- United States

- /

- Professional Services

- /

- NasdaqGS:CNDT

Organogenesis Holdings Leads These 3 US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals from earnings reports and economic data, investors remain vigilant in their search for promising opportunities. Penny stocks, a term that may seem outdated yet still relevant, offer potential growth avenues often found in smaller or newer companies with solid financial foundations. In this article, we will explore several penny stocks that demonstrate financial strength and long-term potential, providing a glimpse into under-the-radar opportunities for discerning investors.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $93.03M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8999 | $6.54M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.40 | $9.63M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.56 | $1.91B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3052 | $11.04M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $50.16M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.78 | $43.03M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.14 | $20.75M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9143 | $81.09M | ★★★★★☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Organogenesis Holdings (NasdaqCM:ORGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes solutions for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of approximately $363.35 million.

Operations: The company's revenue is primarily derived from its regenerative medicine segment, which generated $455.04 million.

Market Cap: $363.35M

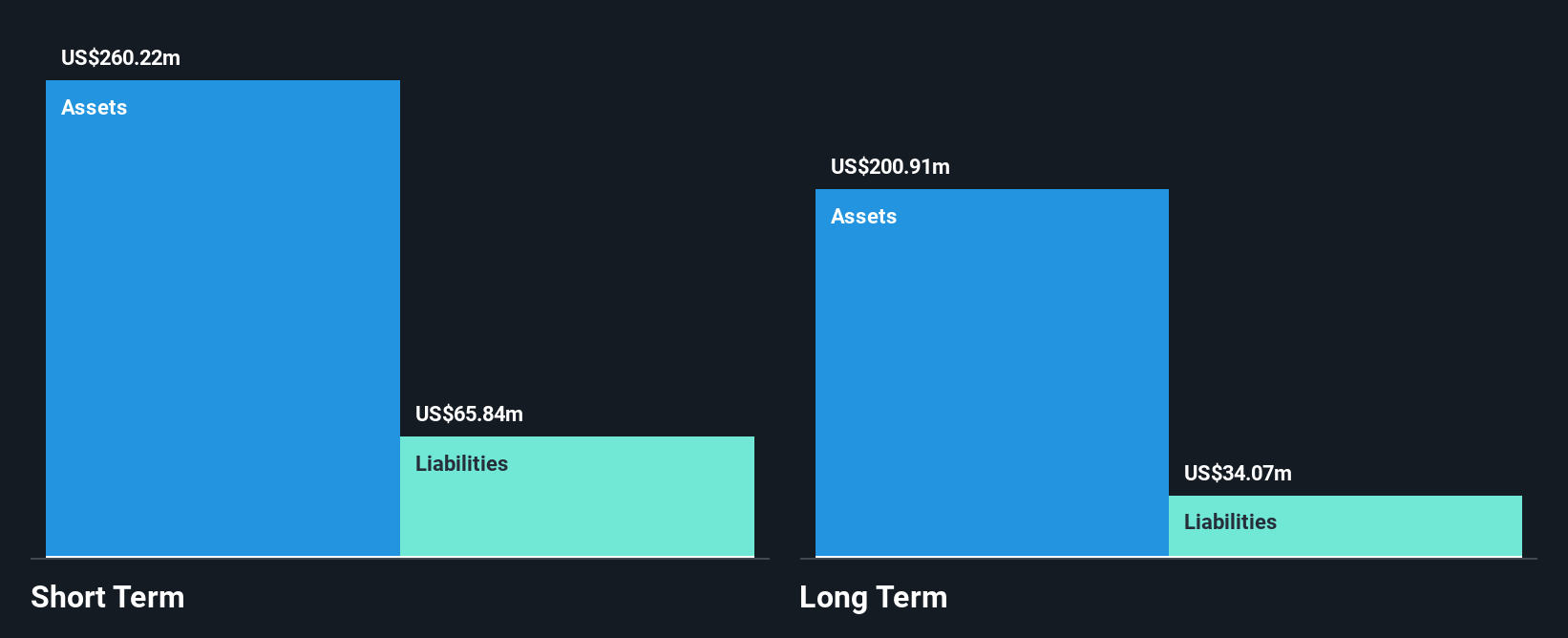

Organogenesis Holdings Inc. has demonstrated financial resilience with short-term assets of US$238.5 million exceeding both short and long-term liabilities, and its interest payments are well-covered by EBIT. Despite being unprofitable, the company has reduced losses over the past five years and forecasts significant earnings growth. Recent strategic moves include a share repurchase program funded by preferred stock sales, expansion plans for a new biomanufacturing facility in Rhode Island, and positive interim results from a Phase 3 trial for knee osteoarthritis treatment. However, volatility remains high with significant insider selling observed recently.

- Dive into the specifics of Organogenesis Holdings here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Organogenesis Holdings' future.

Telos (NasdaqGM:TLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Telos Corporation, along with its subsidiaries, offers cyber, cloud, and enterprise security solutions globally and has a market cap of approximately $231.62 million.

Operations: The company's revenue is primarily derived from its Security Solutions segment, which generated $75.49 million, and its Secure Networks segment, contributing $47.47 million.

Market Cap: $231.62M

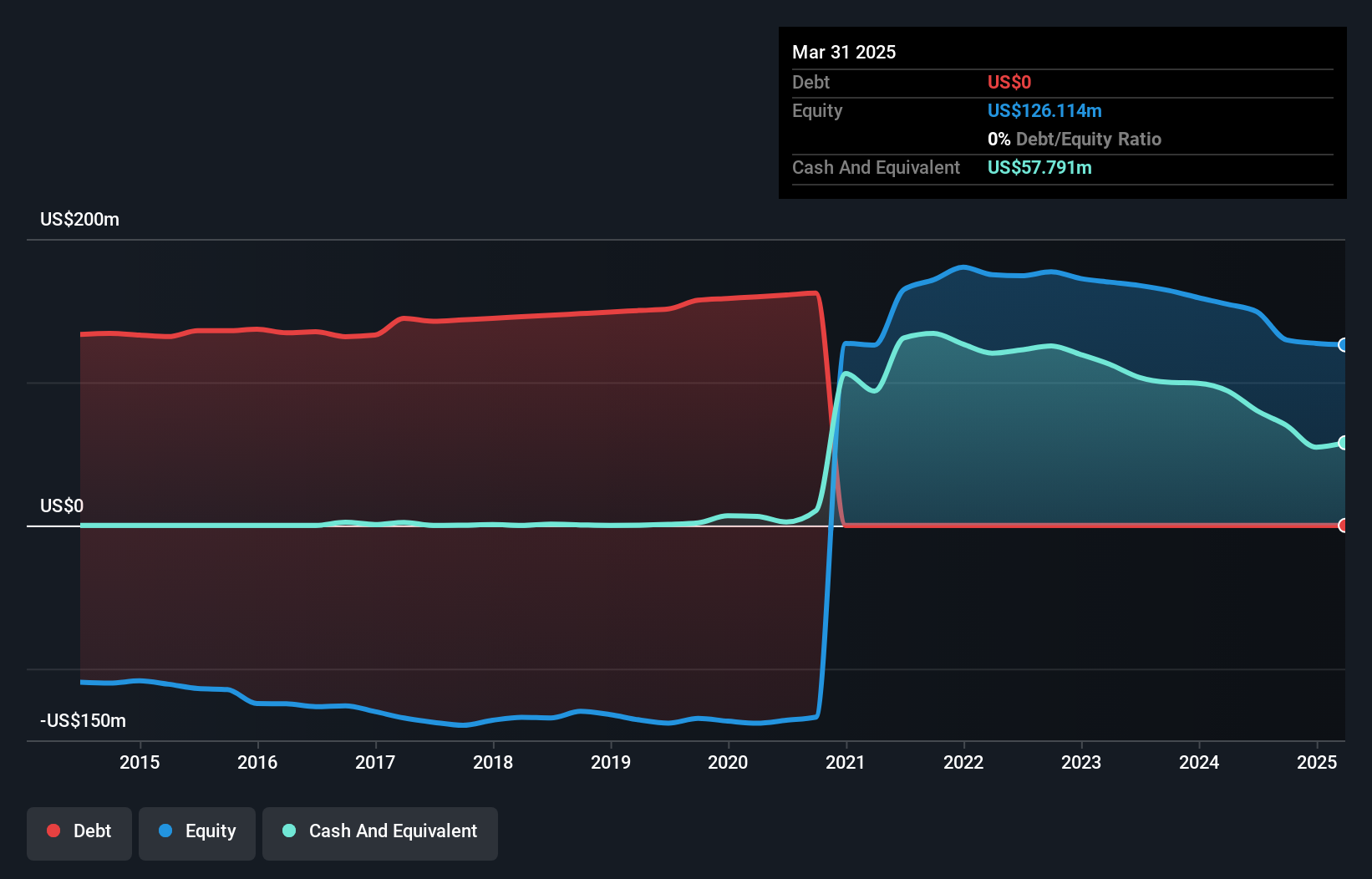

Telos Corporation, with a market cap of US$231.62 million, is currently unprofitable and not expected to achieve profitability in the near term. The company has seen a decline in revenue from US$36.19 million to US$23.78 million year-over-year for Q3 2024, alongside increased net losses. Despite these challenges, Telos is expanding its TSA PreCheck enrollment centers across the U.S., aiming for long-term growth potential through increased consumer convenience. The company's financial position remains stable with short-term assets of US$99.3 million exceeding liabilities and no debt on its balance sheet, offering some resilience amid ongoing volatility concerns.

- Navigate through the intricacies of Telos with our comprehensive balance sheet health report here.

- Gain insights into Telos' outlook and expected performance with our report on the company's earnings estimates.

Conduent (NasdaqGS:CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of approximately $634.76 million.

Operations: The company generates revenue through its Commercial segment ($1.88 billion), Government segment ($1.03 billion), and Transportation segment ($722 million).

Market Cap: $634.76M

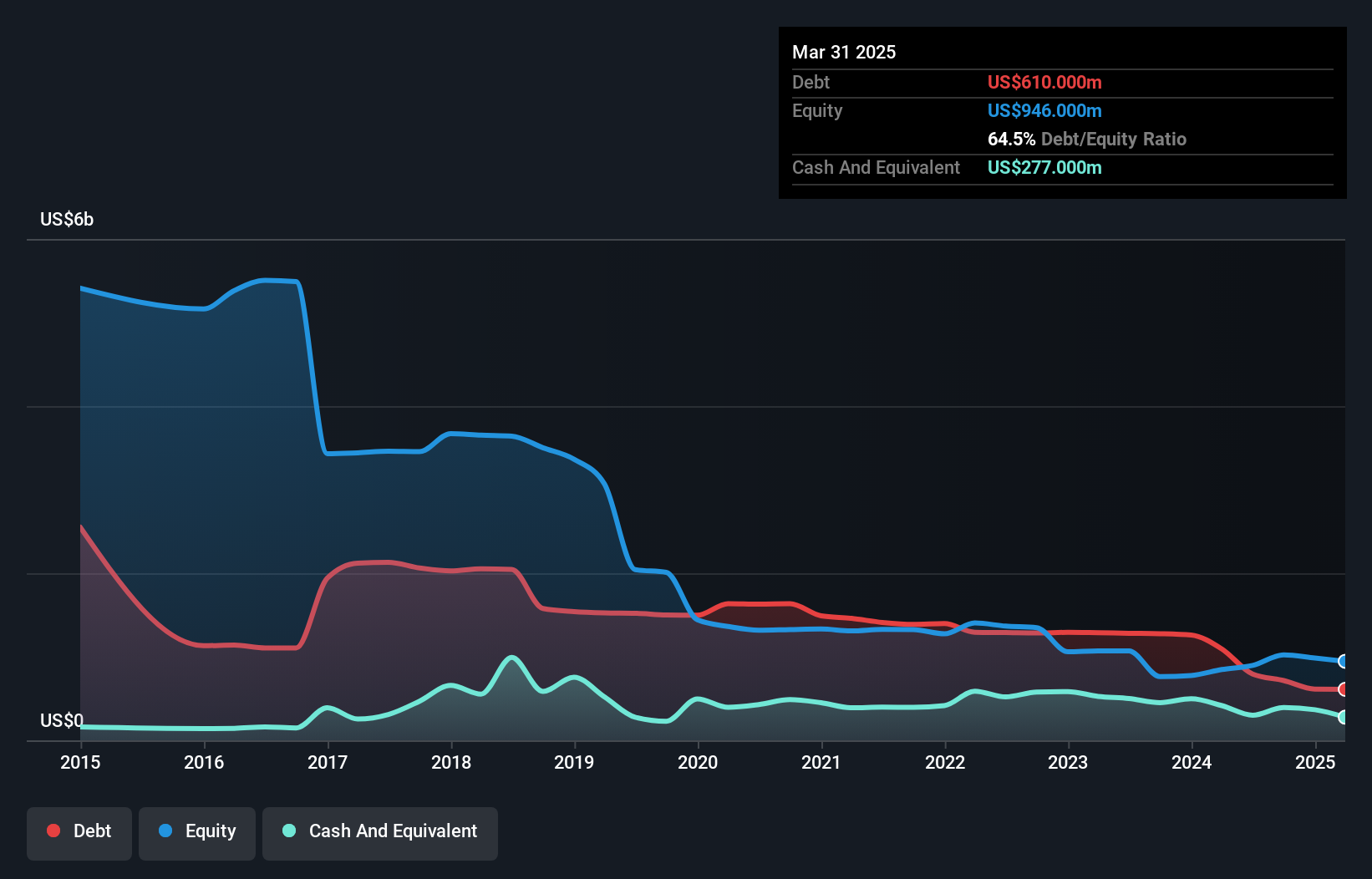

Conduent Incorporated, with a market cap of US$634.76 million, has shown financial stability and growth potential in the penny stock arena. The company has become profitable over the past year, boasting an outstanding return on equity of 43.4%. Its debt to equity ratio has improved over five years, and short-term assets exceed both long-term and short-term liabilities. Recent strategic alliances and client contracts like the US$92 million deal with Alaska's Department of Health highlight its expanding footprint in government services. However, future earnings are forecasted to decline significantly, which presents a potential risk for investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Conduent.

- Explore Conduent's analyst forecasts in our growth report.

Where To Now?

- Click this link to deep-dive into the 713 companies within our US Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNDT

Conduent

Provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally.

Undervalued with adequate balance sheet.