- United States

- /

- Biotech

- /

- NasdaqCM:ORGO

December 2025's Top Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As the United States market experiences fluctuations, with technology shares weighing on major indices like the Nasdaq, investors are closely monitoring economic indicators and Federal Reserve actions. In this context, penny stocks—often seen as smaller or newer companies—remain a compelling area of interest due to their potential for growth when backed by strong financials. Despite being an outdated term, these stocks can offer unique opportunities for investors seeking to uncover hidden value in financially sound companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.79 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.09 | $186.41M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.26 | $548.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.24 | $1.35B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.75 | $178.24M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.54 | $589.37M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.8755 | $6.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.08 | $92.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jinxin Technology Holding (NAMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jinxin Technology Holding Company operates as a digital content service provider in the People’s Republic of China, with a market cap of $71.44 million.

Operations: The company generates revenue from its Internet Information Providers segment, totaling CN¥416.95 million.

Market Cap: $71.44M

Jinxin Technology Holding Company, with a market cap of $71.44 million, operates in the digital content sector and reported half-year sales of CN¥208.5 million. Despite a net loss of CN¥21.29 million, the company has no debt and its short-term assets significantly exceed liabilities, indicating financial stability amidst volatility typical for penny stocks. The management team is experienced with an average tenure of 10.9 years, although the board is relatively new with 1.3 years average tenure. Recently, Jinxin announced a share repurchase program worth up to $2 million to be funded from existing cash reserves until October 2026.

- Jump into the full analysis health report here for a deeper understanding of Jinxin Technology Holding.

- Gain insights into Jinxin Technology Holding's historical outcomes by reviewing our past performance report.

Organogenesis Holdings (ORGO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $611.72 million.

Operations: The company generates its revenue primarily from its regenerative medicine segment, which accounts for $464.62 million.

Market Cap: $611.72M

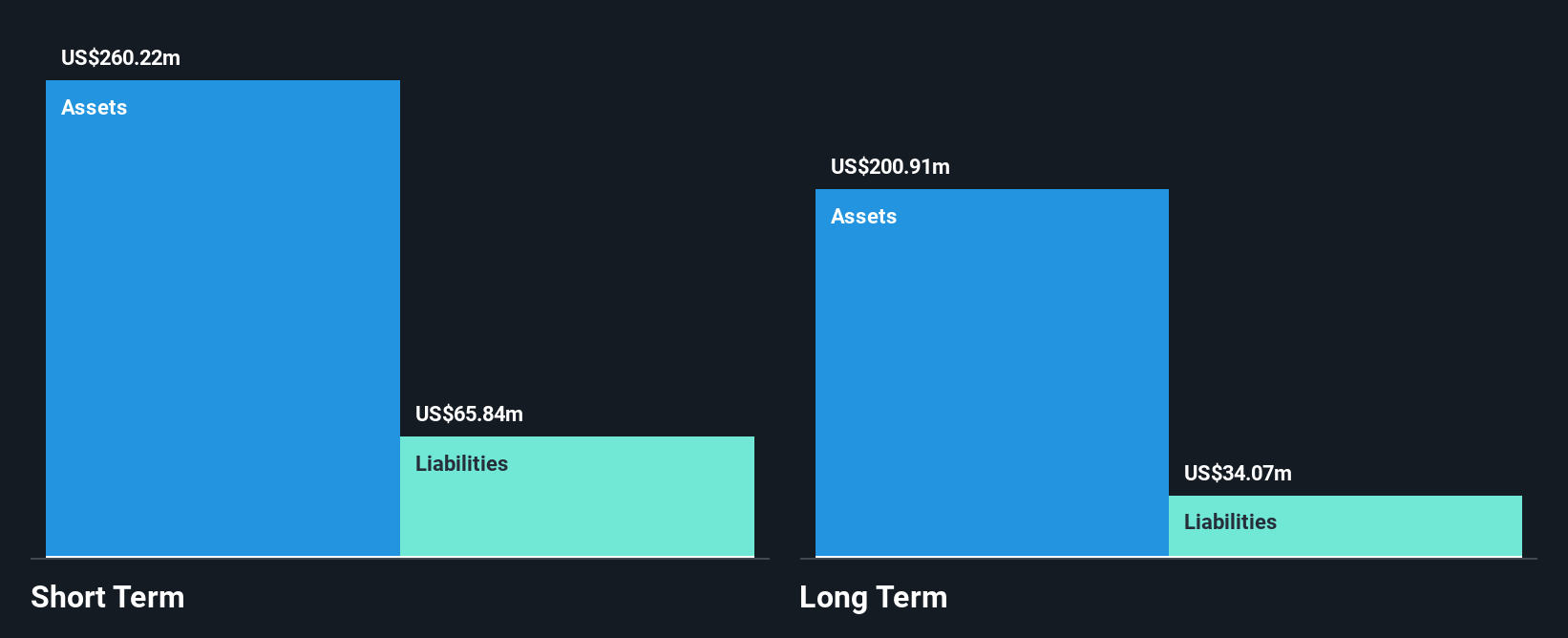

Organogenesis Holdings, with a market cap of $611.72 million, is navigating the challenges typical of penny stocks, marked by high volatility and recent insider selling. Despite being unprofitable and experiencing increased losses over five years, it reported third-quarter revenue growth to US$150.86 million from US$115.18 million year-over-year and raised its 2025 earnings guidance. The company has a seasoned management team and no debt, with short-term assets exceeding liabilities. Its regenerative medicine segment remains pivotal, although recent clinical trials for ReNu did not meet primary endpoints but showed potential for FDA review under RMAT designation due to unmet medical needs in knee osteoarthritis treatment.

- Click here to discover the nuances of Organogenesis Holdings with our detailed analytical financial health report.

- Understand Organogenesis Holdings' earnings outlook by examining our growth report.

Zura Bio (ZURA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zura Bio Limited is a clinical-stage biotechnology company focused on developing medicines for immune and inflammatory disorders in the United States, with a market cap of $261.39 million.

Operations: Zura Bio Limited has not reported any revenue segments.

Market Cap: $261.39M

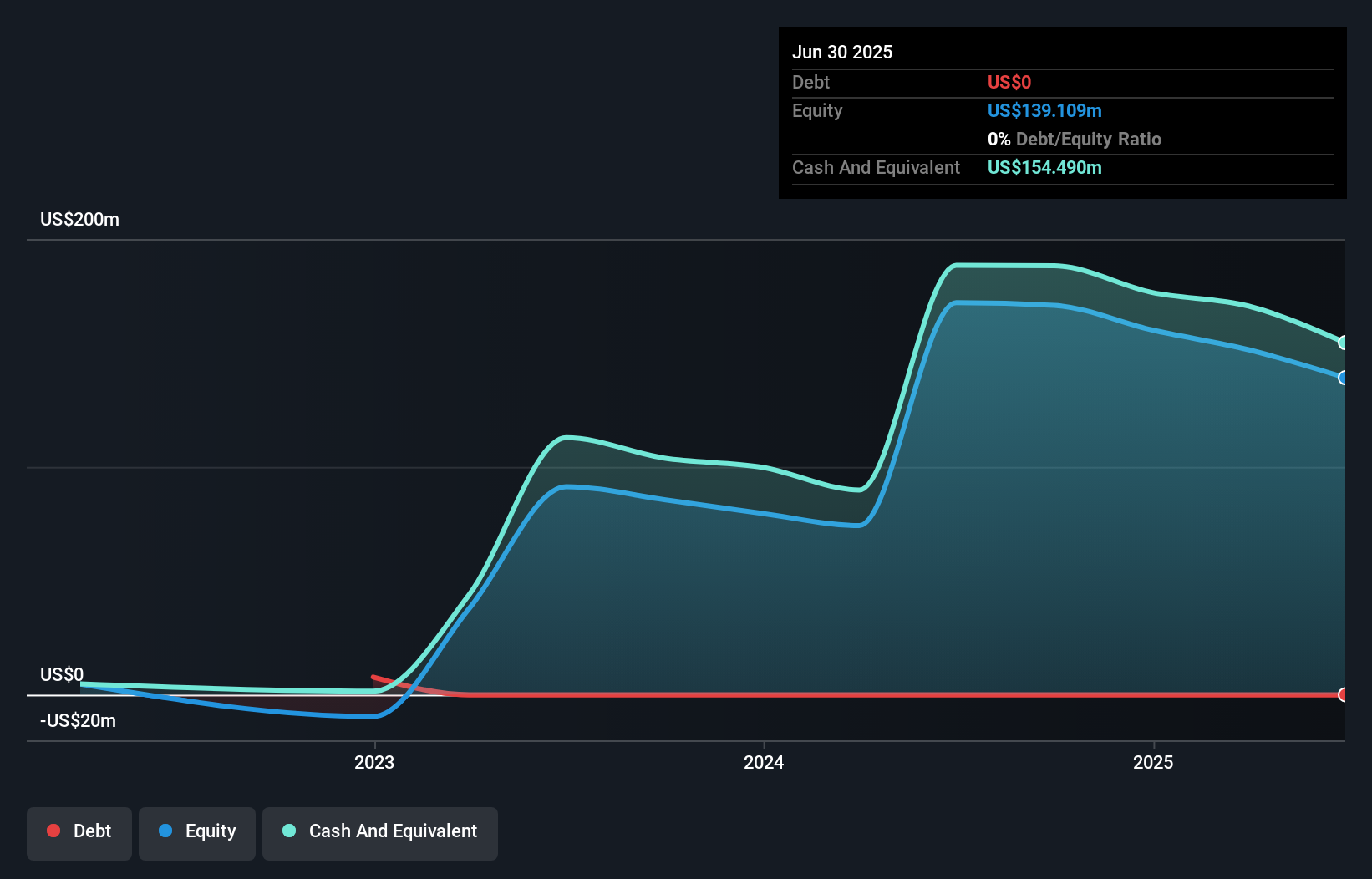

Zura Bio Limited, with a market cap of US$261.39 million, is a pre-revenue biotech firm facing typical penny stock volatility and management changes. It recently reported a third-quarter net loss of US$18.04 million, down from the previous year, amidst an interim CEO appointment due to medical leave. Despite being debt-free with sufficient cash runway for over two years and short-term assets exceeding liabilities, Zura remains unprofitable with earnings forecasted to decline by 20.8% annually over the next three years. The board's inexperience and high weekly volatility further underscore its speculative nature within the sector.

- Get an in-depth perspective on Zura Bio's performance by reading our balance sheet health report here.

- Explore Zura Bio's analyst forecasts in our growth report.

Where To Now?

- Discover the full array of 343 US Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORGO

Organogenesis Holdings

A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)