- United States

- /

- Software

- /

- NasdaqGS:TEAM

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.8%, contributing to a 14% increase over the past 12 months, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that not only capitalize on technological innovations but also demonstrate strong potential for sustained revenue and earnings expansion in line with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Ardelyx | 21.05% | 61.75% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 224 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of approximately $4.13 billion.

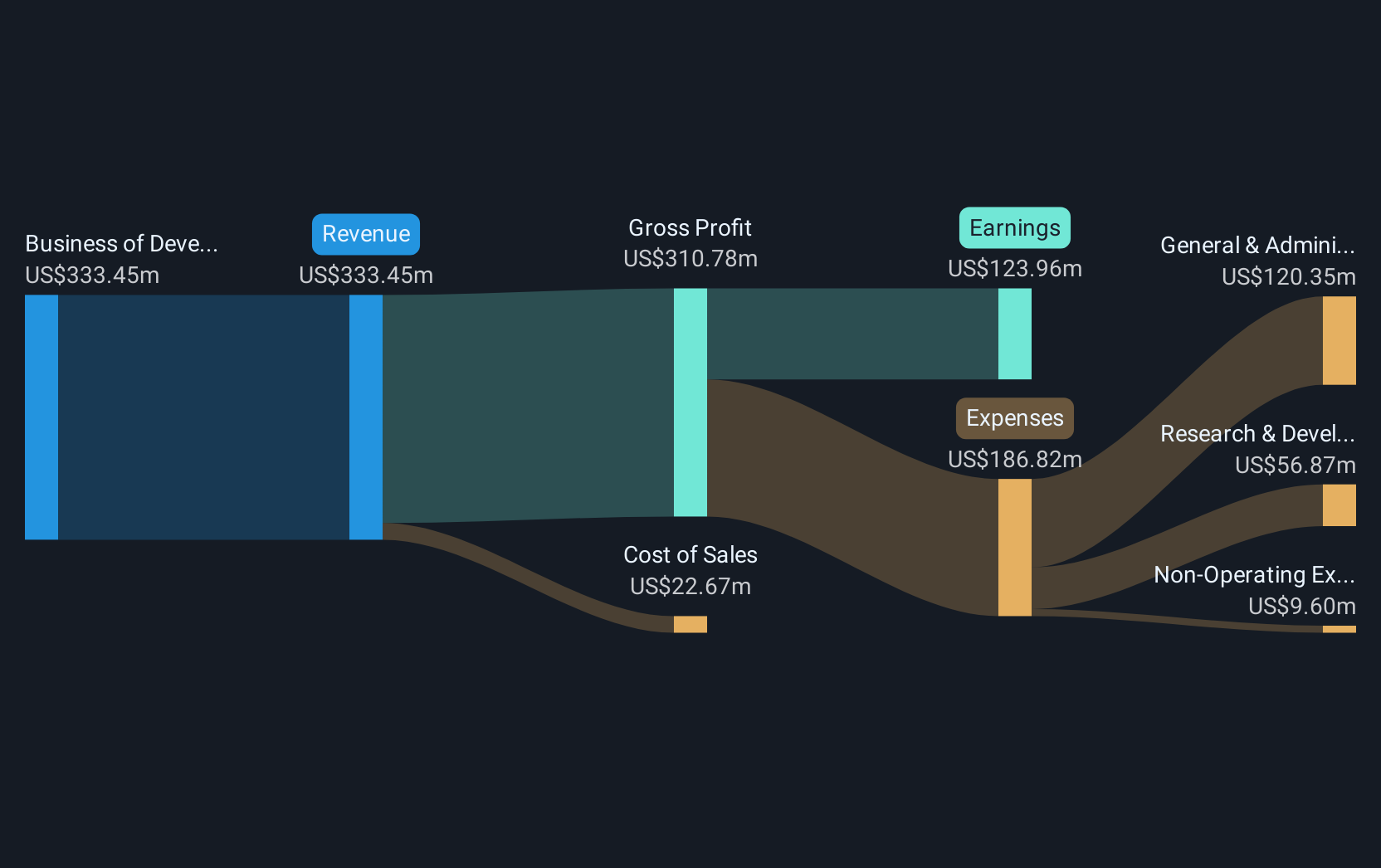

Operations: Krystal Biotech generates revenue primarily from its business of developing and commercializing pharmaceuticals, amounting to $333.45 million. The company's focus on genetic medicines addresses diseases with high unmet medical needs in the U.S.

Krystal Biotech's recent inclusion in the Russell 2000 Defensive and Growth-Defensive Indexes underscores its emerging prominence within the biotech sector, particularly following its successful Phase 3 trial initiation for KB803. This product targets a critical need in dystrophic epidermolysis bullosa treatment, demonstrating Krystal's commitment to addressing rare diseases with innovative gene therapies. Moreover, the company's substantial earnings growth from $0.932 million to $35.73 million year-over-year highlights robust financial health and operational efficiency. These achievements, coupled with a strategic focus on R&D that led to significant advancements like VYJUVEK’s approval in Europe, position Krystal Biotech as a notable entity driving forward genetic medicine and patient care enhancements.

- Click to explore a detailed breakdown of our findings in Krystal Biotech's health report.

Examine Krystal Biotech's past performance report to understand how it has performed in the past.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $56.05 billion, is a global company that designs, develops, licenses, and maintains various software products through its subsidiaries.

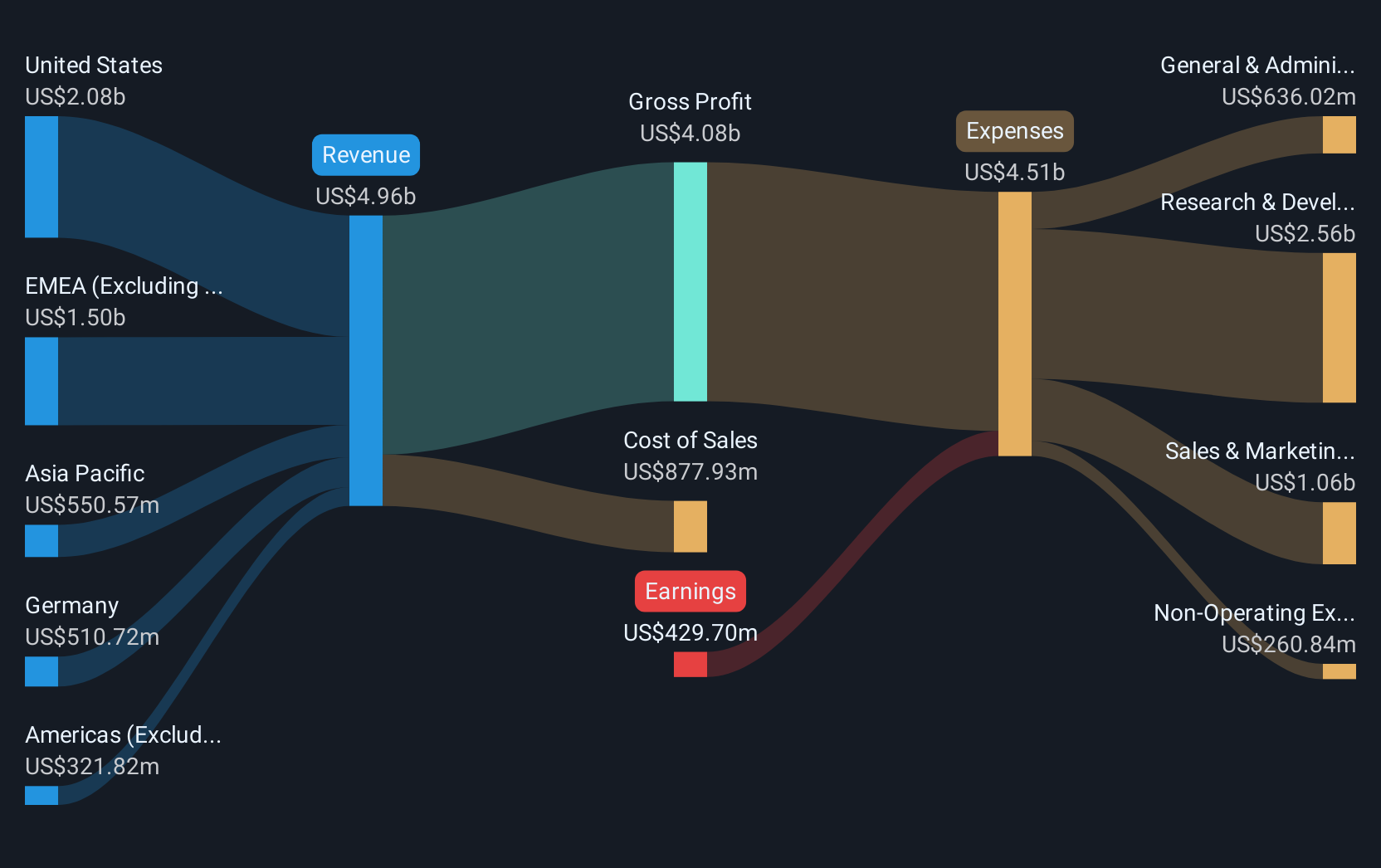

Operations: Atlassian generates revenue primarily from its software and programming segment, which amounts to $4.96 billion.

Atlassian's dynamic presence in the tech arena is underscored by its robust R&D commitment, with expenses reaching $1.2 billion, representing a significant proportion of revenue. This investment fuels innovation in software solutions, aligning with industry shifts towards SaaS models that promise recurring revenue streams. Despite recent financial turbulence indicated by a net loss of $70.81 million for Q3 2025, Atlassian's strategic maneuvers include substantial share repurchases totaling $138.88 million in early 2025, reflecting confidence in its long-term value proposition and operational direction. The firm's proactive engagement at global tech conferences further highlights its pursuit of leadership within digital transformation spaces.

- Delve into the full analysis health report here for a deeper understanding of Atlassian.

Evaluate Atlassian's historical performance by accessing our past performance report.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based CRM platform for businesses across the Americas, Europe, and the Asia Pacific with a market cap of $29.58 billion.

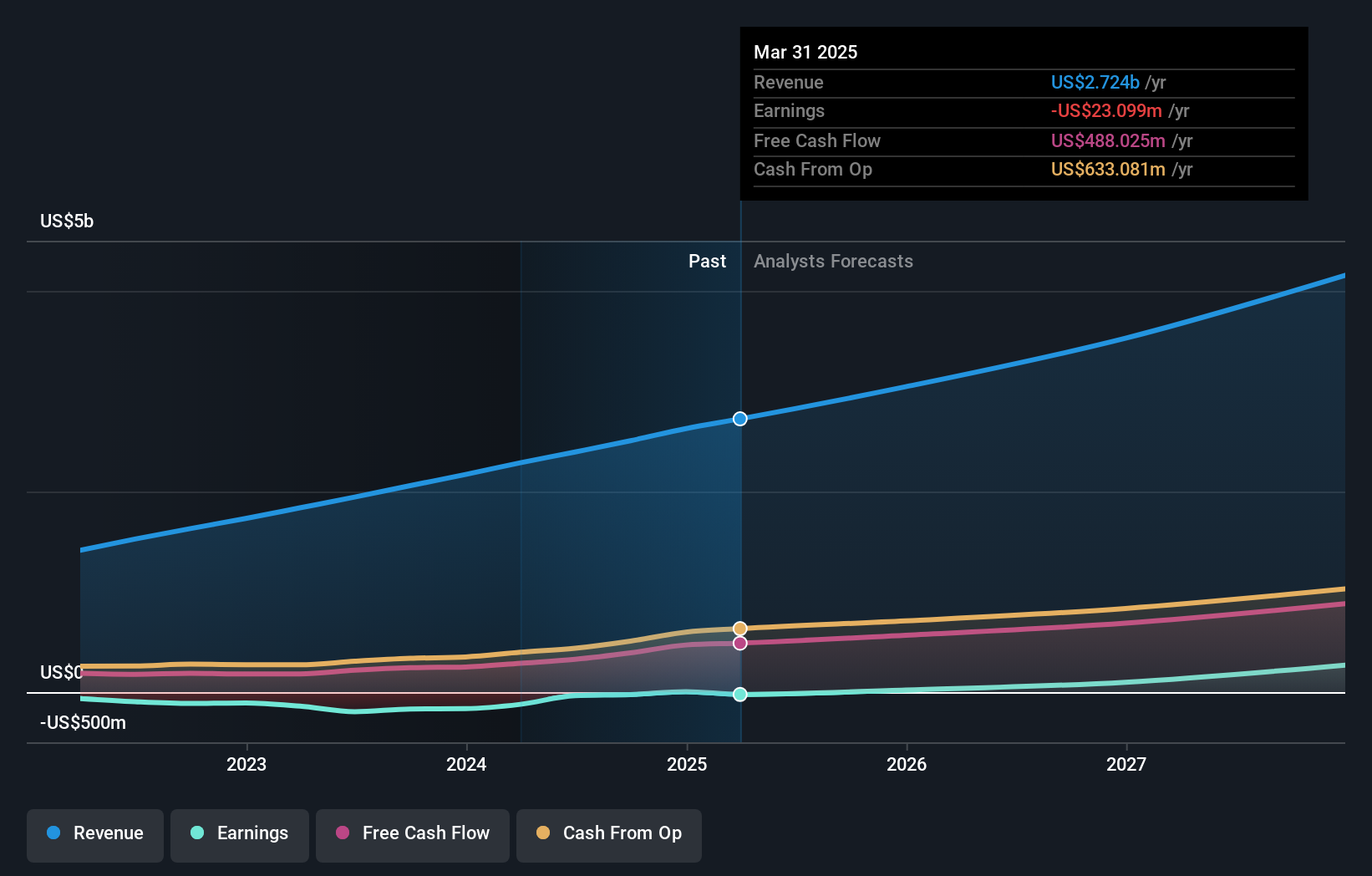

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $2.72 billion. This cloud-based CRM platform serves a diverse range of businesses across multiple regions, providing essential tools for customer relationship management.

HubSpot, a key player in the CRM space, is leveraging AI innovations to enhance user engagement and operational efficiency. With a 14% annual revenue growth outpacing the US market average of 8.7%, HubSpot's strategic integration of ChatGPT into its CRM systems exemplifies its commitment to technological advancement and customer-centric solutions. This move not only diversifies its offerings but also solidifies its position in a competitive market. Despite current unprofitability, HubSpot's expected earnings growth of 44% annually signals strong future prospects, further supported by recent governance enhancements aimed at improving shareholder influence and corporate agility.

- Take a closer look at HubSpot's potential here in our health report.

Review our historical performance report to gain insights into HubSpot's's past performance.

Next Steps

- Reveal the 224 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives