- United States

- /

- Biotech

- /

- NasdaqGS:INCY

3 US Stocks Estimated To Be 14.6% To 47.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market edges close to record highs, buoyed by positive wholesale inflation data and a stable tariff environment, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this context, identifying undervalued stocks becomes crucial as these investments can offer potential upside in a market where major indices have recently posted weekly gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.65 | $36.99 | 49.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.80 | $58.90 | 47.7% |

| Old National Bancorp (NasdaqGS:ONB) | $23.89 | $45.71 | 47.7% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | $33.65 | $64.49 | 47.8% |

| Incyte (NasdaqGS:INCY) | $70.42 | $134.89 | 47.8% |

| Array Technologies (NasdaqGM:ARRY) | $6.79 | $13.53 | 49.8% |

| Constellium (NYSE:CSTM) | $9.34 | $18.31 | 49% |

| First Advantage (NasdaqGS:FA) | $19.93 | $38.12 | 47.7% |

| Fluence Energy (NasdaqGS:FLNC) | $6.43 | $12.61 | 49% |

| Kyndryl Holdings (NYSE:KD) | $41.79 | $82.10 | 49.1% |

Let's review some notable picks from our screened stocks.

Duolingo (NasdaqGS:DUOL)

Overview: Duolingo, Inc. is a mobile learning platform that operates in the United States, the United Kingdom, and internationally with a market cap of $19.03 billion.

Operations: The company generates revenue of $689.46 million from its educational software segment.

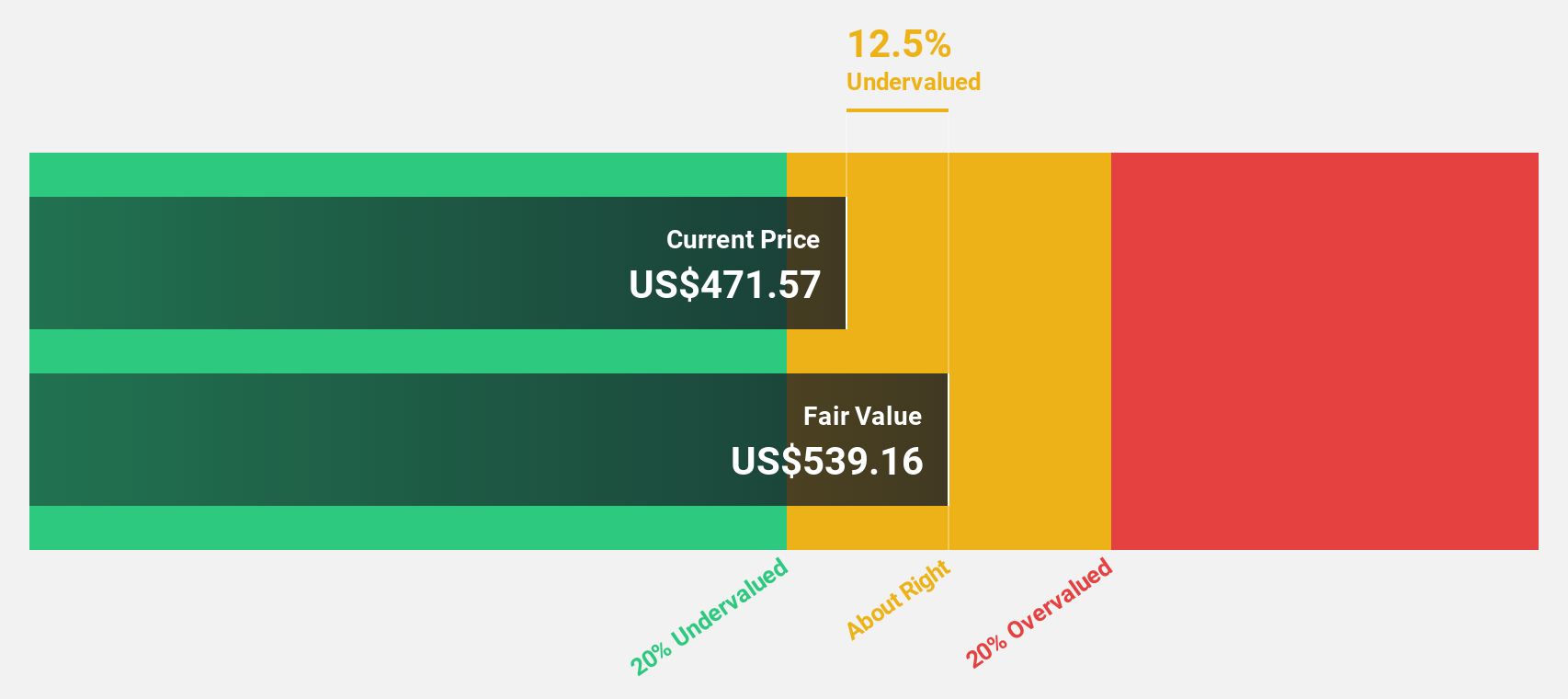

Estimated Discount To Fair Value: 14.6%

Duolingo is trading at US$432.69, approximately 14.6% below its estimated fair value of US$506.64, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 35.5% annually over the next three years, outpacing the broader U.S. market's growth rate of 14.5%. Recent product enhancements and a strategic board appointment bolster Duolingo's innovative edge and leadership capabilities in the education technology sector.

- Upon reviewing our latest growth report, Duolingo's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Duolingo.

Incyte (NasdaqGS:INCY)

Overview: Incyte Corporation is a biopharmaceutical company focused on the discovery, development, and commercialization of therapeutics across the United States, Europe, Canada, and Japan with a market cap of approximately $13.63 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to approximately $4.24 billion.

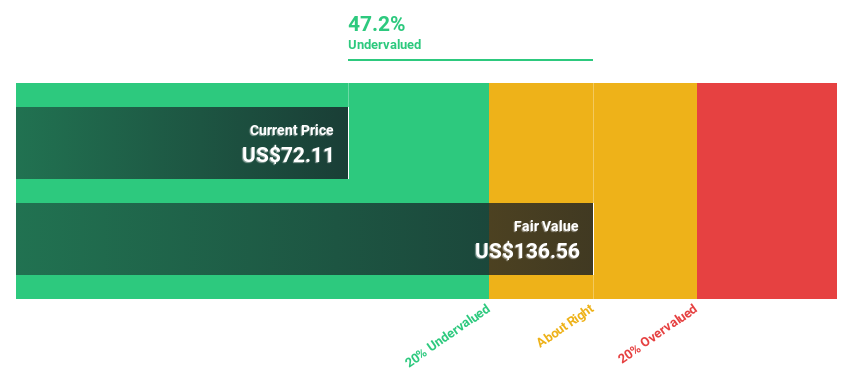

Estimated Discount To Fair Value: 47.8%

Incyte is trading at US$70.42, significantly below its estimated fair value of US$134.89, suggesting undervaluation based on cash flows. Despite a decline in net profit margins from 16.2% to 0.8%, earnings are projected to grow at 23.8% annually over the next three years, surpassing the U.S. market's growth rate of 14.5%. Recent strategic shifts and FDA approvals for treatments like Niktimvo enhance Incyte's potential for future profitability and market positioning.

- Our comprehensive growth report raises the possibility that Incyte is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Incyte.

Inspire Medical Systems (NYSE:INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea, with a market cap of approximately $5.51 billion.

Operations: The company's revenue is primarily derived from its Patient Monitoring Equipment segment, which generated $802.80 million.

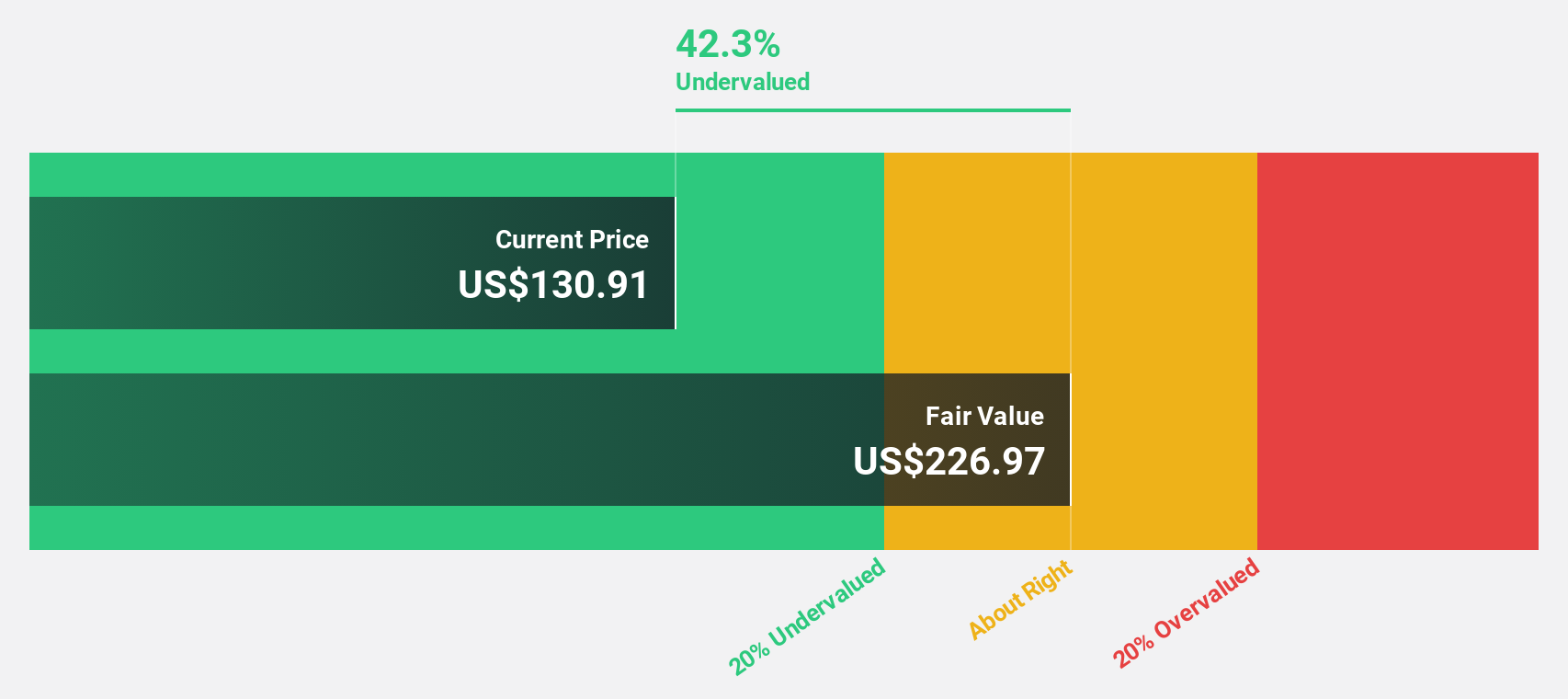

Estimated Discount To Fair Value: 18.1%

Inspire Medical Systems is trading at US$185.61, about 18.1% below its estimated fair value of US$226.59, indicating potential undervaluation based on cash flows. The company reported a net income of US$53.51 million for 2024, transitioning from a prior loss and achieving significant earnings growth with projections of 26% annually over the next three years, outpacing the U.S. market's expected growth rate of 14.5%.

- In light of our recent growth report, it seems possible that Inspire Medical Systems' financial performance will exceed current levels.

- Dive into the specifics of Inspire Medical Systems here with our thorough financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 160 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives