- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

ChromaDex And 2 Other Undervalued Small Caps In US With Insider Buying

Reviewed by Simply Wall St

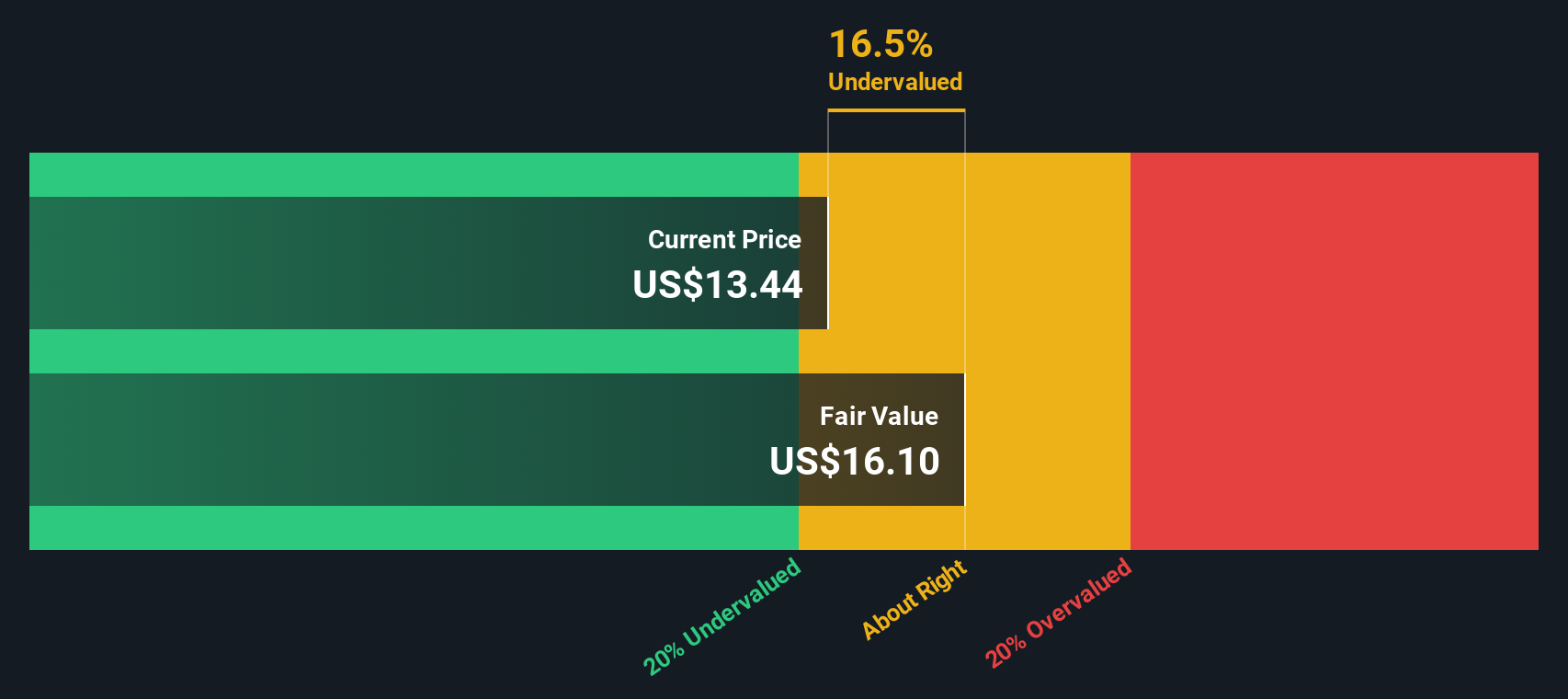

The United States market has remained flat over the past week but has shown a robust 21% increase over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued and have insider buying can be a strategic approach for investors seeking opportunities in smaller companies like ChromaDex.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 11.3x | 2.9x | 49.44% | ★★★★★☆ |

| Array Technologies | NA | 1.1x | 48.89% | ★★★★★☆ |

| OptimizeRx | NA | 1.3x | 32.55% | ★★★★★☆ |

| German American Bancorp | 14.1x | 4.7x | 46.86% | ★★★★☆☆ |

| First United | 12.2x | 3.3x | 35.04% | ★★★★☆☆ |

| Quanex Building Products | 29.6x | 0.8x | 40.99% | ★★★★☆☆ |

| S&T Bancorp | 11.7x | 4.0x | 37.91% | ★★★★☆☆ |

| Arrow Financial | 15.0x | 3.3x | 39.08% | ★★★☆☆☆ |

| Limbach Holdings | 35.8x | 1.8x | 47.99% | ★★★☆☆☆ |

| Franklin Financial Services | 14.9x | 2.4x | 22.39% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

ChromaDex (NasdaqCM:CDXC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ChromaDex is a company focused on developing and commercializing dietary supplements, ingredients, and analytical reference standards, with a market cap of approximately $0.24 billion.

Operations: ChromaDex generates revenue primarily from its Consumer Products segment, followed by Ingredients and Analytical Reference Standards and Services. Over recent periods, the company's gross profit margin has shown a positive trend, reaching 61.45% as of September 2024. Operating expenses are significant, with General & Administrative costs being a major component. Despite historical net losses, the company reported a positive net income margin of 1.62% in September 2024, indicating improved financial performance.

PE: 293.6x

ChromaDex, a small company in the U.S., is catching attention with its projected 81.83% annual earnings growth. Despite relying on external borrowing for funding, which carries higher risk, insider confidence is reflected through recent share purchases by executives in late 2024. The company's engagement with Crowe LLP as their new auditor and participation in key investor conferences highlights proactive management efforts to strengthen financial transparency and investor relations.

- Click here to discover the nuances of ChromaDex with our detailed analytical valuation report.

Gain insights into ChromaDex's historical performance by reviewing our past performance report.

SNDL (NasdaqCM:SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

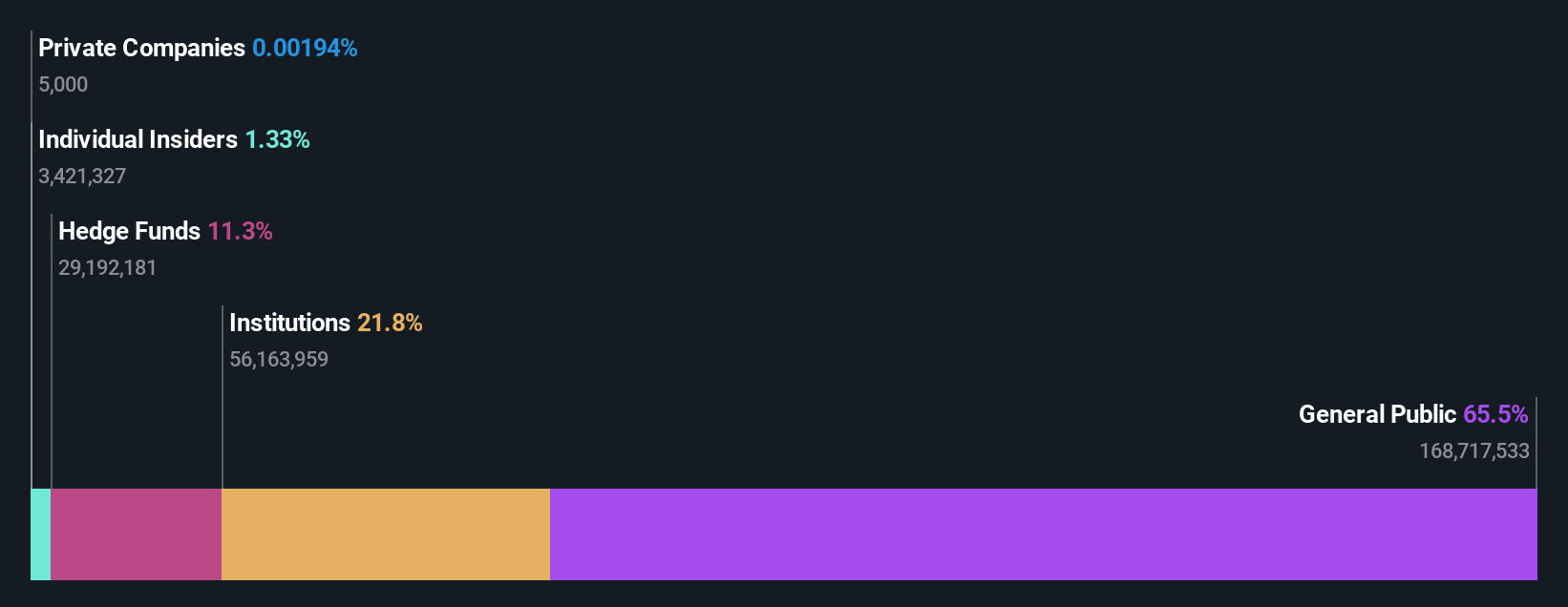

Overview: SNDL operates in the cannabis and liquor retail sectors, with a focus on cannabis operations and a market capitalization of CA$1.54 billion.

Operations: The company's revenue streams primarily consist of CA$560.67 million from liquor retail, CA$303.67 million from cannabis retail, and CA$98.42 million from cannabis operations. The gross profit margin has shown an upward trend, reaching 25.12% by the latest period in 2025.

PE: -6.0x

SNDL, a cannabis company with a market cap under US$1 billion, is gaining attention for its strategic moves despite current unprofitability. Their recent three-year supply agreement with Aurora Cannabis valued at US$27 million highlights their expanding footprint in premium cannabis products. The collaboration with HYTN Innovations to develop GMP-compliant vape cartridges underscores their commitment to innovation and regulatory compliance. Insider confidence is evident from recent share purchases by executives, suggesting belief in future growth potential amidst industry challenges.

- Get an in-depth perspective on SNDL's performance by reading our valuation report here.

Examine SNDL's past performance report to understand how it has performed in the past.

Potbelly (NasdaqGS:PBPB)

Simply Wall St Value Rating: ★★★☆☆☆

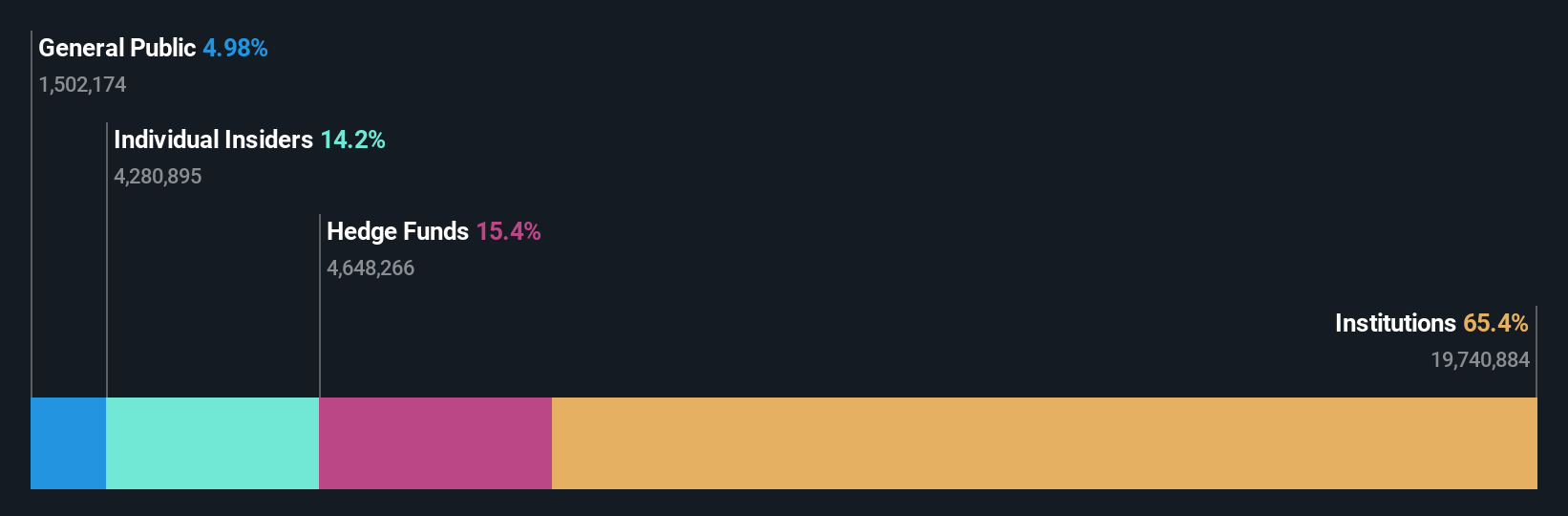

Overview: Potbelly operates a chain of sandwich shops and has a market capitalization of $0.13 billion.

Operations: Potbelly's revenue primarily comes from its sandwich shops, with a recent figure of $471.72 million. The company has experienced fluctuations in its gross profit margin, reaching 35.50% by the latest period. Operating expenses have been significant, with general and administrative expenses contributing notably to costs at $49.1 million in the most recent data point.

PE: 9.9x

Potbelly, a fast-casual dining brand known for its toasted sandwiches, is expanding in Phoenix, North Carolina, and Delaware. This growth aligns with their strategy to franchise in key markets. Despite challenges like forecasted earnings decline of 62.7% annually over the next three years and reliance on external borrowing, insider confidence remains evident through recent share purchases. The company’s expansion efforts could bolster local economies by creating jobs while enhancing its market presence with new locations opening soon.

Key Takeaways

- Click through to start exploring the rest of the 47 Undervalued US Small Caps With Insider Buying now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives