- United States

- /

- Entertainment

- /

- NYSE:SPOT

Exploring Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As U.S. markets trend towards all-time highs, driven by robust performances in technology and other sectors, investors are increasingly attentive to the underlying factors that contribute to a company's success. In this climate, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

| BBB Foods (NYSE:TBBB) | 23.6% | 99.4% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here's a peek at a few of the choices from the screener.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $25.33 billion.

Operations: The company generates its revenue primarily through sales of subscription services to its cloud platform and related support services, totaling approximately $2.03 billion.

Insider Ownership: 38.5%

Earnings Growth Forecast: 52.8% p.a.

Zscaler, a company in the spotlight for its growth trajectory and insider activities, is currently trading at 38.9% below its estimated fair value, with expectations of significant profit increases (forecasted at 52.84% annually). Despite this potential, there's caution due to recent substantial insider selling and shareholder dilution over the past year. Recent strategic moves include partnerships for enhanced cybersecurity measures and pursuing acquisitions to bolster their platform capabilities, alongside providing optimistic revenue forecasts for upcoming fiscal periods.

- Unlock comprehensive insights into our analysis of Zscaler stock in this growth report.

- In light of our recent valuation report, it seems possible that Zscaler is trading behind its estimated value.

Palantir Technologies (NYSE:PLTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. develops software platforms for the intelligence community, focusing on counterterrorism in the US, UK, and globally, with a market cap of approximately $47.48 billion.

Operations: The company generates revenue through two primary segments: Commercial at $1.07 billion and Government at $1.27 billion.

Insider Ownership: 13.4%

Earnings Growth Forecast: 24.4% p.a.

Palantir Technologies, a key player in AI integration across diverse sectors, recently reported a substantial year-over-year revenue increase to US$634.34 million and net income growth to US$105.53 million for Q1 2024. The company's strategic expansions include deepening ties with Tampa General Hospital to enhance healthcare operations using AI and broadening its partnership with Eaton for advanced ERP solutions. Despite these positive developments, shareholder dilution over the past year raises concerns about potential equity value impacts. Forecasted earnings growth remains robust at 24.38% annually, outpacing the broader U.S market prediction of 14.7%.

- Get an in-depth perspective on Palantir Technologies' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Palantir Technologies' share price might be on the expensive side.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates globally, offering audio streaming subscription services with a market capitalization of approximately $62.20 billion.

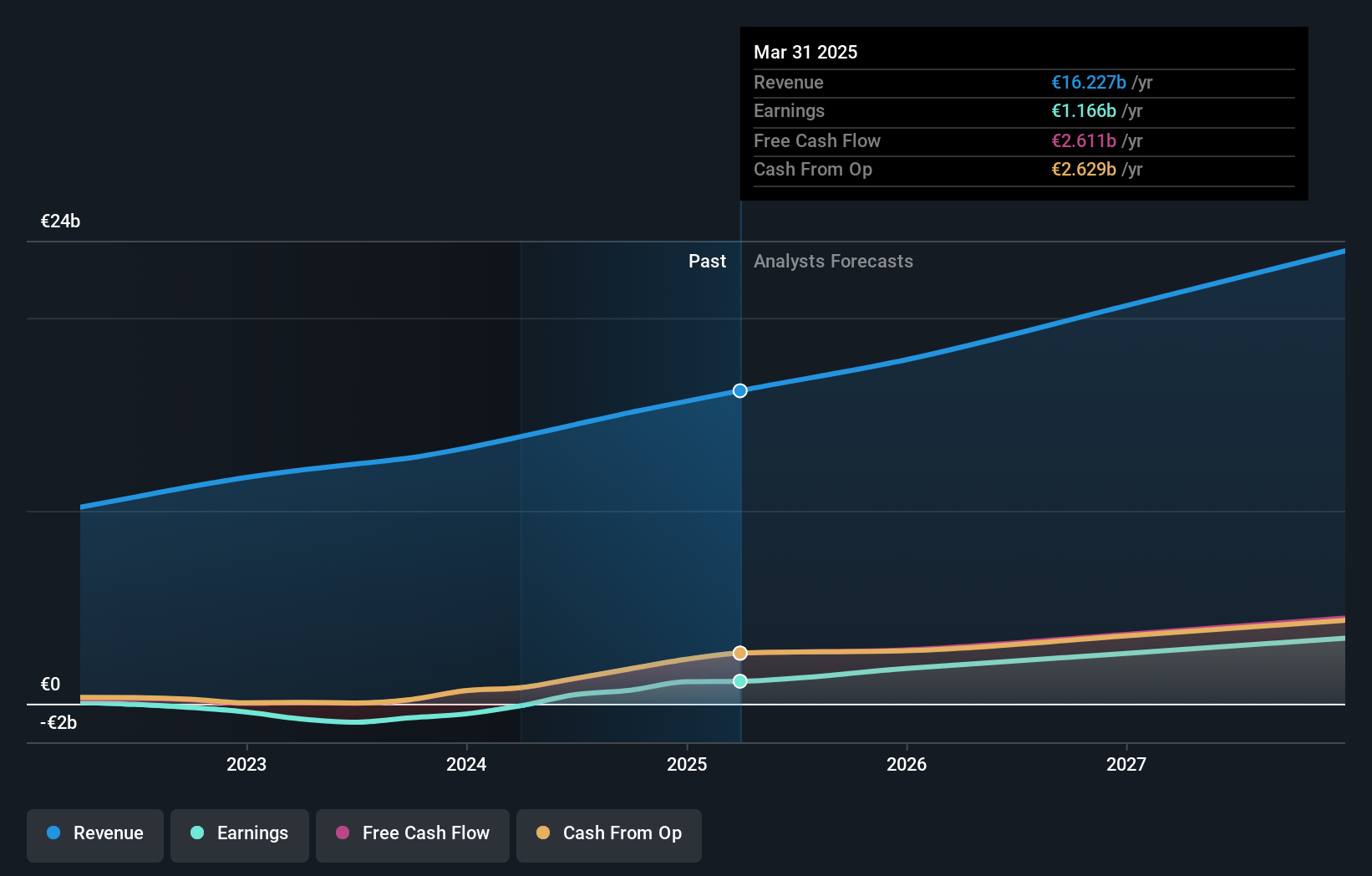

Operations: The company generates revenue primarily through two segments: Premium, which brought in €12.10 billion, and Ad-Supported, contributing €1.74 billion.

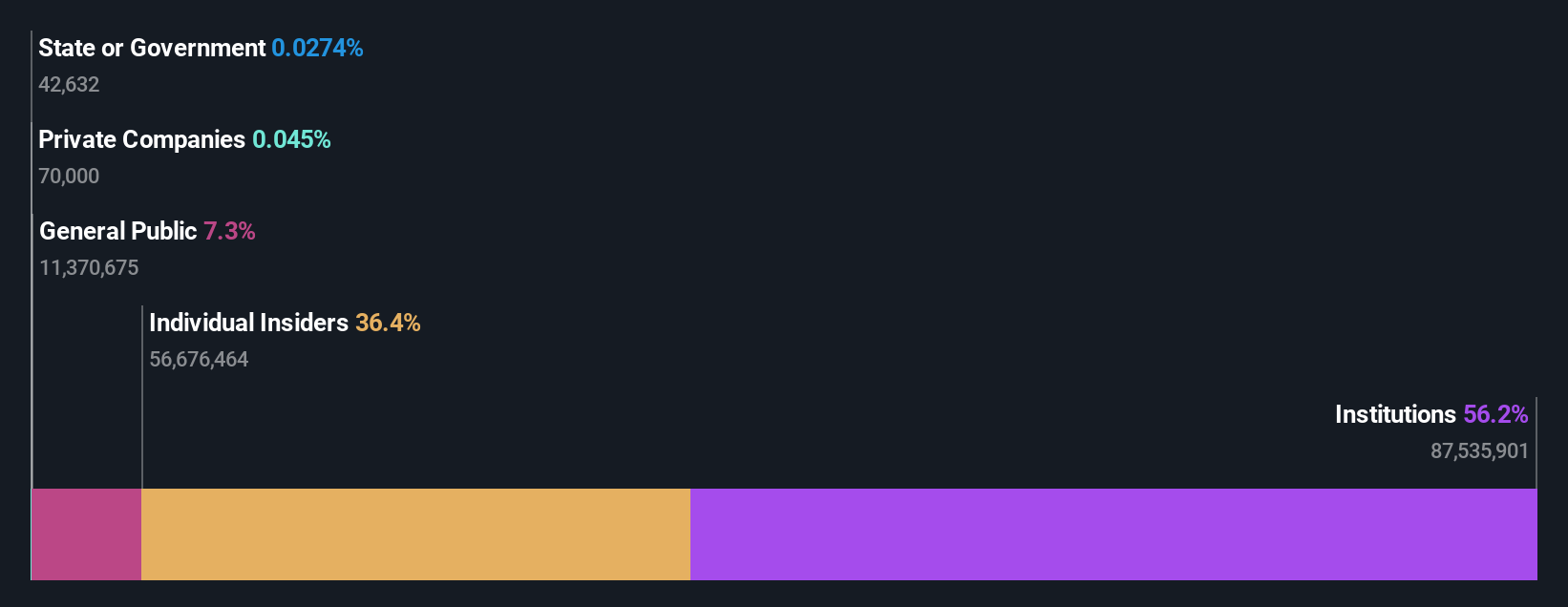

Insider Ownership: 18%

Earnings Growth Forecast: 40.6% p.a.

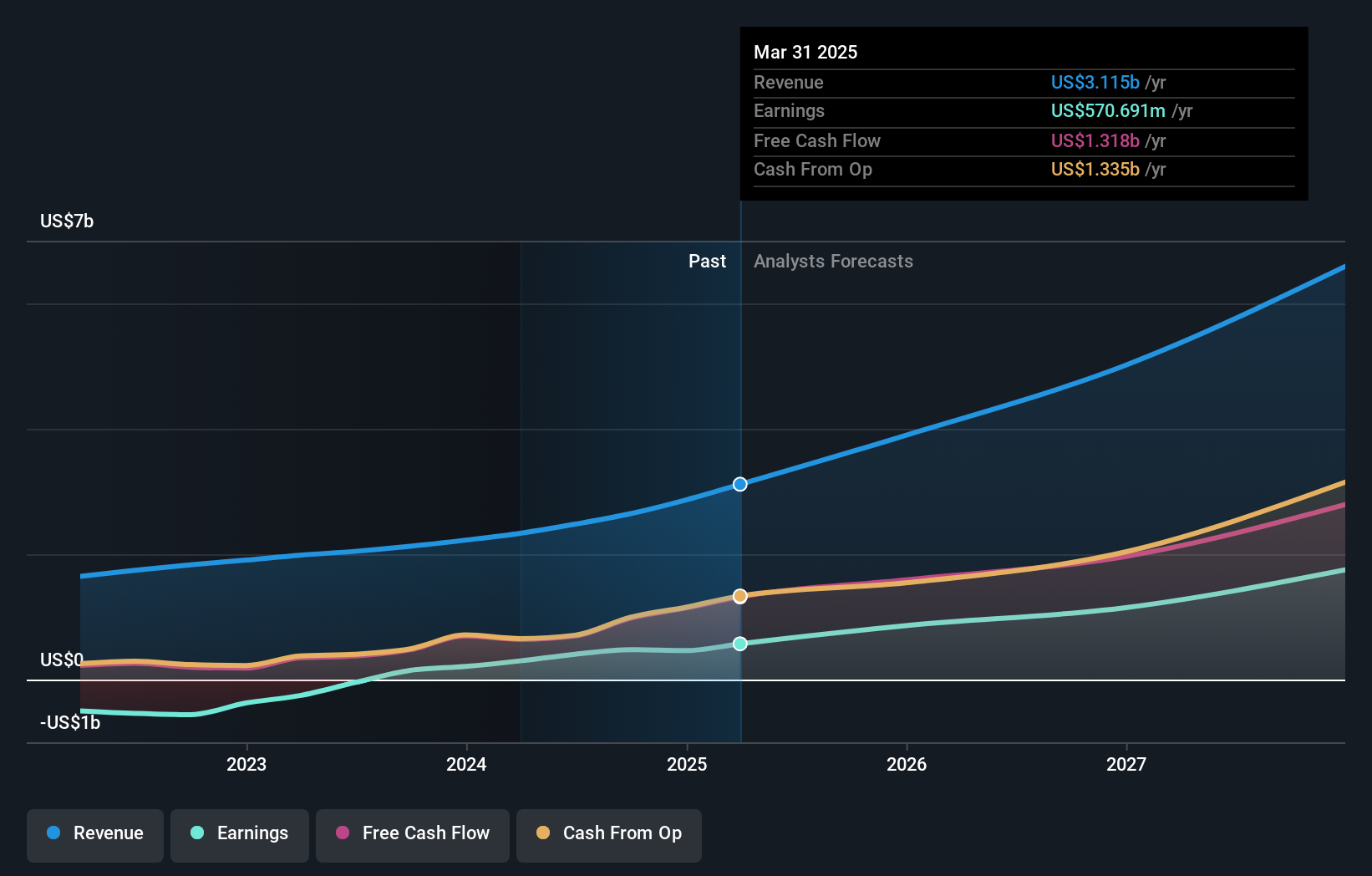

Spotify Technology S.A. has shown significant financial improvement, reporting a shift from a net loss to a profit of EUR 197 million in Q1 2024, with sales rising to EUR 3.64 billion from EUR 3.04 billion year-over-year. The company anticipates continued growth with projections for increased monthly active users and premium subscribers in Q2, alongside an expected revenue of EUR 3.8 billion and an operating profit of EUR 250 million. However, the lack of insider buying over the past three months and recent shareholder dilution could temper investor enthusiasm despite these positive trends.

- Take a closer look at Spotify Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Spotify Technology's current price could be inflated.

Seize The Opportunity

- Explore the 179 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Spotify Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives