Stock Analysis

- United States

- /

- Entertainment

- /

- NYSE:SE

Unveiling 3 US Growth Companies With High Insider Ownership And Up To 20% Revenue Growth

Reviewed by Simply Wall St

Amid a backdrop of record highs for the Nasdaq and moderate gains across other major indices, the U.S. stock market continues to display resilience despite mixed economic signals. In such an environment, growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's take a closer look at a couple of our picks from the screened companies.

PDD Holdings (NasdaqGS:PDD)

Simply Wall St Growth Rating: ★★★★★★

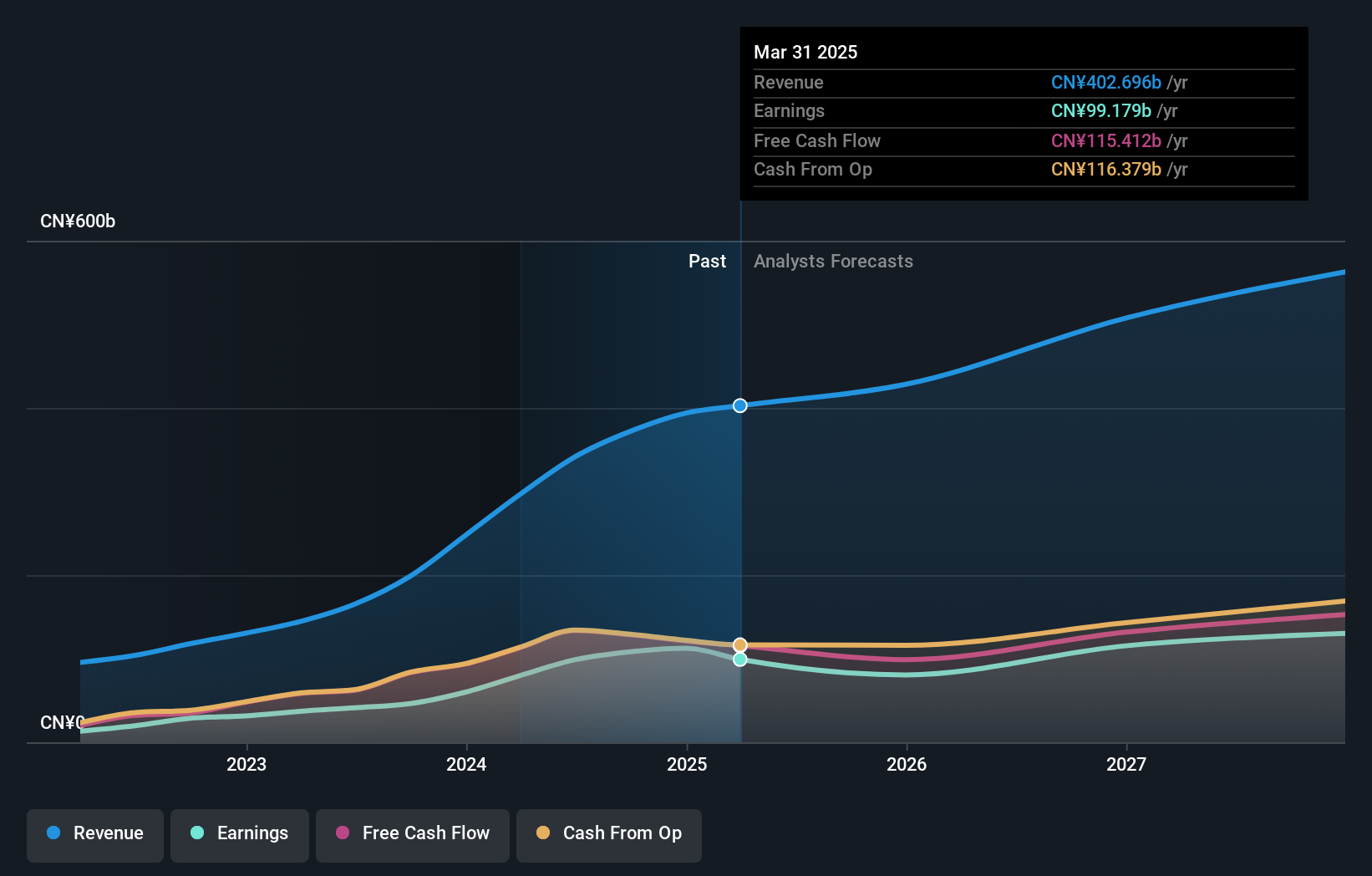

Overview: PDD Holdings Inc., a multinational commerce group, manages a diverse portfolio of businesses with a market capitalization of approximately $190.73 billion.

Operations: The company generates CN¥296.81 billion in revenue from its Internet Software & Services segment.

Insider Ownership: 32.1%

Revenue Growth Forecast: 20.8% p.a.

PDD Holdings, a growth-focused company with substantial insider ownership, has demonstrated robust financial performance and promising forecasts. Recently, the company reported a significant increase in quarterly sales to CNY 86.81 billion and net income to CNY 27.99 billion, reflecting strong operational efficiency. Analysts predict PDD's earnings will grow by 23.2% annually, outpacing the US market projection of 14.7%. Despite recent shareholder dilution, PDD is valued at 64.6% below estimated fair value and is expected to see its stock price rise by approximately 49.7%, indicating potential undervaluation relative to future growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of PDD Holdings.

- The analysis detailed in our PDD Holdings valuation report hints at an deflated share price compared to its estimated value.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other regions, with a market capitalization of approximately $41.06 billion.

Operations: The company's revenue is primarily generated from e-commerce at $9.68 billion, followed by digital entertainment and digital financial services, which contribute $2.09 billion and $1.85 billion respectively.

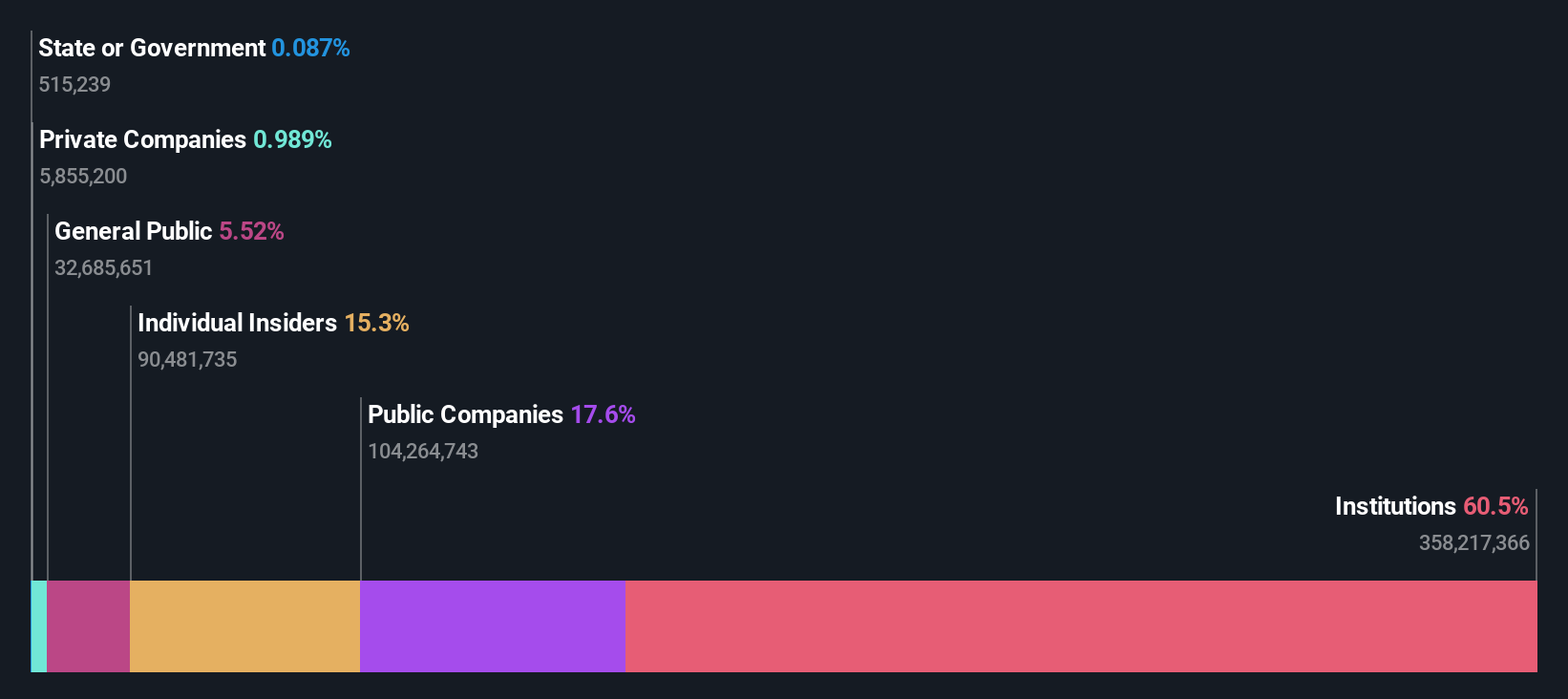

Insider Ownership: 15.1%

Revenue Growth Forecast: 11.4% p.a.

Sea Limited, a growth-oriented firm with high insider ownership, is navigating a complex financial landscape. Despite a recent quarterly net loss of US$23.66 million, the company's revenue rose to US$3.73 billion from US$3.04 billion year-over-year, showcasing resilience in earnings generation. Forecasted to grow earnings by 41.8% annually and revenue by 11.4% annually, Sea's performance is projected to outpace the broader US market significantly, although impacted by large one-off items affecting its quality of earnings.

- Click here to discover the nuances of Sea with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Sea's share price might be too pessimistic.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

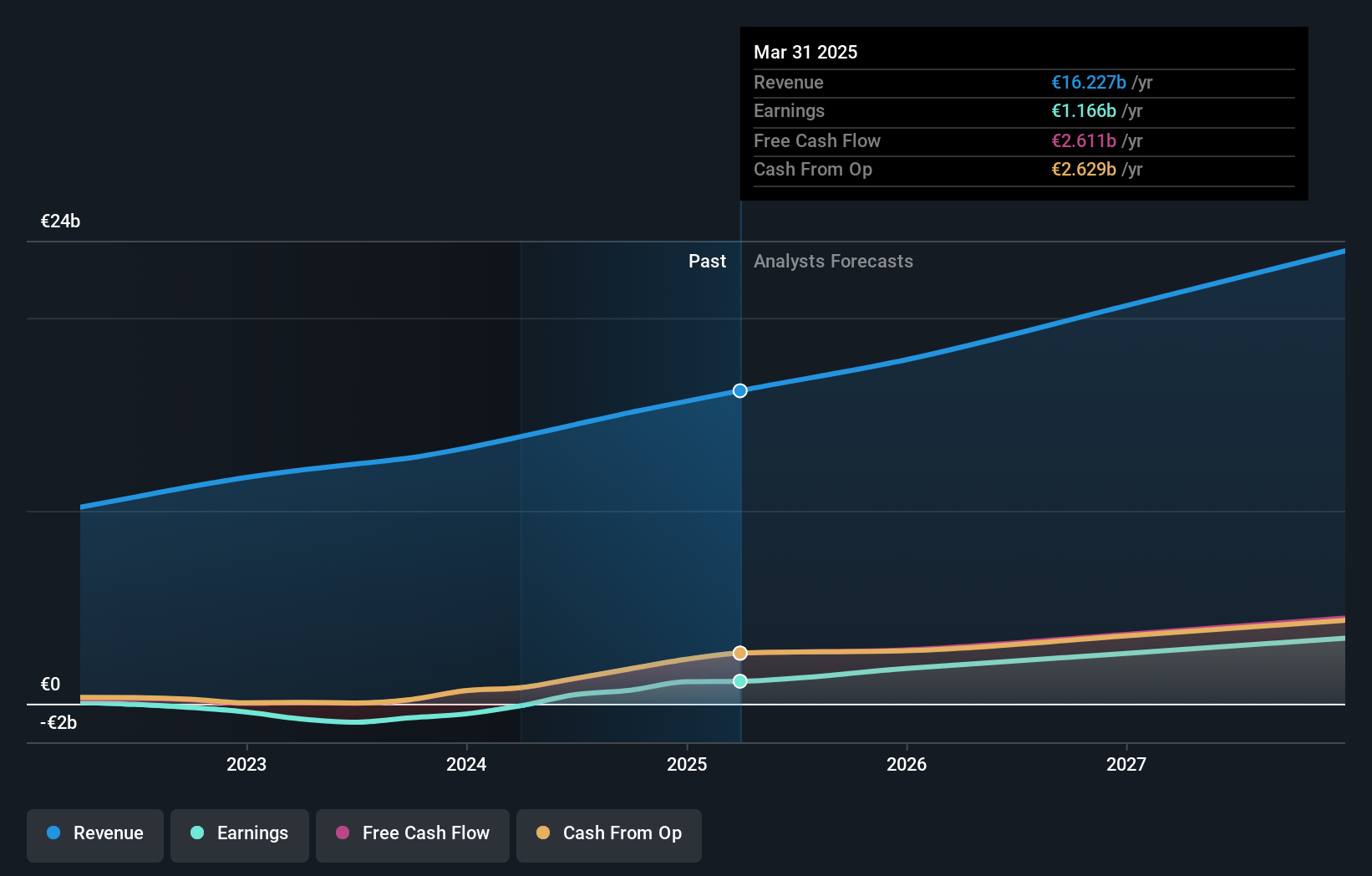

Overview: Spotify Technology S.A. operates globally, offering audio streaming subscription services with a market capitalization of approximately $62.66 billion.

Operations: The company generates revenue primarily through two segments: Premium, which brings in €12.10 billion, and Ad-Supported, contributing €1.74 billion.

Insider Ownership: 17.9%

Revenue Growth Forecast: 12.2% p.a.

Spotify Technology has recently shown promising financial improvements, reporting a net income of €197 million for Q1 2024, a significant turnaround from a net loss the previous year. This growth accompanies its inclusion in the Russell Top 200 Growth Index, reflecting its potential in high-growth segments. Despite past shareholder dilution, Spotify is expected to see earnings grow by approximately 40.56% annually and revenue increase by 12.2% annually, outpacing general US market trends. However, it lacks substantial insider buying over the past three months and has completed only minimal share repurchases within this period.

- Dive into the specifics of Spotify Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Spotify Technology's share price might be on the expensive side.

Key Takeaways

- Click here to access our complete index of 183 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Sea is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.

Excellent balance sheet with reasonable growth potential.