- United States

- /

- Media

- /

- NYSE:CCO

AtriCure And Two Other Undervalued Small Caps With Insider Actions In The United States

Reviewed by Simply Wall St

Recent remarks from Federal Reserve Chairman Jerome Powell have infused optimism into the U.S. stock market, propelling the S&P 500 to a record close above 5,500. This buoyant backdrop provides a fertile environment for exploring potential opportunities in undervalued small-cap stocks, which may benefit from broader economic conditions and insider actions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Leggett & Platt | NA | 0.3x | 22.44% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 31.74% | ★★★★★☆ |

| AtriCure | NA | 2.8x | 47.35% | ★★★★★☆ |

| Titan Machinery | 3.6x | 0.1x | 30.54% | ★★★★★☆ |

| Franklin Financial Services | 8.9x | 1.8x | 37.72% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.3x | 17.53% | ★★★★☆☆ |

| Papa John's International | 19.4x | 0.7x | 37.65% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -139.61% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -140.34% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

AtriCure (NasdaqGM:ATRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.47 billion.

Operations: The company generates revenue primarily from its surgical and medical equipment segment, which recorded sales of $414.60 million. It has observed a gross profit margin of 75.26% in the most recent period, indicating the percentage of revenue exceeding the cost of goods sold.

PE: -30.8x

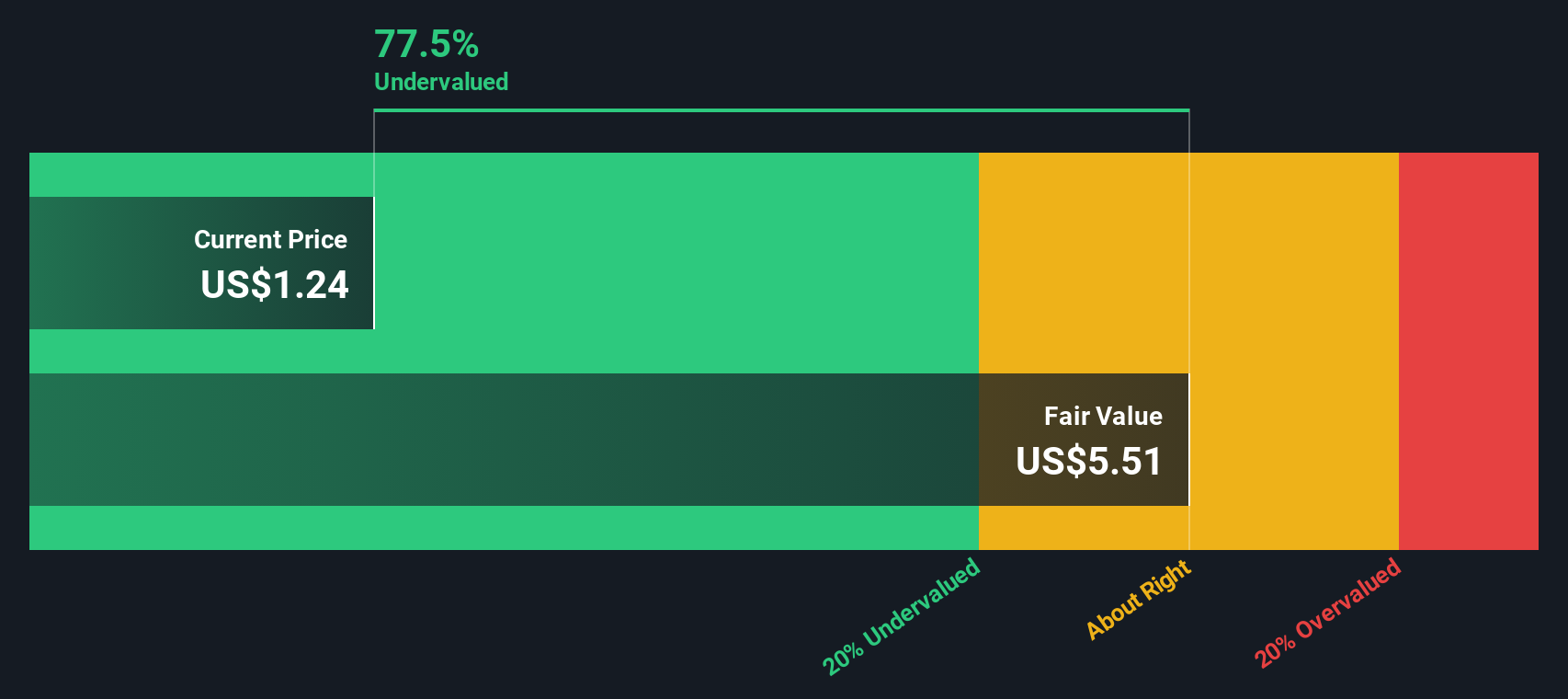

AtriCure, recently dropped from multiple Russell 2000 indexes, remains intriguing with its innovative cryoSPHERE+ probe enhancing surgical outcomes and potentially reducing opioid dependency post-surgery. Despite a net loss widening to US$13.27 million in Q1 2024 from US$6.48 million the previous year, revenue surged to US$108.85 million, reflecting a robust growth trajectory supported by insider confidence as evidenced by recent share purchases by company insiders. With projected annual revenues reaching up to US$466 million, AtriCure's strategic advancements underscore its potential amidst challenges.

- Click to explore a detailed breakdown of our findings in AtriCure's valuation report.

Assess AtriCure's past performance with our detailed historical performance reports.

Clear Channel Outdoor Holdings (NYSE:CCO)

Simply Wall St Value Rating: ★★★★★☆

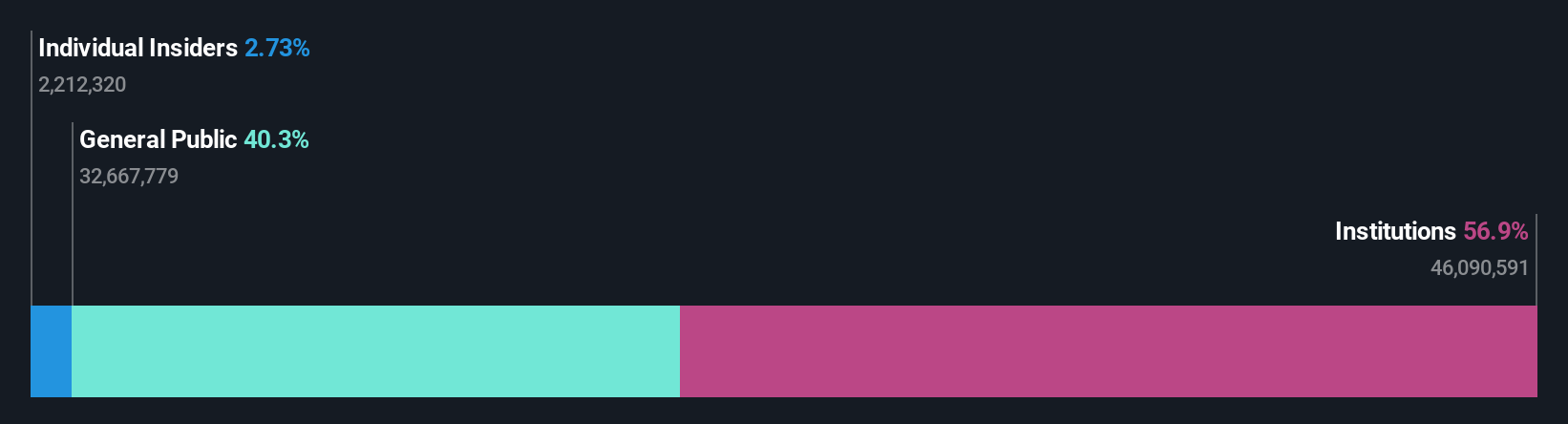

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning airport, European, and American markets, with a market capitalization of approximately $0.57 billion.

Operations: The company generates significant revenue from America (excluding airports) with $1.11 billion, followed by Europe-north at $630.45 million, and airports contributing $334.74 million. The gross profit margin has shown variability over periods but recently recorded at 47.43% in the latest quarter of 2024, indicating the proportion of revenue exceeding the cost of goods sold before deducting operating expenses.

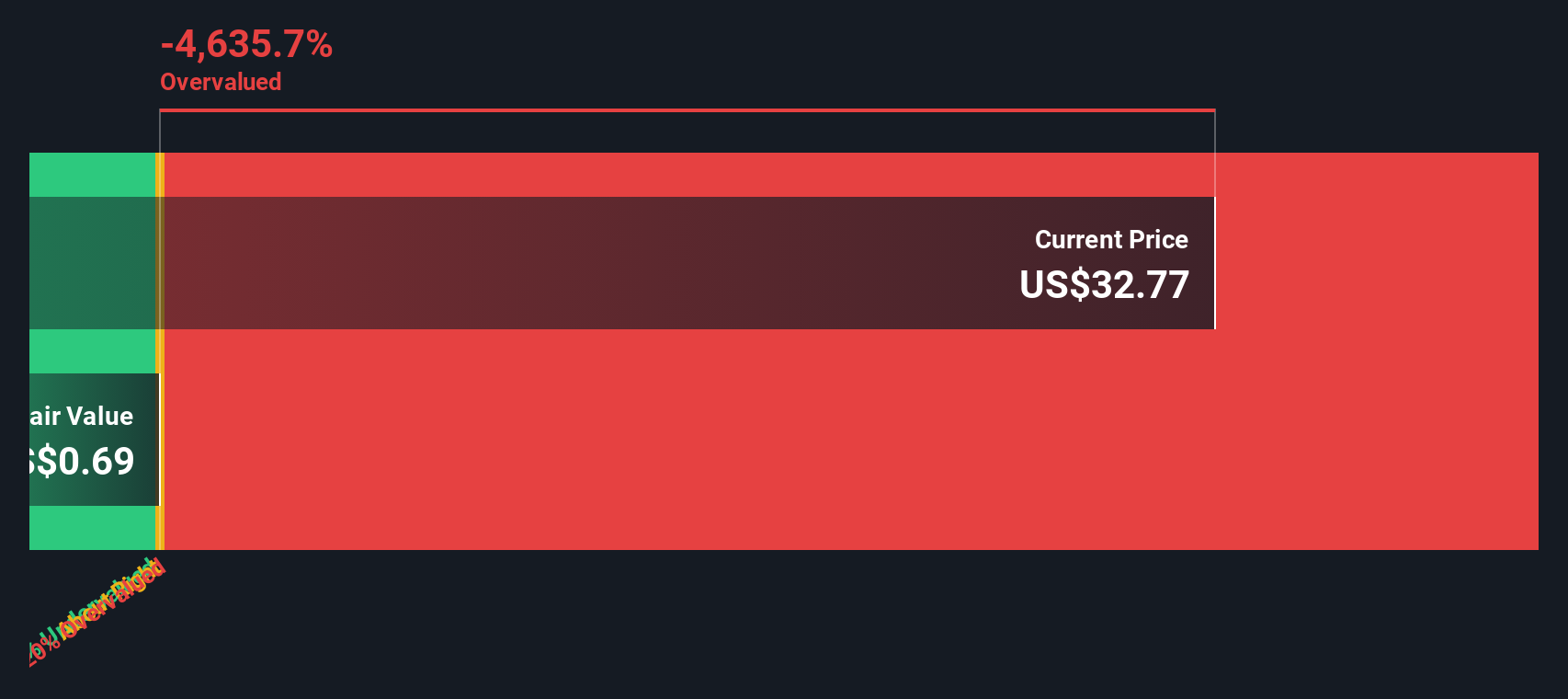

PE: -4.9x

Despite its current unprofitability and reliance on higher-risk external borrowing, Clear Channel Outdoor Holdings recently showcased robust growth potential by being added to multiple Russell indexes as of July 1, 2024. This inclusion reflects a positive market recognition and could hint at underlying strengths not immediately apparent from its financials alone. Insider confidence is evidenced by recent purchases, suggesting those closest to the company foresee a bright future. With expected revenue between US$2.2 billion and US$2.26 billion for the year, Clear Channel is positioning itself for recovery and growth in a challenging sector.

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing, on a leveraged basis, in a diversified portfolio of mortgage assets.

Operations: The business generates revenue through a diversified portfolio of mortgage assets, achieving a gross profit margin of 0.89 and operating expenses amounting to $54.35 million in the most recent quarter.

PE: 8.4x

Chimera Investment's recent 1-for-3 reverse stock split and a dividend increase to $0.35 per share underscore its strategic adjustments amid challenging market conditions. Despite a slight expected decline in earnings over the next three years, insider confidence remains evident as they recently purchased shares, signaling belief in the company's resilience and potential for growth. This move, coupled with their complete repurchase of significant shares under the 2020 buyback plan, highlights their commitment to enhancing shareholder value while navigating through higher-risk funding structures solely from external borrowing.

- Navigate through the intricacies of Chimera Investment with our comprehensive valuation report here.

Examine Chimera Investment's past performance report to understand how it has performed in the past.

Make It Happen

- Click through to start exploring the rest of the 61 Undervalued Small Caps With Insider Buying now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCO

Clear Channel Outdoor Holdings

Operates as an out-of-home advertising company in the United States and Singapore.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives