Quote of the Week: “I've done well over time but made lots of mistakes, too. Learn from your mistakes.” - Kenneth Fisher

And just like that, we are into the third quarter and the second half of 2024.

Equity markets have done better than many expected, despite interest rates remaining elevated. Yes, most of the heavy lifting has been done by ‘big tech’ but the outlook for the broader market has actually improved.

This week, we are looking at what’s been happening under the hood across equity markets, as well as looking ahead to the second half of 2024.

Let’s dive in!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

💸 US Short-Term borrowing set to increase dramatically ( FT )

- Our take: The fact that the US budget deficit keeps growing shouldn’t be news to anyone. The timing of the actual borrowing (i.e. when the US Treasury needs to issue and sell new bonds) is more complex. This depends on the exact timing of maturing bonds (that need to be rolled over), as well as major expenses (like the recent aid packages to Ukraine and Israel).

- The Treasury is also selling more short-dated debt instruments than normal - presumably because it expects rates to fall. To add to the complexity, some funds can only invest in short-dated debt, while others can only invest in longer-dated debt.

- Some analysts expect a big spike in short-term borrowing in the next three months, which could put a strain on liquidity. That probably won’t be a problem unless there are any other crises at the same time.

-

💳 Judge rejects Visa and Mastercard’s $30 billion settlement on swipe fees ( Yahoo Finance )

- Our take: In March, Visa and Mastercard proposed a deal that would (slightly) reduce the fees they charge merchants. A Judge has now put the deal on hold and is likely to reject it. $30 billion might sound alarming but it was actually the estimated amount merchants would save over the next five years, after which the deal would expire. The actual reduction in fees was 0.04%, which was quite literally a tiny fraction of what they charge merchants. The companies will likely need to improve their offer, but it’s unlikely to have a substantial impact on their respective earnings.

-

👗 Online Fashion Retailer Shein files for London IPO ( WSJ )

- Our take: Shein, which was last valued at $45 billion, originally filed to list in New York in 2023. That filing ran into trouble as it coincided with negative publicity over working conditions at several Shein suppliers in China. Shein is now based in Singapore, but began in China, where most of its suppliers are still located. Companies with links to China are finding it increasingly difficult to do business in the US. This is likely to lead to even more creative arrangements with companies based in connector countries like Vietnam, Indonesia and Mexico .

-

🏬 Amazon to launch discount store to take on Temu and Shein ( CNBC )

- Our take: It’s been a busy week for e-commerce. Days after Shein announced its London IPO, Amazon pitched a new budget storefront to sellers in China. How those sellers might differ from Shein remains to be seen. The Everything Store seems to be under pressure after the growth of Temu ( PDD ) and Shein in Western markets. Also in the world of e-commerce, Target is teaming up with Shopify to expand its third-party marketplace . The bottom line: retail is a brutal industry, and margins are seldom safe.

-

🔌 Europe green power deals set for strong year ( SPGlobal )

- Our take: We recently wrote about wind and solar energy. From an investor's point of view, green energy has been a disaster until recently. But 2023 was a record year for new green energy capacity additions. 2024 is shaping up to be another record year, particularly in Europe. S&P Global Commodity Insights reported 145 new deals between January and May, compared to 94 in the first five months of 2023. Electricity prices have fallen dramatically, so the winners might end up being suppliers and consumers, rather than utilities.

-

🍎 Benedict Evans on Apple Intelligence ( BenEvans )

- Our take: Evans recently published an essay on Apple’s AI strategy. One of the things he pointed out was that with Apple’s approach, workloads will be ‘ unbundled into individual features which are inherently easier to run as small power-efficient models on small power-efficient devices .’ This pushes the cost of inference to the user, which could completely alter the economics of AI applications. The essay is worth reading if you are trying to understand who the winners (and losers) in the AI arms race might be. His previous essay on building AI products with ‘buggy’ LLMs is also a good read.

-

The consensus on tariffs is changing ( Axios )

- Our take: Axios wrote an interesting deep dive on the shifting attitude to tariffs. The pro-capitalism view has always been that tariffs make imports more expensive for consumers and punish low-cost producers. This is all true, but it's become a lot more complicated with subsidies, IP theft and wide-ranging strategic objectives. But, as Axios points out, trying to ‘ advance a number of totally separate goals is a lot to ask from trade policy .’

📅 Second Quarter And Half-Year Review

For most economies, the soft landing scenario has continued to play out in the second quarter.

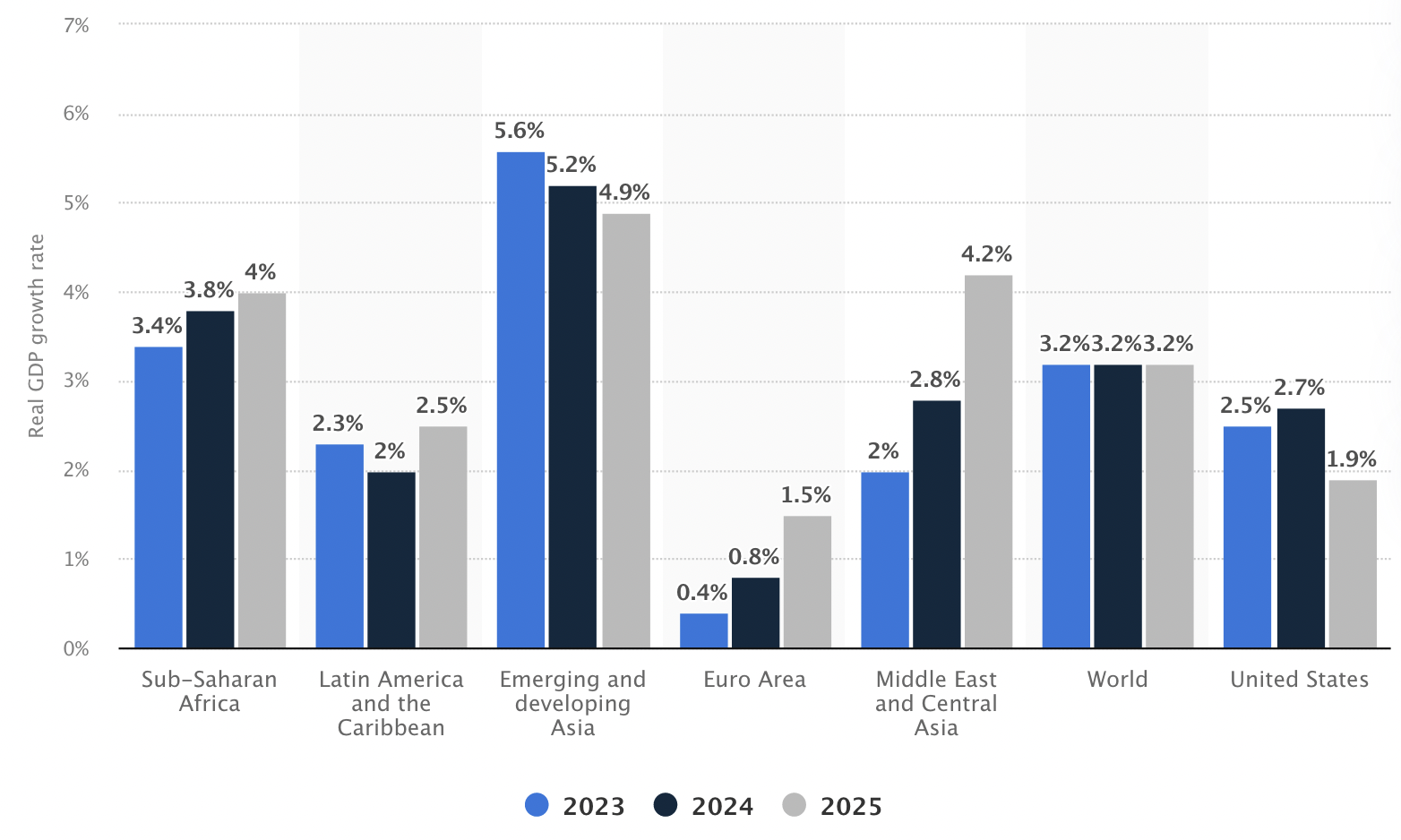

The IMF has made far fewer changes to its GDP growth projections than it did in 2022 and 2023.

The IMF expects global growth to remain at 2023’s level of 3.2% through 2024 and 2025. However, they expect this to include a slowdown in the US and Asia offset by accelerating growth in Europe and non-Asian emerging economies.

✨ Inflation across the globe has either fallen or stabilized, which has led to improved confidence and taken the pressure off corporate profits. Lower inflation expectations and fewer mentions of recessions does a lot for business and consumer confidence.

Central banks have begun to cut rates in the economies where inflation is close to target levels. However, stubborn inflation in the US, UK and Australia means rate cuts have been pushed further into the future. Bond yields in a lot of countries peaked in April or May - but they remain at elevated levels.

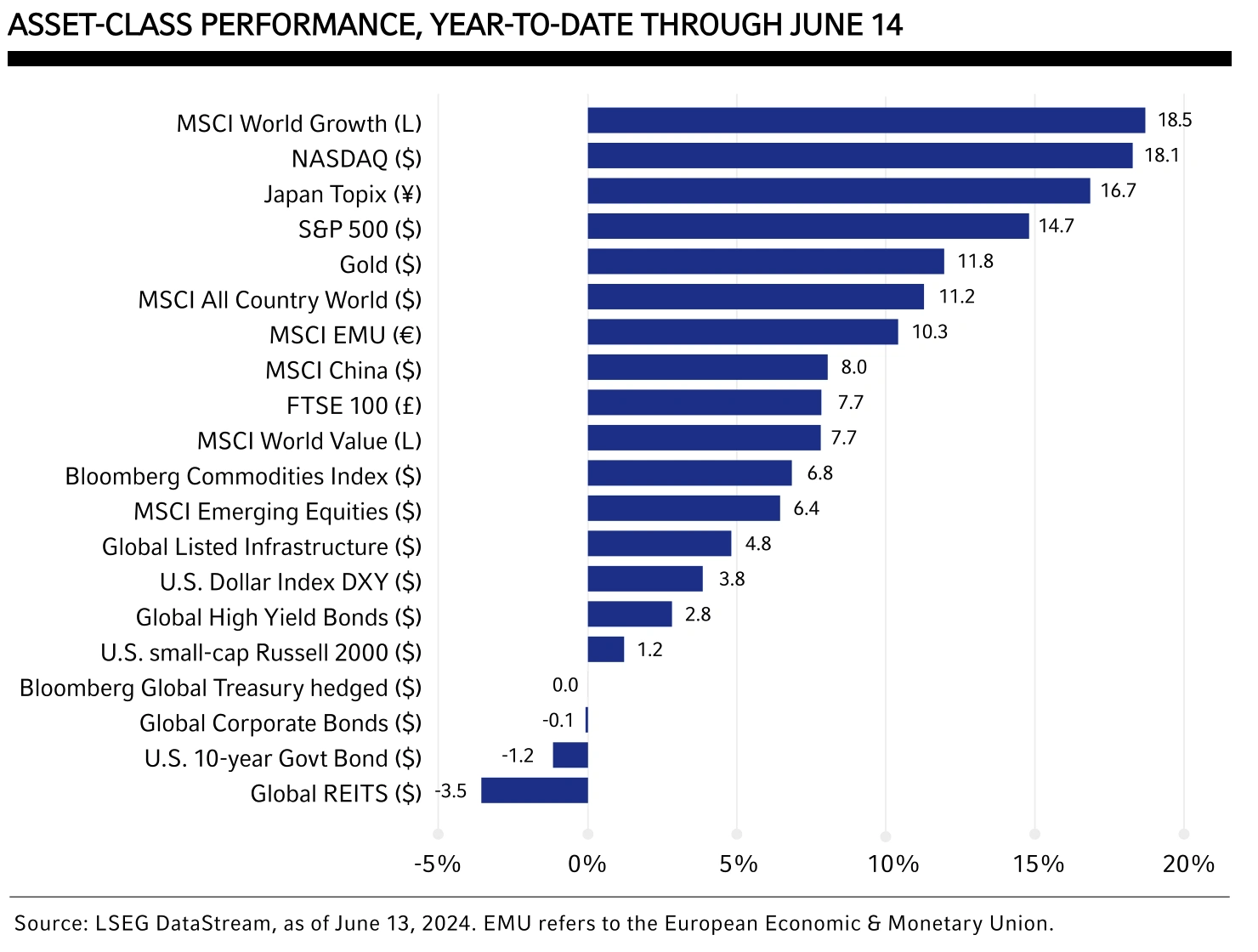

The AI and big tech themes have continued to dominate equity markets through the second quarter. Indexes with exposure to the ‘Magnificent 7’ have outperformed across the board. Elsewhere, equities have made modest gains, apart from certain markets where unique factors are at play.

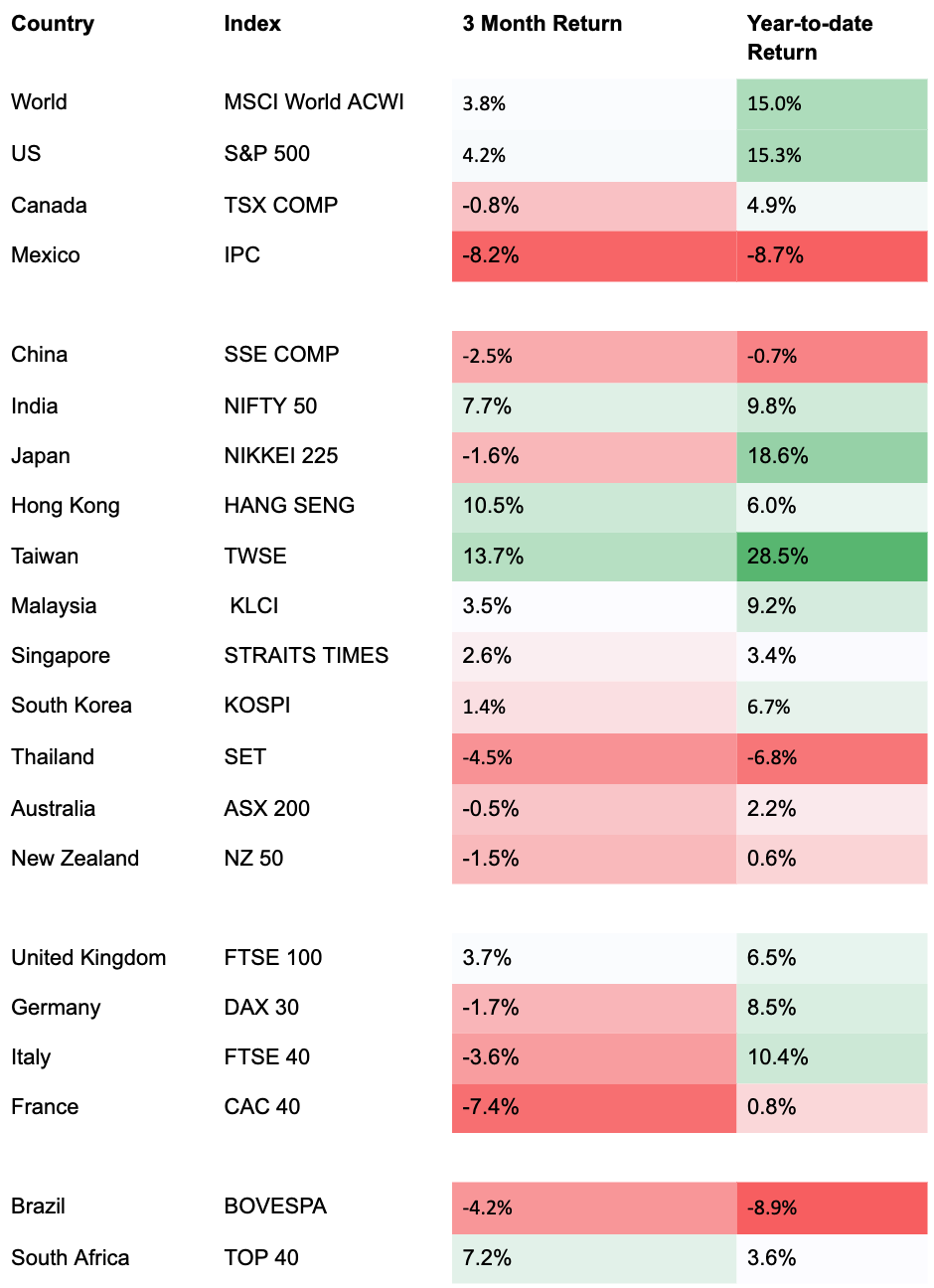

The performance of country-specific benchmark indexes paints a different picture, with plenty of markets in the red for the year. Most of the variation can be attributed to three things:

- 🔍 Some indexes are becoming very concentrated. For example, TSMC now makes up nearly 30% of Taiwan’s index. China’s various indexes also appear to contradict one another due to slight differences in composition.

- 🇨🇳 The economic slowdown in China has affected its trading partners in Asia. But once again, the indexes reflect the performance of the largest companies - not necessarily the entire market.

- 📉 Recent political events have led to volatility in Mexico and France, which erased gains made earlier in the year.

🌎 North America

US equities have benefitted from rising earnings across most sectors, despite rate cuts being pushed further into the future. But most of the index gains have come from big tech, and small-cap indexes are in negative territory year to date. There are smaller companies that are performing well, but there are a lot more that are underperforming.

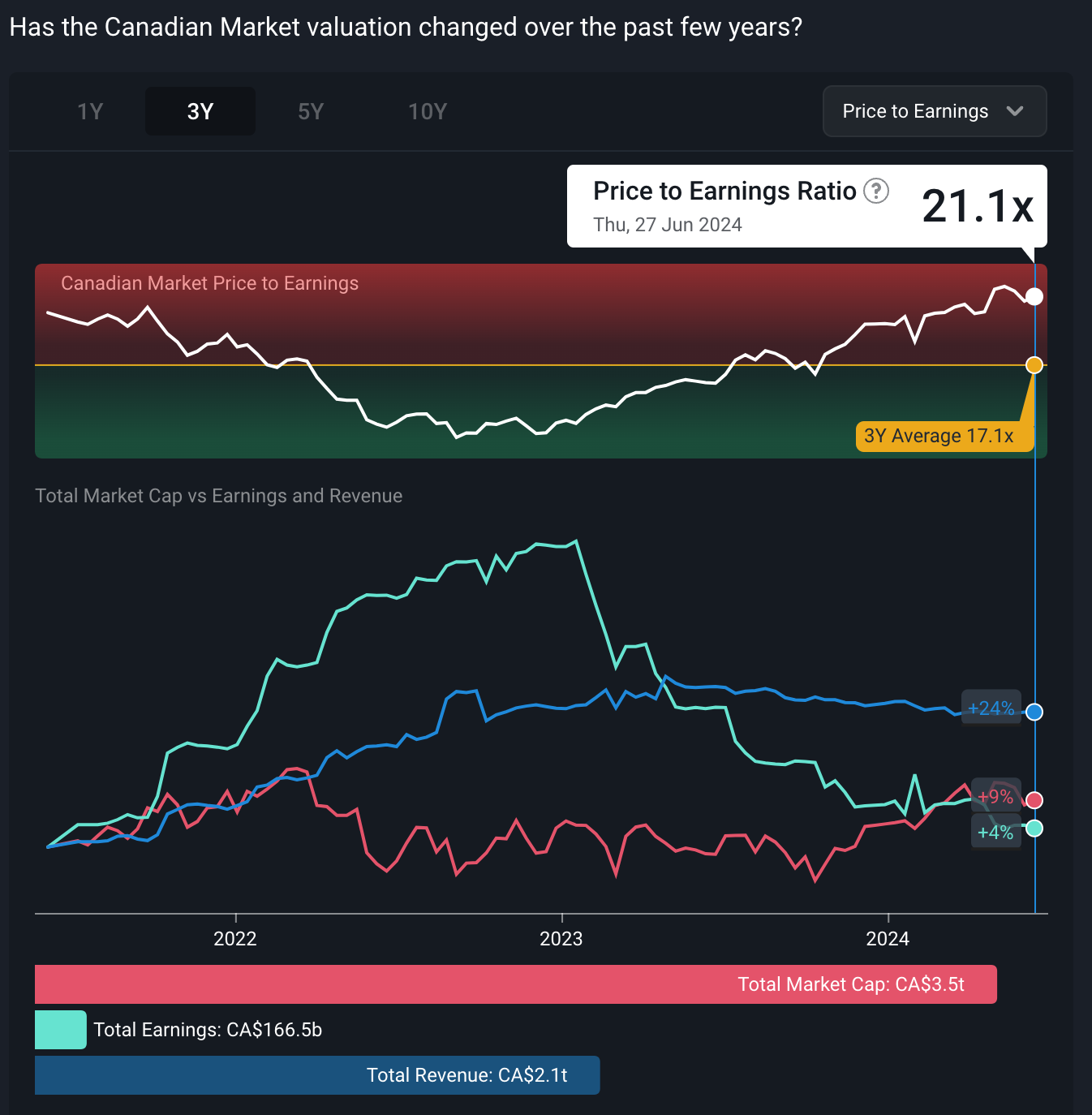

In Canada, corporate earnings have fallen significantly in the last 18 months (see chart below) due to falling revenue and margin pressure. But earnings are now declining at a slower rate and investors are looking beyond the current profit slump.

Valuations appear high but would look more reasonable if or when earnings do rebound. If you think that’ll occur, then today’s prices might be appealing to you.

🇪🇺 Europe

Europe’s economic recovery has been very slow as the continent dealt with high energy prices, high interest rates and low export demand. But the outlook has improved as energy prices and inflation have fallen and the ECB has made its first rate cut.

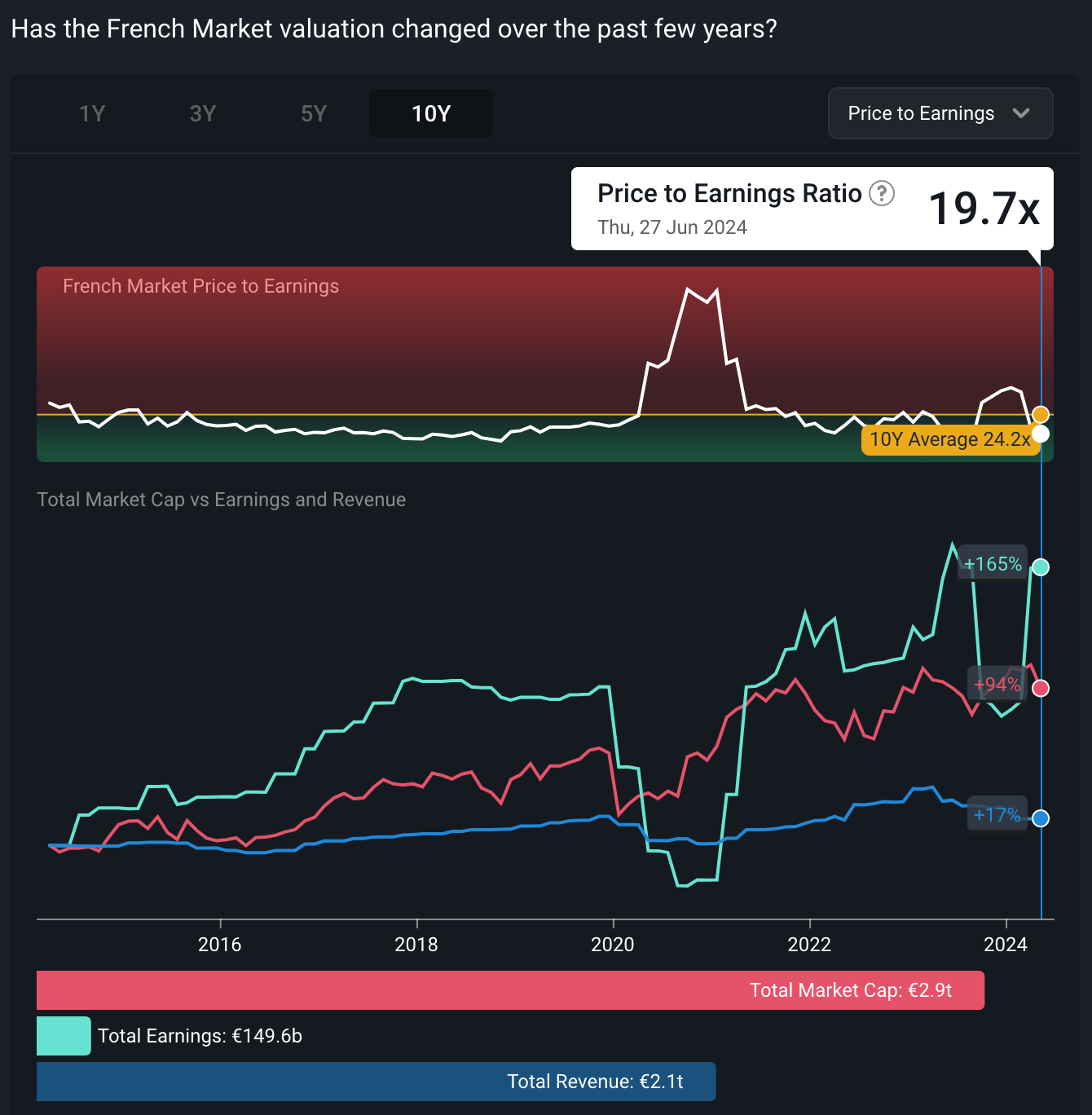

Corporate earnings have begun to improve in some cases, or stopped falling in others. The chart below reflects a sharp recovery in earnings for companies in France. Beneath the surface, the trend in profits varies widely across different sectors and industries, and this is the case for most European markets. If you head to the Markets page , you can view charts like this for each country, as well as sectors and industries within that market.

These charts provide valuable insights into historical trends and investor sentiment.

Looking forward, improving GDP growth and lower relative valuations may support European markets.

🌏 Asia - Pacific

India and Japan continue to stand out in Asia, with rising corporate earnings and strong underlying fundamentals. However, momentum has slowed and Japan’s index slipped in the second quarter.

Elsewhere in Asia, performance has been sector, industry, and stock-specific stock specific.

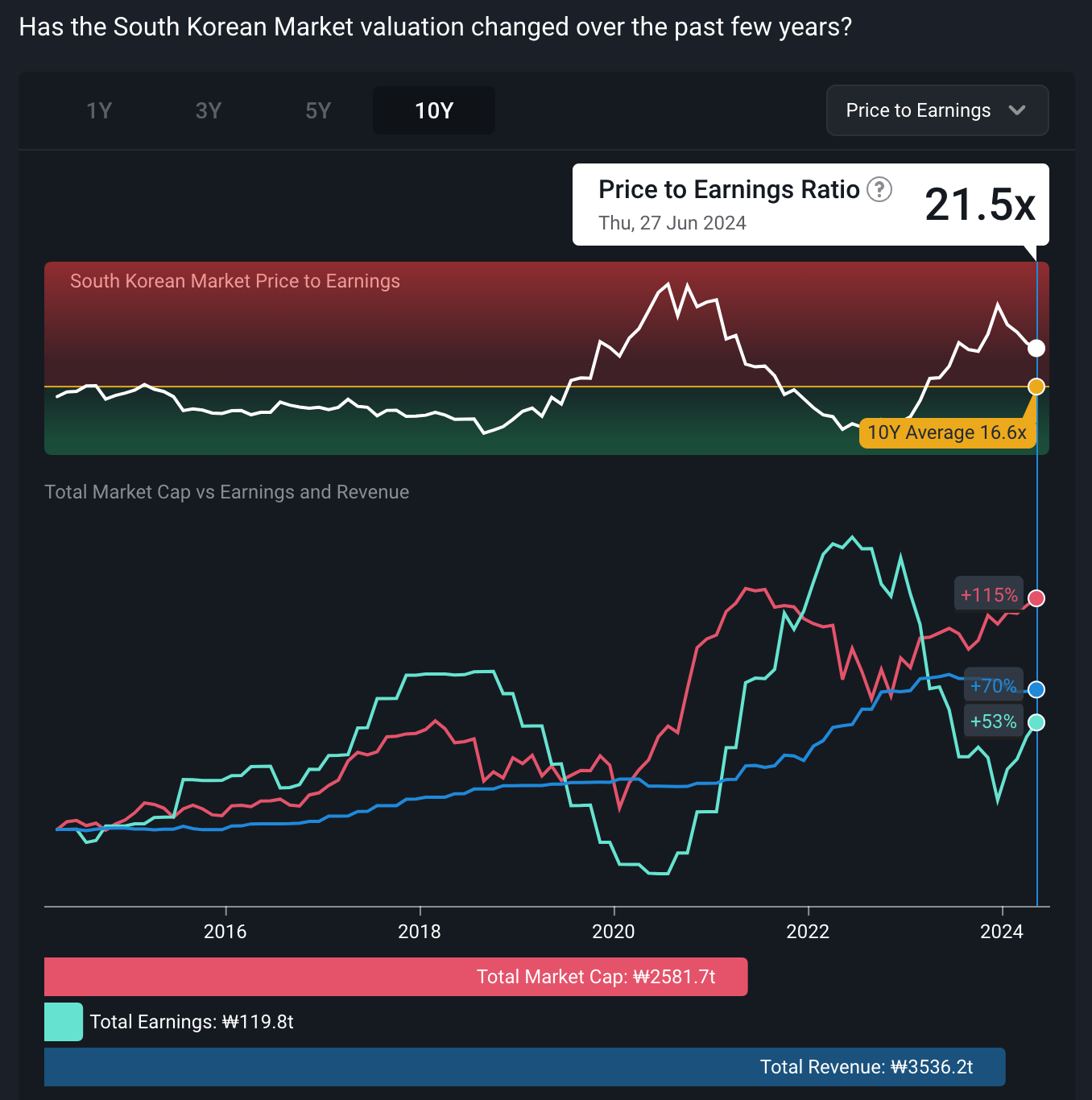

Korea, shown below, is now experiencing a recovery in earnings while earnings in other markets have begun to decline. There appears to be a fair amount of mean reversion and rotation between markets in Asia.

Australia and New Zealand's economies are struggling under the pressure of high interest rates and stubborn inflation. Higher prices and mortgage rates have resulted in lower consumer sentiment and spending, at a time when export demand from China is also lower than hoped. These economies could really do with several rate cuts to improve sentiment.

💡 The Insight: Heading Into The Third Quarter With A Goldilocks Economy

The term ‘Goldilocks economy’ refers to a situation where economic growth is neither too hot nor too cold. In other words, growth isn’t high enough to cause inflation, but it's also steady enough to keep sentiment and investment at healthy levels.

✨ Stock prices often do quite well under these conditions as expectations aren’t too high, and things keep turning out to be a little better than expected.

At the moment, we have several positive and negative catalysts to consider.

✅ On the positive side, we have:

- Inflation has fallen dramatically, although it's still higher than target rates.

- The expectation of a recession has faded.

- Earnings are recovering in some markets, and falling at a slower rate in others.

- Geopolitical concerns have eased. The risks remain but seem less pressing.

- More attractive relative valuations could lead to rotation into lagging markets, including small caps, value stocks, European and emerging market stocks. This would be healthy for markets and lead to less concentration in a handful of very large companies.

❌ And on the negative side:

- Economic growth is slowing in leading economies

- Upcoming elections in the US, UK and Europe are causing some nervousness. Rising populism could result in more protectionist policies as well as uncertainty.

- Recent elections in India and Mexico didn’t go the way some investors hoped.

- There’s a growing fear that the current cycle of AI-related investment could end quite suddenly. What that would mean for big tech valuations and the broader market is uncertain.

These positive and negative catalysts are quite well-balanced. There are a few risks, but investors are usually rewarded for taking on those risks.

Heading into the second half of 2024 it's as important as ever to be diversified across several industries, and also to stick with higher-quality companies. The higher-for-longer scenario is playing out for interest rates, and that means low-quality, speculative stocks remain a risky proposition.

Screener Tip: If you are looking for offshore diversification from your local market, a lot of exchanges include dual-listed companies. These are companies that are listed on a market but based in another country.

You can find these by using the Simply Wall St stock screener , with the following steps:

- Select your country or exchange under the ‘Filter by Market’ tab.

- Click on ‘Edit’ on the ‘Advanced Filters’ tab.

- Scroll to the last section and turn ‘Hide secondary listings’ off, and turn ‘Show companies with currency different to exchange’ on.

Key Events During the Next Week

Investors will be paying close attention to the three employment reports due this week.

Monday

- 🇨🇳 China’s Caixin Manufacturing PMI will shed more light on the state of China’s Economy. The index is forecast to fall slightly from the previous level of 51.7.

- 🇯🇵 Japan’s consumer confidence index is expected to fall from 36.2 to 36.

- 🇺🇸 The US PMI index is expected to be 51, up from 48.7 in the prior period.

Tuesday

France’s preliminary inflation rate will be released and is expected to fall to 2.4%, from 2.6% in May.

- 🇺🇸 The US JOLTs jobs report will be published. In April, job openings fell to the lowest level in three years, and this report is being closely watched as the labor market begins to show signs of a more pronounced slowdown.

Wednesday

- 🇺🇸 The US ADP employment report is expected to show private businesses adding 100K new jobs, down from 152K in May,

- 🇺🇸 The minutes from the last FOMC meeting will be published.

Thursday

- 🇬🇧 The UK general election takes place. One week out, the odds of Rishi Sunak keeping his job were 33 to 1.

Friday

- 🇺🇸 US non-farm payrolls are forecast to be 160K, down from 272K last month. The unemployment rate is expected to be steady at 4%

This week, most of the corporate world is taking a break ahead of second-quarter earnings season kicks off on 12th July. There are no major companies reporting, although lots of small caps and OTC companies are scheduled to report.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.