Quote of the Week: “I’d buy small caps if starting over now. I think if you're working with a small amount of money with exactly the same background that Charlie and I have and the same ideas, same ability we have you know I think you can make very significant sums. But as soon as you start getting the money up into the millions, many millions, the curve on expectable results falls off dramatically.” - Warren Buffett

Over the past few weeks we had a look at the healthcare sector, which has underperformed over the last two years. Another underperforming group of stocks has been small-cap stocks. Over longer periods, small caps have outperformed the wider market, and they often do well as bull markets mature.

This week we are looking at the data on small-cap performance over various periods, and some of the traps to avoid when looking for investment opportunities in the space.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🎙️ Spotify tests Gen AI voiceover ads ( TechCrunch )

- Our take: The company is launching an in-house creative agency to help brands create marketing campaigns. The agency is developing a tool that advertisers can use to create scripts and voice-overs using generative AI. It will be an interesting test to see how well the company can monetize an AI tool, and whether it attracts new advertisers to the platform. The podcast ad business is also a key growth opportunity for Spotify.

- Check out some of these narratives on Spotify.

- Our take: The company is launching an in-house creative agency to help brands create marketing campaigns. The agency is developing a tool that advertisers can use to create scripts and voice-overs using generative AI. It will be an interesting test to see how well the company can monetize an AI tool, and whether it attracts new advertisers to the platform. The podcast ad business is also a key growth opportunity for Spotify.

-

📉 Lithium price finds stability with new pricing floor ( S&P Global )

- Our take: The slowing EV market, combined with more lithium supply steadily coming online, drove the price of lithium down 79% from $66k per tonne in Feb 2023 to $13.8k in late May this year. The new downcycle left producers trying to protect their margins and the lithium price itself (i.e. cutting production), which created a new price floor. Forecasts by commodity analysts expect lithium to be in an oversupply until 2028, but that doesn’t mean we can’t see price appreciation in the near term if demand rebounds or if supply continues to be constrained.

-

🏦 Fisker files for bankruptcy ( Barrons )

- Our take: Fisker has become the latest casualty of the slowing EV market. One of the differences between EV companies and most tech growth companies is the capital required to keep an automaker going. Fisker burnt through nearly $900 million in 2023, and would have needed a lot more to get to breakeven - assuming it could. When EV sales were rising each year, raising fresh capital might have been possible - but investors aren’t willing to bet on startups in an industry with no growth and falling margins.

-

❌ Adobe sued for subscriptions that are too hard to cancel ( The Verge )

- Our take: The impact on Adobe’s churn from this lawsuit remains to be seen. If the company is forced to make canceling a subscription easier, it might finally enable a portion of currently subscribed users to leave the service, which could decrease users and revenues. Alternatively, an easier cancellation process may entice non-existing users to subscribe for at least short periods of time for their needs rather than not at all, which could increase users and revenue (like we see on the streaming platforms). Regardless of what happens, to reduce churn, SaaS companies should aim to provide more value in their subscription than what they’re charging. And of course, don’t do rent-seeking, everyone hates that.

-

🤑 OpenAI could become a for-profit ( Neowin )

- Our Take: This would give the company a “B-corp” certification and legally require it to consider its impact on society and the environment, while balancing the interests of its shareholders with those of employees, customers, the community, and the environment. Going down this path would allow it to IPO at some point, which many investors would probably find enticing given the hype around it.

-

🇨🇳 China home prices fall the most in 10 years ( Reuters )

- Our take: Despite the latest round of stimulus measures, China’s property market remains in a slump. There was also bad news in other sectors, as industrial output and fixed asset investment were lower than forecast. The one bright spot came in the form of better than expected retail sales figures. China is now more dependent than ever on exports, where it's also facing headwinds in the form of a growing list of tariffs. Global investors can be thankful that their exposure to China’s local economy is limited.

🧢 How to Invest in Small Caps Without Losing Your Shirt 👕

If you hear about a stock that doubled in a week, or read an article about the next 10-bagger (that you absolutely have to own), chances are it's a small cap. It’s less often that you hear about the ones that didn’t work out.

For every big winner, there are plenty of losers - but those big wins do plenty of heavily lifting, as small cap indexes have actually outperformed over large caps indexes over longer periods of time.

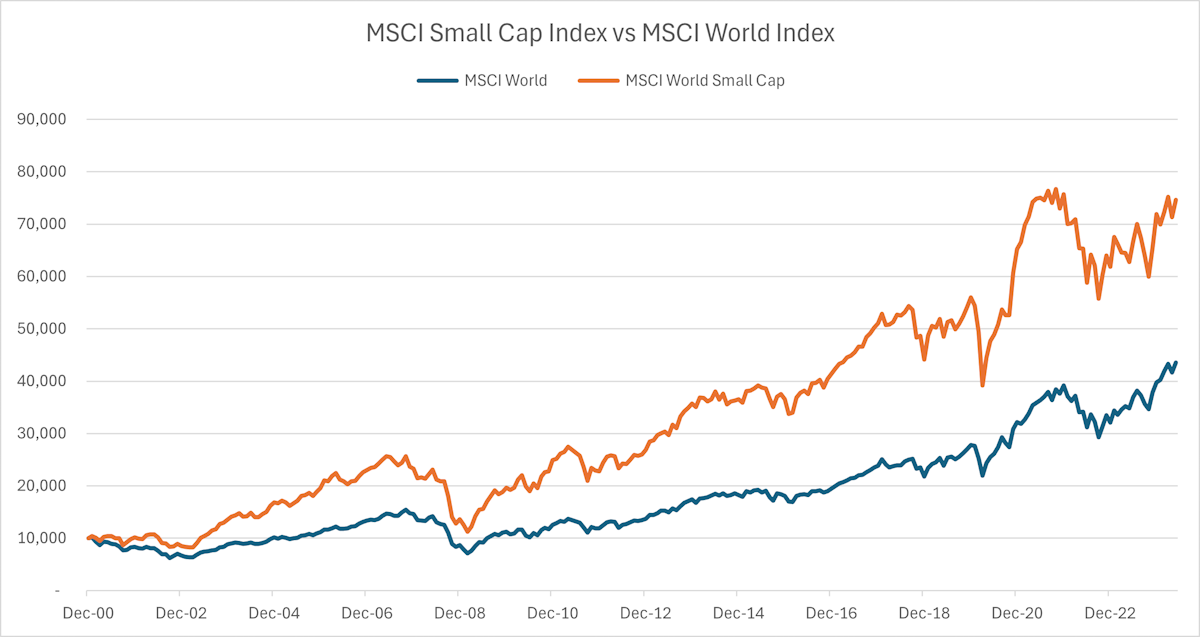

✨ Since 2000, the MSCI World Small Cap index has risen 646%, nearly twice the MSCI World index's 335%. The catch is that nearly all that outperformance occurred during the first 10 years.

Small cap outperformance wasn’t unique to the 2000 to 2010 period. Over most periods prior to 2010 they outperform large caps. More recently, low interest rates and the pace of tech innovation have favored larger companies.

It’s entirely possible smaller companies outperform again in the future, particularly after lagging for such a long period. But there are a few caveats, and investors need to be able to avoid the lemons at the bottom of the market value table.

🔬 Small Caps and Very Small Caps

The small cap universe includes companies with a market value up to $2 billion, but it also includes very small companies, even those with a market value of $100,000. There’s a big difference between companies on either end of that range.

The MSCI World small cap index shown above includes 4,100 companies with a market value between $20 million and $22 billion (probably overdue a rebalance). The average size is $1.8 billion, and the median value is $1.1 billion. So there are some very small companies in the index but they don’t have much impact on its performance.

Very small listed companies (micro caps, nano caps and penny stocks) have much less reliable performance. The following tale will give you an idea of the odds of success. We usually use US stocks for examples, so this time we’re looking at the UK market.

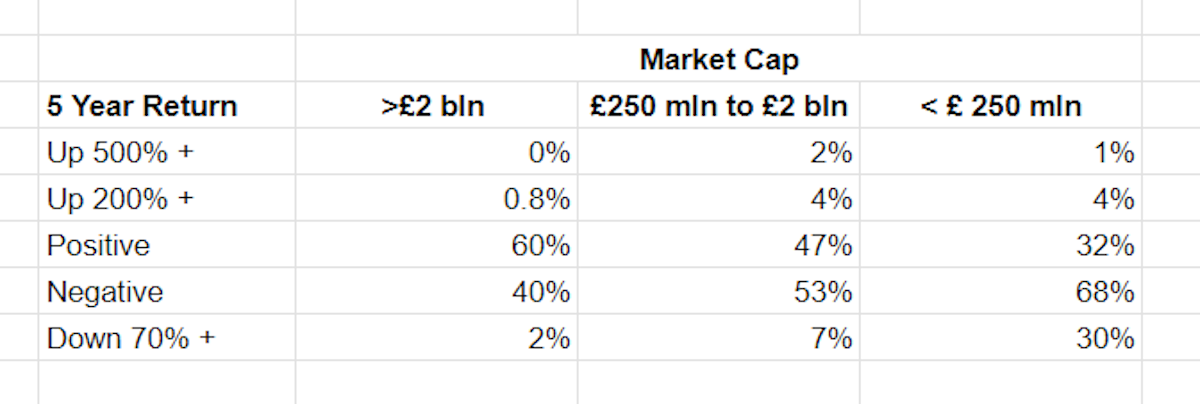

This is the 5-year price performance for UK listed companies with a market value above £100k. There are 830 companies, divided into three groups:

- Mid and large caps: over £2 billion

- Small caps: £250 million to £2 billion

- Microcaps: under £250 million

✨ While there were a handful of big winners amongst the small caps and microcaps, there were far more losers. The important takeaway is the number of big losers amongst the microcaps and how it increases as you move from ‘small’ to ‘micro’. When you move into the micro cap universe, the odds are really stacked against you.

✅ The Advantages Of Small Cap Investing

Slightly bigger companies (i.e. those above $300 million or so) can be very lucrative for retail investors. They are too small to move the needle for large funds, and don’t generate enough fee income for analysts. That means they are more likely to be overlooked and mispriced, but it also means you need to do more work to find the information you need.

Small caps can also offer more growth potential, and big returns if they do get big enough to get the attention of fund managers and analysts.

Small companies are usually more focussed on a single business - which makes it easier to understand them.

📈 Small cap growth stocks

Small companies that have the potential to become big companies can generate huge returns for investors. The thing is, there’s typically plenty of volatility along the way. Most of these types of companies are in the tech, media and consumer sectors, but they can be in other sectors.

These companies are often prioritising growth over profitability, so they might not be profitable yet. But they should have growing sales, or at the very least there should be evidence of traction in the market. There should also be evidence of a competitive advantage because strong sales growth attracts competitors.

For investors, the biggest challenge is figuring out how big their addressable market is, how much market share they can capture, and what sort of margin they can earn in the future. That will determine a reasonable price to pay and still be able to generate a return.

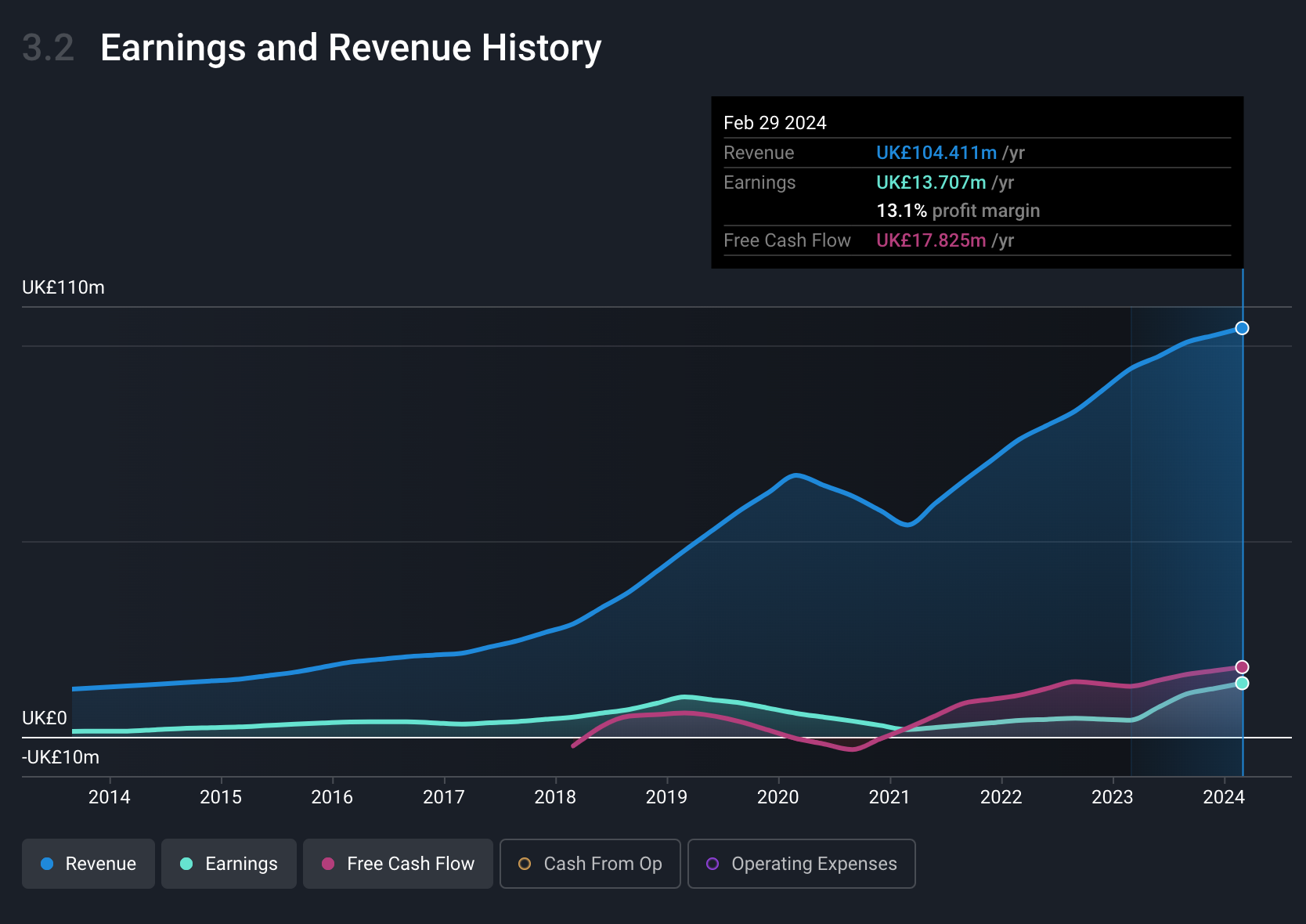

London-listed AB Dynamics plc sells test systems used for driver assistance and autonomous vehicle technology. Revenue has doubled in the last three years, and the company already earns a respectable margin. If you were working out a fair value, the key factors would be the potential market size and the competitive environment.

💰 Small-Cap Value/Quality Stocks

Small companies don’t have to be growth machines to deliver excellent long-term returns for shareholders. In fact, companies increasing revenues at modest rates are more likely to be overlooked and trading at attractive valuations.

✨ These are often companies that provide niche products and services - and often the less glamorous the industry the better. The industrial, financial and healthcare sectors are full of small companies that provide essential goods and services to other industries. The limited market size often means there isn’t much competition, and there’s less pressure on margins.

Some of these companies earn annuity revenue, in which case their revenues are fairly stable. But a lot have ‘lumpy’ revenue streams because they do a small number of big deals each year.

Less consistent revenue can be an advantage because it leads to price volatility, and more opportunities to invest at an attractive price.

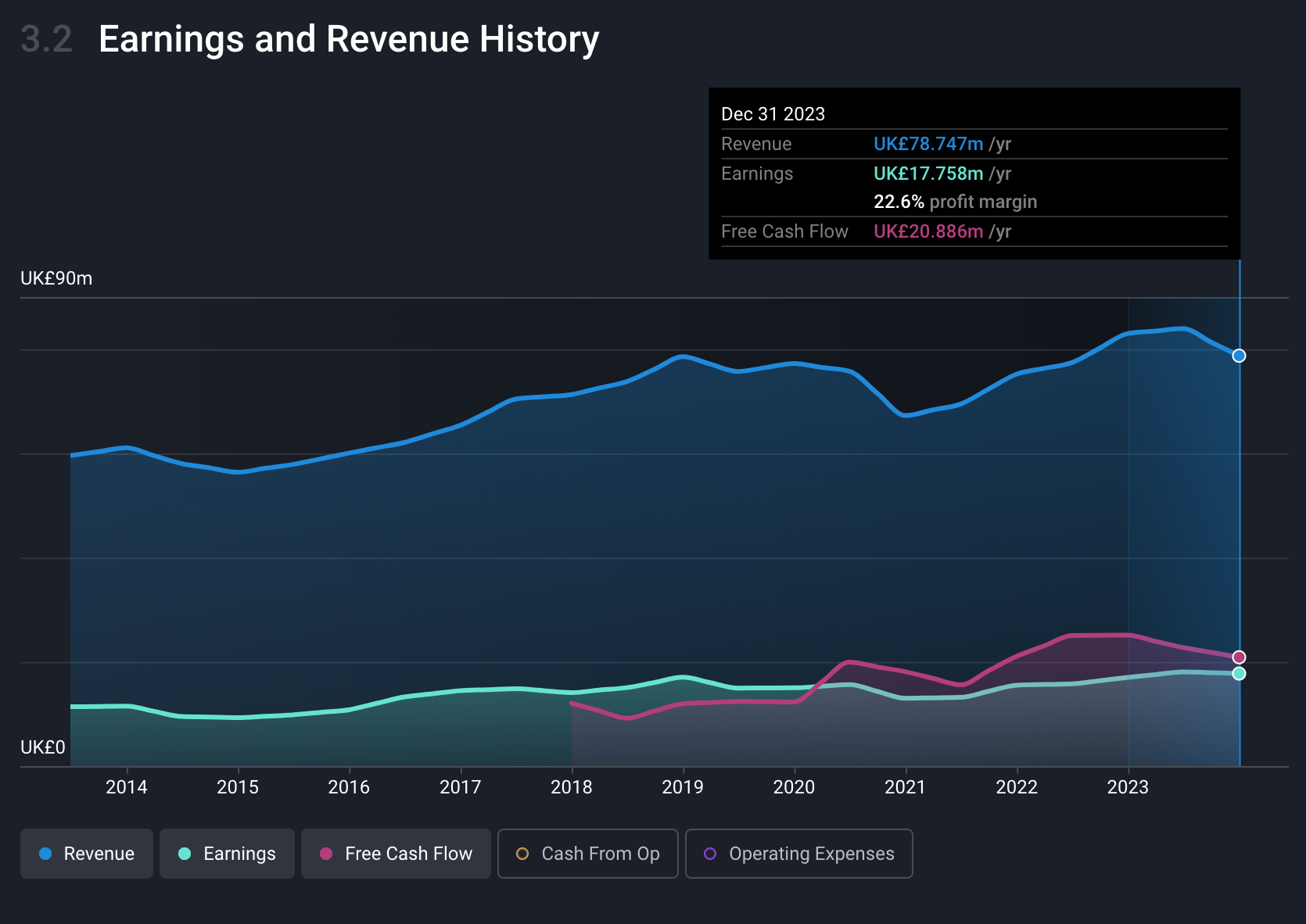

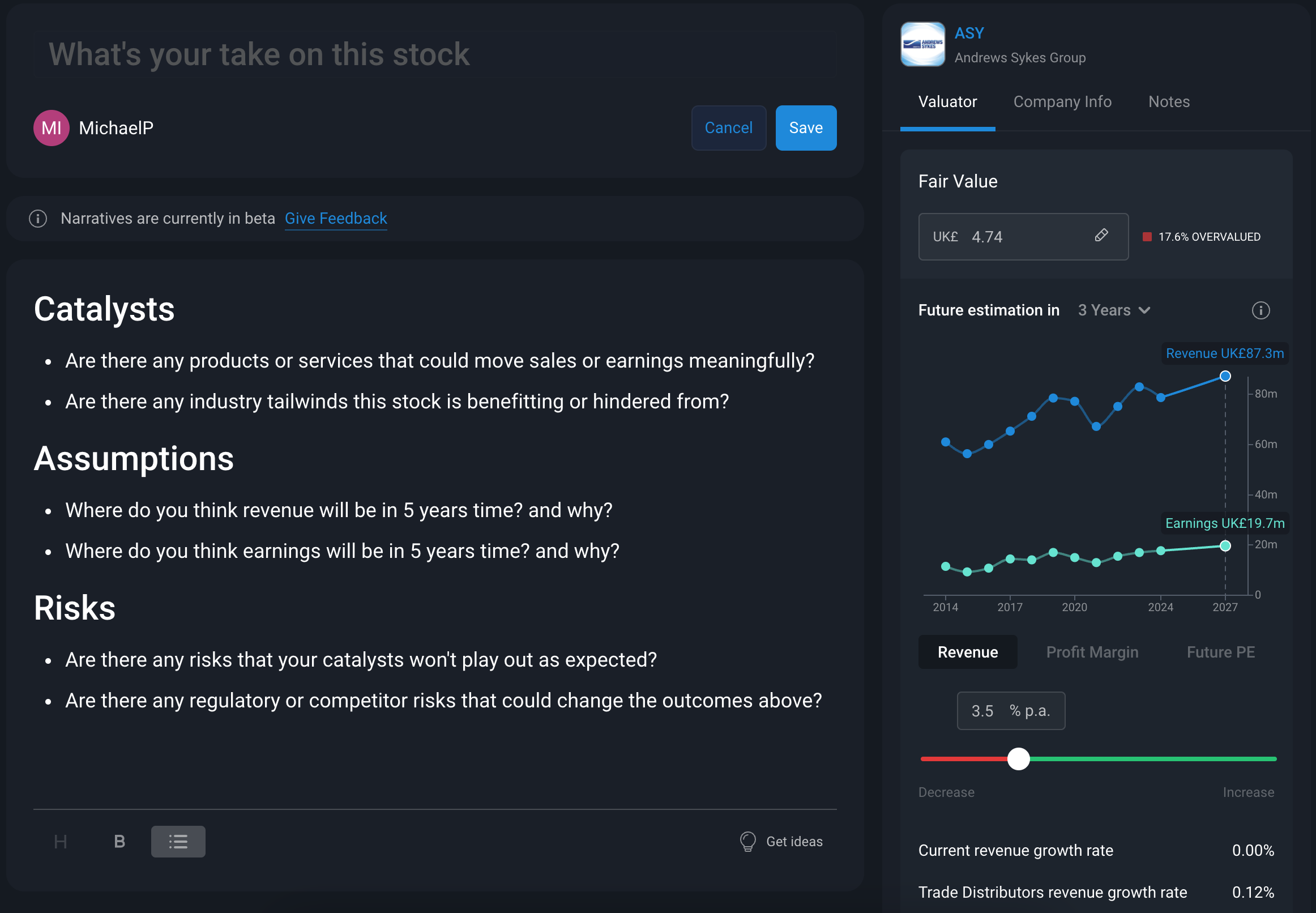

Andrews Sykes Group , which sells and installs environmental control equipment, is a typical example. Revenue hasn’t increased every year but it has increased gradually over time, and so has the profit margin, which is now 22%. The company is also able to pay big dividends with its cash flow.

You can create a fair value and narrative using the Simply Wall St Narrative tool from any stock on your watchlist or portfolio.

Writing your narrative out helps you outline what future state you think the business could reach. As for estimating a fair value, that can help you decide what price to pay if you do want to invest. Narratives are a great way to inform your decision-making processes, whether that's to buy, sell or continue holding a company's stock.

When creating a fair value on our tool, the key variables you’ll need to decide on are revenue growth, future profit margins and a future PE ratio.

Below is an example for Andres Sykes Group mentioned above. This fair value estimate assumes revenue grows in line with historical trends (roughly 3.5%) for the next 3 years, and that profit margins and PE ratio stay flat at around 22% and 13x, respectively.

If you happen to believe that’s likely to occur (with a discount rate of 7.6% which you can also change), then you might believe the shares are worth roughly £4.74 per share.

You’ll notice in this example that there are no analyst growth forecasts. This is often the case for small caps, as very few are covered by analyst at brokerage firms.

While that means you have to come up with your own estimates, the lack of coverage also makes it more likely that a company has been overlooked by investors.

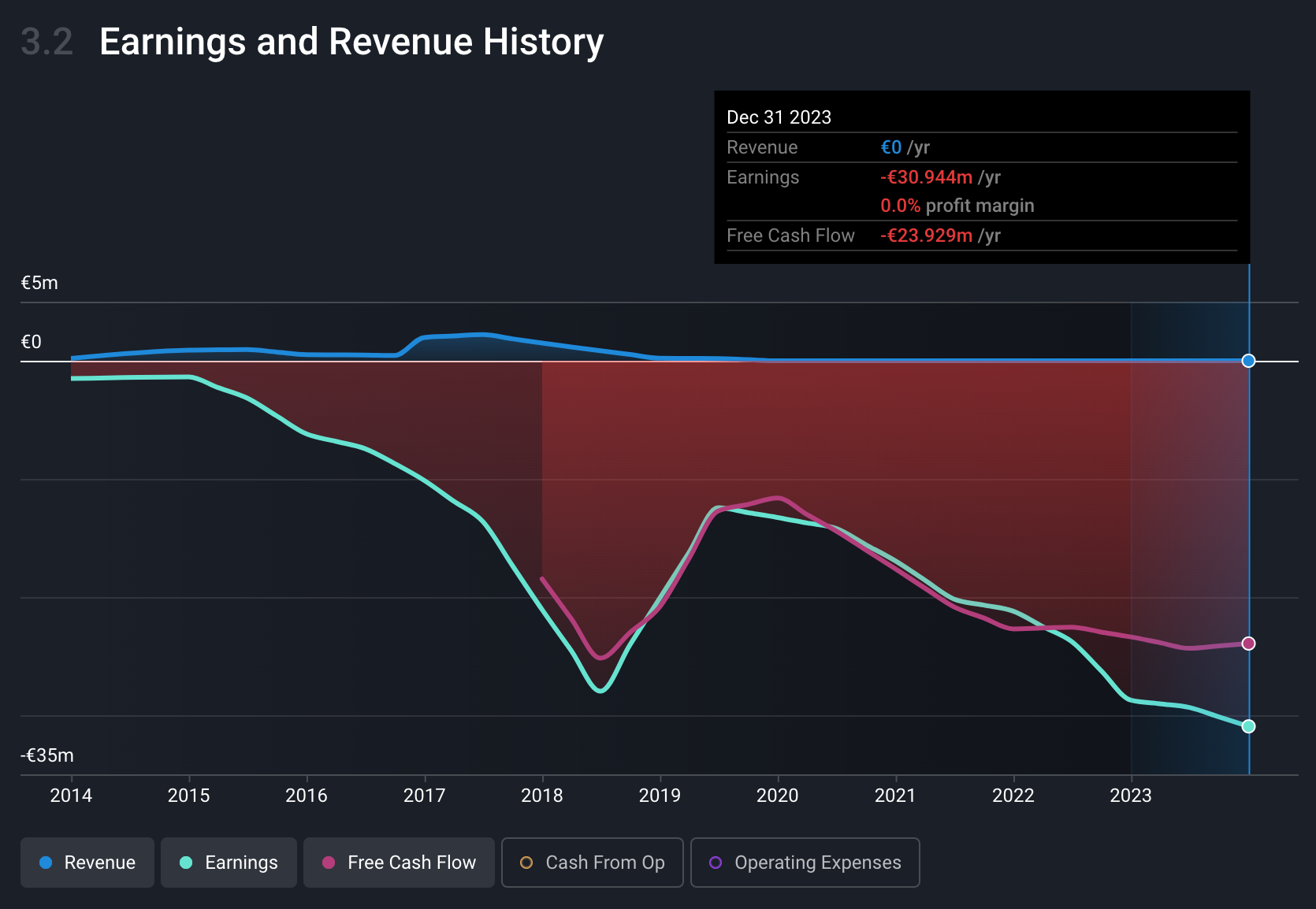

🤔 Speculative And Pre-revenue Businesses

At the high end of the risk spectrum are speculative stocks. These are usually classified as penny stocks, micro-caps or nanocaps, but they can be much bigger.

As an example, Virgin Galactic reached a market value of $19 billion (and are currently sitting at $200m), but shares many of the qualities of speculative penny stocks.

These companies:

-

❌💸 Typically have little or no revenue.

-

🏆 Are often pursuing a goal with massive upside potential, but low odds of achieving that goal . Examples include biotechs, energy and resource exploration companies, and companies developing clean energy technologies.

-

💭 Often have a very compelling idea, but no real business.

This is what the revenue, earnings and cash flow chart for a company in this part of the market often looks like:

Some companies in this space are completely legitimate, and some are outright scams. Many fall somewhere between the two. A company can pursue a real goal, but exaggerate the progress they are making to keep raising capital - which then gets paid out as lucrative salaries and bonuses to executives.

The smaller a company is, the more likely its stock is to be the subject of manipulation, ‘pump and dump’ schemes, and fake publicity campaigns.

Working out a realistic valuation for a company like this is also tricky and it is easy to overestimate the potential and underestimate the risks. Investors are often diluted significantly as the company keeps issuing new stock, and needs to be accounted for in the valuation.

Another overlooked risk is that if the company is successful, it will get acquired at a price that doesn’t actually compensate investors for the risk. If you own a stock that gets acquired at a 100% premium, it might seem like a great return - but you may have needed a much higher return to justify the risk you took. Remember, if the probability of success is 5%, you need a 2,000% return to offset that risk.

💡 The Insight: Invest In Businesses Not Ideas

The small cap universe is full of companies with great ideas. But turning good ideas into profitable businesses isn’t easy, and you can avoid a lot of losers by looking for real businesses.

You can also increase your odds of success by asking the following questions about a company, and particularly those that don’t have a proven business:

- 💰 Is the executive team enriching itself at the expenses of shareholders?

- If a company is losing money, management salaries should be very modest. If the leadership team is confident about a company’s future, they will take most of their pay in shares or options. If they aren’t, they’ll probably opt for cash.

- 🧑💼 What are the executive team’s backgrounds?

- Value destroying companies are often run by people with a history of starting similar businesses, often in whatever industry is popular with investors at the time. Legitimate business leaders usually have a track record in one industry.

- ❓ Why is this company listed?

- Being publicly listed is expensive and takes time and effort on a management team. Venture capital funds invest billions in privately held companies when they see potential. If a small company is publicly listed, it may mean it was turned down in the private market.

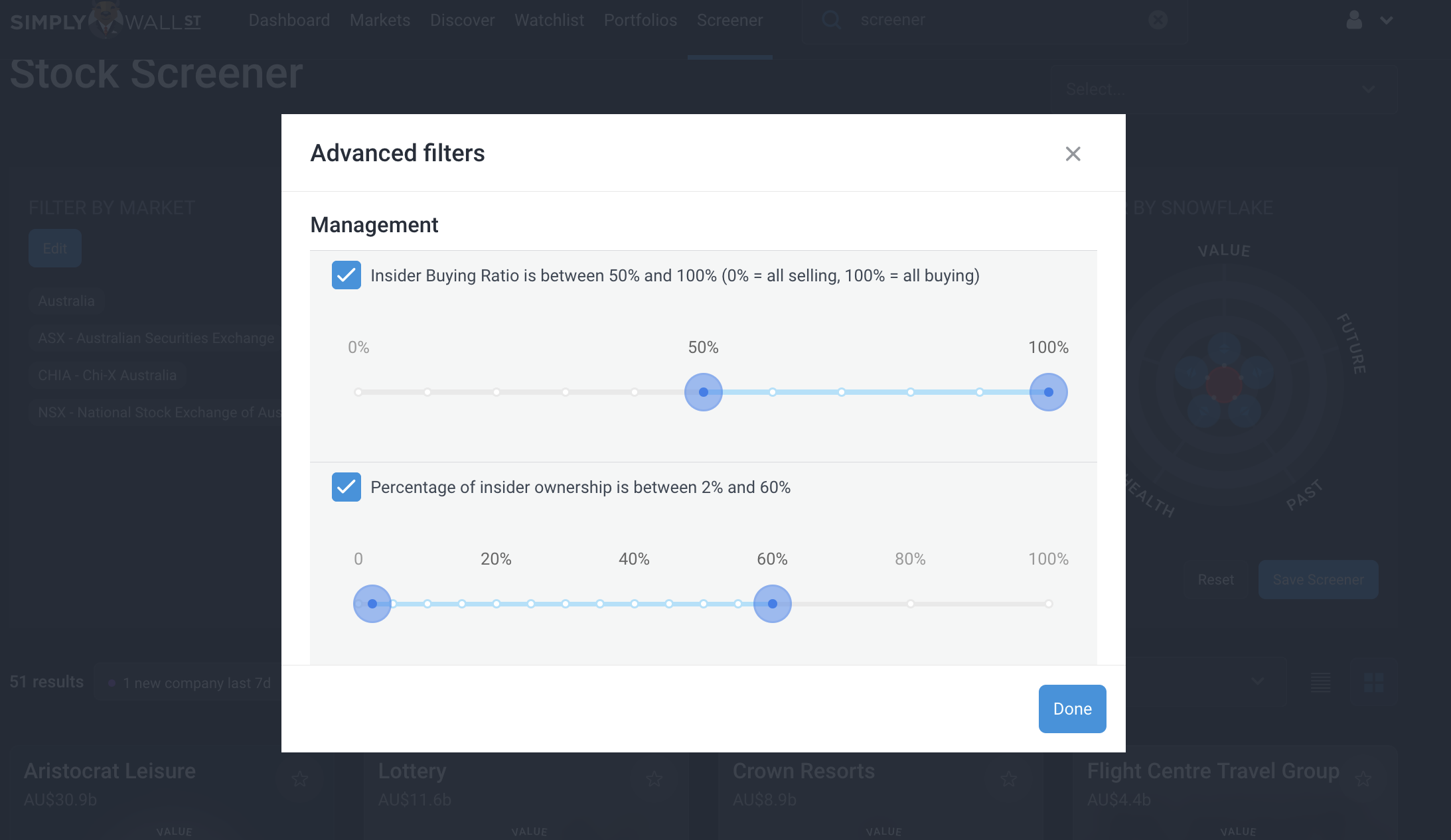

While these are specific questions to ask when we’re looking at a particular stock, how do we narrow down our investable universe of stocks to find specific stocks to look at?

That’s where a Screener comes in. Using ours , you can simply and easily add on filters for everything from future growth prospects and proven past performance to dividend yield and management alignment.

Company management filters in the Screener tool - Simply Wall St

You can narrow down your investible universe of stocks from tens of thousands to hundreds or even dozens in just a few clicks.

Once you’re happy with the filters, you can save your screener on your account to be notified of any new stocks that meet your criteria going forward.

Key Events During the Next Week

Tuesday

- 🇨🇦 Canada’s year-on-year inflation rate will be published for May and is forecast to fall slightly, from 2.7 to 2.6%.

Thursday

- 🇺🇸 The US GDP Q1 growth rate final estimate is expected to be 1.3%, lower growth than what we saw in Q4'23, which came in at 3.4%.

- 🇺🇸 US month-on-month Durable good orders growth will be released and is forecast to fall to 0.4% from 0.7%.

Friday

- 🇫🇷 France’s year-on-year inflation rate is forecast to tick up to 2.5% from 2.3%.

- 🇺🇸 The US Core PCE price index is due, and expected to rise slightly to 0.4% year-on-year. Personal income and spending are both expected to rise slightly.

- 🇺🇸 The US Chicago PMI index is forecast to rise from 35.4 to 42.

Earnings season is all but winding down, however, there are a few big players that are due to report this week:

- Micron Technology

- Nike

- Paychex

- General Mills

- FedEx

- Levi Strauss

- Carnival Corp

- Manchester United

- AngloGold Ashanti

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.