- United States

- /

- Software

- /

- NasdaqGS:TEAM

Insider-Favored Growth Companies To Watch In May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.3%, contributing to a 12% climb over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this favorable environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those most familiar with their operations and potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 38.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 44.8% |

| Red Cat Holdings (NasdaqCM:RCAT) | 14.8% | 123% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| CoreWeave (NasdaqGS:CRWV) | 38.3% | 69.9% |

Let's explore several standout options from the results in the screener.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $58.74 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

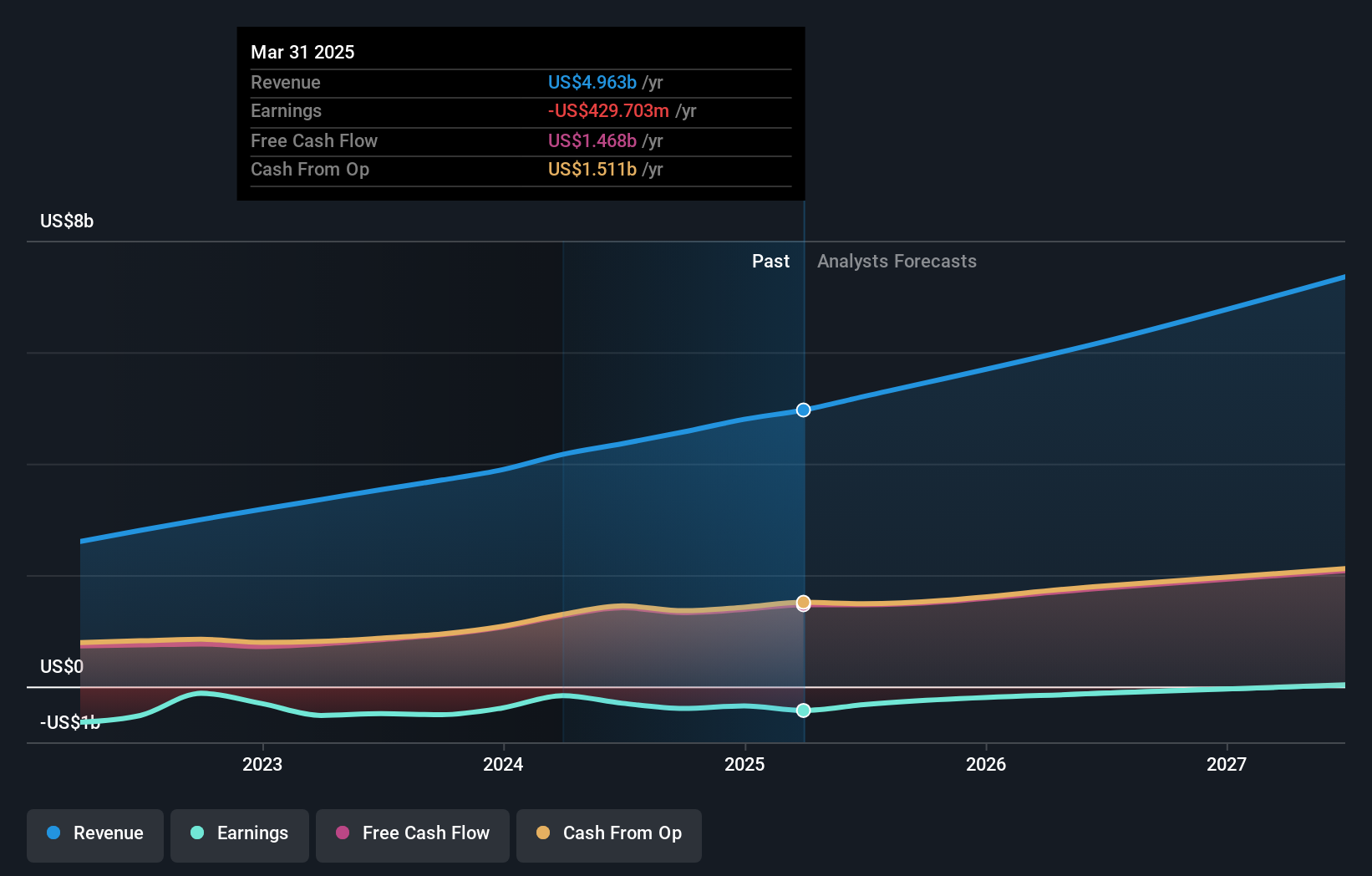

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $4.96 billion.

Insider Ownership: 37.5%

Atlassian's revenue is forecast to grow at 15.7% annually, surpassing the US market average of 8.4%, while its earnings are expected to increase by 60.18% per year, indicating strong growth potential despite recent net losses. Insider activity shows more buying than selling in the past three months, suggesting confidence in future performance. Recent Q3 results reported revenue of US$1.36 billion but a net loss of US$70.81 million, reflecting ongoing challenges amidst growth efforts.

- Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

- Our valuation report here indicates Atlassian may be overvalued.

Tesla (NasdaqGS:TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tesla, Inc. is involved in designing, developing, manufacturing, leasing, and selling electric vehicles along with energy generation and storage systems globally; it has a market cap of approximately $1.03 trillion.

Operations: Tesla's revenue is primarily derived from its automotive segment, which generated $84.54 billion, and its energy generation and storage segment, which contributed $11.18 billion.

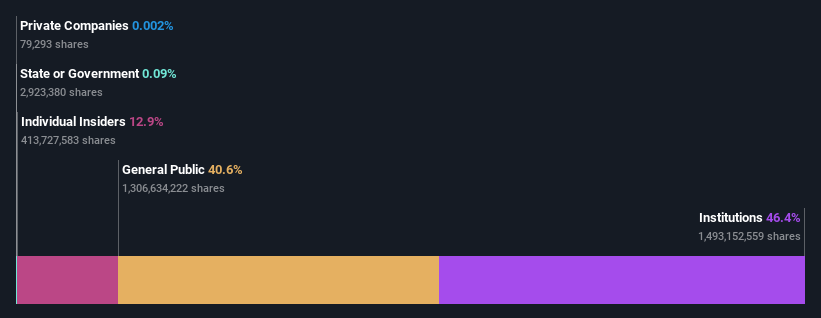

Insider Ownership: 12.9%

Tesla's insider activity shows more buying than selling recently, indicating confidence despite legal challenges over its Full Self-Driving technology. While earnings are forecast to grow significantly at 27.6% annually, recent results show a decline in net income to US$409 million from US$1.39 billion year-over-year. Revenue growth is expected at 15.9% per year, outpacing the broader market but remaining below optimal growth rates for high-growth companies amidst share price volatility and legal scrutiny.

- Unlock comprehensive insights into our analysis of Tesla stock in this growth report.

- Our expertly prepared valuation report Tesla implies its share price may be too high.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates as a consumer internet company through its subsidiaries, serving markets in Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of approximately $84.33 billion.

Operations: Sea Limited generates its revenue from three main segments: Digital Entertainment ($3.71 billion), E-commerce ($7.29 billion), and Digital Financial Services ($1.21 billion).

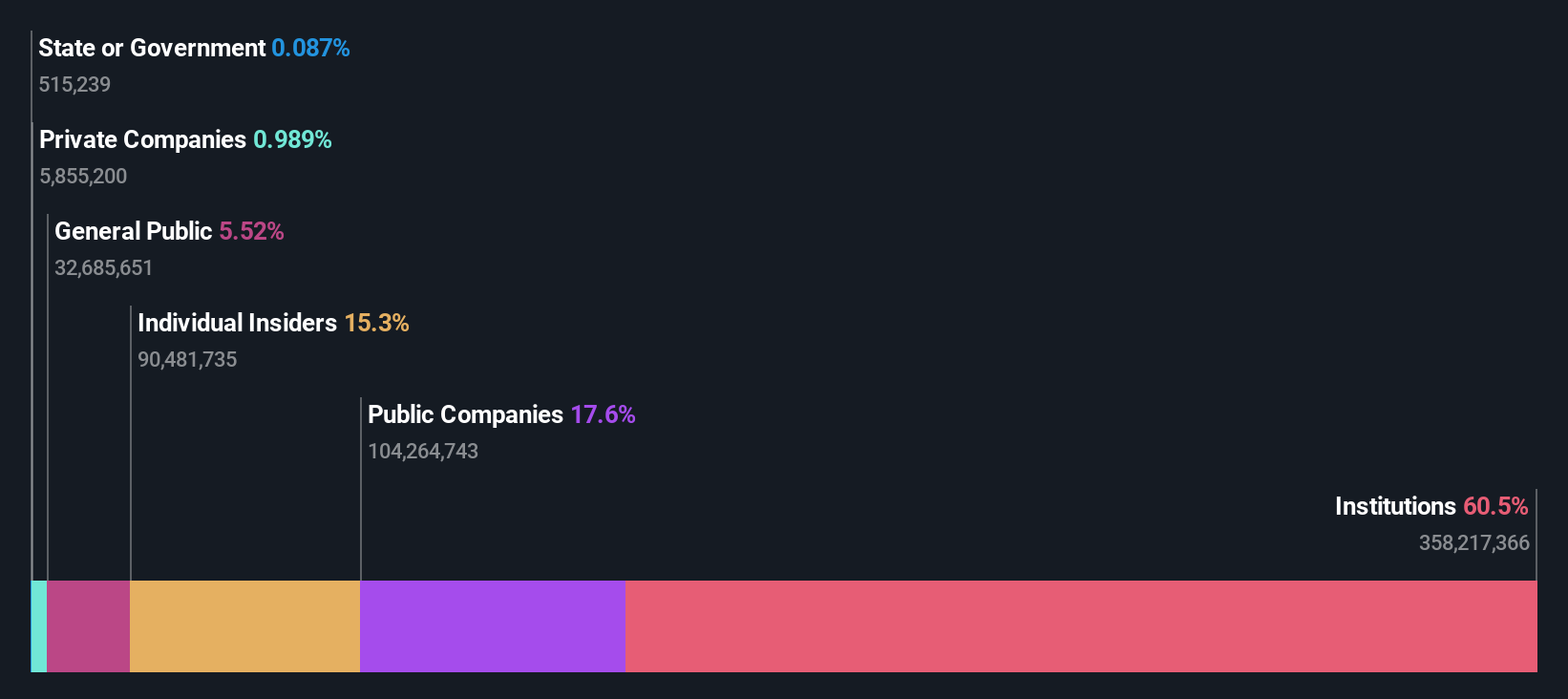

Insider Ownership: 14.7%

Sea Limited's strong insider ownership aligns with its forecasted robust earnings growth of 26.33% annually, surpassing the US market average. Recent Q1 2025 results show revenue at US$4.84 billion, up from US$3.73 billion year-over-year, and a turnaround to net income of US$403.05 million from a loss previously. Although revenue growth is slower than ideal for high-growth firms, Sea trades slightly below fair value and shows potential in profitability improvement despite large one-off items affecting results.

- Click here and access our complete growth analysis report to understand the dynamics of Sea.

- Our comprehensive valuation report raises the possibility that Sea is priced higher than what may be justified by its financials.

Where To Now?

- Unlock our comprehensive list of 196 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 30 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Atlassian, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives