- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

US Stocks Estimated To Be Trading Below Intrinsic Value In February 2025

Reviewed by Simply Wall St

As of February 2025, U.S. stock markets have been experiencing heightened volatility due to recent tariff announcements and ongoing concerns about trade policies, which have impacted major indices like the S&P 500 and Nasdaq Composite. Amidst this uncertainty, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value, offering potential opportunities for those seeking to navigate the current market landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Brookline Bancorp (NasdaqGS:BRKL) | $12.06 | $24.01 | 49.8% |

| AGNC Investment (NasdaqGS:AGNC) | $9.95 | $19.40 | 48.7% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $111.39 | $218.02 | 48.9% |

| Coastal Financial (NasdaqGS:CCB) | $88.40 | $172.68 | 48.8% |

| Verra Mobility (NasdaqCM:VRRM) | $26.19 | $51.74 | 49.4% |

| BeiGene (NasdaqGS:ONC) | $223.37 | $439.15 | 49.1% |

| Bilibili (NasdaqGS:BILI) | $16.72 | $32.78 | 49% |

| QuinStreet (NasdaqGS:QNST) | $23.71 | $47.35 | 49.9% |

| Equifax (NYSE:EFX) | $267.52 | $531.27 | 49.6% |

| Gold Royalty (NYSEAM:GROY) | $1.33 | $2.63 | 49.4% |

Let's uncover some gems from our specialized screener.

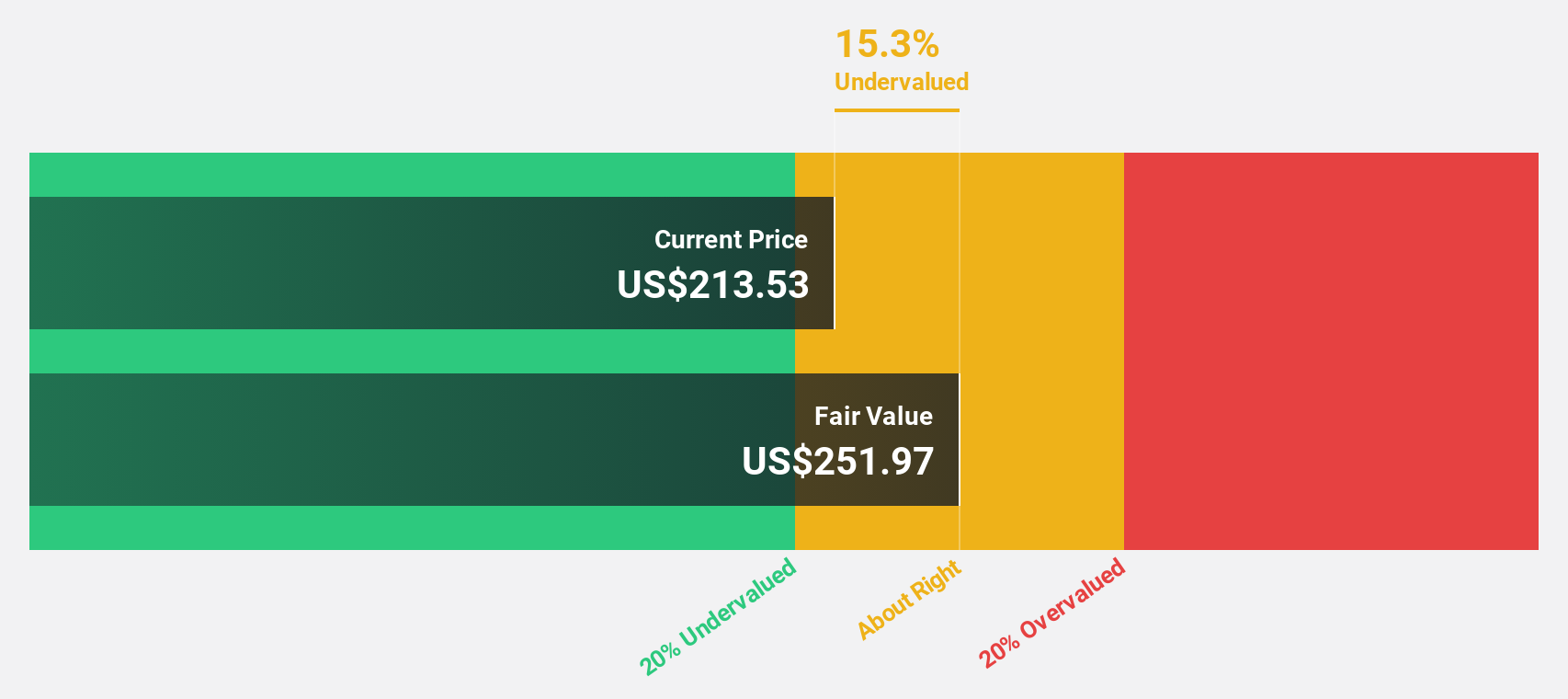

Atlassian (NasdaqGS:TEAM)

Overview: Atlassian Corporation, with a market cap of approximately $80.38 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $4.79 billion.

Estimated Discount To Fair Value: 17%

Atlassian's stock is trading at US$311.4, which is 17% below its estimated fair value of US$374.96, suggesting it may be undervalued based on cash flows. Despite reporting a net loss of US$38.21 million in Q2 2025, the company has shown revenue growth and forecasts indicate above-market annual profit growth over the next three years. The recent strategic collaboration with AWS aims to enhance cloud capabilities and drive substantial enterprise user migration, potentially boosting future cash flows.

- Our growth report here indicates Atlassian may be poised for an improving outlook.

- Click here to discover the nuances of Atlassian with our detailed financial health report.

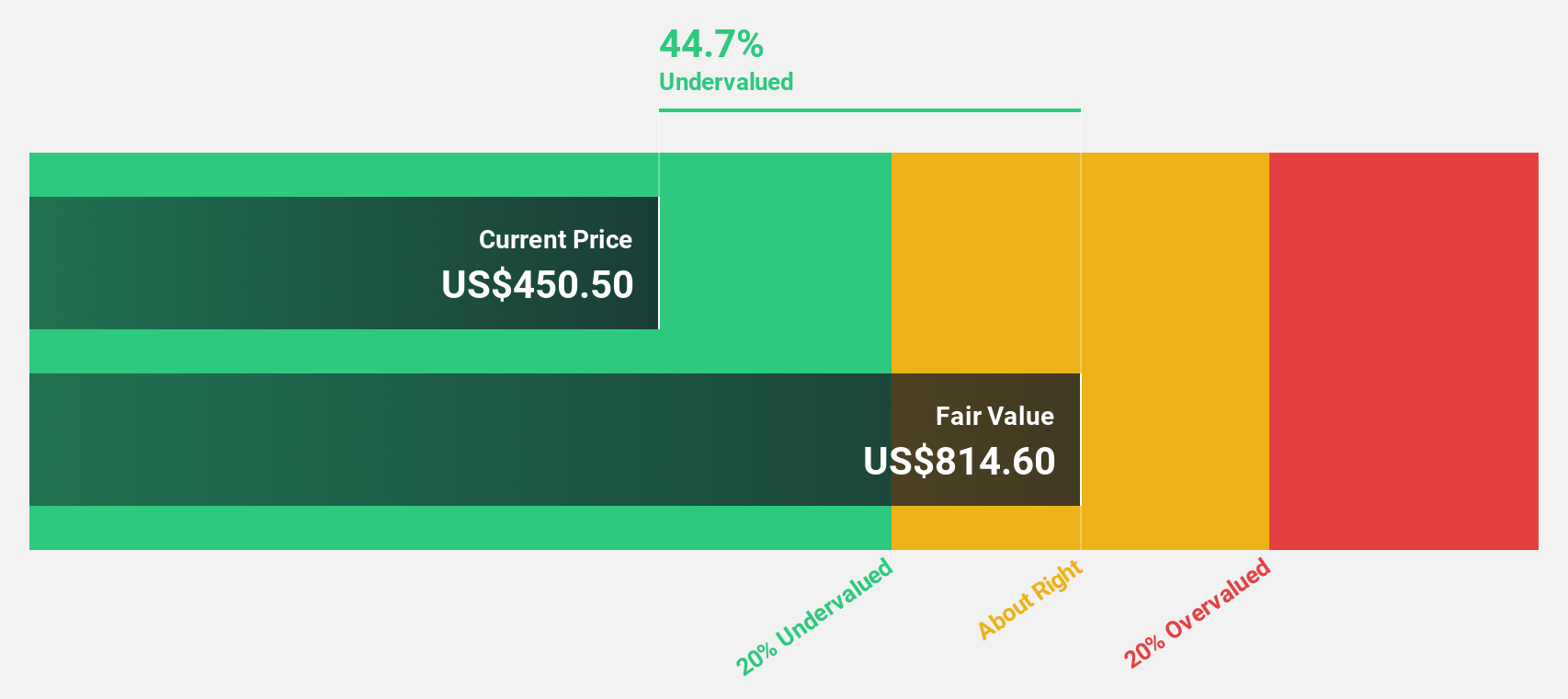

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $118.90 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated $10.63 billion.

Estimated Discount To Fair Value: 36.4%

Vertex Pharmaceuticals is trading at US$470.37, significantly below its estimated fair value of US$739.21, indicating potential undervaluation based on cash flows. The company recently received FDA approval for JOURNAVX, a non-opioid pain treatment, enhancing its product portfolio. Despite a net loss in the first nine months of 2024 due to strategic investments and development costs, Vertex's earnings are projected to grow annually by 36.44%, supported by strong future profitability forecasts and innovative collaborations like the agreement with Zai Lab for povetacicept development in Asia.

- Insights from our recent growth report point to a promising forecast for Vertex Pharmaceuticals' business outlook.

- Take a closer look at Vertex Pharmaceuticals' balance sheet health here in our report.

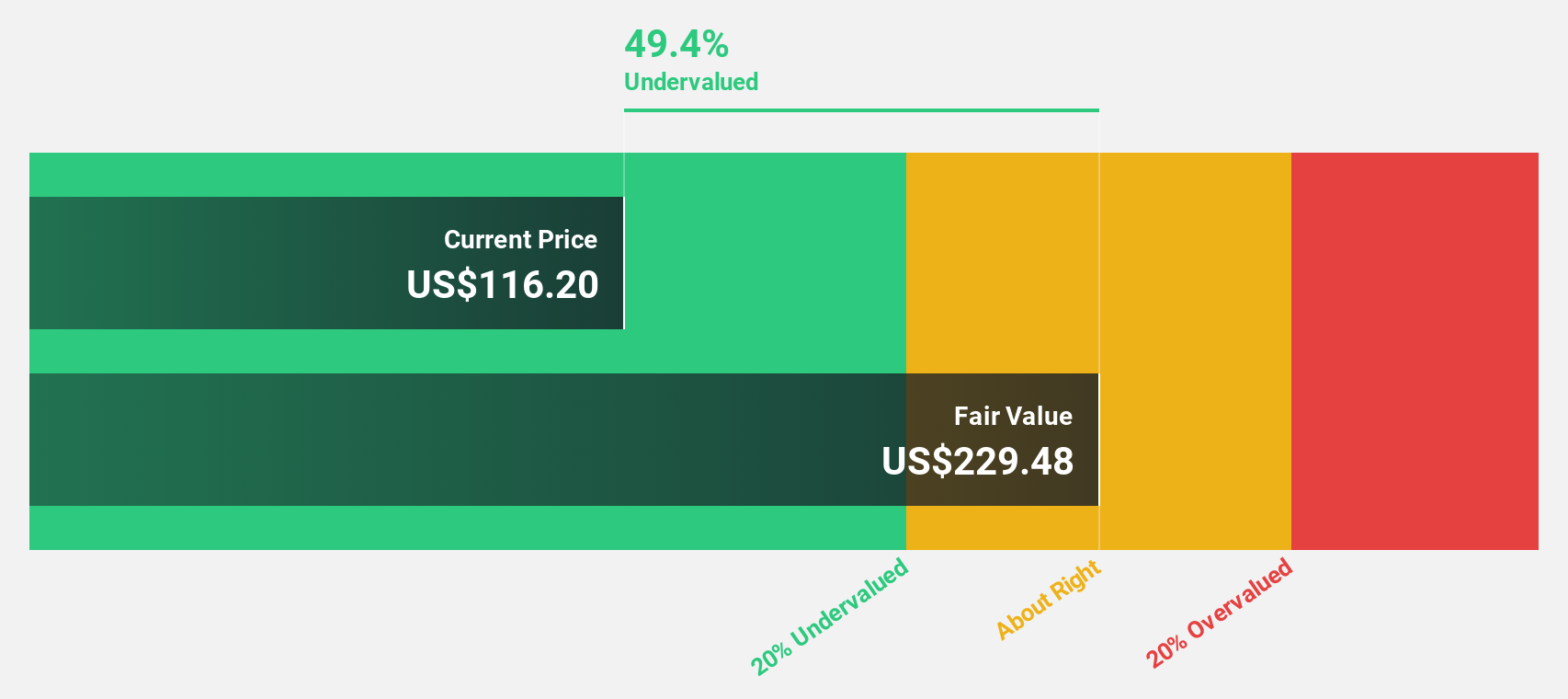

Reddit (NYSE:RDDT)

Overview: Reddit, Inc. operates a website that organizes digital communities and has a market cap of approximately $35.04 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated $1.12 billion.

Estimated Discount To Fair Value: 28.5%

Reddit, Inc. is trading at US$202.31, well below its estimated fair value of US$282.79, highlighting potential undervaluation based on cash flows. The company's revenue is expected to grow at 22.8% annually, outpacing the broader US market growth rate and contributing to a forecasted earnings increase of 56.17% per year as it moves towards profitability within three years. Recent presentations at major conferences underscore Reddit's active engagement with investors and stakeholders globally.

- Our expertly prepared growth report on Reddit implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Reddit stock in this financial health report.

Seize The Opportunity

- Discover the full array of 180 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives