- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

High Growth Tech Stocks in US for April 2025

Reviewed by Simply Wall St

In the current U.S. market landscape, tech stocks are leading the charge as key indices like the S&P 500 and Nasdaq Composite see gains amid easing trade tensions with China, despite ongoing volatility from tariff announcements. For investors eyeing high growth opportunities in the tech sector, it's crucial to focus on companies that demonstrate resilience and adaptability in navigating fluctuating economic conditions and geopolitical challenges.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 65.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.72% | 58.76% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software platform that aids advertisers in improving the marketing and monetization of their content globally, with a market cap of approximately $84.97 billion.

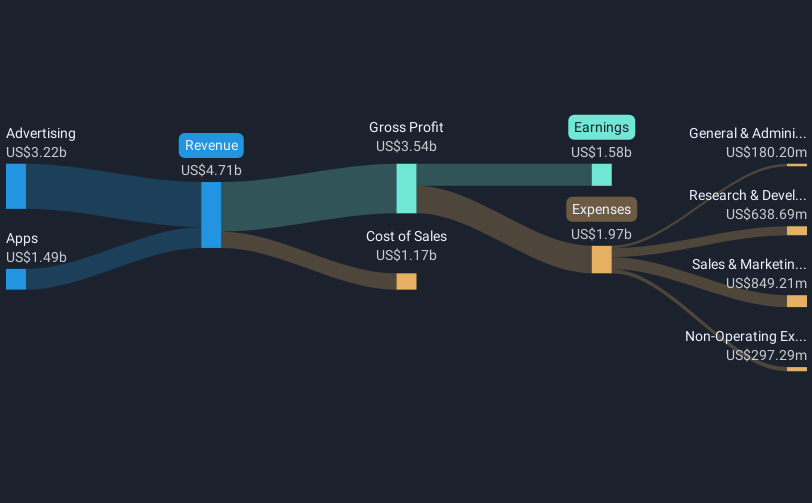

Operations: AppLovin generates revenue primarily from two segments: Apps, contributing $1.49 billion, and Advertising, which brings in $3.22 billion. The company focuses on enhancing marketing and monetization for advertisers both in the U.S. and internationally through its software platform.

AppLovin's strategic maneuvers, including a bid for TikTok's non-Chinese assets and recent board changes with the appointment of Maynard Webb, underscore its aggressive expansion into global advertising markets. Despite facing allegations of ad fraud impacting its reputation, the company continues to innovate with AI technologies in digital advertising. Financially, AppLovin has shown robust growth with a 344.3% increase in earnings over the past year and an annualized revenue growth rate of 15.4%. Additionally, it has repurchased shares worth $1.17 billion since October last year, reflecting confidence in its business model amidst challenges. These developments suggest that while navigating through regulatory and legal hurdles remains critical, AppLovin is poised to capitalize on significant market opportunities through technological advancements and strategic acquisitions.

- Click to explore a detailed breakdown of our findings in AppLovin's health report.

Review our historical performance report to gain insights into AppLovin's's past performance.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in the People’s Republic of China, with a market cap of $6.97 billion.

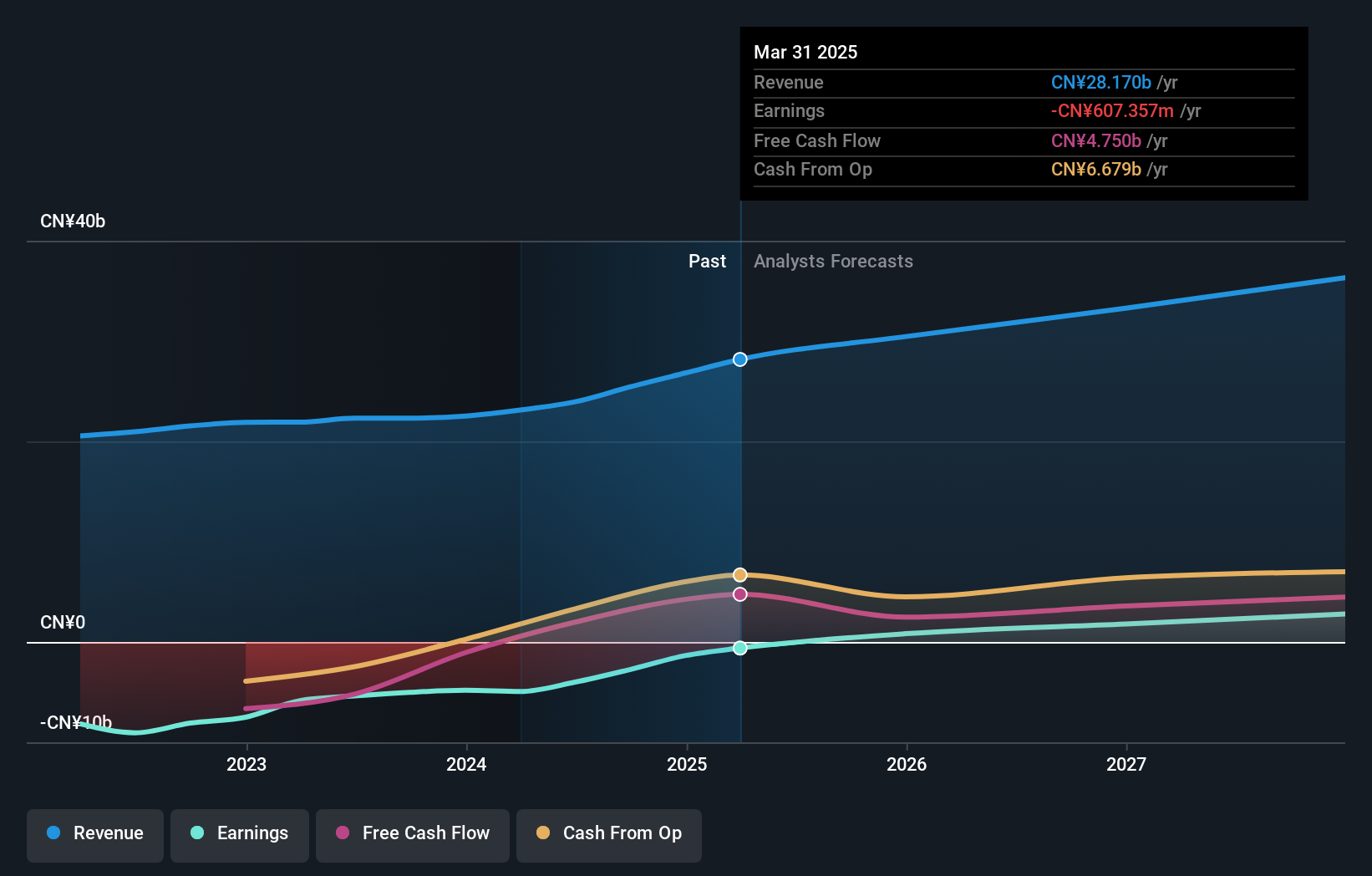

Operations: The company generates revenue primarily from internet information services, amounting to CN¥26.83 billion.

Bilibili, navigating through a transformative phase, has demonstrated a promising uptick in its financial health with a significant reduction in net loss to CNY 1.35 billion from CNY 4.82 billion year-over-year and an impressive revenue jump to CNY 26.83 billion, marking an annual growth rate of 9.2%. This growth trajectory is underscored by strategic presentations at key industry events and robust guidance for continued revenue expansion in 2025. Notably, the company's proactive approach in share repurchases, totaling $16.36 million for the year, reflects confidence in its operational strategy despite its current unprofitable status. As Bilibili progresses towards profitability with forecasted earnings growth of 50.47% annually, it remains poised to outperform within the competitive landscape of interactive media and services.

- Get an in-depth perspective on Bilibili's performance by reading our health report here.

Assess Bilibili's past performance with our detailed historical performance reports.

Reddit (NYSE:RDDT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market capitalization of $18.30 billion.

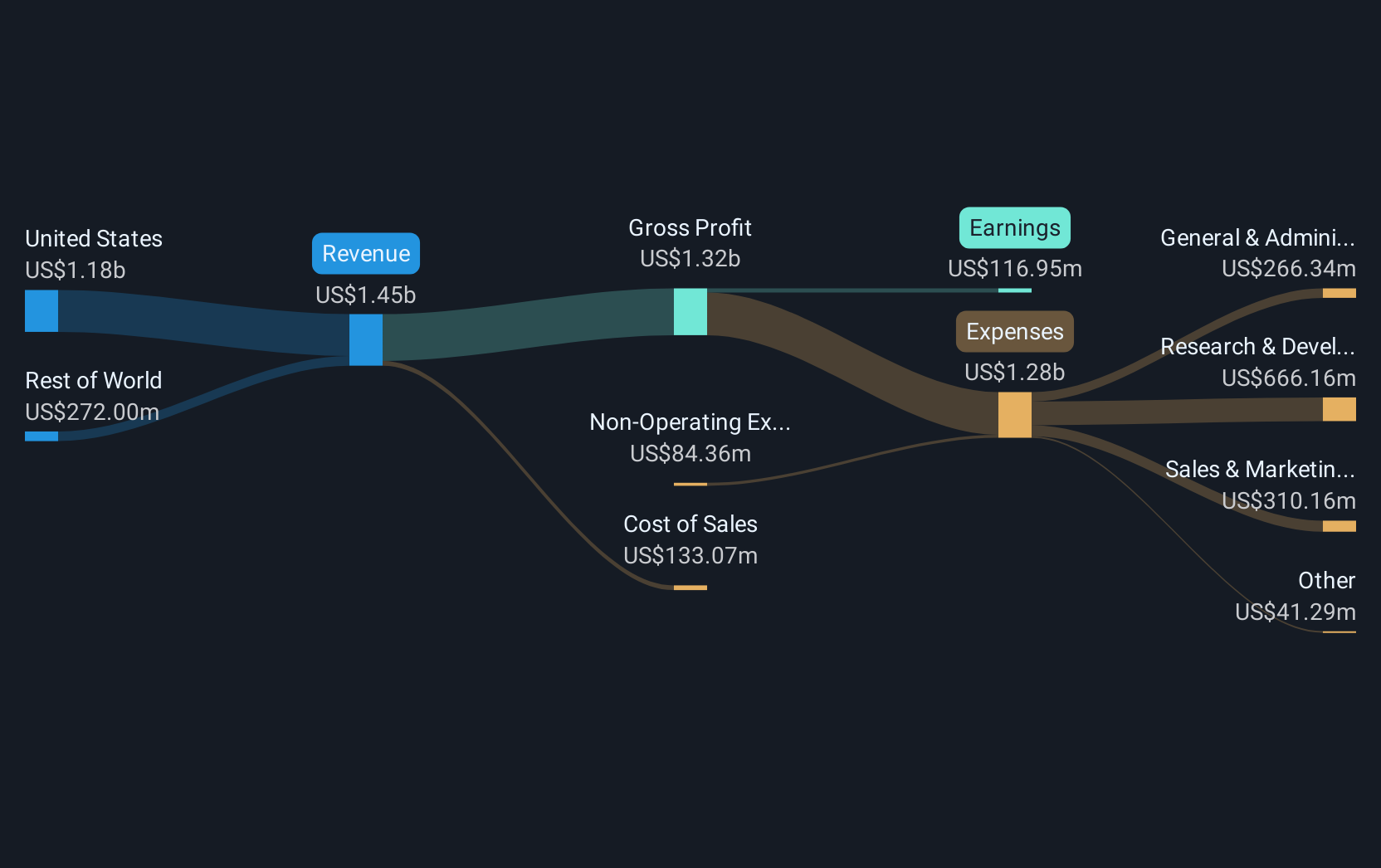

Operations: Reddit generates revenue primarily from its Internet Information Providers segment, amounting to $1.30 billion. The company's operations span both domestic and international markets, leveraging its digital community platform for growth.

Reddit's integration with Samdesk and Integral Ad Science, enhancing data analytics and advertising quality, underscores its strategic push to capitalize on its vast user interactions. This is evident from the recent 62% surge in annual revenue to $1.3 billion, despite a widened net loss of $484.28 million for 2024. The company's aggressive advertiser acquisition strategy and inclusion in the NASDAQ Internet Index signal robust efforts to diversify revenue streams and stabilize financials amidst high market volatility. These moves are pivotal as Reddit aims for profitability, forecasting a substantial revenue range of $360 million to $370 million for Q1 2025 alone, reflecting confidence in its growth trajectory and operational strategies within the tech sector.

- Navigate through the intricacies of Reddit with our comprehensive health report here.

Evaluate Reddit's historical performance by accessing our past performance report.

Make It Happen

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 230 more companies for you to explore.Click here to unveil our expertly curated list of 233 US High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives