- United States

- /

- Interactive Media and Services

- /

- NYSE:KIND

3 Penny Stocks On US Exchanges With Market Caps Up To $2B

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a sluggish start to 2025, investors are eyeing opportunities amid renewed optimism in major indices. Penny stocks, though often associated with high risk due to their smaller size and less-established nature, can still present valuable opportunities when backed by strong financials. By focusing on companies with solid balance sheets and potential for growth, investors may uncover promising prospects within this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8224 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.00 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.63 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3264 | $12.01M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.74 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9846 | $88.55M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.54 | $377.99M | ★★★★☆☆ |

Click here to see the full list of 719 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Accuray (NasdaqGS:ARAY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Accuray Incorporated is a company that designs, develops, manufactures, and sells radiosurgery and radiation therapy systems for tumor treatment across various global markets, with a market cap of $208.17 million.

Operations: The company's revenue is primarily derived from its proprietary medical devices used in radiation therapy, totaling $444.20 million.

Market Cap: $208.17M

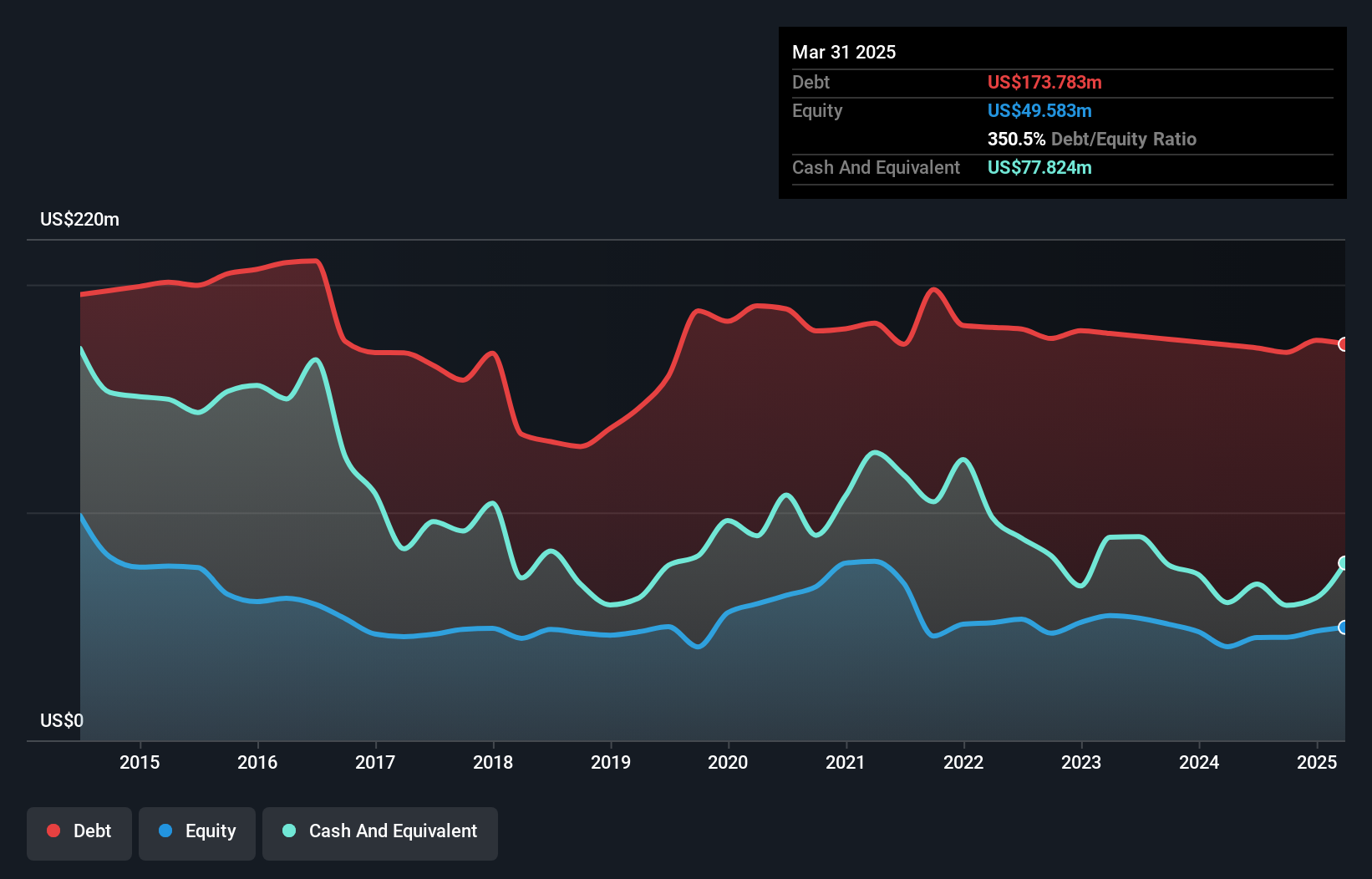

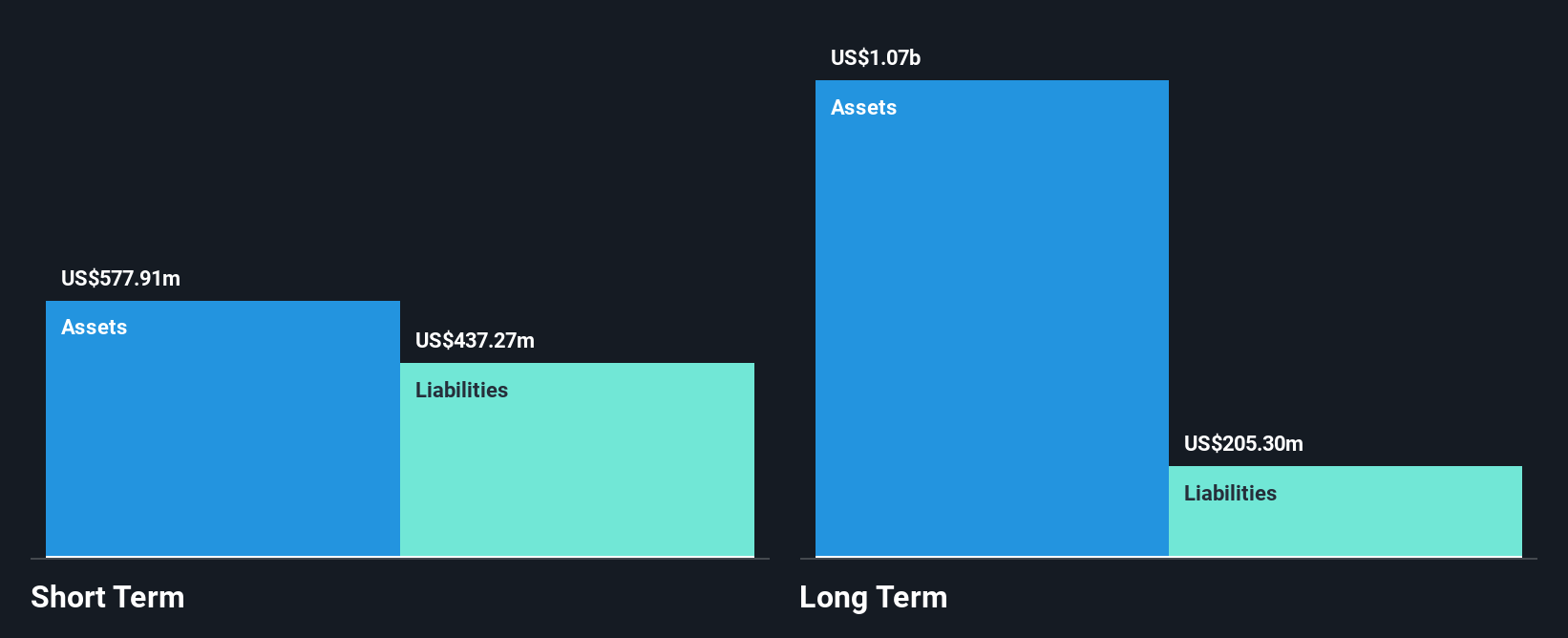

Accuray's financial position presents a mixed picture for investors considering penny stocks. The company reported revenues of US$101.55 million for the first quarter ending September 2024, with a net loss of US$3.95 million, highlighting ongoing profitability challenges. Despite this, Accuray's short-term assets exceed both its short and long-term liabilities, indicating adequate liquidity management. However, the high net debt to equity ratio of 245.5% suggests significant leverage concerns that could affect future financial flexibility. Recent executive changes and a shelf registration filing for US$17.595 million indicate strategic adjustments possibly aimed at strengthening operational capabilities and capital structure.

- Get an in-depth perspective on Accuray's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Accuray's future.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, the United Kingdom, and Germany, with a market cap of approximately $1.27 billion.

Operations: The company generates its revenue primarily through its advertising segment, which amounts to $1.69 billion.

Market Cap: $1.27B

Taboola.com Ltd. offers a compelling case for penny stock investors, despite its current unprofitability and increasing losses over the past five years. The company has a market cap of approximately US$1.27 billion and generates substantial revenue, with projections between US$1.735 billion to US$1.765 billion for 2024. Taboola's financial health is supported by short-term assets exceeding liabilities and a positive cash flow runway extending over three years, minimizing immediate liquidity risks. Recent strategic partnerships with Future and The Weather Company enhance its growth potential, while innovations like the Abby AI platform could drive operational efficiencies in advertising campaigns.

- Navigate through the intricacies of Taboola.com with our comprehensive balance sheet health report here.

- Assess Taboola.com's future earnings estimates with our detailed growth reports.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public services both in the United States and internationally, with a market cap of $940.07 million.

Operations: The company generates revenue of $237.61 million from its Internet Information Providers segment.

Market Cap: $940.07M

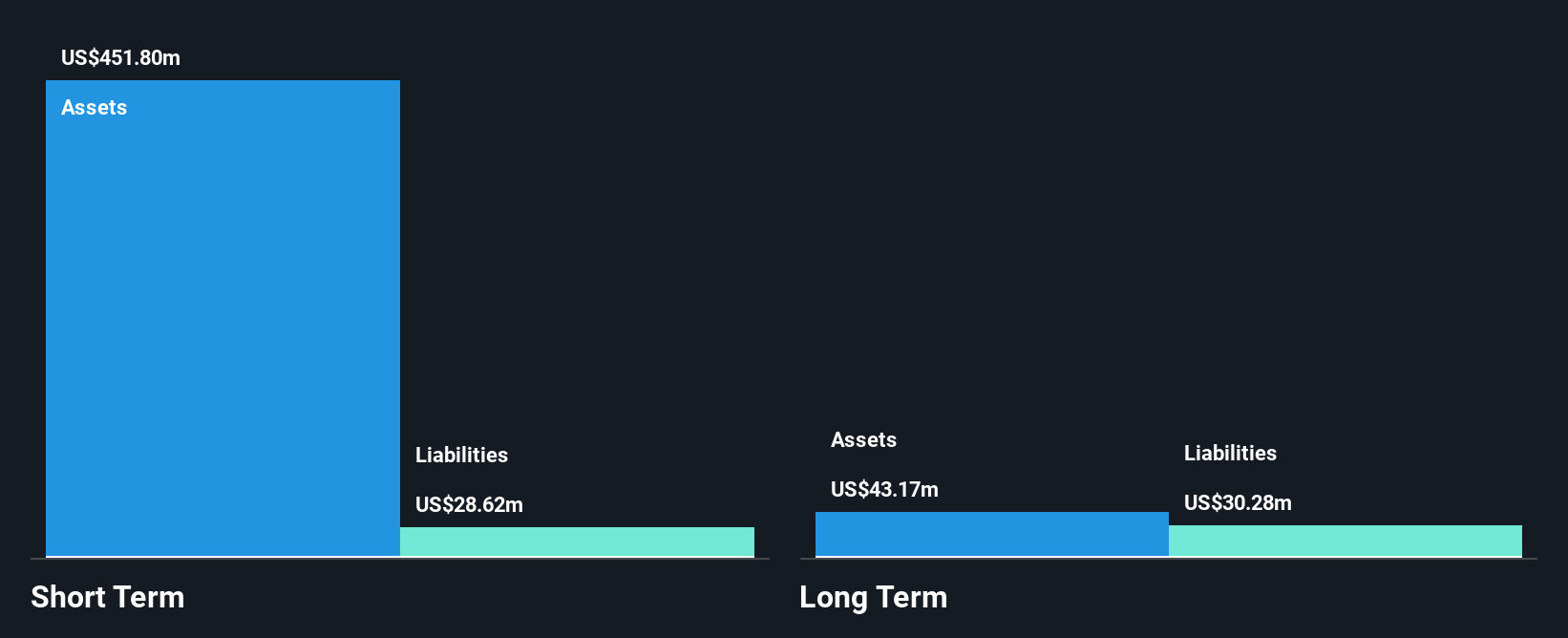

Nextdoor Holdings, Inc. presents a mixed picture for penny stock investors with its unprofitability and declining earnings over the past five years. Despite trading significantly below estimated fair value, the company remains debt-free and maintains a strong cash runway exceeding three years based on current free cash flow. Revenue is expected to grow by 10.77% annually, supported by recent third-quarter sales of US$65.61 million, up from US$56.09 million year-over-year, while net losses have narrowed considerably. Strategic initiatives like the NEXT product transformation underscore efforts to enhance user engagement and potentially bolster future financial performance.

- Take a closer look at Nextdoor Holdings' potential here in our financial health report.

- Learn about Nextdoor Holdings' future growth trajectory here.

Taking Advantage

- Explore the 719 names from our US Penny Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nextdoor Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nextdoor Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KIND

Nextdoor Holdings

Operates a neighborhood network that connects neighbors, businesses, and public agencies in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives