- United States

- /

- Media

- /

- NYSE:GTN

Exploring August 2025's Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As of late August 2025, the U.S. stock market has shown resilience with major indices like the Dow Jones and S&P 500 closing higher despite political uncertainties impacting the Federal Reserve. In this environment, small-cap stocks remain a focal point for investors seeking opportunities beyond large-cap tech giants, especially as economic indicators suggest potential shifts in monetary policy. A good small-cap stock often combines strong fundamentals with strategic insider activity, which can signal confidence in the company's future prospects amidst broader market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.2x | 4.0x | 33.96% | ★★★★★★ |

| PCB Bancorp | 10.3x | 3.1x | 30.15% | ★★★★★☆ |

| First United | 10.2x | 3.0x | 42.65% | ★★★★★☆ |

| Peoples Bancorp | 10.5x | 2.0x | 42.89% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 0.8x | 49.73% | ★★★★★☆ |

| S&T Bancorp | 11.6x | 3.9x | 36.85% | ★★★★☆☆ |

| GEN Restaurant Group | NA | 0.1x | -606.19% | ★★★★☆☆ |

| Citizens & Northern | 11.8x | 2.9x | 40.11% | ★★★☆☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -86.04% | ★★★☆☆☆ |

| Farmland Partners | 7.2x | 8.8x | -45.59% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Domo (DOMO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Domo operates in the software and programming industry, providing cloud-based business intelligence solutions with a market capitalization of $0.49 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $317.05 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 76.56%. Operating expenses are largely driven by sales and marketing efforts, followed by research and development costs.

PE: -8.8x

Domo, a tech company in the U.S., is gaining traction for its cloud integration capabilities, particularly through partnerships with Snowflake. Despite being unprofitable and reliant on external borrowing, Domo's addition to multiple value indices suggests market recognition of potential. Recent insider confidence was shown when they purchased shares in June 2025. Enhanced data management tools and strategic alliances bolster its position in AI-driven analytics, offering promising growth avenues despite current financial challenges.

- Navigate through the intricacies of Domo with our comprehensive valuation report here.

Examine Domo's past performance report to understand how it has performed in the past.

Peapack-Gladstone Financial (PGC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Peapack-Gladstone Financial operates as a bank holding company providing banking and wealth management services, with a market cap of approximately $0.57 billion.

Operations: Peapack-Gladstone Financial generates revenue primarily from its banking segment, contributing $173.46 million, and wealth management services, which add $65.08 million. Operating expenses have been a significant factor, with general and administrative expenses reaching up to $160.33 million in the latest period. The company's net income margin has fluctuated over time, recently recorded at 13.58%.

PE: 15.6x

Peapack-Gladstone Financial, a smaller player in the financial sector, has shown promising signs of being undervalued. With earnings projected to increase by nearly 50% annually, this growth potential is noteworthy. Insider confidence is evident as F. Meyercord recently purchased 6,316 shares for US$179,608 in July 2025. Despite a low allowance for bad loans at 71%, the company reported improved net interest income of US$48 million for Q2 2025 compared to US$35 million last year. Additionally, its inclusion in multiple Russell growth benchmarks highlights its growing market presence and potential appeal to investors seeking value opportunities within smaller firms.

Gray Media (GTN)

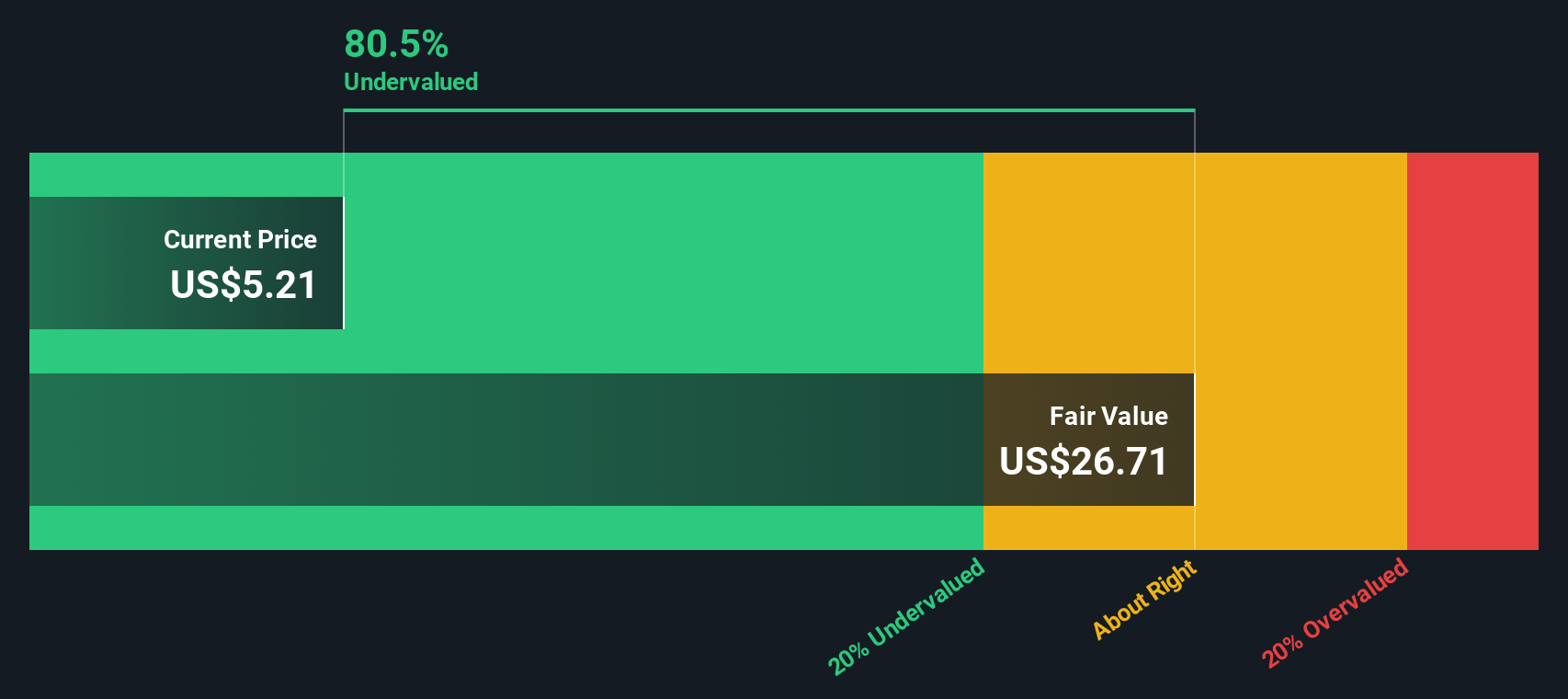

Simply Wall St Value Rating: ★★★★★☆

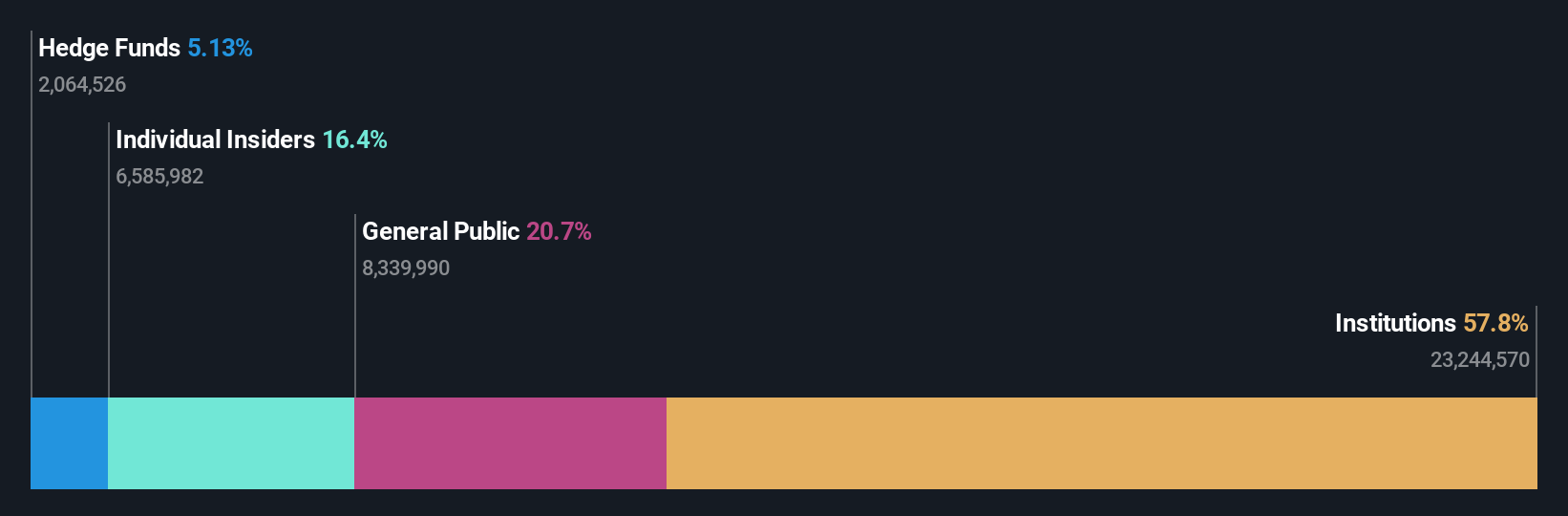

Overview: Gray Media operates as a television broadcasting company with additional operations in production companies, and it has a market capitalization of approximately $1.52 billion.

Operations: Gray Media generates revenue primarily from its broadcasting segment, contributing $3.44 billion, and a smaller portion from production companies at $108 million. The company's gross profit margin has shown variability, reaching 41.54% in December 2020 but declining to 32.46% by September 2023. Operating expenses have remained significant, with general and administrative expenses consistently impacting the overall financial performance.

PE: 4.0x

Gray Media is navigating a challenging financial landscape, with earnings expected to decline by 12% annually over the next three years. Despite this, insider confidence remains evident as insiders have recently increased their stake in the company. Gray's strategic initiatives include a new AI-driven investigative project and an innovative video streaming partnership with Google Cloud, set to enhance viewer engagement starting January 2026. These moves could position Gray favorably within the evolving media industry.

Make It Happen

- Reveal the 84 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTN

Gray Media

A multimedia company, owns and/or operates television stations and digital assets in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)