- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WB

How Investors Are Reacting To Weibo (WB) Surpassing Q2 2025 Revenue and Earnings Expectations

Reviewed by Simply Wall St

- Weibo Corporation announced its second quarter and first half 2025 earnings, reporting revenue of US$444.8 million and net income of US$125.69 million for Q2, both higher than the same period last year.

- The company’s basic and diluted earnings per share from continuing operations also increased year-on-year, highlighting improved efficiency and profitability during the first half of 2025.

- We’ll examine how the consistent growth in revenue and earnings sharpens Weibo’s investment narrative and future earnings outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Weibo Investment Narrative Recap

To be a Weibo shareholder, you have to believe that the company can sustain engagement and monetization in an increasingly crowded Chinese social media market, even as competitive threats and regulatory constraints persist. The latest earnings, which show a modest year-on-year rise in both revenue and net income, support the short-term catalyst of increased efficiency, but do not fundamentally alter the risk picture. The biggest immediate risk, continued dependence on advertising and competition from short-video platforms, remains material and unchanged.

Among Weibo’s recent announcements, the distribution of an annual cash dividend for fiscal year 2024 stands out as especially relevant. This signals ongoing profitability and management confidence in free cash flow generation, factors that matter when assessing whether the company can absorb cyclical ad spend swings or reinvest in new user engagement features. Yet, as these results suggest, sustaining margin and revenue growth will remain challenging until there is clear evidence of traction from innovation or diversification strategies.

However, even as profits trend up, investors should not overlook how exposure to China’s volatile ad market could quickly impact future quarters...

Read the full narrative on Weibo (it's free!)

Weibo's narrative projects $1.9 billion revenue and $416.6 million earnings by 2028. This requires 2.8% yearly revenue growth and a $44.5 million earnings increase from $372.1 million today.

Uncover how Weibo's forecasts yield a $11.96 fair value, a 6% upside to its current price.

Exploring Other Perspectives

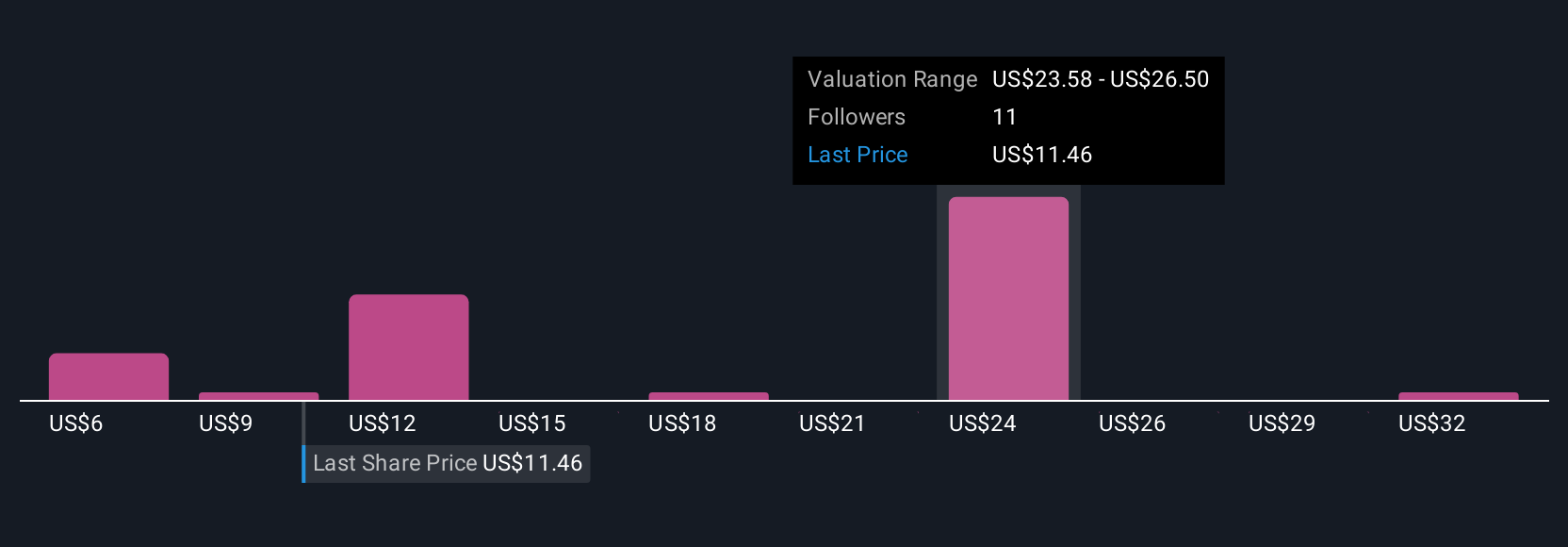

Seven fair value estimates from the Simply Wall St Community range widely from US$6.08 to US$35.25 per share. While many see current price levels as low, growing advertising competition and shifting user habits raise bigger questions about future earnings power.

Explore 7 other fair value estimates on Weibo - why the stock might be worth 46% less than the current price!

Build Your Own Weibo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weibo research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Weibo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weibo's overall financial health at a glance.

No Opportunity In Weibo?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weibo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WB

Through its subsidiaries, operates as a social media platform for people to create, discover, and distribute content in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives