- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WB

Can Weibo's (WB) Real-Time Engagement During Crises Reinforce Its Digital Media Leadership?

Reviewed by Sasha Jovanovic

- On Friday, a major cryptocurrency crash erased US$19 billion in value and became the second most searched topic on Weibo, driven by heightened US-China trade tensions and sudden market volatility.

- This surge in public discussion highlights the platform's role as a key channel for real-time information sharing during economic uncertainty, underscoring its influence in the digital media landscape.

- We'll examine how Weibo's increased user engagement during crises may affect its investment narrative and future growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Weibo Investment Narrative Recap

To be a Weibo shareholder, you need to believe that the platform’s ability to capture engagement during fast-moving news cycles and crises translates into durable user activity and advertising opportunities, offsetting shifting content trends and regulatory headwinds. The recent surge in Weibo activity around the US$19 billion cryptocurrency crash, while highlighting its relevance, does not materially change the company’s central short-term catalyst: success in integrating AI-driven features that increase ad efficiency and user retention. The biggest risk remains Weibo’s dependence on advertising against a backdrop of evolving client demand and market volatility.

In terms of recent announcements, Weibo’s August earnings report stands out, with Q2 revenue and net income both showing year-on-year improvement despite ongoing macroeconomic pressures. This context reinforces the focus on Weibo’s AI-powered monetization strategy as core to its ability to capitalize on increased user activity during heightened news events, while continuing to navigate competitive threats from fast-growing short-video platforms.

On the other hand, investors should not overlook the implications of intensifying competition from short-video and livestreaming rivals like Douyin and Kuaishou...

Read the full narrative on Weibo (it's free!)

Weibo's narrative projects $1.9 billion revenue and $416.6 million earnings by 2028. This requires 2.8% yearly revenue growth and a $44.5 million earnings increase from the current earnings of $372.1 million.

Uncover how Weibo's forecasts yield a $11.96 fair value, a 3% upside to its current price.

Exploring Other Perspectives

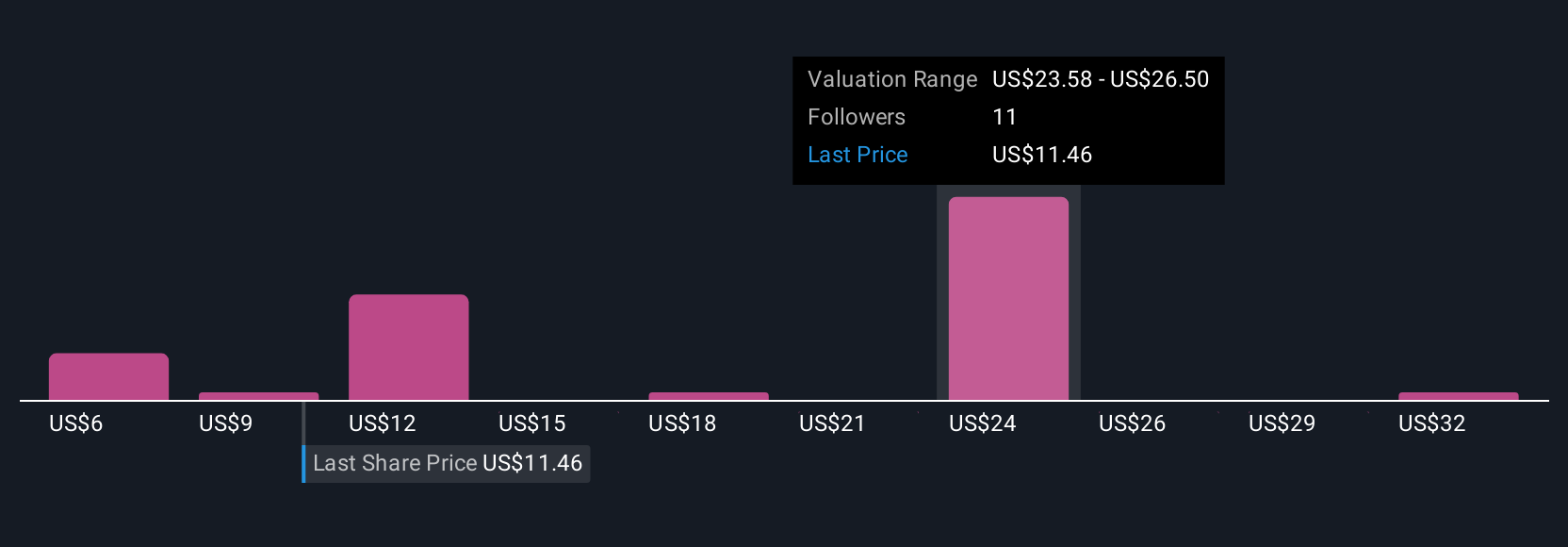

The Simply Wall St Community provided eight fair value estimates for Weibo, spanning from US$6.08 to US$35.25 per share. While this community signals a wide range of valuations, rising engagement during uncertainty may be tested if short-video competitors accelerate user migration, so consider several viewpoints as you assess Weibo’s future.

Explore 8 other fair value estimates on Weibo - why the stock might be worth 48% less than the current price!

Build Your Own Weibo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weibo research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Weibo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weibo's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weibo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WB

Through its subsidiaries, operates as a social media platform for people to create, discover, and distribute content in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives