- United States

- /

- Software

- /

- NasdaqGS:SVCO

US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences turbulence, with major indices like the Dow Jones Industrial Average and S&P 500 facing significant declines due to Federal Reserve policy signals, investors are increasingly seeking stability in growth companies with strong insider ownership. In this context, high insider ownership can indicate confidence from those closest to the business, potentially offering a layer of resilience amid broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Loop Industries (NasdaqGM:LOOP) | 33% | 65.2% |

Let's explore several standout options from the results in the screener.

Silvaco Group (NasdaqGS:SVCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Silvaco Group, Inc. offers technology computer-aided design software, electronic design automation software, and semiconductor intellectual property solutions with a market cap of $250.19 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for $54.31 million.

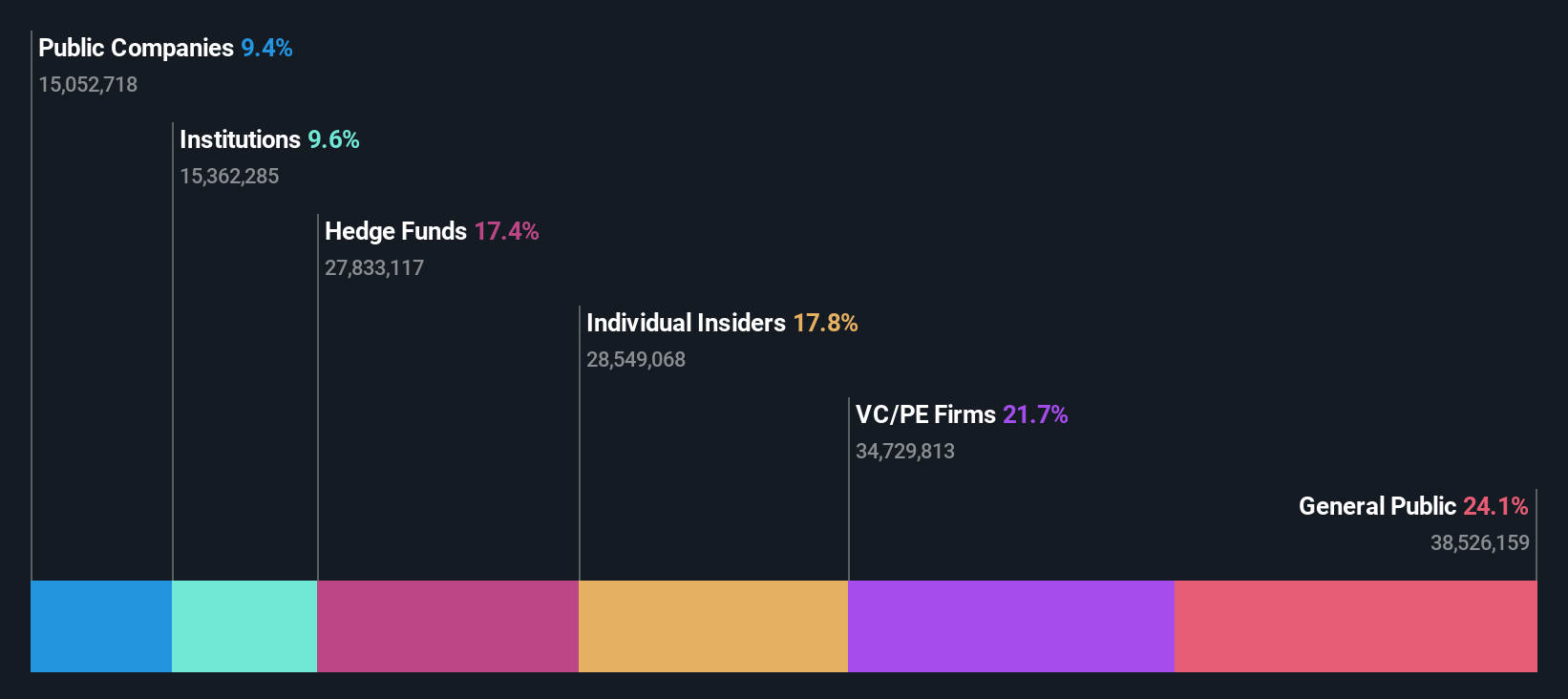

Insider Ownership: 37.3%

Earnings Growth Forecast: 98.3% p.a.

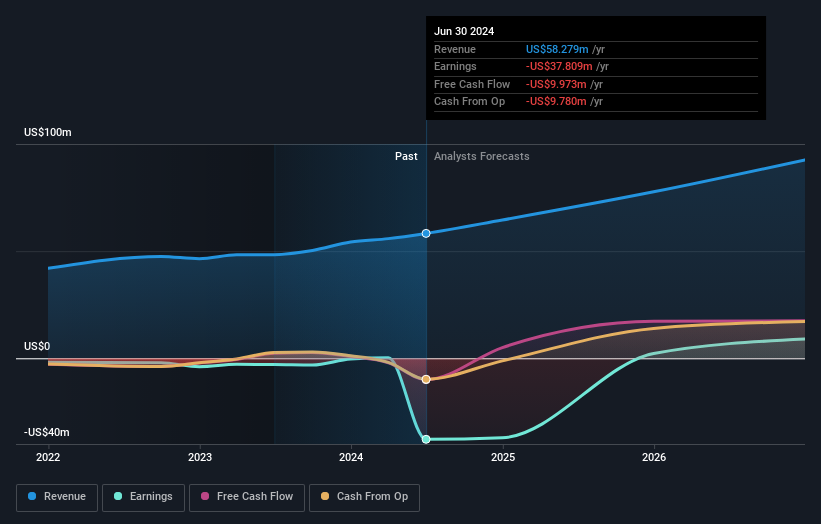

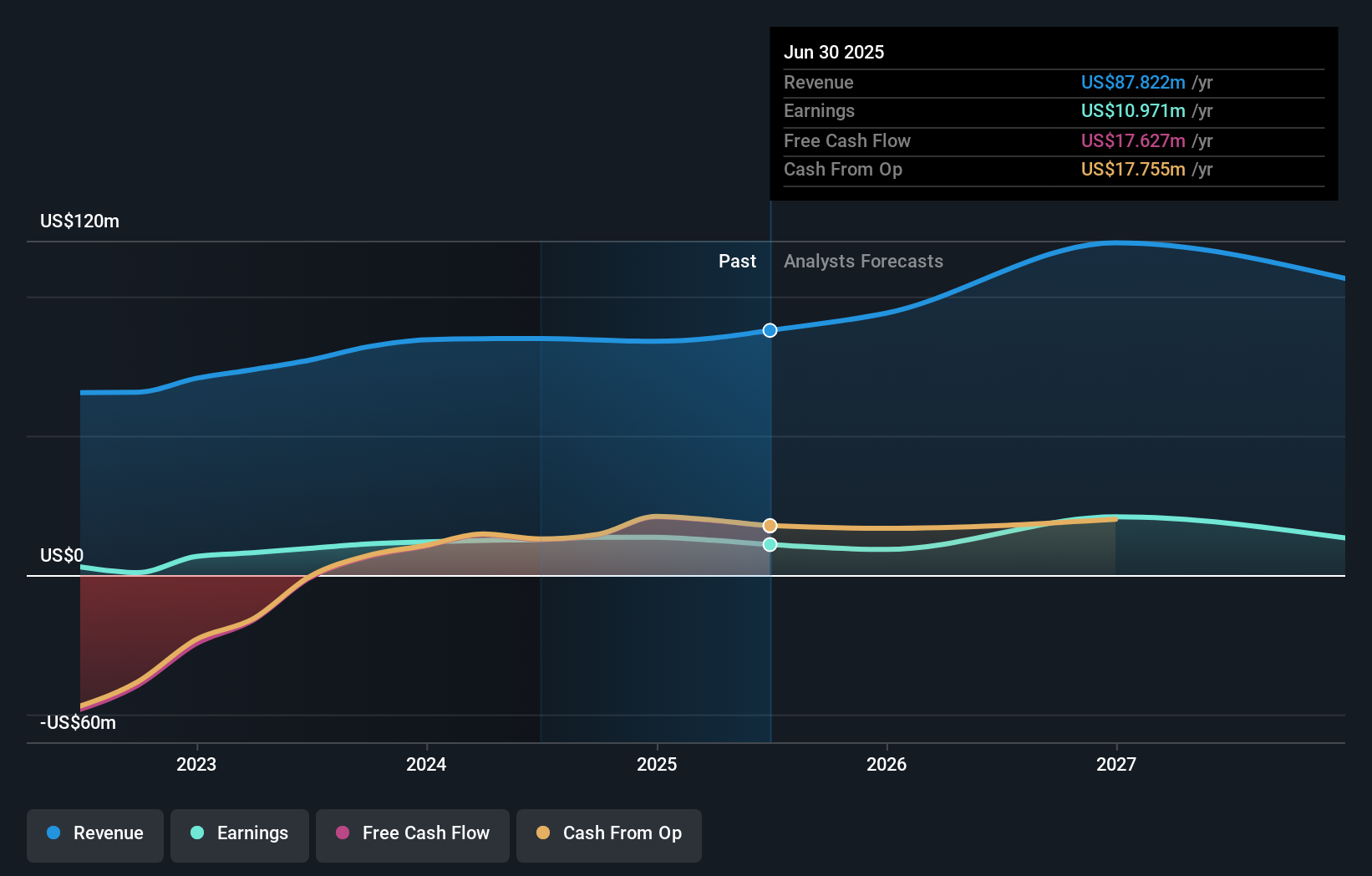

Silvaco Group faces challenges with a recent net loss of US$6.55 million for Q3 2024, contrasting with a net income of US$1.45 million the previous year. Despite this, revenue is projected to grow faster than the U.S. market at 17.5% annually, and profitability is expected within three years. Insider activity shows significant selling recently, but shares are trading well below their estimated fair value, suggesting potential undervaluation amidst high volatility and strategic leadership changes.

- Unlock comprehensive insights into our analysis of Silvaco Group stock in this growth report.

- The valuation report we've compiled suggests that Silvaco Group's current price could be quite moderate.

Travelzoo (NasdaqGS:TZOO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Travelzoo, with a market cap of $250.84 million, operates as an Internet media company offering travel, entertainment, and local experiences globally.

Operations: The company's revenue is derived from several segments, including Travelzoo North America ($54.97 million), Travelzoo Europe ($24.90 million), Jack’s Flight Club ($4.27 million), and New Initiatives ($0.24 million).

Insider Ownership: 38.3%

Earnings Growth Forecast: 34.7% p.a.

Travelzoo's Q3 2024 results show a net income increase to US$3.18 million from US$2.35 million, despite slightly lower sales of US$20.1 million. The company is executing a share repurchase program, having bought back over 10% of shares for US$12.57 million, signaling confidence in its valuation. Forecasts indicate robust revenue growth at 24.8% annually and significant earnings growth at 34.7%, outpacing the broader U.S market, although recent insider selling may concern some investors.

- Dive into the specifics of Travelzoo here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Travelzoo is trading behind its estimated value.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a maintenance, repair, and operating (MRO) products trading and service platform in China, offering spare parts, chemicals, manufacturing parts, general consumables, and office supplies with a market cap of approximately $562.21 million.

Operations: The company's revenue primarily comes from its Business-To-Business Trading and Services of Industrial Products segment, which generated CN¥8.84 billion.

Insider Ownership: 17.7%

Earnings Growth Forecast: 120.3% p.a.

ZKH Group's recent strategic partnership with Zhejiang Tmall Technology is set to enhance its industrial product offerings and market reach. Despite a net loss of CNY 81.75 million in Q3 2024, the company shows improvement from the previous year. Revenue growth is forecasted at 10.2% annually, exceeding the U.S market average, and profitability is expected within three years. Trading significantly below estimated fair value, ZKH offers potential upside as analyst consensus predicts a price increase of 22.6%.

- Click to explore a detailed breakdown of our findings in ZKH Group's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of ZKH Group shares in the market.

Key Takeaways

- Reveal the 200 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SVCO

Silvaco Group

Provides technology computer aided design (TCAD) software, electronic design automation (EDA) software, and semiconductor intellectual property (SIP) solutions in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives