- United States

- /

- Banks

- /

- NasdaqGS:PCB

Undervalued Small Caps With Insider Action In October 2025

Reviewed by Simply Wall St

As the U.S. market continues to break records with the S&P 500 and Nasdaq reaching new highs, small-cap stocks often present unique opportunities amid broader economic shifts such as interest rate cuts and government shutdowns. In this environment, identifying promising small-cap stocks can hinge on factors like insider activity and their potential for growth within a dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Limbach Holdings | 31.1x | 2.0x | 39.48% | ★★★★★★ |

| PCB Bancorp | 9.5x | 2.8x | 36.01% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 26.61% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 41.25% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.30% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.6x | 36.80% | ★★★★☆☆ |

| Shore Bancshares | 10.0x | 2.6x | -78.87% | ★★★☆☆☆ |

| Arrow Financial | 14.7x | 3.2x | 20.16% | ★★★☆☆☆ |

| Farmland Partners | 6.9x | 8.4x | -42.40% | ★★★☆☆☆ |

| Tilray Brands | NA | 2.3x | -44.55% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Thryv Holdings (THRY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thryv Holdings is a company that provides small and medium-sized businesses with software as a service (SaaS) solutions and marketing services, with a market cap of approximately $1.02 billion.

Operations: Thryv Holdings generates revenue primarily through its SaaS and Marketing Services segments. The company experienced a gross profit margin of 66.06% as of the most recent period, with significant operating expenses including sales and marketing costs.

PE: -5.8x

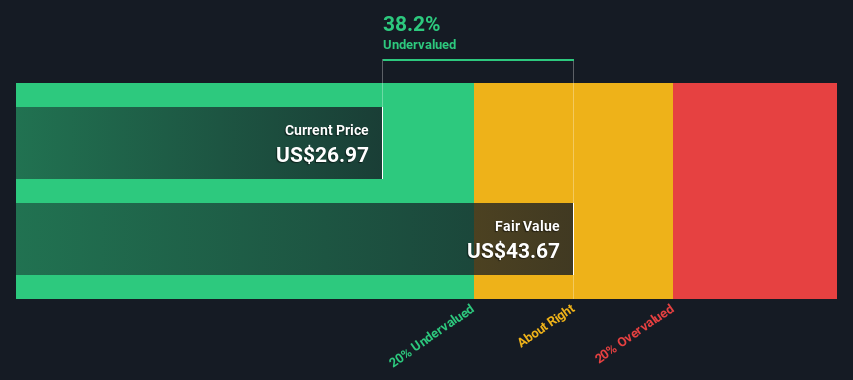

Thryv Holdings, a company focused on small and medium-sized businesses, has seen insider confidence with Joseph Walsh purchasing 8,000 shares valued at US$103,200 in August 2025. Despite facing higher risk due to external borrowing for funding, Thryv's strategic moves include appointing Sean Wechter as CTO and launching the Thryv Workforce Center payroll solution. The company's earnings guidance for 2025 forecasts SaaS revenue between US$460 million and US$465 million. With a focus on technology-driven growth, Thryv aims to enhance its competitive edge in the market.

- Click here and access our complete valuation analysis report to understand the dynamics of Thryv Holdings.

Gain insights into Thryv Holdings' past trends and performance with our Past report.

Arrow Financial (AROW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Arrow Financial is a community banking organization with operations focused on providing a range of financial services, and it has a market cap of approximately $0.43 billion.

Operations: Arrow Financial's primary revenue stream is from community banking, with a recent revenue of $140.42 million. The company consistently reports a gross profit margin of 100%, indicating no cost of goods sold in the financial data provided. Operating expenses, primarily driven by general and administrative costs, have shown an upward trend over time, impacting net income margins which have varied but recently stood at 21.76%.

PE: 14.7x

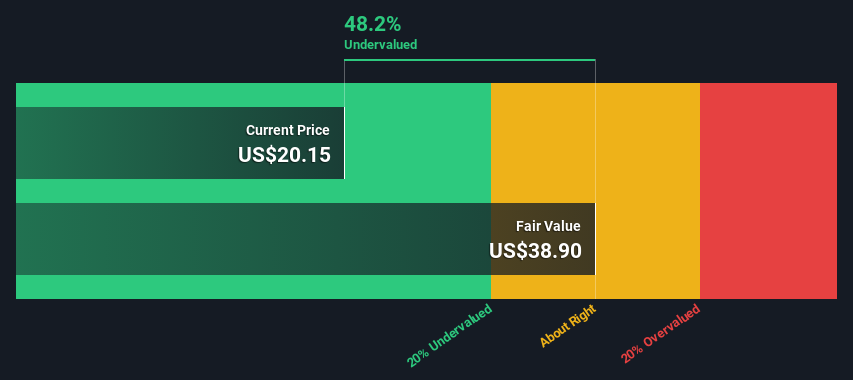

Arrow Financial's recent financial performance highlights its potential as an undervalued investment. For the second quarter of 2025, net interest income rose to US$32.53 million from US$27.15 million a year earlier, while net income increased to US$10.81 million from US$8.6 million. The company also declared a dividend increase and completed significant share repurchases worth US$8.56 million since April 2024, reflecting strong insider confidence with Penko Ivanov acquiring 12,000 shares for approximately US$353,486 in June 2025, marking a substantial percentage change in their holdings by over 155%.

- Delve into the full analysis valuation report here for a deeper understanding of Arrow Financial.

Understand Arrow Financial's track record by examining our Past report.

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★☆

Overview: PCB Bancorp operates as a bank holding company providing a range of commercial banking services primarily to small and medium-sized businesses, with a market capitalization of $0.23 billion.

Operations: PCB Bancorp generates revenue primarily from its operations in the banking industry, with recent figures showing revenue of $102.26 million. The company has consistently reported a gross profit margin of 100%, indicating no cost of goods sold is recorded against its revenues. Operating expenses, including general and administrative costs, form a significant portion of expenditures, with recent operating expenses totaling $57.90 million. Net income margins have shown variability over time, recently recorded at 29.99%.

PE: 9.5x

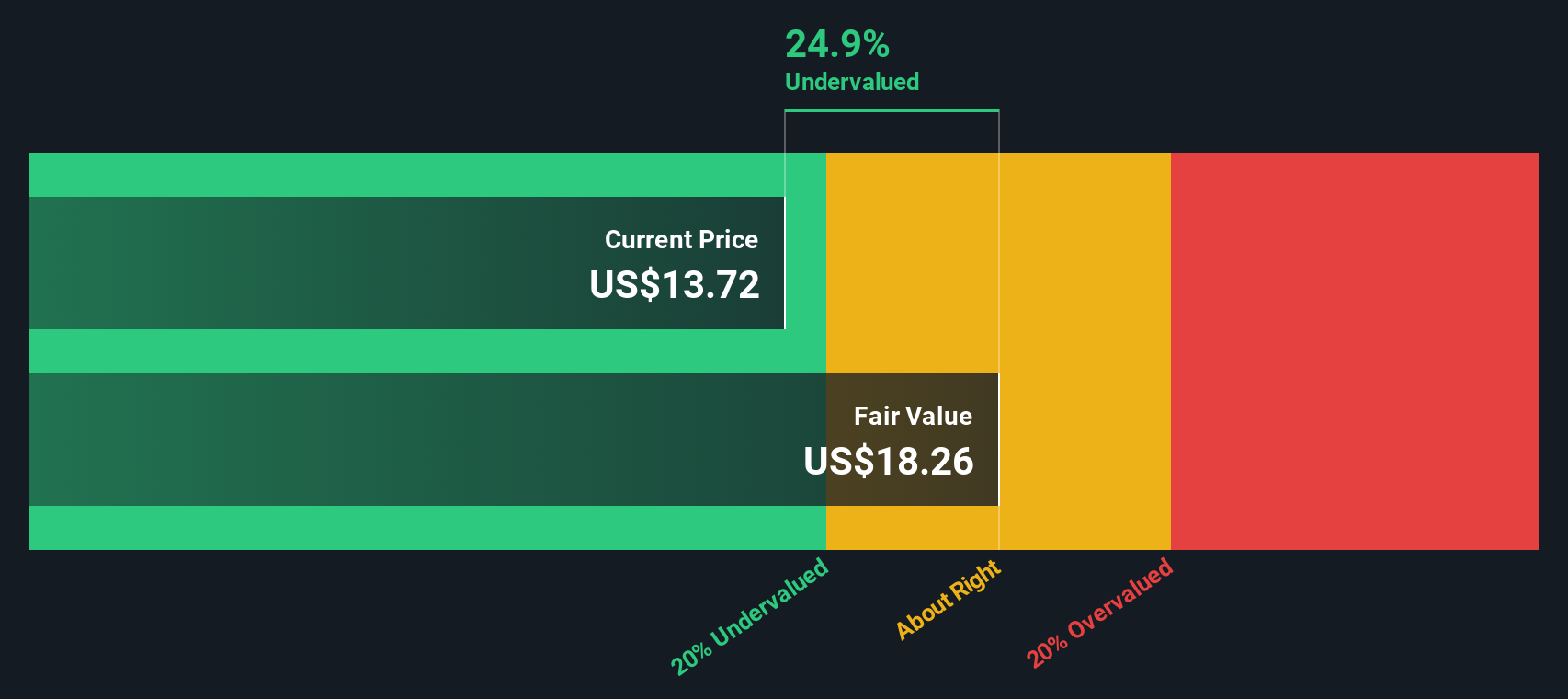

PCB Bancorp's recent performance highlights its potential as an undervalued investment. The company reported a rise in net interest income to US$25.99 million for Q2 2025, up from US$21.74 million the previous year, with net income increasing to US$9.07 million from US$6.28 million. Notably, insider confidence is evident with Sang Lee purchasing 18,200 shares worth approximately US$390K between April and July 2025, suggesting belief in future growth prospects alongside a forecasted annual earnings growth of 10%. Additionally, PCB has been actively repurchasing shares and declared a quarterly dividend of $0.20 per share payable mid-August 2025.

- Unlock comprehensive insights into our analysis of PCB Bancorp stock in this valuation report.

Review our historical performance report to gain insights into PCB Bancorp's's past performance.

Summing It All Up

- Navigate through the entire inventory of 72 Undervalued US Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCB

PCB Bancorp

Operates as the bank holding company for PCB Bank that provides various banking products and services to small and middle market businesses and individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives