- United States

- /

- Media

- /

- NasdaqGS:SIRI

Sirius XM Holdings (NasdaqGS:SIRI) Flat After Dropping From FTSE All-World Index

Reviewed by Simply Wall St

Sirius XM Holdings (NasdaqGS:SIRI) experienced a price movement of 1.8% over the last week. During this period, the company was removed from the FTSE All-World Index, which can influence investor perceptions and trading activity. Meanwhile, broader market trends showed modest gains due to optimism about potential tariff reductions, although the overall market was relatively flat. The tech sector, where Sirius XM Holdings is partly categorized, benefited from a rally led by major technology companies. Despite these broader positive market dynamics, the index exclusion likely had a more direct effect on the company's stock price movement this week.

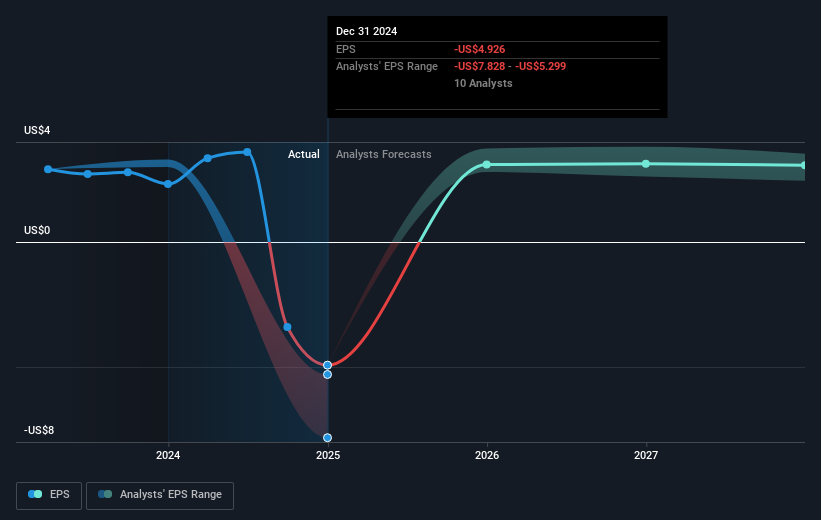

Over the past year, Sirius XM Holdings saw its total shareholder return, factoring in share price and dividends, decrease by 37.32%. This is a significant underperformance compared to the broader US market, which gained 8.1%, and the US Media industry's decline of 5.6% over the same period. A series of revenue declines contributed to this performance. For instance, Q3 2024 revenue dropped to US$2.17 billion, down from US$2.27 billion the previous year, while the full-year revenue totaled US$8.70 billion, resulting in a net loss of US$2.08 billion, a substantial downturn from the previous year's net income of US$988 million.

Additionally, Sirius XM faced index exclusions, impacting its visibility among index-tracked funds. The company was removed from the NASDAQ-100 in June 2024, followed by departures from the NASDAQ Composite and FTSE All-World Index. In contrast, Sirius XM is attempting to balance its financial strategy, continuing with share buybacks amounting to 801,609 shares, which may support share price stability over time but have not offset the impact of broader market conditions entirely.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIRI

Sirius XM Holdings

Operates as an audio entertainment company in North America.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026