- United States

- /

- Consumer Finance

- /

- NYSE:YRD

3 Dividend Stocks To Consider With Up To 7.2% Yield

Reviewed by Simply Wall St

As U.S. markets navigate the complexities of trade tensions and potential tariff reimpositions, investors are keeping a close watch on the Dow Jones, S&P 500, and Nasdaq indices following their recent record highs. In this environment of uncertainty, dividend stocks can offer a measure of stability and income through consistent payouts, making them an attractive option for those seeking to balance risk with reliable returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.55% | ★★★★★☆ |

| Universal (UVV) | 5.58% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.53% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.04% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 5.70% | ★★★★★★ |

| Credicorp (BAP) | 4.84% | ★★★★★☆ |

| CompX International (CIX) | 4.55% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.64% | ★★★★★★ |

| Chevron (CVX) | 4.61% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

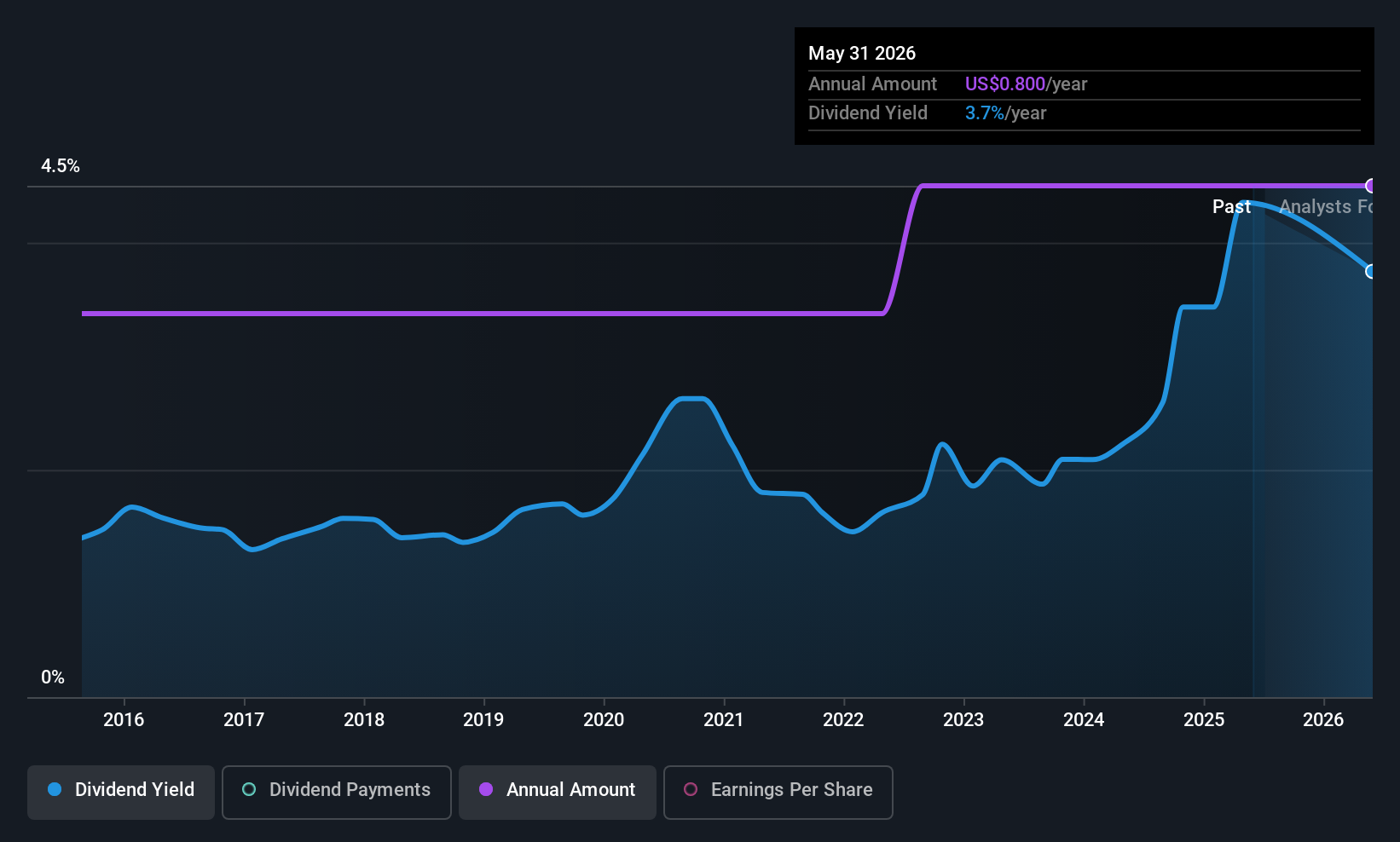

Scholastic (SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation publishes and distributes children's books globally, with a market cap of approximately $577.23 million.

Operations: Scholastic Corporation generates revenue through its key segments: Children's Book Publishing and Distribution ($943 million), Education Solutions ($319.80 million), and International operations ($273.60 million).

Dividend Yield: 3.7%

Scholastic's dividend payments have been reliable and stable over the past decade, showing consistent growth. However, the current dividend yield of 3.7% is lower compared to top-tier US dividend payers. While dividends are covered by cash flows with a 65.3% cash payout ratio, they are not well-covered by earnings due to a high payout ratio of 121.5%. Recent strategic initiatives aim to enhance profitability and shareholder value despite recent index exclusions and board changes.

- Unlock comprehensive insights into our analysis of Scholastic stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Scholastic is priced lower than what may be justified by its financials.

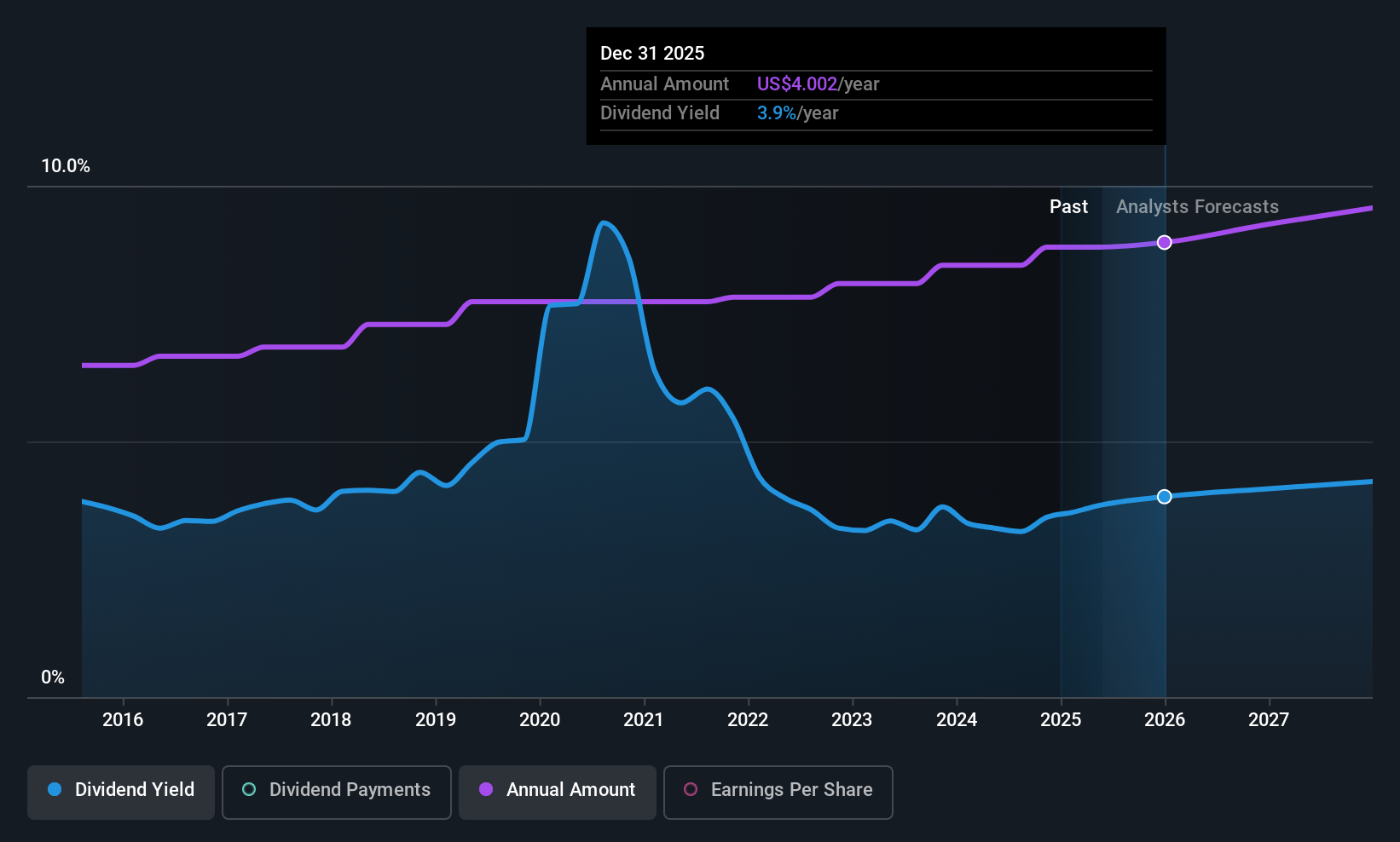

Exxon Mobil (XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various countries including the United States, Canada, and the United Kingdom, with a market cap of approximately $483.47 billion.

Operations: Exxon Mobil's revenue segments include Upstream operations in the United States ($53.26 billion) and internationally ($56.32 billion), Energy Products in the United States ($122.10 billion) and internationally ($182.15 billion), Chemical Products in the United States ($15.53 billion) and internationally ($17.68 billion), as well as Specialty Products in the United States ($8.04 billion) and internationally ($12.86 billion).

Dividend Yield: 3.5%

Exxon Mobil's dividend yield of 3.53% is reliable and stable, having grown over the past decade, though it falls short of top-tier US dividend payers. The dividends are sustainably covered by both earnings and cash flows, with payout ratios of 51.4% and 60.5%, respectively. Recent strategic moves include potential asset sales in France for $350 million amid regulatory challenges in Europe, highlighting efforts to streamline operations while maintaining shareholder returns through buybacks and consistent dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Exxon Mobil.

- Our expertly prepared valuation report Exxon Mobil implies its share price may be lower than expected.

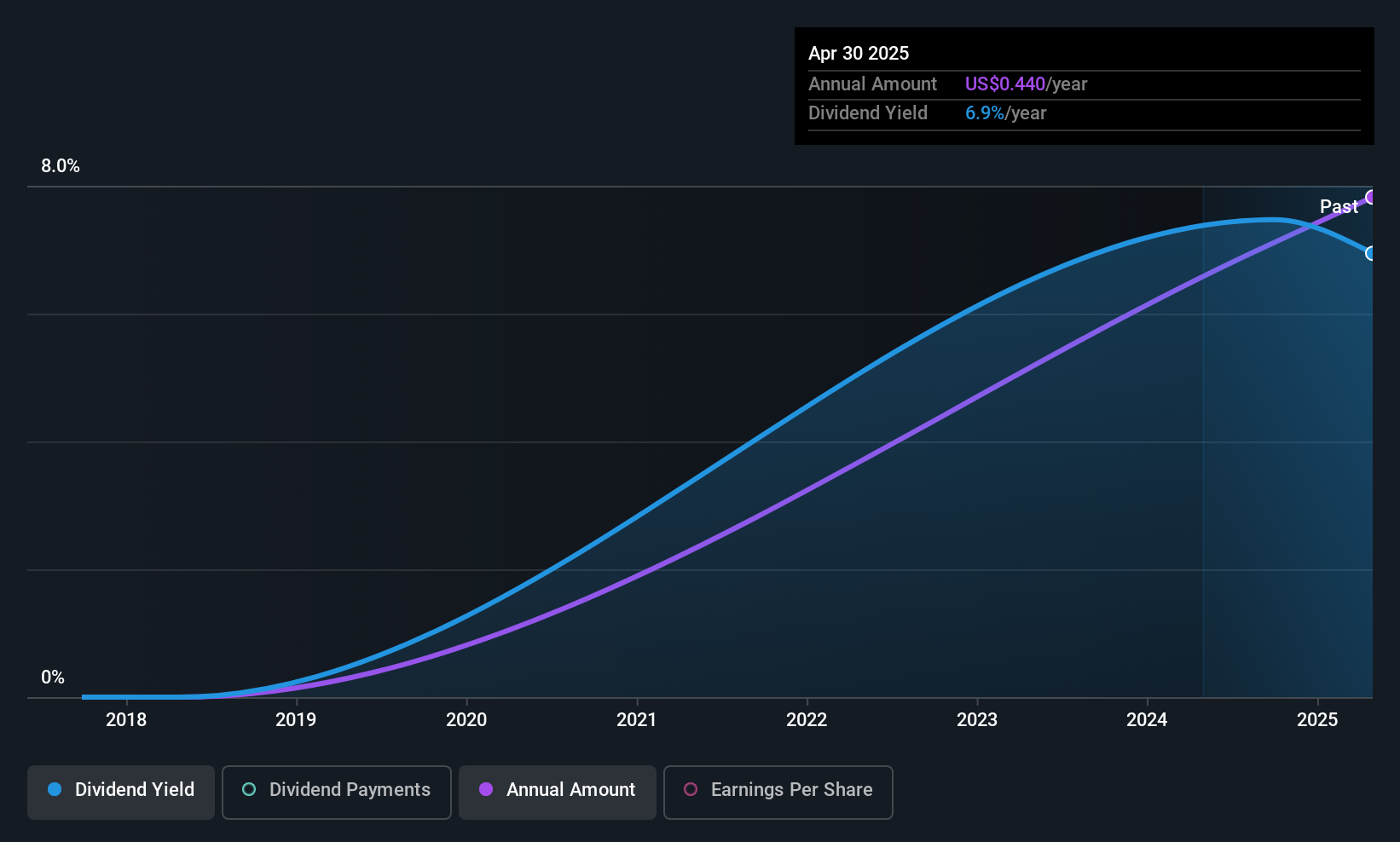

Yiren Digital (YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of $522.76 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business, which accounts for CN¥3.91 billion, and its Insurance Brokerage Business, contributing CN¥354.90 million.

Dividend Yield: 7.3%

Yiren Digital's dividend yield of 7.27% ranks it among the top 25% of US dividend payers, with a low payout ratio of 19.7%, ensuring dividends are well-covered by earnings and cash flows. However, it's too early to assess stability or growth in dividends as they were recently initiated. Despite a drop in profit margins from last year, Yiren Digital is expanding its market reach and expects revenue between RMB 1.6 billion to RMB 1.7 billion for the year.

- Get an in-depth perspective on Yiren Digital's performance by reading our dividend report here.

- Our valuation report unveils the possibility Yiren Digital's shares may be trading at a discount.

Where To Now?

- Discover the full array of 133 Top US Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives