- United States

- /

- Entertainment

- /

- NasdaqCM:LVO

LiveOne Leads The Pack Of 3 US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape shaped by tech earnings and labor market data, investors are keenly observing how these factors influence broader economic conditions. Penny stocks, despite being an older term, continue to capture attention for their potential to offer growth opportunities at lower price points. When these smaller or newer companies exhibit strong financial health and promising fundamentals, they can present compelling opportunities for investors seeking value in less conventional areas of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.799 | $5.75M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $162.03M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.175 | $522.01M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2999 | $10.13M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.82 | $2.81M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.36 | $145.32M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.05 | $94.44M | ★★★★★☆ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $2.91 | $94.17M | ★★★★★☆ |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

LiveOne (NasdaqCM:LVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LiveOne, Inc. is a digital media company that focuses on acquiring, distributing, and monetizing live music, Internet radio, podcasting/vodcasting, and music-related streaming and video content with a market cap of $65.24 million.

Operations: The company generates revenue from its segments as follows: Media ($8.34 million), Slacker ($69.59 million), and PodcastOne ($45.82 million).

Market Cap: $65.24M

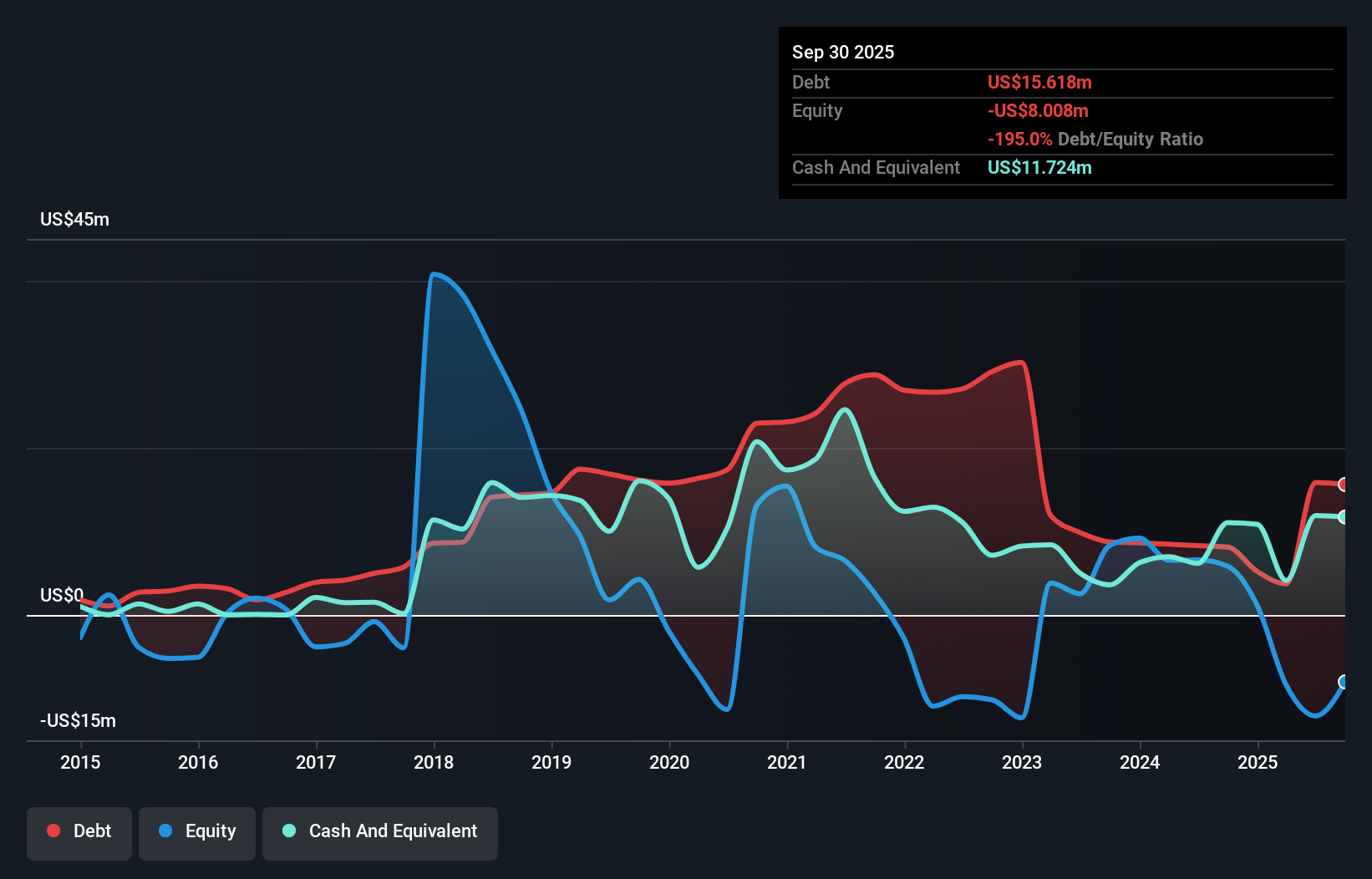

LiveOne, Inc., with a market cap of US$65.24 million, is navigating the penny stock landscape by leveraging strategic partnerships and expanding its digital media offerings. Recent collaborations, such as those with Kartoon Studios and TextNow, aim to broaden its audience reach and enhance member engagement through diverse content channels. Despite being unprofitable, LiveOne has reduced losses over the past five years and maintains a satisfactory net debt to equity ratio of 32.2%. Revenue growth is anticipated at 12.51% annually, supported by positive free cash flow projections that ensure a cash runway exceeding three years.

- Click here to discover the nuances of LiveOne with our detailed analytical financial health report.

- Evaluate LiveOne's prospects by accessing our earnings growth report.

Chimerix (NasdaqGM:CMRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chimerix, Inc. is a biopharmaceutical company focused on developing medicines to improve and extend the lives of patients with deadly diseases, with a market cap of approximately $86.95 million.

Operations: The company's revenue is derived entirely from its Pharmaceuticals segment, totaling $0.144 million.

Market Cap: $86.95M

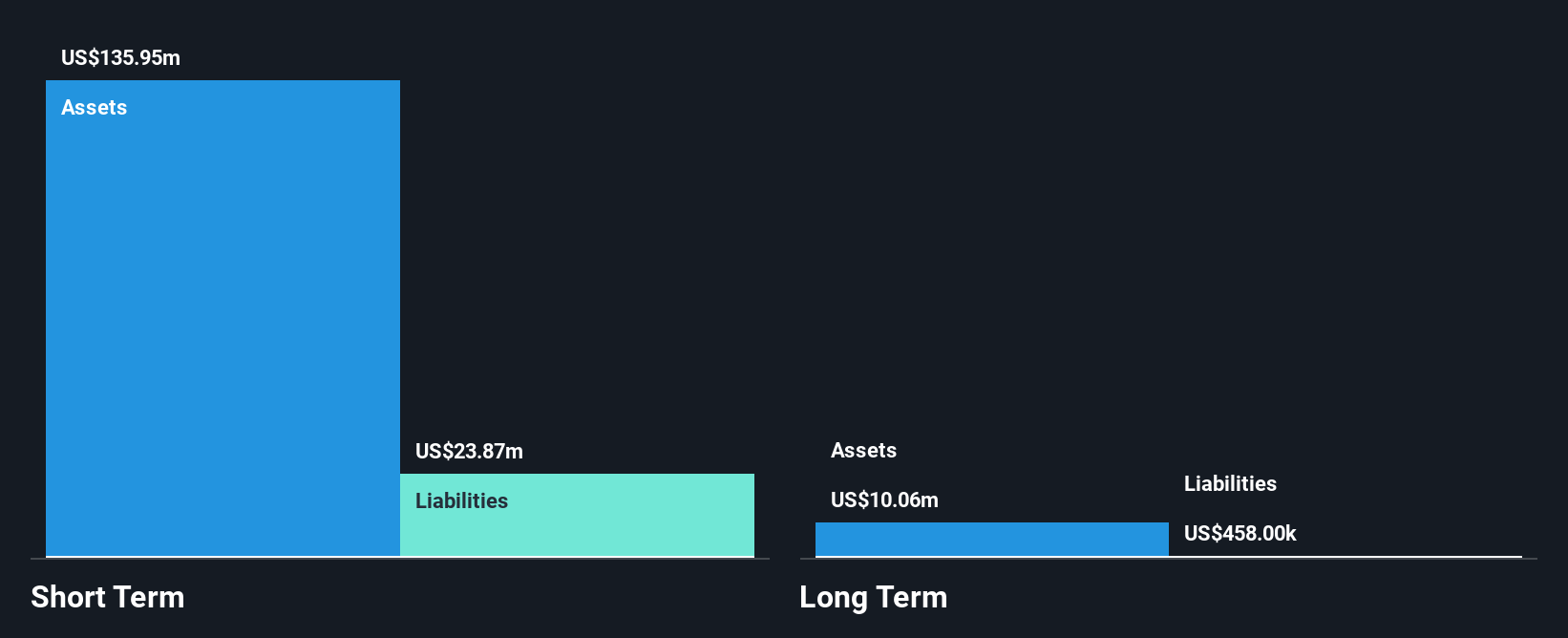

Chimerix, Inc., with a market cap of US$86.95 million, is navigating the penny stock domain as a pre-revenue biopharmaceutical company. Despite being unprofitable and not expected to achieve profitability in the next three years, Chimerix has managed to reduce its losses over the past five years. The company benefits from an experienced management team and board, with average tenures of 2.5 and 5.6 years respectively. Chimerix is debt-free with short-term assets significantly exceeding liabilities, providing a cash runway for approximately 1.7 years even as free cash flow decreases slightly each year.

- Unlock comprehensive insights into our analysis of Chimerix stock in this financial health report.

- Learn about Chimerix's future growth trajectory here.

Lyell Immunopharma (NasdaqGS:LYEL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lyell Immunopharma, Inc. is a clinical-stage company focused on developing T cell reprogramming technologies for treating solid tumors, with a market cap of $245.84 million.

Operations: The company generates its revenue primarily from its biotechnology segment, amounting to $0.054 million.

Market Cap: $245.84M

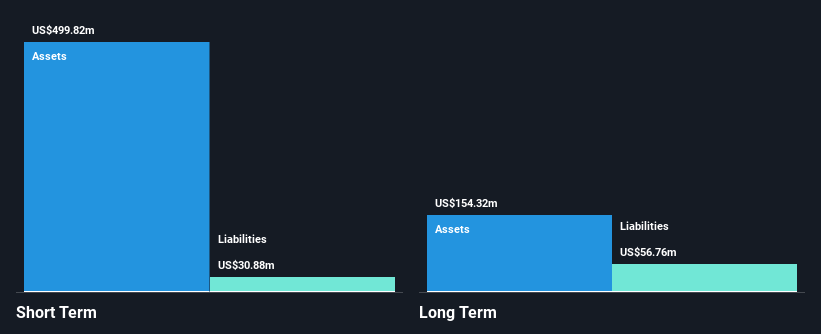

Lyell Immunopharma, Inc., with a market cap of US$245.84 million, operates as a pre-revenue entity in the biotech sector. Despite its unprofitable status and forecasted decline in earnings by 14.5% annually over three years, Lyell maintains financial stability with no debt and sufficient cash runway for over three years at current free cash flow levels. The company has an experienced board and management team, although its share price remains highly volatile. Recent discussions regarding potential acquisition of ImmPACT Bio USA Inc highlight strategic efforts to enhance its position in the competitive cell therapy landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of Lyell Immunopharma.

- Review our growth performance report to gain insights into Lyell Immunopharma's future.

Make It Happen

- Explore the 756 names from our US Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LVO

LiveOne

A digital media company, engages in the acquisition, distribution, and monetization of live music, Internet radio, podcasting/vodcasting, and music-related streaming and video content.

Excellent balance sheet slight.