- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Why The Cloud, YouTube and the Estimated Growth in Advertising Give Alphabet Inc. (NASDAQ:GOOGL) a Positive Outlook

Key takeaways:

- Even though there is negative sentiment for the second quarter, advertising spend is projected to increase into 2024.

- Google is increasingly catering ads to a wider demographic with the growth of YouTube.

- The growth of the cloud needs to be taken into deeper consideration, as it can offset a possible decline in revenues and be a high value creating segment for Google.

After Snap Inc (NASDAQ:SNAP) posted weak guidance, investors have cut their positions in advertising platforms such as Alphabet Inc. (NASDAQ:GOOGL). The question remains if advertisers have a temporary slump, or if their business is going to be limited for longer.

In this analysis, we will consider the possible development for advertisers, and we will evaluate what may differentiate Google from other platforms.

As a quick re-cap, we will look at the position of Google as an advertiser. The primary source of income for Google is "intent-based" advertising via the search engine. This means that Google pairs people with things that they are actively looking for. Advertisers bid for positions in search results, and Google makes revenue per clicks. This makes Google reliant on the marketing (digital ads) spend of companies. While estimates on this vary, we can get a general picture by looking at the expectations for future advertising spend.

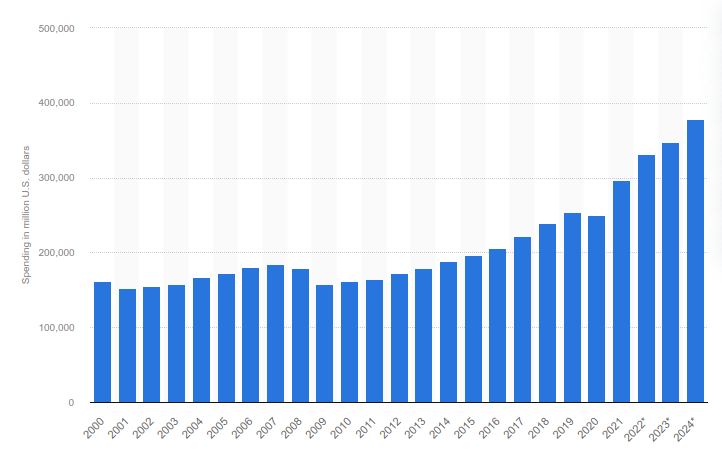

In the chart below, we see the projections for advertising spend up to 2024:

The key takeaway from this is that while there may be a temporary tightening of marketing budgets, the advertising spend in the future is still expected to increase, and Google will gain a portion of that budget.

The next step of our analysis is to see if there are any factors that would put Google in a better position in the future. Here we can consider at least two aspects:

- Google's competitor, Meta (NASDAQ:FB) has been hit by the iOS tracking opt-in mechanism, which reduces the effectiveness of Facebook's ad targeting. If this proves to be a sustained problem for FB, then Google may be in a position to pick up the leftover advertising spend.

- YouTube's ads revenue seems to be growing 14.3% y/y, giving Google a second vein to grow the advertising business. YouTube's ad model is more akin to a social network, which lets Google cater to advertisers with different needs and target audience.

The previous two points were focused on advertising, however Google is increasingly showing their presence as a key cloud provider. In the latest quarter, it managed to grow cloud revenue by 44% y/y, as the company is pushing its cloud services to large enterprise clients.

This leaves us to wait out the next few quarters, and see if Google delivers on growth. However, for investors that believe that the company will recover, this is a great time to make a deeper dive into the fundamentals.

Analyzing Google's Growth

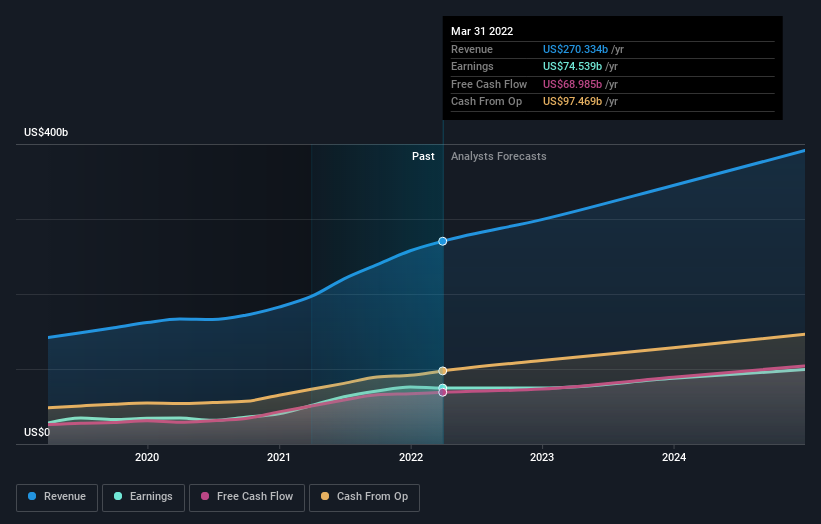

Another way to get a clearer picture for the company is to look at how analysts are expecting Alphabet to preform in the future.

The chart below indicates a small deceleration of growth in 2022, but a continuation of it nonetheless. This indicates that investors may be overreacting to a market decline, while the fundamentals remain resilient and may even end up being offset by cloud revenue growth.

See our latest analysis for Alphabet

With that in mind, we wouldn't be too quick to come to a conclusion on Alphabet. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Alphabet going out to 2024, and you can see them free on our platform here.

Conclusion

Both macro trends and analysts forecasts indicate that Google is in a good position to continue growing. Advertising revenue for 2024 is still on the uptrend, and Google may pick up some of the churned advertisers from Facebook.

The company is also focusing on the cloud segment, and arguably this is where the company has a lot of potential to develop against peers like Microsoft and Amazon.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Alphabet that you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)