- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed earnings reports and fluctuating indices, investors are closely watching how major tech companies and financial institutions influence broader market trends. Amidst this backdrop, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities, as such ownership often signals confidence in the company's long-term prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| MoneyLion (NYSE:ML) | 20.2% | 92.4% |

| Myomo (NYSEAM:MYO) | 13.7% | 56.7% |

| Hesai Group (NasdaqGS:HSAI) | 24.4% | 74.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of approximately $6.99 billion.

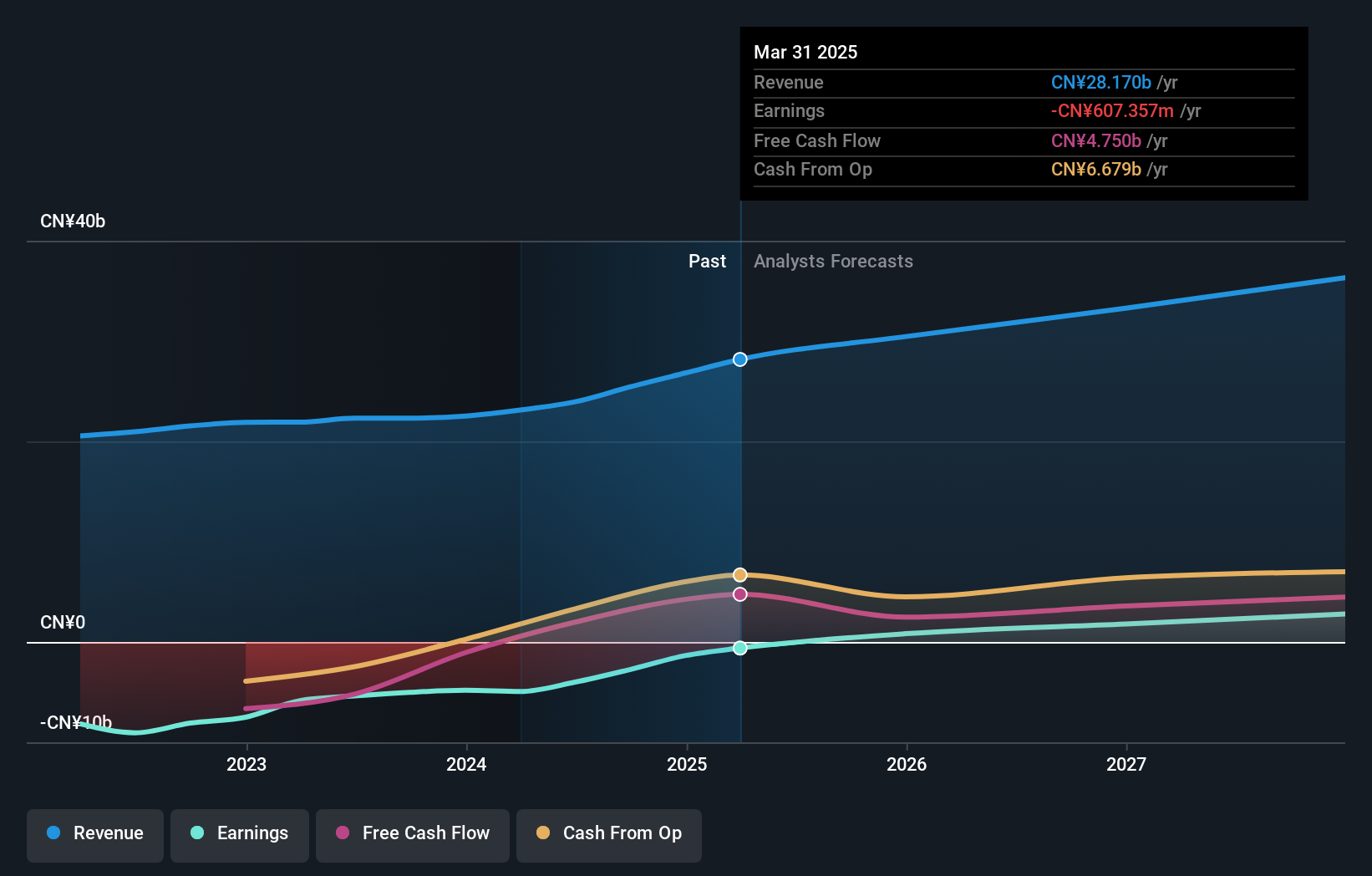

Operations: The company's revenue primarily comes from its Internet Information Providers segment, which generated CN¥25.45 billion.

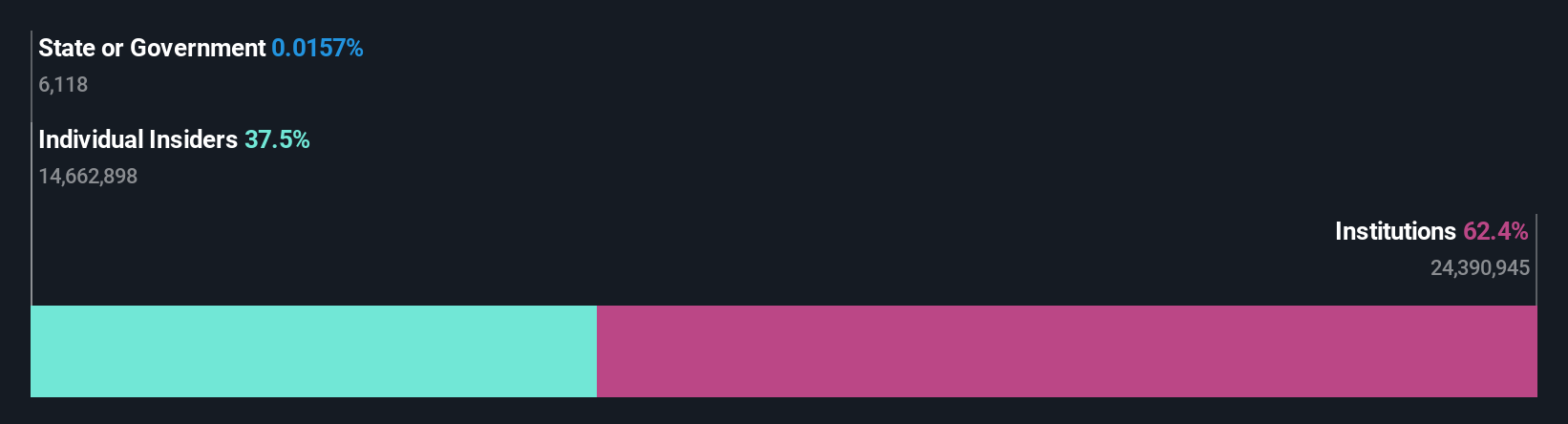

Insider Ownership: 20.3%

Earnings Growth Forecast: 64.8% p.a.

Bilibili's recent earnings report shows significant improvement, with revenue rising to CNY 7.31 billion and net loss narrowing substantially. Despite no substantial insider buying recently, the company trades at a notable discount to its estimated fair value. Earnings are forecasted to grow significantly, with profitability expected in three years. Bilibili announced a US$200 million share repurchase program, indicating confidence in its financial position and potential for future growth despite slower revenue growth forecasts compared to peers.

- Take a closer look at Bilibili's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Bilibili's share price might be too pessimistic.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States, with a market cap of approximately $514.71 million.

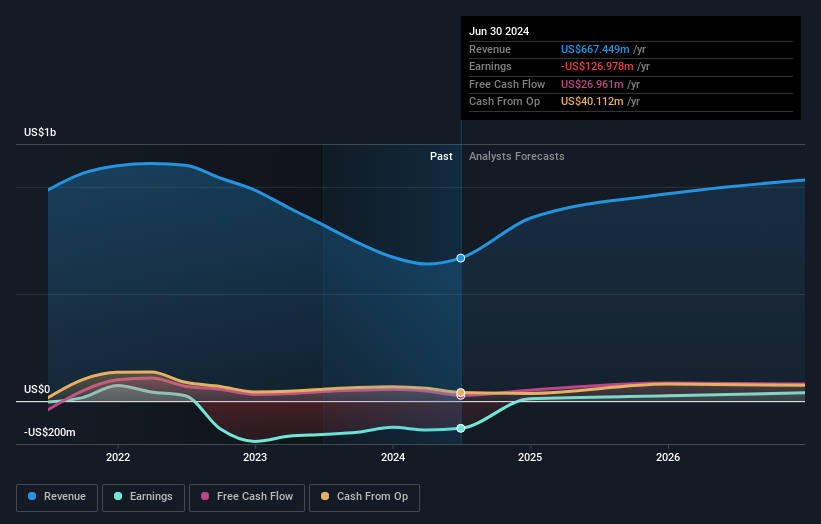

Operations: The company's revenue segments include Home at $119.98 million, Consumer at $216.33 million, and Insurance at $436.60 million.

Insider Ownership: 18.1%

Earnings Growth Forecast: 51.9% p.a.

LendingTree demonstrates strong growth potential with high insider ownership, as insiders have been buying more shares than selling recently. The company's revenue is forecast to grow at 9.2% annually, outpacing the US market. LendingTree's strategic partnership with Coverdash enhances its platform by offering business insurance, potentially increasing customer engagement and reducing acquisition costs. Analysts expect a significant stock price increase of 68.5%, while profitability is anticipated within three years, reflecting above-average market growth prospects.

- Click to explore a detailed breakdown of our findings in LendingTree's earnings growth report.

- Our expertly prepared valuation report LendingTree implies its share price may be lower than expected.

Marcus & Millichap (NYSE:MMI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Marcus & Millichap, Inc. is an investment brokerage company that offers real estate investment brokerage and financing services to commercial real estate buyers and sellers in the United States and Canada, with a market cap of approximately $1.36 billion.

Operations: The company's revenue is primarily derived from the delivery of commercial real estate services, amounting to $622.23 million.

Insider Ownership: 37.4%

Earnings Growth Forecast: 124.9% p.a.

Marcus & Millichap exhibits strong growth potential with substantial insider ownership, trading significantly below its estimated fair value. The company's revenue is projected to grow at 22.1% annually, surpassing the US market average, and it is expected to achieve profitability within three years. Recent earnings reports show improved financial performance with a reduced net loss of US$5.39 million for Q3 2024 compared to the previous year, indicating positive momentum despite current losses.

- Get an in-depth perspective on Marcus & Millichap's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Marcus & Millichap's share price might be on the expensive side.

Key Takeaways

- Embark on your investment journey to our 202 Fast Growing US Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Bilibili, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives