- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Top Growth Companies With High Insider Ownership May 2025

Reviewed by Simply Wall St

As the U.S. market navigates a mixed landscape with rising Treasury yields and a recent credit rating downgrade, investors are closely watching how these factors impact overall economic sentiment and major indices like the S&P 500 and Dow Jones Industrial Average. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience, as insiders often have a vested interest in the long-term success of their businesses.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 16.2% | 37.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 64.6% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.6% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Here's a peek at a few of the choices from the screener.

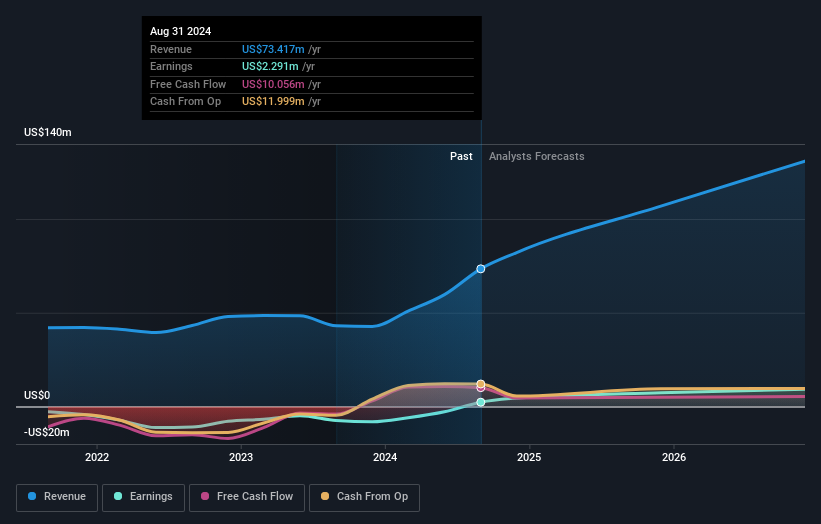

Byrna Technologies (NasdaqCM:BYRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Byrna Technologies Inc. is a less-lethal self-defense technology company that develops, manufactures, and sells personal security solutions across multiple continents, with a market cap of $575.07 million.

Operations: The company's revenue is derived from its Aerospace & Defense segment, totaling $95.29 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 17.8% p.a.

Byrna Technologies is experiencing significant growth, with revenue forecasted to increase by 23.4% annually, outpacing the US market. Recent developments include the launch of their Byrna Compact Launcher and a new ammunition facility in Indiana, enhancing domestic production capabilities. Despite no substantial insider buying or selling recently, insiders show confidence by holding shares. First-quarter earnings revealed a net income rise to US$1.66 million from US$0.017 million year-over-year, indicating improving profitability.

- Click to explore a detailed breakdown of our findings in Byrna Technologies' earnings growth report.

- Our valuation report here indicates Byrna Technologies may be overvalued.

Establishment Labs Holdings (NasdaqCM:ESTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Establishment Labs Holdings Inc. is a medical technology company that manufactures and markets devices for aesthetic and reconstructive plastic surgeries, with a market cap of $1.05 billion.

Operations: The company generates revenue of $170.24 million from its medical products segment, which focuses on the aesthetic and reconstructive plastic surgery market.

Insider Ownership: 10%

Earnings Growth Forecast: 67.5% p.a.

Establishment Labs Holdings is poised for significant growth, with revenue projected to rise 22.4% annually, surpassing the US market's average. Despite a volatile share price and a recent net loss of US$20.71 million in Q1 2025, the company is expected to achieve profitability within three years. Insider ownership remains strong without substantial recent buying or selling activity. The appointment of Peter Caldini as CEO may bring strategic leadership amid these financial dynamics.

- Unlock comprehensive insights into our analysis of Establishment Labs Holdings stock in this growth report.

- According our valuation report, there's an indication that Establishment Labs Holdings' share price might be on the expensive side.

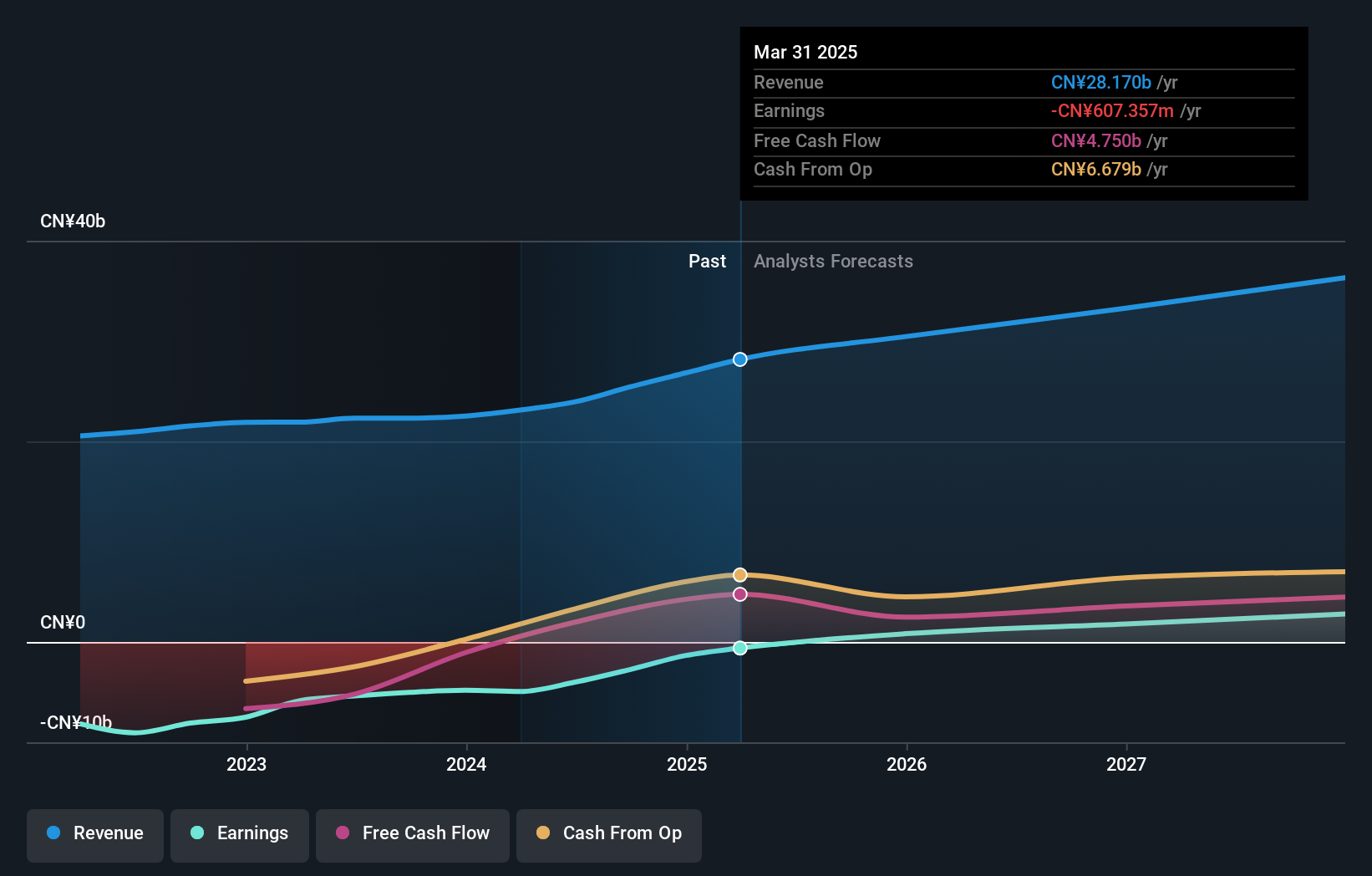

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in the People’s Republic of China, with a market cap of approximately $8.09 billion.

Operations: The company generates revenue of CN¥26.83 billion from its Internet Information Providers segment, focusing on online entertainment services for young audiences in China.

Insider Ownership: 19.8%

Earnings Growth Forecast: 50.5% p.a.

Bilibili, trading at a substantial discount to its estimated fair value, is poised for growth with revenue expected to increase by 9.2% annually, outpacing the US market's average. While the company reported a net loss of CNY 1.35 billion in 2024, this was an improvement from the previous year. Bilibili anticipates achieving profitability within three years and has recently completed a share buyback worth $16.36 million, reflecting confidence in its future prospects.

- Get an in-depth perspective on Bilibili's performance by reading our analyst estimates report here.

- Our valuation report here indicates Bilibili may be undervalued.

Key Takeaways

- Explore the 190 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Bilibili, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives