- United States

- /

- Software

- /

- NasdaqGS:APP

May 2025's Noteworthy Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Over the past week, the United States market has risen by 2.2%, contributing to an 8.2% increase over the last year, with earnings projected to grow by 14% annually in the coming years. In this environment of steady growth, identifying stocks that are estimated to be below their intrinsic value can offer investors potential opportunities for long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| FB Financial (NYSE:FBK) | $44.62 | $89.12 | 49.9% |

| MINISO Group Holding (NYSE:MNSO) | $18.53 | $36.62 | 49.4% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.33 | $55.11 | 48.6% |

| Owens Corning (NYSE:OC) | $144.46 | $284.31 | 49.2% |

| German American Bancorp (NasdaqGS:GABC) | $38.57 | $74.67 | 48.3% |

| Pure Storage (NYSE:PSTG) | $47.58 | $93.52 | 49.1% |

| Ready Capital (NYSE:RC) | $4.44 | $8.67 | 48.8% |

| HealthEquity (NasdaqGS:HQY) | $91.42 | $179.14 | 49% |

| Live Oak Bancshares (NYSE:LOB) | $26.93 | $52.48 | 48.7% |

| Coeur Mining (NYSE:CDE) | $5.45 | $10.87 | 49.8% |

Let's explore several standout options from the results in the screener.

AppLovin (NasdaqGS:APP)

Overview: AppLovin Corporation develops a software-based platform aimed at improving marketing and monetization for advertisers both in the United States and globally, with a market cap of approximately $104.07 billion.

Operations: AppLovin's revenue is derived from two main segments: Apps, generating $1.49 billion, and Advertising, contributing $3.22 billion.

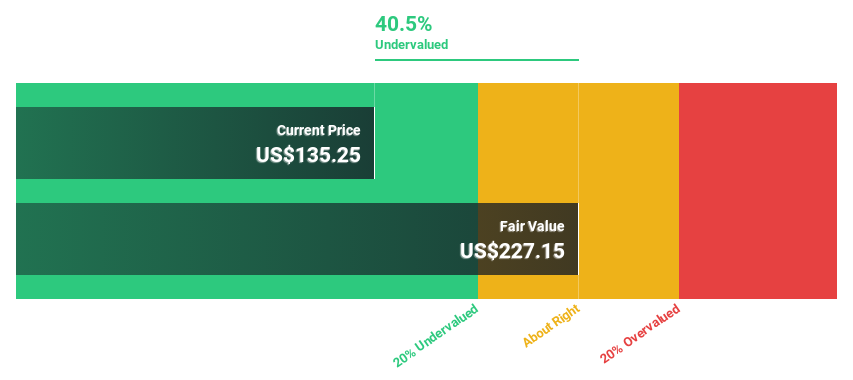

Estimated Discount To Fair Value: 11.4%

AppLovin is trading at US$301.84, below its estimated fair value of US$340.64, indicating potential undervaluation based on cash flows. Despite impressive earnings growth of 344.3% over the past year and a forecasted annual profit growth rate of 22.5%, concerns arise from legal challenges alleging fraudulent advertising practices and high debt levels. The recent appointment of Maynard Webb to the board may strengthen governance amidst these issues, while M&A rumors involving TikTok suggest strategic expansion possibilities.

- Upon reviewing our latest growth report, AppLovin's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in AppLovin's balance sheet health report.

Bilibili (NasdaqGS:BILI)

Overview: Bilibili Inc. offers online entertainment services targeting young audiences in China and has a market cap of $7.58 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, totaling CN¥26.83 billion.

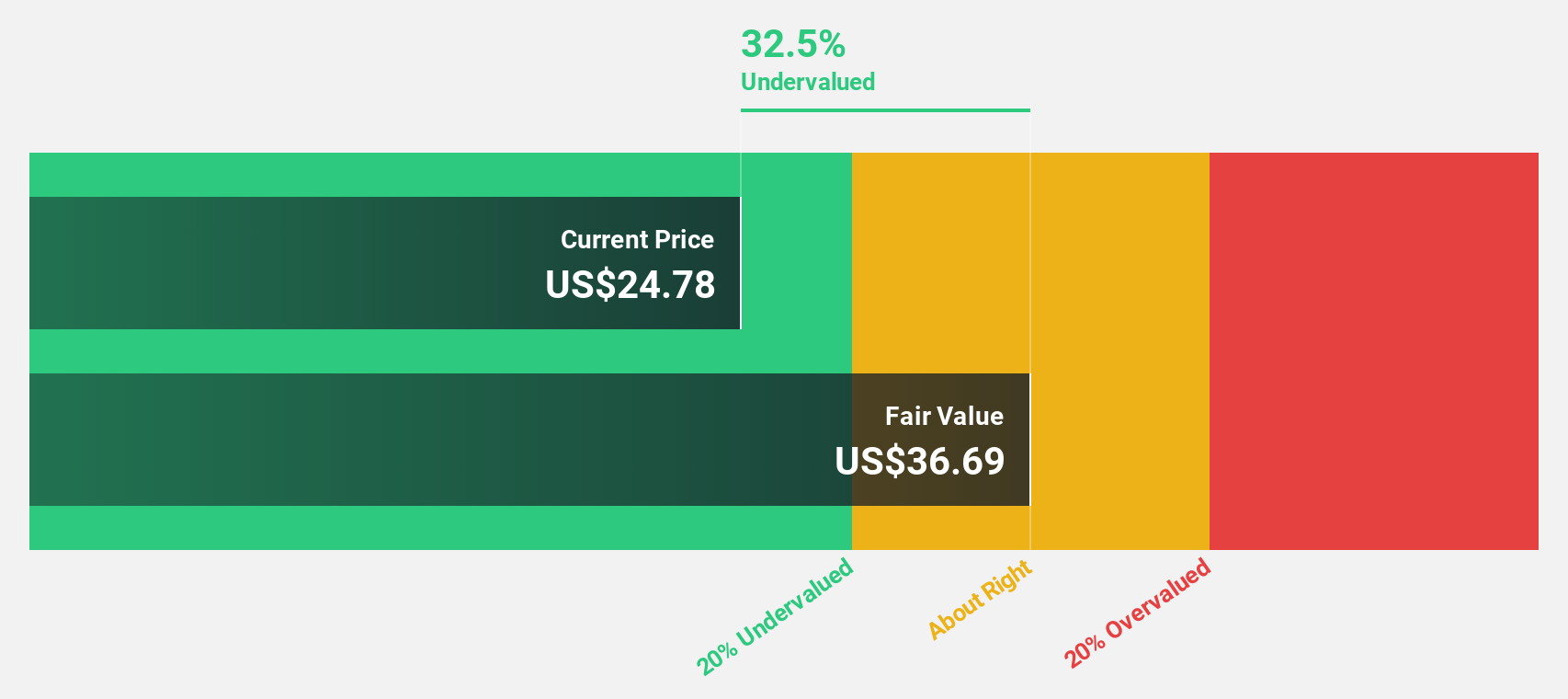

Estimated Discount To Fair Value: 40.6%

Bilibili, trading at US$18.28, is significantly undervalued compared to its fair value estimate of US$30.79. The company is expected to become profitable within three years, with revenue growth projected at 9.2% annually—outpacing the broader U.S. market's 8.4%. Recent results highlight a reduced net loss for 2024 and a completed share buyback worth $16.36 million, reflecting strategic financial management amidst ongoing revenue expansion efforts for 2025.

- Insights from our recent growth report point to a promising forecast for Bilibili's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Bilibili.

Sotera Health (NasdaqGS:SHC)

Overview: Sotera Health Company offers sterilization, lab testing, and advisory services for the healthcare industry across the United States, Canada, Europe, and internationally, with a market cap of $3.51 billion.

Operations: The company generates revenue through its Nordion segment at $181.91 million, Nelson Labs at $223.84 million, and Sterigenics at $701.04 million.

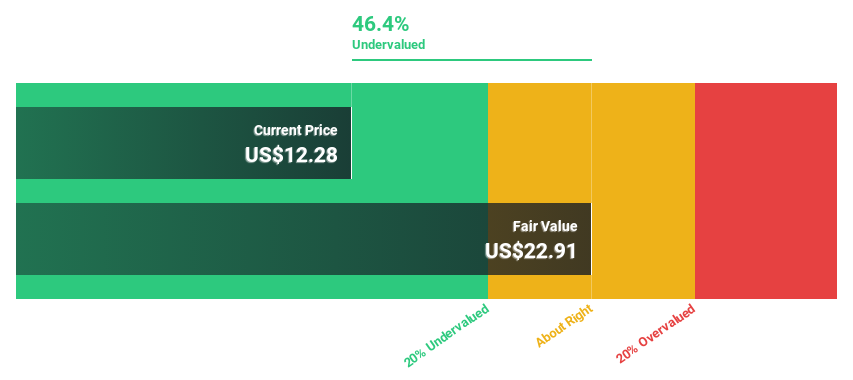

Estimated Discount To Fair Value: 43.9%

Sotera Health, trading at US$12.92, is significantly undervalued with an estimated fair value of US$23.03. Despite recent earnings challenges and a net loss in Q1 2025, the company maintains a robust growth forecast with earnings expected to rise significantly over the next three years. However, interest payments remain a concern due to insufficient coverage by current earnings. Revenue growth projections are modest at 5.6% annually, trailing behind broader market expectations.

- Our earnings growth report unveils the potential for significant increases in Sotera Health's future results.

- Click here to discover the nuances of Sotera Health with our detailed financial health report.

Seize The Opportunity

- Click here to access our complete index of 176 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives