- United States

- /

- Chemicals

- /

- NYSE:SQM

Discover International Paper Among 3 Stocks Estimated To Be Below Fair Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a pause in its recovery amid ongoing concerns about tariffs and potential economic recession, investors are keenly observing the Federal Reserve's upcoming decisions on monetary policy. With major indices like the S&P 500 and Nasdaq Composite having recently faced declines, there is growing interest in identifying stocks that may be undervalued relative to their intrinsic worth. In such a volatile environment, finding stocks estimated to be below fair value can offer opportunities for investors looking to capitalize on potential market mispricings.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.21 | $56.29 | 49.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.92 | $61.31 | 49.6% |

| Semrush Holdings (NYSE:SEMR) | $9.64 | $18.99 | 49.2% |

| MINISO Group Holding (NYSE:MNSO) | $21.01 | $41.33 | 49.2% |

| Associated Banc-Corp (NYSE:ASB) | $22.44 | $44.84 | 50% |

| Pure Storage (NYSE:PSTG) | $49.87 | $99.55 | 49.9% |

| Smurfit Westrock (NYSE:SW) | $45.07 | $90.05 | 50% |

| KBR (NYSE:KBR) | $50.92 | $101.62 | 49.9% |

| Advanced Micro Devices (NasdaqGS:AMD) | $103.51 | $204.16 | 49.3% |

| Mobileye Global (NasdaqGS:MBLY) | $14.44 | $28.77 | 49.8% |

Here's a peek at a few of the choices from the screener.

International Paper (NYSE:IP)

Overview: International Paper Company produces and sells renewable fiber-based packaging and pulp products across North America, Latin America, Europe, and North Africa with a market cap of approximately $27.14 billion.

Operations: The company's revenue is primarily derived from Industrial Packaging at $15.53 billion and Global Cellulose Fibers at $2.79 billion.

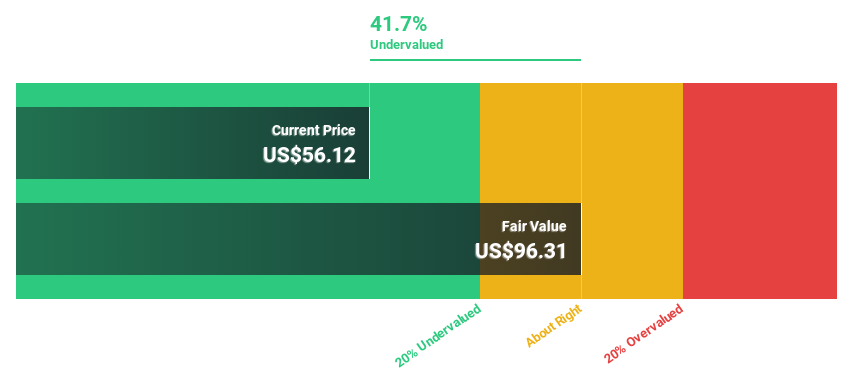

Estimated Discount To Fair Value: 47.3%

International Paper is trading at US$52.04, significantly below its estimated fair value of US$98.81, indicating it may be undervalued based on cash flows. Despite recent facility closures affecting capacity and workforce, the company is focusing on strategic investments to enhance service delivery. Revenue and earnings are forecast to grow faster than the market, but high debt levels and dividend sustainability concerns remain. Executive changes aim to bolster financial leadership amid these transformations.

- In light of our recent growth report, it seems possible that International Paper's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of International Paper.

Sociedad Química y Minera de Chile (NYSE:SQM)

Overview: Sociedad Química y Minera de Chile S.A. is a global mining company with a market cap of approximately $12.99 billion.

Operations: The company's revenue segments include Potassium ($270.78 million), Industrial Chemicals ($78.16 million), Iodine and Derivatives ($968.31 million), Lithium and Derivatives ($2.24 billion), and Specialty Plant Nutrition ($941.94 million).

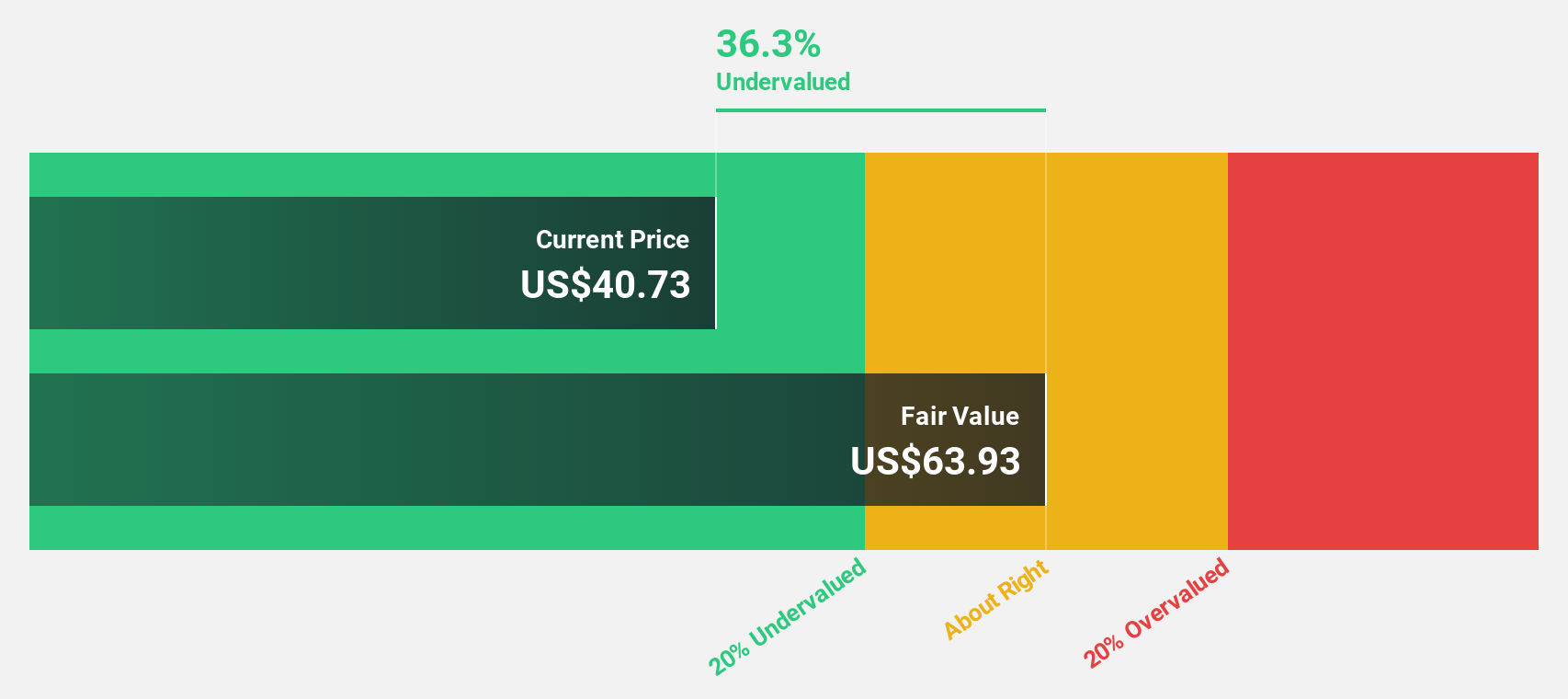

Estimated Discount To Fair Value: 43.6%

Sociedad Química y Minera de Chile is trading at US$45.61, substantially below its estimated fair value of US$80.81, reflecting potential undervaluation based on cash flows. Despite a net loss in 2024 and high debt levels, the company anticipates becoming profitable within three years with revenue growth surpassing the U.S. market average. Recent production increases and 2025 sales volume guidance highlight operational momentum, though dividend sustainability remains a concern due to insufficient coverage by earnings or free cash flows.

- Insights from our recent growth report point to a promising forecast for Sociedad Química y Minera de Chile's business outlook.

- Click here to discover the nuances of Sociedad Química y Minera de Chile with our detailed financial health report.

Truist Financial (NYSE:TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $53.58 billion.

Operations: The company's revenue segments include Wholesale Banking at $10.11 billion and Consumer and Small Business Banking at $11.24 billion.

Estimated Discount To Fair Value: 41%

Truist Financial is trading at US$40.85, significantly below its fair value estimate of US$69.26, indicating potential undervaluation based on cash flows. Despite a dividend yield of 5.09% that isn't currently well-covered by earnings, the company's revenue is expected to grow at 15.4% annually, outpacing the U.S. market average. Analysts project a 25.9% stock price increase and anticipate profitability within three years, although return on equity remains modest at an expected 10%.

- The analysis detailed in our Truist Financial growth report hints at robust future financial performance.

- Get an in-depth perspective on Truist Financial's balance sheet by reading our health report here.

Key Takeaways

- Click through to start exploring the rest of the 191 Undervalued US Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sociedad Química y Minera de Chile, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with adequate balance sheet.