- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP): Revisiting Valuation After a Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

MP Materials (MP) has quietly outperformed this year, with the stock up around 3% despite rare earth price swings and ongoing losses. Investors are weighing its growth story against a still-challenging profit picture.

See our latest analysis for MP Materials.

That move comes after a volatile stretch where rare earth headlines and MP’s expansion progress have pulled the share price around. Yet a powerful year to date share price return of roughly 265 percent and triple digit multi year total shareholder returns suggest underlying momentum is still very much intact.

If MP’s resurgence has you rethinking growth opportunities in materials, it could be worth scanning for fast growing stocks with high insider ownership as potential next wave candidates.

With MP still loss making but growing fast, and trading well below analyst targets despite huge multi year returns, the real question is whether today’s price is a rare earth bargain or already reflects tomorrow’s growth.

Most Popular Narrative Narrative: 24.4% Undervalued

Compared with the last close at $59.82, the most followed narrative sees fair value near $79.11, framing MP as a high growth story still mispriced.

The analysts have a consensus price target of $77.0 for MP Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $65.0.

Want to see what justifies turning deep current losses into strong profits, while attaching a premium multiple more typical of market darlings? The narrative leans on rapid scaling, sharply improving margins, and a bold view of where earnings could land once the build out ends. Curious how those moving parts add up to that higher fair value band? Read on to unpack the assumptions behind this call.

Result: Fair Value of $79.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent execution hurdles at new facilities or policy shifts affecting key contracts could easily derail the margin expansion and profitability story.

Find out about the key risks to this MP Materials narrative.

Another Take On Value

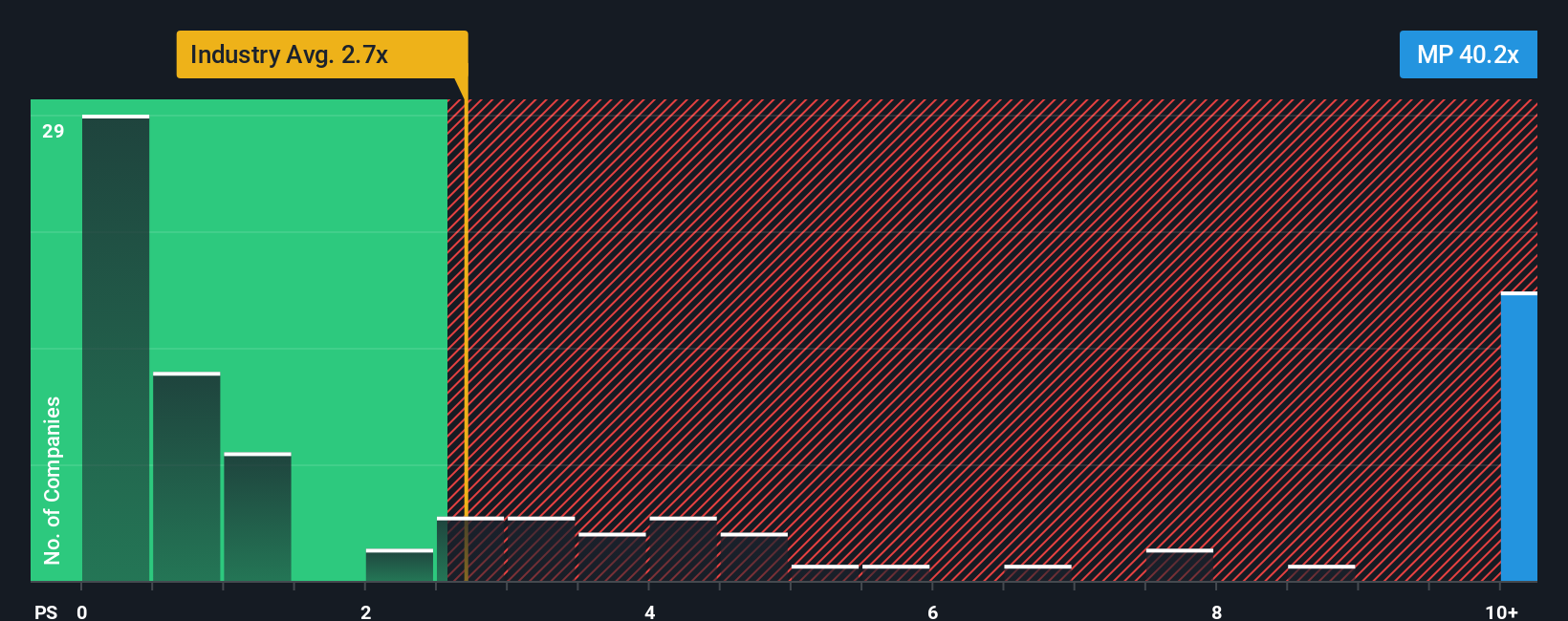

While the narrative frames MP as around 24 percent undervalued, a simple price to sales lens paints a very different picture. MP trades at about 45.6 times sales, versus roughly 2 times for the US metals and mining industry and only 0.8 times for peers, and well above its fair ratio of 2.6 times. That rich gap suggests the market is already baking in unusually strong execution, leaving little room for missteps. Is this a premium worth paying at this stage of the cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If this view does not quite match your own, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall St Screener to spot high conviction opportunities you might otherwise overlook.

- Tap into potential multi baggers by scanning these 3591 penny stocks with strong financials that already back their story with strengthening financials and real business traction.

- Position ahead of the next productivity wave by targeting these 27 AI penny stocks that harness artificial intelligence to power scalable, data driven growth.

- Identify quality at sensible prices with these 895 undervalued stocks based on cash flows that appear mispriced relative to their projected cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026