- United States

- /

- Packaging

- /

- NYSE:IP

3 Stocks That May Be Undervalued By Up To 44.2%

Reviewed by Simply Wall St

The United States market has shown positive momentum, rising 2.9% over the last week and 14% over the past year, with earnings projected to grow by 15% annually. In such a climate, identifying stocks that appear undervalued can be crucial for investors seeking opportunities that align with these growth trends.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.65 | $51.02 | 49.7% |

| TXO Partners (TXO) | $15.09 | $29.56 | 49% |

| Mid Penn Bancorp (MPB) | $29.10 | $57.45 | 49.3% |

| MAC Copper (MTAL) | $12.11 | $23.97 | 49.5% |

| Hess Midstream (HESM) | $37.96 | $73.68 | 48.5% |

| Granite Ridge Resources (GRNT) | $6.34 | $12.41 | 48.9% |

| Carter Bankshares (CARE) | $17.80 | $35.50 | 49.9% |

| Camden National (CAC) | $41.88 | $82.62 | 49.3% |

| BioLife Solutions (BLFS) | $21.66 | $42.65 | 49.2% |

| Acadia Realty Trust (AKR) | $18.62 | $36.48 | 49% |

Let's dive into some prime choices out of the screener.

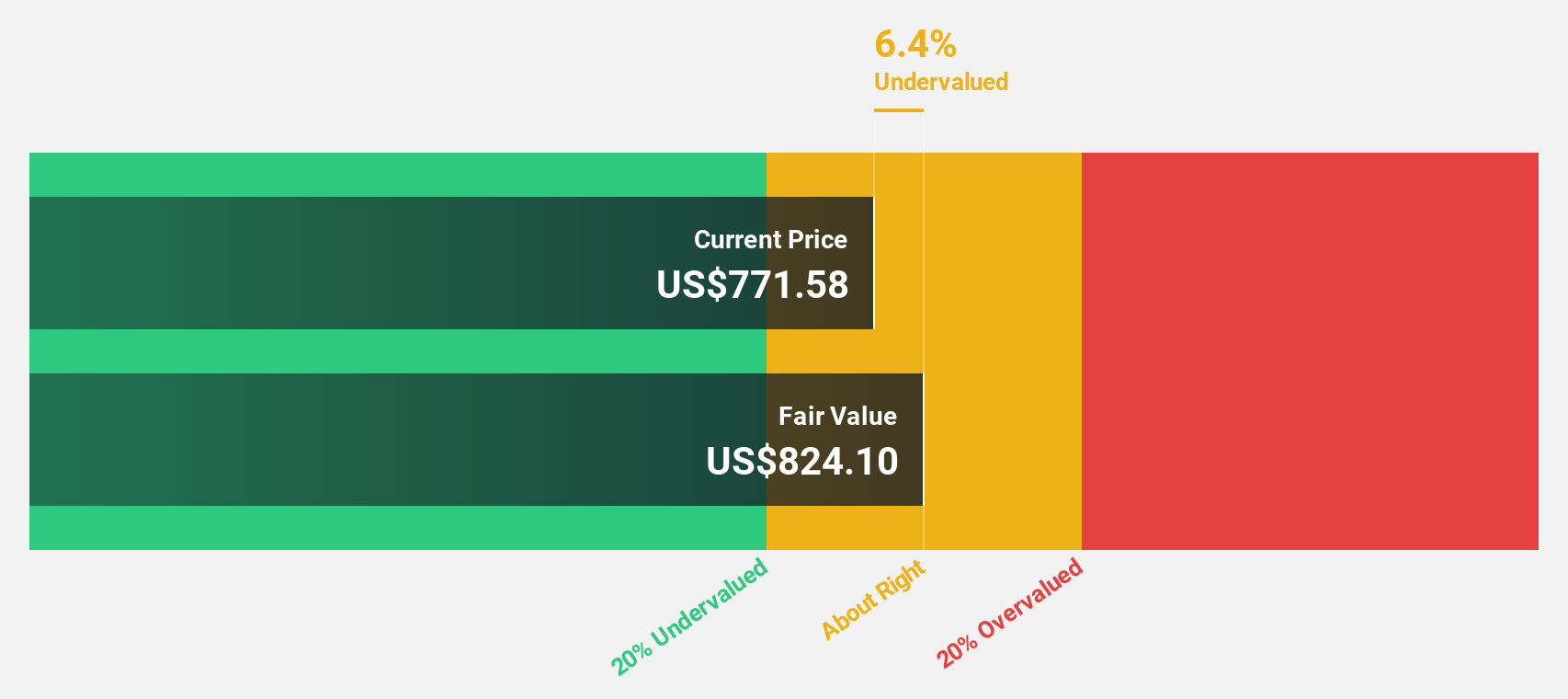

Intuit (INTU)

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States, with a market cap of approximately $219.71 billion.

Operations: Intuit's revenue is primarily derived from its Global Business Solutions segment at $10.62 billion, followed by the Consumer segment at $4.85 billion, Credit Karma at $2.10 billion, and Pro-Tax at $618 million.

Estimated Discount To Fair Value: 11.1%

Intuit Inc. is trading at US$779.61, slightly below its estimated fair value of US$876.54, indicating potential undervaluation based on cash flows. Recent AI-driven enhancements to QuickBooks and Mailchimp are designed to boost productivity and streamline operations for businesses, potentially improving cash flow management. However, significant insider selling in the past quarter may warrant caution despite strong earnings growth forecasts exceeding the broader market expectations and recent upward revisions in revenue guidance.

- Our earnings growth report unveils the potential for significant increases in Intuit's future results.

- Dive into the specifics of Intuit here with our thorough financial health report.

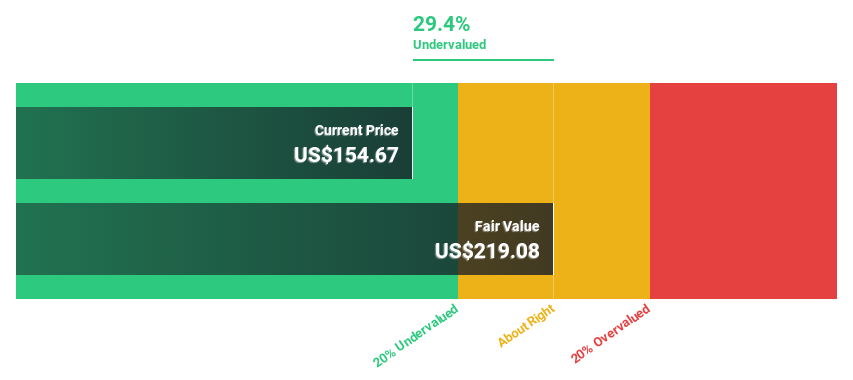

Capital One Financial (COF)

Overview: Capital One Financial Corporation is a financial services holding company that offers a range of financial products and services in the United States, Canada, and the United Kingdom, with a market capitalization of approximately $81.52 billion.

Operations: The company's revenue is primarily derived from three segments: Credit Card at $18.64 billion, Consumer Banking at $7.36 billion, and Commercial Banking at $3.45 billion.

Estimated Discount To Fair Value: 11.7%

Capital One Financial, trading at US$215.18, is slightly undervalued compared to its fair value estimate of US$243.59 based on cash flows. The recent acquisition of Discover Financial Services could enhance revenue growth, which is forecast to outpace the broader market significantly. However, the company's return on equity is projected to remain low in three years. Preferred stock buybacks and a consistent dividend history further underline Capital One's focus on shareholder returns amidst robust earnings growth expectations.

- Upon reviewing our latest growth report, Capital One Financial's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Capital One Financial stock in this financial health report.

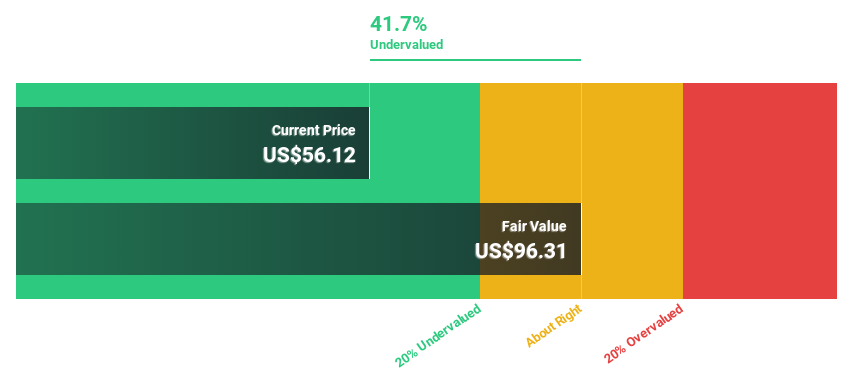

International Paper (IP)

Overview: International Paper Company produces and sells renewable fiber-based packaging and pulp products across North America, Latin America, Europe, and North Africa with a market cap of approximately $24.72 billion.

Operations: The company's revenue segments include Global Cellulose Fibers, which generated $2.73 billion.

Estimated Discount To Fair Value: 44.2%

International Paper, trading at US$49.45, is significantly undervalued with a fair value estimate of US$88.66 based on cash flows. Despite recent restructuring efforts to streamline operations and focus on sustainable packaging, the company's debt coverage by operating cash flow remains weak. Earnings are forecast to grow substantially faster than the market at 31.2% annually, though dividend sustainability is questionable due to insufficient earnings and free cash flow coverage amidst large one-off financial impacts.

- The analysis detailed in our International Paper growth report hints at robust future financial performance.

- Navigate through the intricacies of International Paper with our comprehensive financial health report here.

Turning Ideas Into Actions

- Discover the full array of 174 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)