- United States

- /

- Banks

- /

- NasdaqCM:NBBK

Unveiling US Market's Undiscovered Gems April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 4.4% drop, reflecting a broader trend of flat performance over the past year despite forecasts of annual earnings growth at 13%. In such an environment, identifying stocks that offer potential for growth and resilience can be crucial for investors seeking opportunities amidst market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

NB Bancorp (NasdaqCM:NBBK)

Simply Wall St Value Rating: ★★★★★★

Overview: NB Bancorp, Inc. operates as a bank holding company for Needham Bank, offering a range of banking products and services in the Greater Boston metropolitan area with a market cap of $633.38 million.

Operations: NB Bancorp generates revenue primarily from its thrift and savings and loan institutions, totaling $160.61 million. The company's market cap stands at $633.38 million.

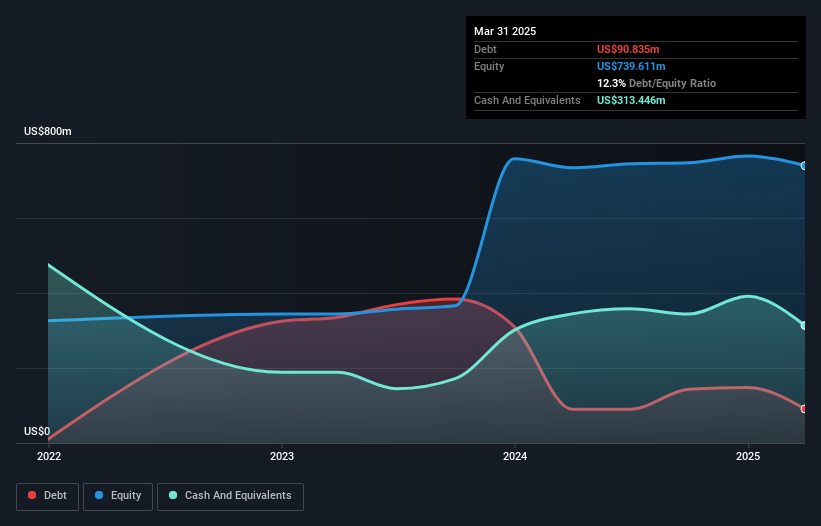

NB Bancorp, with assets totaling US$5.2 billion and equity of US$765.2 million, stands out due to its robust financial health and strategic focus on low-risk funding sources, primarily customer deposits which account for 95% of liabilities. The bank's allowance for bad loans is substantial at 280%, covering non-performing loans that are just 0.3% of total loans. Earnings surged by an impressive 329%, significantly outpacing the industry average growth of 0.03%. Recently, NB Bancorp announced a share repurchase program targeting up to 5% of its issued share capital, reflecting confidence in its valuation with a P/E ratio at a favorable 14.9x compared to the market's 16.3x.

- Navigate through the intricacies of NB Bancorp with our comprehensive health report here.

Explore historical data to track NB Bancorp's performance over time in our Past section.

National Energy Services Reunited (NasdaqCM:NESR)

Simply Wall St Value Rating: ★★★★★★

Overview: National Energy Services Reunited Corp. offers oilfield services in the Middle East and North Africa region, with a market capitalization of approximately $579.16 million.

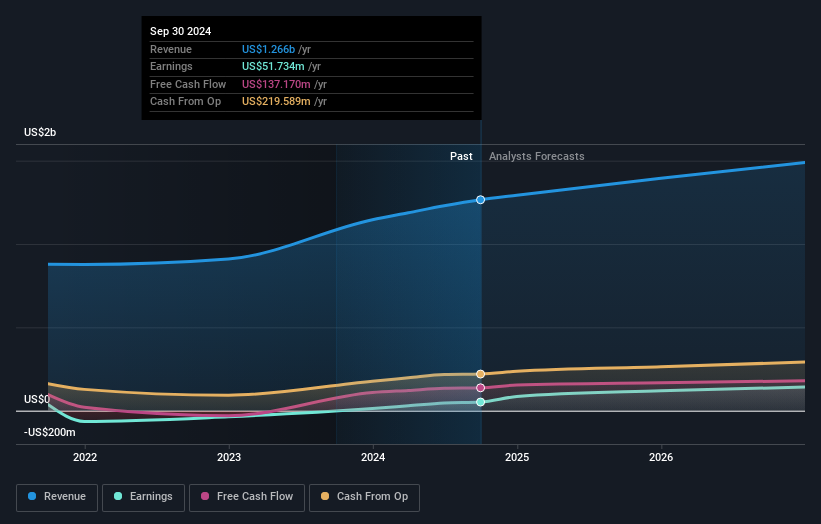

Operations: NESR generates revenue primarily from Production Services and Drilling and Evaluation Services, with the former contributing $878.08 million and the latter $423.63 million.

National Energy Services Reunited (NESR) is making strides with its robust earnings growth, recording a 506.6% increase over the past year, far outpacing the industry average of 9.6%. The company trades at an attractive valuation, sitting 79.8% below its estimated fair value. NESR's financial health appears solid with a net debt to equity ratio of 30.4%, and interest payments are comfortably covered by EBIT at 3.5 times coverage. Recent earnings reports highlight impressive performance, with Q4 sales reaching US$343 million and net income jumping to US$26 million from US$2 million the previous year, signaling strong operational momentum.

DRDGOLD (NYSE:DRD)

Simply Wall St Value Rating: ★★★★★☆

Overview: DRDGOLD Limited is a gold mining company focused on extracting gold from surface mine tailings in South Africa, with a market capitalization of approximately $1.43 billion.

Operations: DRDGOLD generates revenue primarily from two segments: Ergo, contributing ZAR 5.05 billion, and FWGR, adding ZAR 2.02 billion.

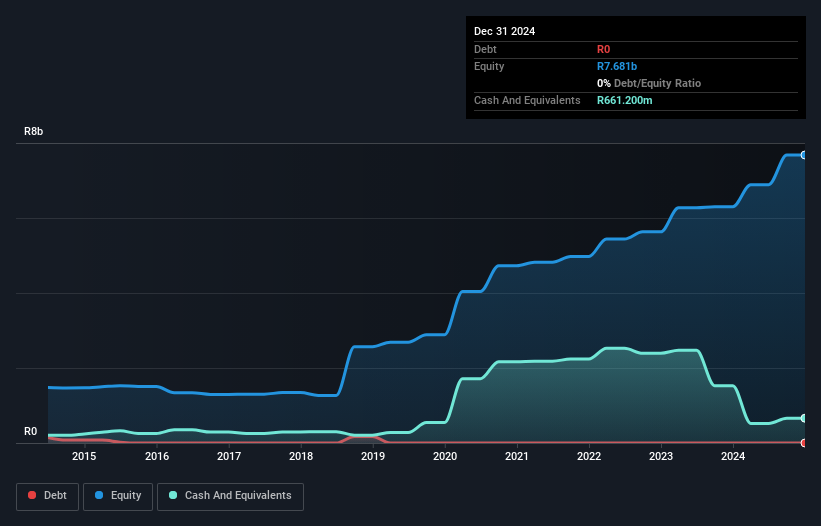

DRDGold, a nimble player in the mining sector, is trading at 54% below its estimated fair value, making it an intriguing pick for those eyeing potential growth. With no debt on its books and earnings that surged by 28% last year, DRDGold outpaced the broader metals and mining industry significantly. Despite not being free cash flow positive recently, the company reported net income of ZAR 970 million for H1 2025 compared to ZAR 589 million a year earlier. Production guidance remains robust with expectations of producing up to 165,000 ounces of gold annually by 2028.

- Unlock comprehensive insights into our analysis of DRDGOLD stock in this health report.

Understand DRDGOLD's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 285 US Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NB Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NBBK

NB Bancorp

Focuses on operating as a bank holding company for Needham Bank that provides various banking products and services in Greater Boston metropolitan area and surrounding communities in the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives