- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Is Cleveland-Cliffs Stock Still Attractive After a 40.6% Surge in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Cleveland-Cliffs at around $13.41 is a bargain or a value trap right now, you are not alone. This breakdown is designed to help you cut through the noise.

- The stock has risen about 5.2% over the last week and 31.5% over the past month, and is now up 40.6% year to date, even though longer-term returns over 3 and 5 years remain slightly negative.

- Recent headlines have focused on shifting steel demand expectations, ongoing trade policy discussions, and Cleveland-Cliffs’ continued push to position itself as a key domestic supplier for automotive and infrastructure projects. Together, these themes have reshaped how investors think about the company’s growth prospects and risk profile.

- Within our framework, Cleveland-Cliffs receives a 3/6 valuation score, which means it screens as undervalued on half of our key checks. Next, we will walk through those methods before finishing with a more intuitive way to think about the company’s fair value.

Find out why Cleveland-Cliffs's 22.4% return over the last year is lagging behind its peers.

Approach 1: Cleveland-Cliffs Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back into present dollar terms.

For Cleveland-Cliffs, the latest twelve month Free Cash Flow is roughly -$1.53 Billion, reflecting a challenging recent cash environment. Analysts and internal projections then assume a recovery, with Free Cash Flow expected to turn positive and gradually rise to about $595 Million by 2035, based on a 2 Stage Free Cash Flow to Equity approach. Early years draw on analyst estimates, while the later years are extrapolated using Simply Wall St growth assumptions.

Bringing all these projected cash flows back to today produces an estimated intrinsic value of about $8.75 per share. With the stock trading around $13.41, the DCF implies it is roughly 53.2% overvalued relative to these cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cleveland-Cliffs may be overvalued by 53.2%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

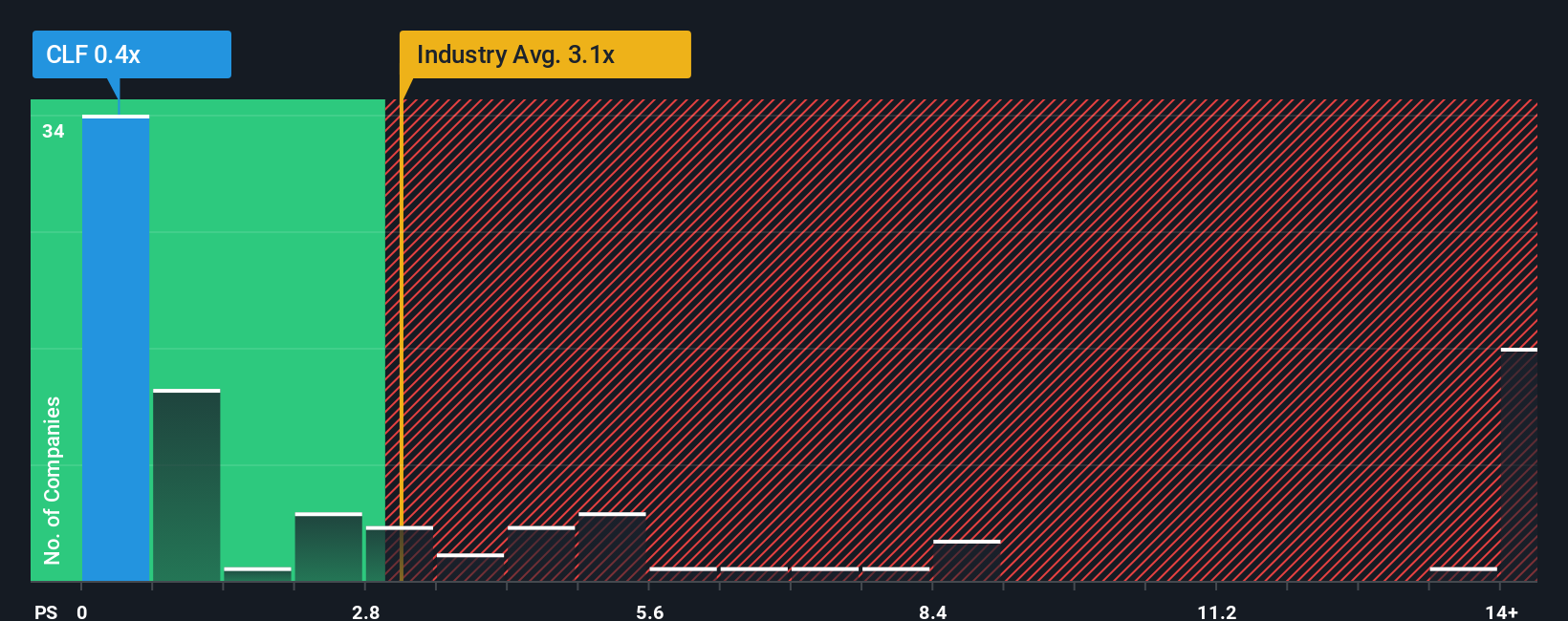

Approach 2: Cleveland-Cliffs Price vs Sales

For companies like Cleveland-Cliffs, where earnings and free cash flow can be volatile, the Price to Sales ratio is a useful way to value the business because sales are generally more stable than profits across the cycle. Investors typically pay higher multiples of sales when they expect stronger growth or see lower risk, and lower multiples when growth is modest or the outlook is uncertain.

Cleveland-Cliffs currently trades on a Price to Sales ratio of about 0.46x, which is well below both the Metals and Mining industry average of around 1.95x and the peer group average of roughly 1.55x. Simply Wall St’s proprietary Fair Ratio for the company, which is 0.60x, estimates what a reasonable Price to Sales multiple should be after factoring in Cleveland-Cliffs’ growth profile, margins, risk characteristics, industry positioning and market capitalization. This Fair Ratio offers a more tailored benchmark than a simple comparison with peers or the broader industry, because it adjusts for the company’s specific strengths and vulnerabilities.

With the stock trading at 0.46x versus a Fair Ratio of 0.60x, Cleveland-Cliffs is trading below that Fair Ratio on a sales multiple basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

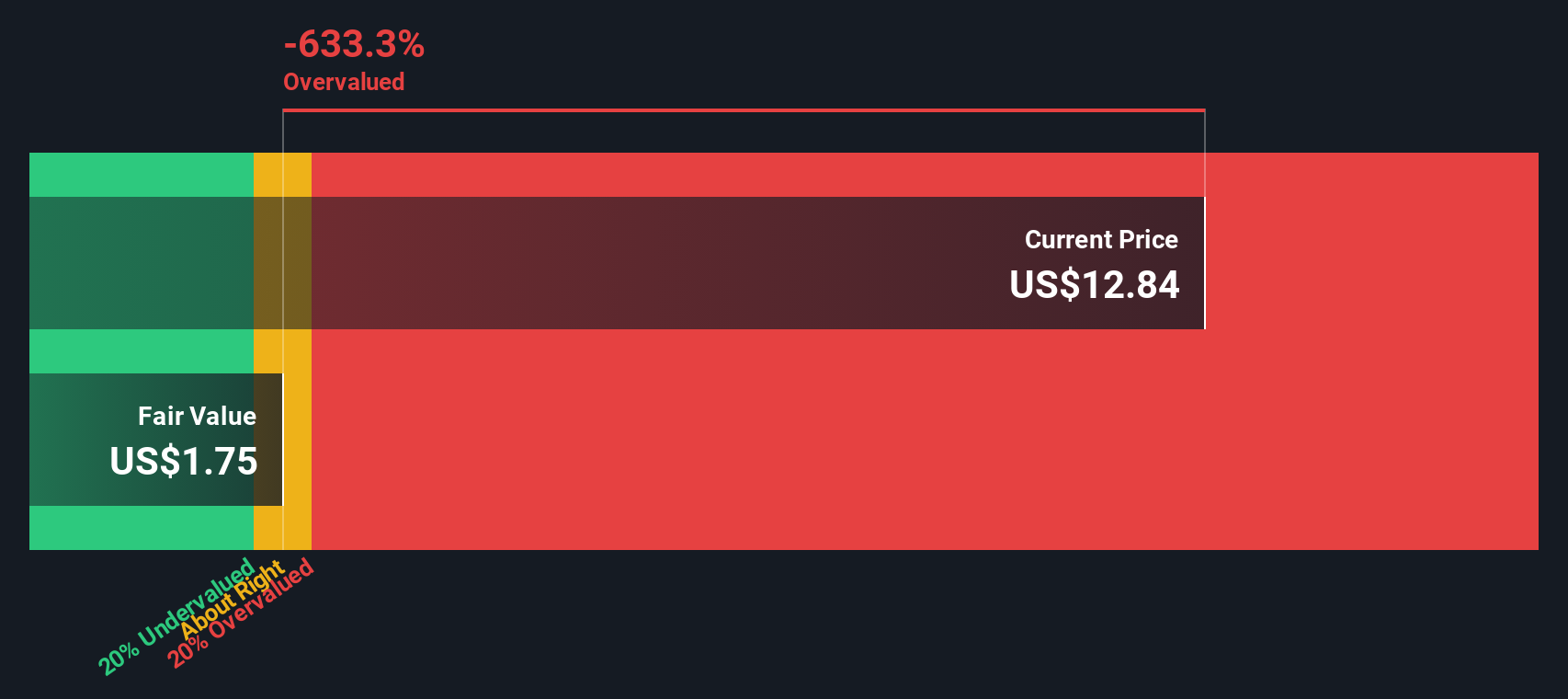

Upgrade Your Decision Making: Choose your Cleveland-Cliffs Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to turn your view of Cleveland-Cliffs into a clear story that links its business outlook to a financial forecast and ultimately to a fair value you can act on. Instead of only relying on static models, a Narrative lets you spell out how you think revenue, earnings and margins will evolve, then automatically translates that story into projected cash flows, a Fair Value estimate and a clear comparison with today’s share price to help you decide whether to buy, hold, or sell. Narratives are built directly inside Simply Wall St’s Community page, where millions of investors share and refine their views, and they update dynamically as fresh information, like earnings results or major news on tariffs and auto demand, comes in. For example, one Cleveland-Cliffs Narrative might assume strong tariff protection and auto demand and arrive at a Fair Value close to the most bullish target of about $14, while a more cautious Narrative that emphasizes decarbonization and blast furnace risks could land nearer the most bearish view of around $5. This gives you a clear framework to see where your own expectations sit on that spectrum.

Do you think there's more to the story for Cleveland-Cliffs? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026