- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (NYSE:CLF) Sees 13% Stock Rise Over The Past Week

Reviewed by Simply Wall St

Cleveland-Cliffs (NYSE:CLF) experienced a notable 13% price increase over the past week. While recent company-specific events contributing to this move are not immediately clear, the broader market context offers some perspective. Generally, U.S. stocks experienced a positive trend with major indexes up by 7%. However, investor sentiment was mixed amidst tech sector troubles and lingering tariff discussions. With broader economic indicators like the U.S. GDP data and job reports creating volatility, Cleveland-Cliffs' price performance may have been swayed by these external market dynamics rather than company-specific news.

The recent 13% price increase in Cleveland-Cliffs shares, amidst broader market movements, highlights potential influences such as U.S. GDP data and job reports, with no immediate company-specific news identified. Over the longer term, the company’s shares have achieved a total return, including dividends, of 83.53% over five years. This performance starkly contrasts with its recent underperformance compared to the US Metals and Mining industry, which saw a 3.1% return over the past year. Currently trading at US$7.24, the company's market valuation remains 35.4% below the consensus analyst price target of US$11.21, suggesting room for appreciation if the forecasts hold.

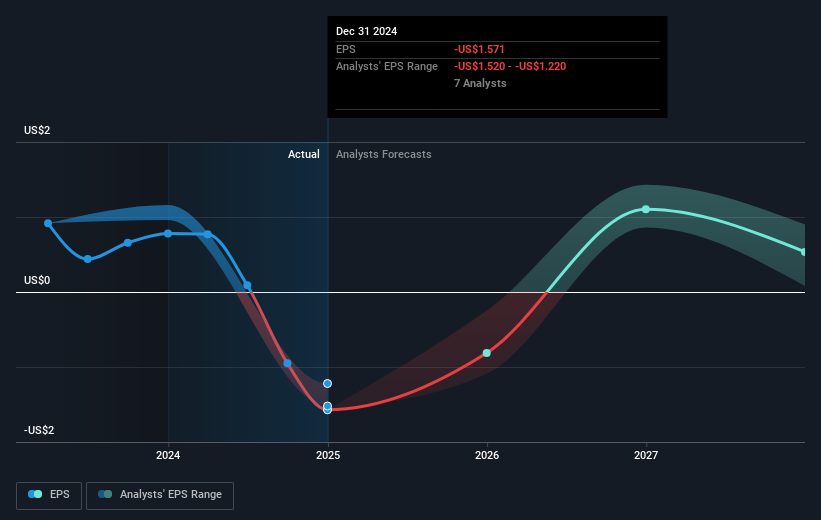

The potential impact on Cleveland-Cliffs' revenue and earnings forecasts from recent market dynamics is varied. While the implementation of tariffs could bolster domestic steel demand and company revenues, prevailing economic conditions and mixed investor sentiment might temper immediate impacts. Analysts project an annual revenue growth of 5.2% over the next three years, with earnings anticipated to grow from a 754 million loss to a projected earning of US$498.7 million by 2028. Nevertheless, high interest rates and reliance on tariff competitiveness continue to pose risks to achieving these targets. With the share price significantly undervalued according to analyst consensus, future market conditions and tariff policies will likely play a critical role in actualizing these projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cleveland-Cliffs, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives