- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

3 Stocks Estimated To Be Trading Below Intrinsic Value By At Least 41.3%

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, major indices like the S&P 500 and Dow Jones Industrial Average are nearing record highs, reflecting investor optimism. In this buoyant environment, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors seeking value in a market driven by monetary policy shifts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $119.88 | $232.81 | 48.5% |

| Sportradar Group (SRAD) | $23.14 | $46.18 | 49.9% |

| Sotera Health (SHC) | $16.90 | $33.63 | 49.7% |

| Schrödinger (SDGR) | $18.13 | $35.35 | 48.7% |

| QXO (QXO) | $22.12 | $43.12 | 48.7% |

| Perfect (PERF) | $1.77 | $3.41 | 48.1% |

| Pattern Group (PTRN) | $12.75 | $25.43 | 49.9% |

| Newsmax (NMAX) | $10.03 | $19.73 | 49.2% |

| FirstSun Capital Bancorp (FSUN) | $37.83 | $73.32 | 48.4% |

| Columbia Banking System (COLB) | $29.26 | $57.69 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Advanced Micro Devices (AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market cap of approximately $360.48 billion.

Operations: AMD's revenue is primarily derived from its Data Center segment at $15.11 billion, followed by the Client segment at $9.86 billion, Gaming at $3.63 billion, and Embedded at $3.43 billion.

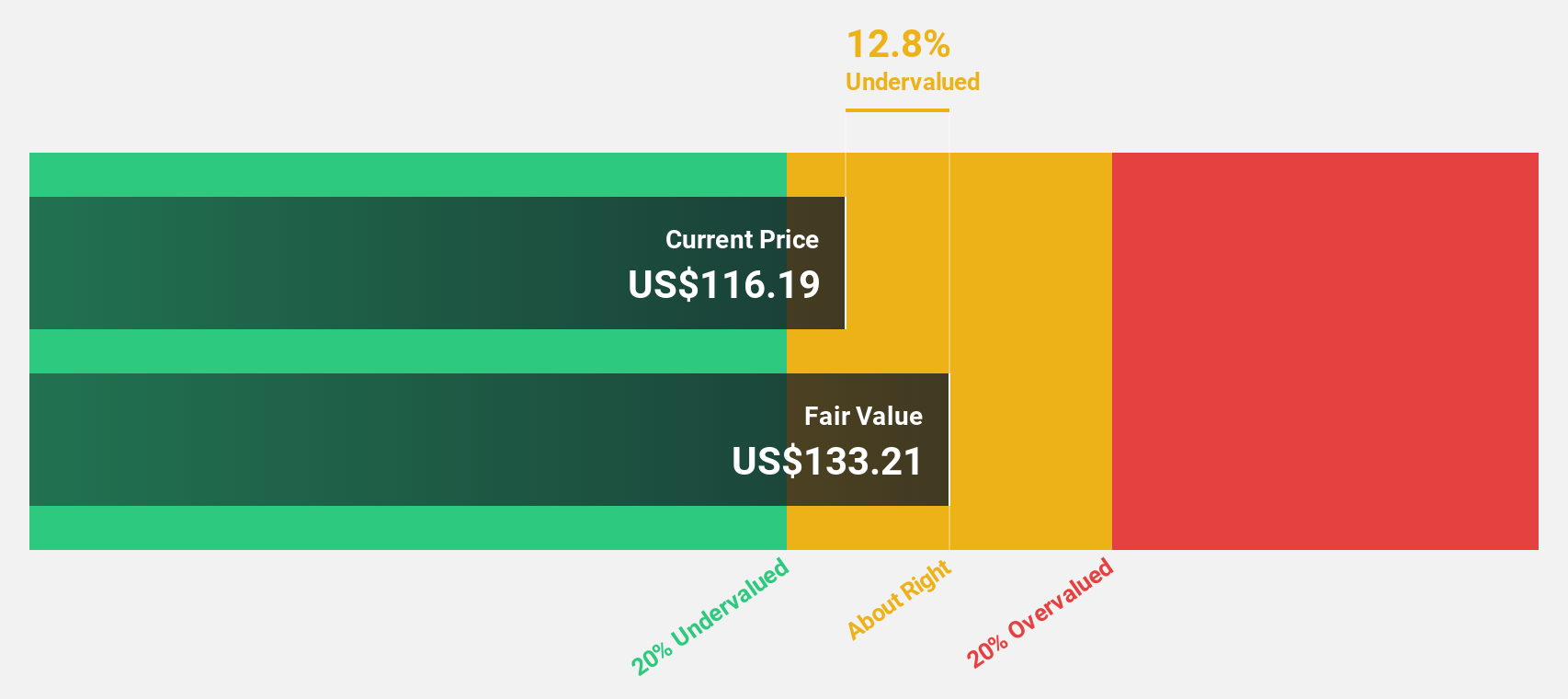

Estimated Discount To Fair Value: 41.4%

Advanced Micro Devices (AMD) is trading at US$221.43, significantly below its estimated fair value of US$378.05, highlighting potential undervaluation based on cash flows. Recent collaborations with HPE and Vultr to enhance AI infrastructure underscore AMD's strategic expansion in high-performance computing. Despite legal challenges from Adeia, AMD's earnings have grown substantially, with forecasts indicating continued robust growth in profits and revenue over the next three years, outpacing the broader US market expectations.

- The analysis detailed in our Advanced Micro Devices growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Advanced Micro Devices.

AngloGold Ashanti (AU)

Overview: AngloGold Ashanti plc is a gold mining company with operations in Africa, Australia, and the Americas, and has a market cap of approximately $41.57 billion.

Operations: The company's revenue primarily comes from its Metals & Mining segment, specifically Gold & Other Precious Metals, totaling $8.58 billion.

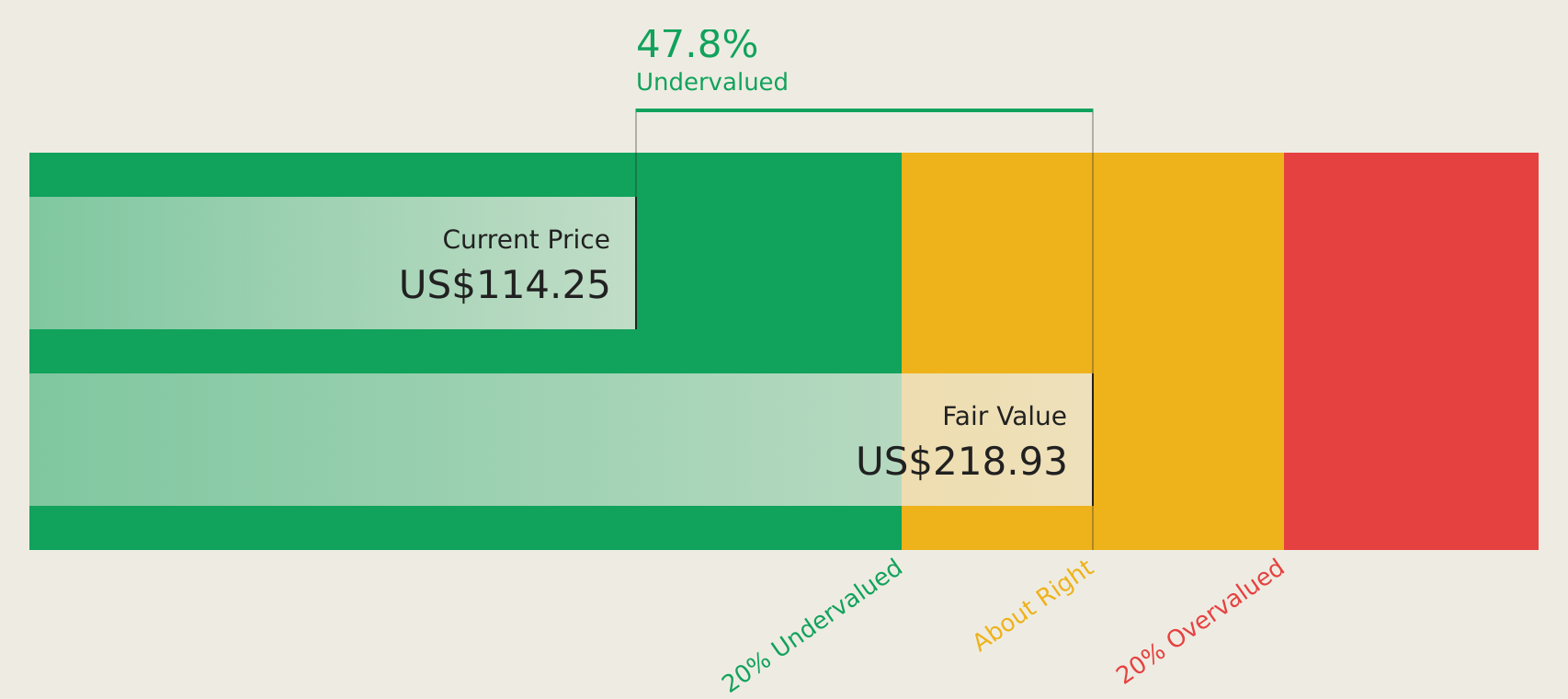

Estimated Discount To Fair Value: 41.3%

AngloGold Ashanti, trading at US$85.50, is significantly undervalued against its estimated fair value of US$145.76, suggesting potential based on cash flows. The company's recent earnings report showed a substantial increase in net income to US$669 million for Q3 2025 from US$223 million the previous year. Despite significant insider selling recently and an unstable dividend track record, AngloGold's earnings growth outpaces market expectations with robust future profit forecasts.

- Upon reviewing our latest growth report, AngloGold Ashanti's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of AngloGold Ashanti stock in this financial health report.

Coeur Mining (CDE)

Overview: Coeur Mining, Inc. is a gold and silver producer with operations in the United States, Canada, and Mexico, and has a market cap of approximately $10.26 billion.

Operations: Coeur Mining generates revenue from its operations at Wharf ($294.12 million), Palmarejo ($420.20 million), Rochester ($377.30 million), and Kensington ($322.30 million).

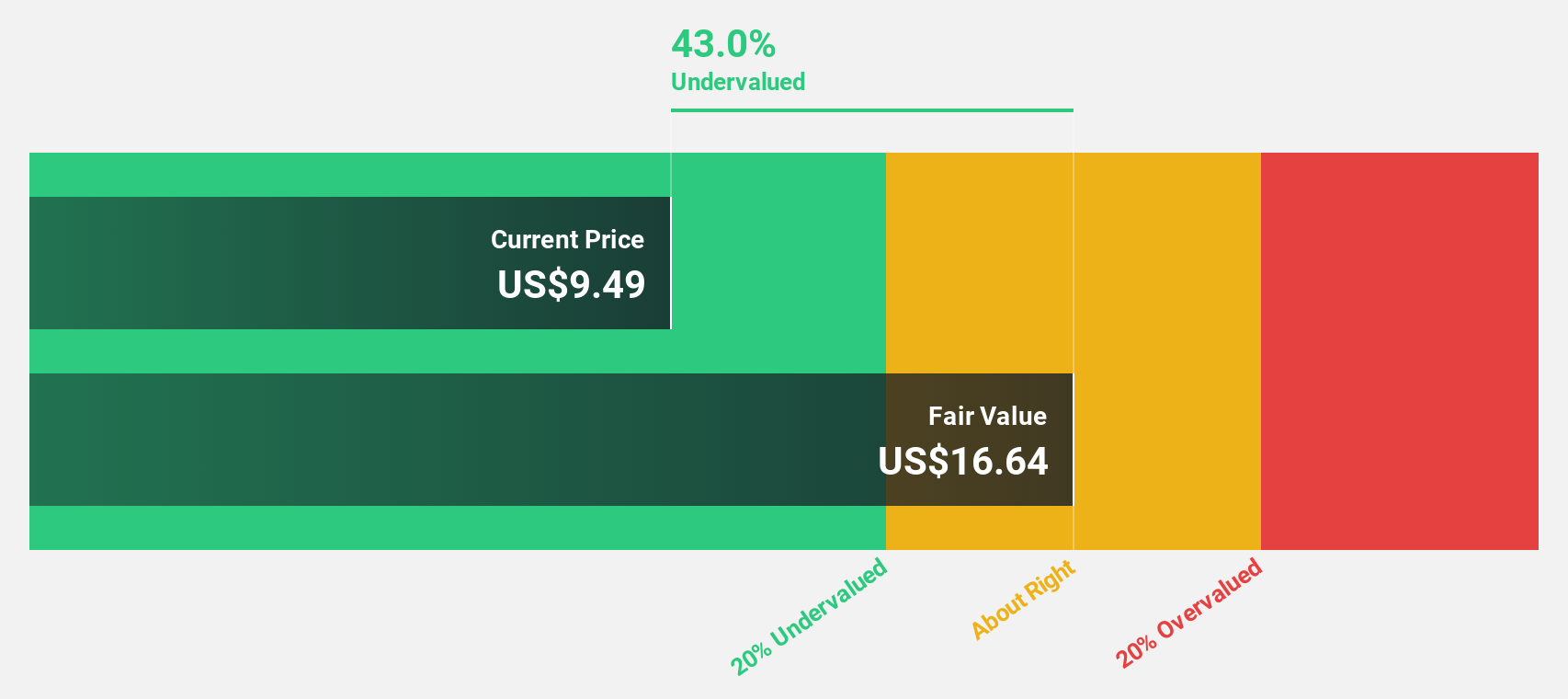

Estimated Discount To Fair Value: 41.5%

Coeur Mining, trading at US$17.48, is significantly undervalued compared to its estimated fair value of US$29.89, highlighting potential based on cash flows. The company's Q3 2025 earnings showed a substantial increase in net income to US$266.82 million from the previous year's US$48.74 million, despite recent shareholder dilution and share price volatility. Future earnings growth is projected to outpace the market significantly, supported by robust exploration results at Palmarejo and other sites.

- Our comprehensive growth report raises the possibility that Coeur Mining is poised for substantial financial growth.

- Get an in-depth perspective on Coeur Mining's balance sheet by reading our health report here.

Key Takeaways

- Get an in-depth perspective on all 206 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion