- United States

- /

- Insurance

- /

- NYSE:RNR

RenaissanceRe Holdings Ltd. (NYSE:RNR) Might Not Be As Mispriced As It Looks

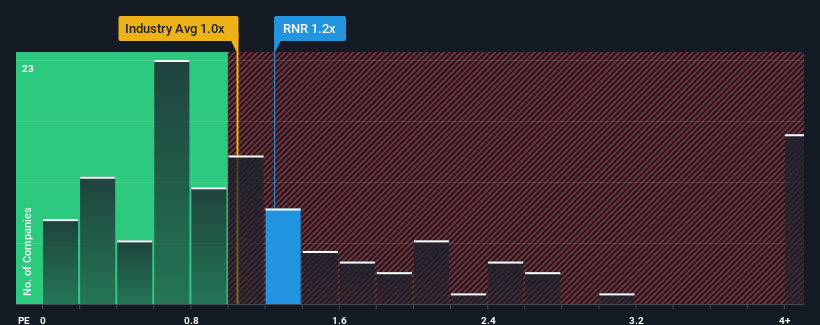

It's not a stretch to say that RenaissanceRe Holdings Ltd.'s (NYSE:RNR) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Insurance industry in the United States, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for RenaissanceRe Holdings

How RenaissanceRe Holdings Has Been Performing

With revenue growth that's superior to most other companies of late, RenaissanceRe Holdings has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think RenaissanceRe Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is RenaissanceRe Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like RenaissanceRe Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. The strong recent performance means it was also able to grow revenue by 87% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 13% over the next year. That's shaping up to be materially higher than the 6.1% growth forecast for the broader industry.

With this information, we find it interesting that RenaissanceRe Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that RenaissanceRe Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider and we've discovered 2 warning signs for RenaissanceRe Holdings (1 is potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RNR

RenaissanceRe Holdings

Provides reinsurance and insurance products in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives