- United States

- /

- Insurance

- /

- NYSE:HRTG

Growth Companies Insiders Favor With Up To 155% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock markets experience fluctuations, with major indices like the Dow Jones, S&P 500, and Nasdaq Composite facing recent declines amid economic uncertainties and policy concerns, investors are keenly observing trends that could signal resilience or growth potential. In such an environment, companies with high insider ownership often attract attention as they indicate confidence from those who know the business best; this is particularly compelling when these firms also demonstrate significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Kingstone Companies (NasdaqCM:KINS) | 17.9% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

We're going to check out a few of the best picks from our screener tool.

Johnson Outdoors (NasdaqGS:JOUT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Johnson Outdoors Inc. designs, manufactures, and markets seasonal and outdoor recreation products for fishing worldwide, with a market cap of $263.37 million.

Operations: The company's revenue segments include Diving at $71.83 million and Fishing at $424.32 million.

Insider Ownership: 29.8%

Earnings Growth Forecast: 155.7% p.a.

Johnson Outdoors has high insider ownership and is forecast to become profitable within three years, outpacing average market growth. Despite a challenging first quarter with a net loss of US$15.29 million, revenue is expected to grow at 10.1% annually, faster than the broader US market's 8.3%. The company trades significantly below its fair value estimate but faces challenges with dividend sustainability due to insufficient earnings coverage.

- Unlock comprehensive insights into our analysis of Johnson Outdoors stock in this growth report.

- In light of our recent valuation report, it seems possible that Johnson Outdoors is trading behind its estimated value.

Proficient Auto Logistics (NasdaqGS:PAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Proficient Auto Logistics, Inc. specializes in auto transportation and logistics services across North America, with a market cap of $272.73 million.

Operations: Proficient Auto Logistics, Inc. generates its revenue primarily from auto transportation and logistics services throughout North America.

Insider Ownership: 25%

Earnings Growth Forecast: 79.1% p.a.

Proficient Auto Logistics is positioned for significant growth, with revenue expected to rise 35% annually, surpassing the US market's 8.3%. Despite a highly volatile share price and trading at 71.3% below its fair value estimate, analysts anticipate a 57.8% stock price increase. The company is forecast to become profitable within three years, exceeding average market growth expectations. Recent presentations and upcoming earnings announcements may provide further insights into its performance trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Proficient Auto Logistics.

- Insights from our recent valuation report point to the potential undervaluation of Proficient Auto Logistics shares in the market.

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of approximately $345.20 million.

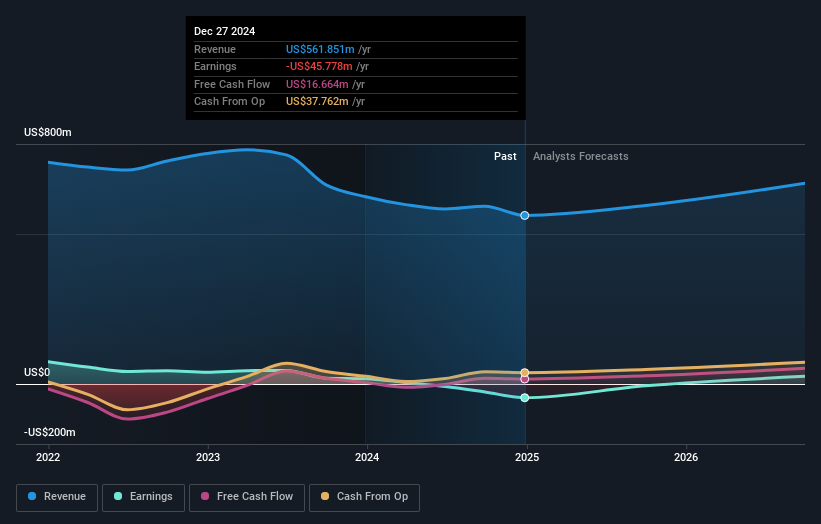

Operations: The company generates revenue from its Insurance - Property & Casualty segment, amounting to $816.99 million.

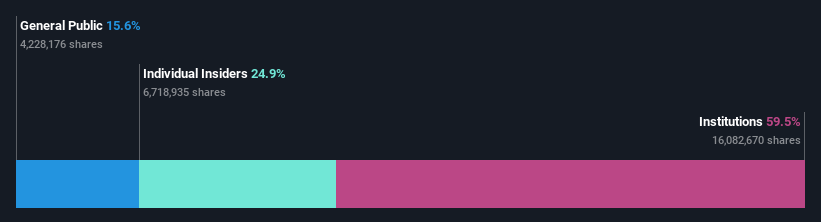

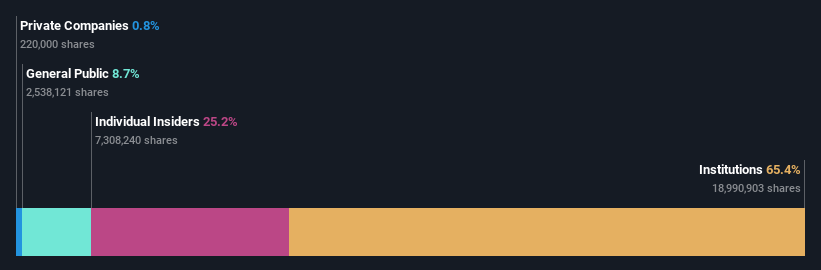

Insider Ownership: 25.1%

Earnings Growth Forecast: 28.9% p.a.

Heritage Insurance Holdings demonstrates potential with a 35.8% earnings increase over the past year and forecasted annual profit growth of 28.9%, outpacing the US market's 13.8%. Despite slower revenue growth projections of 6.8% annually, its price-to-earnings ratio of 5.7x suggests good value relative to peers and industry standards. Recent earnings reveal an increase in net income to US$61.54 million for 2024, reflecting solid financial performance amid no recent insider trading activity or share buybacks.

- Delve into the full analysis future growth report here for a deeper understanding of Heritage Insurance Holdings.

- Upon reviewing our latest valuation report, Heritage Insurance Holdings' share price might be too pessimistic.

Key Takeaways

- Click here to access our complete index of 207 Fast Growing US Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Heritage Insurance Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Heritage Insurance Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRTG

Heritage Insurance Holdings

Through its subsidiaries, provides personal and commercial residential insurance products.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives