- United States

- /

- Insurance

- /

- NYSE:CNA

Why We Think CNA Financial Corporation's (NYSE:CNA) CEO Compensation Is Not Excessive At All

Key Insights

- CNA Financial's Annual General Meeting to take place on 1st of May

- Salary of US$1.25m is part of CEO Dino Robusto's total remuneration

- The overall pay is comparable to the industry average

- CNA Financial's total shareholder return over the past three years was 16% while its EPS grew by 21% over the past three years

Performance at CNA Financial Corporation (NYSE:CNA) has been reasonably good and CEO Dino Robusto has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 1st of May. We present our case of why we think CEO compensation looks fair.

View our latest analysis for CNA Financial

How Does Total Compensation For Dino Robusto Compare With Other Companies In The Industry?

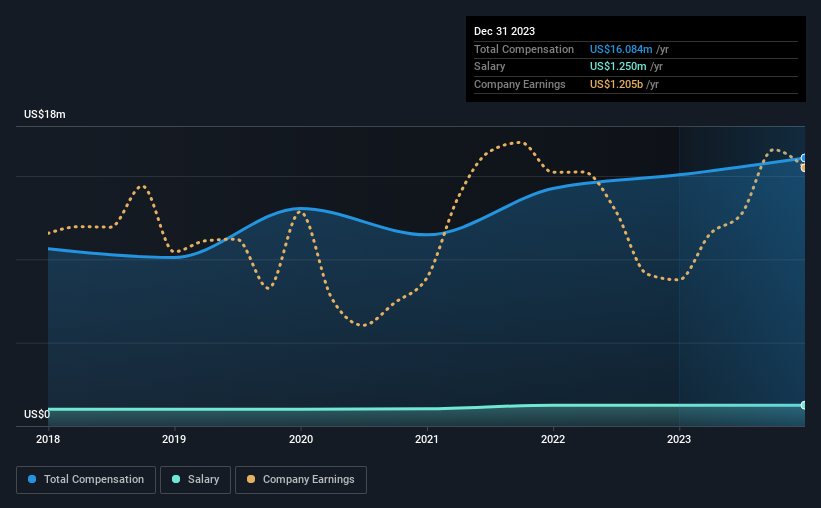

According to our data, CNA Financial Corporation has a market capitalization of US$12b, and paid its CEO total annual compensation worth US$16m over the year to December 2023. That's just a smallish increase of 6.7% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.3m.

On comparing similar companies in the American Insurance industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$15m. This suggests that CNA Financial remunerates its CEO largely in line with the industry average. What's more, Dino Robusto holds US$29m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.3m | US$1.3m | 8% |

| Other | US$15m | US$14m | 92% |

| Total Compensation | US$16m | US$15m | 100% |

Talking in terms of the industry, salary represented approximately 13% of total compensation out of all the companies we analyzed, while other remuneration made up 87% of the pie. It's interesting to note that CNA Financial allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

CNA Financial Corporation's Growth

Over the past three years, CNA Financial Corporation has seen its earnings per share (EPS) grow by 21% per year. In the last year, its revenue is up 12%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has CNA Financial Corporation Been A Good Investment?

CNA Financial Corporation has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for CNA Financial that you should be aware of before investing.

Important note: CNA Financial is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking to trade CNA Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Established dividend payer and fair value.