- United States

- /

- Insurance

- /

- NYSE:CIA

There's Reason For Concern Over Citizens, Inc.'s (NYSE:CIA) Massive 32% Price Jump

Citizens, Inc. (NYSE:CIA) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 64% in the last year.

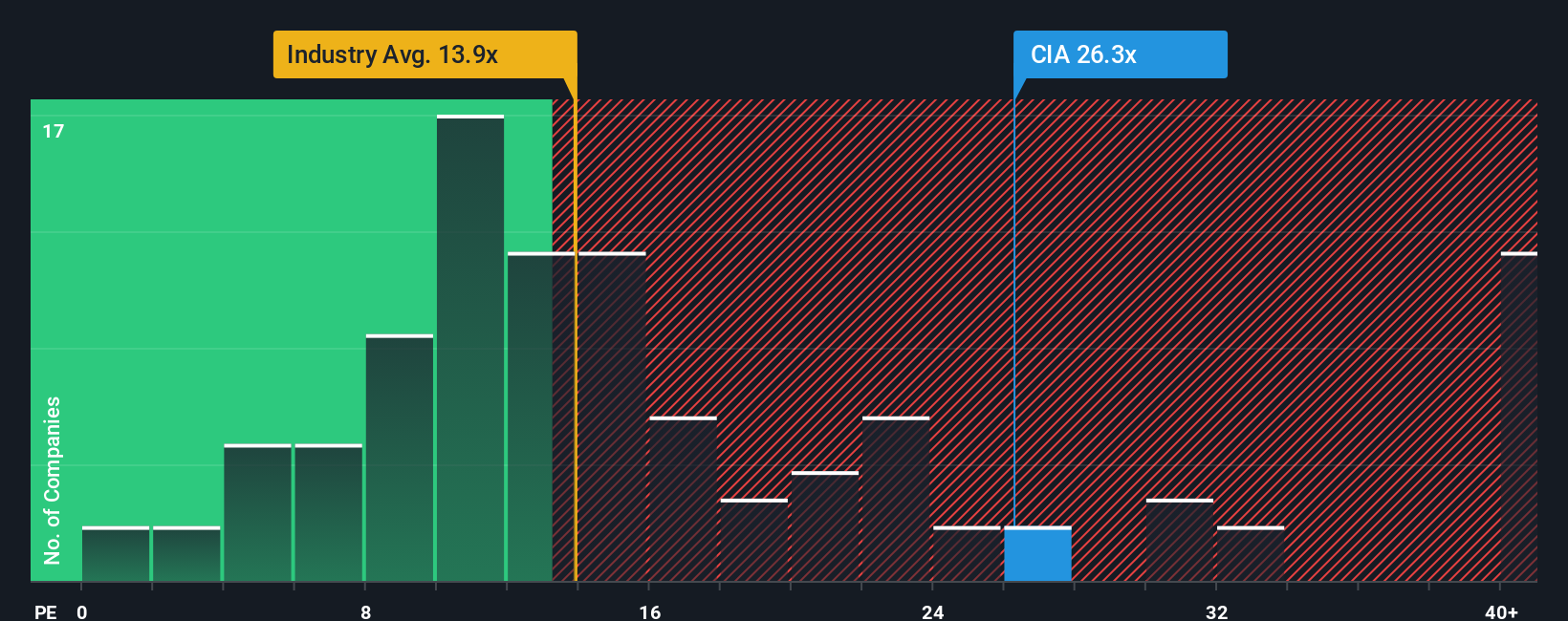

Since its price has surged higher, Citizens may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.3x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that Citizens' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Citizens

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Citizens' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 80% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 14% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Citizens is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Citizens' P/E

The large bounce in Citizens' shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Citizens currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with Citizens.

If these risks are making you reconsider your opinion on Citizens, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CIA

Citizens

A diversified financial services company providing life, living benefits and final expense insurance and other financial products to individuals and small businesses in the U.S., Latin America, and Asia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives