- United States

- /

- Insurance

- /

- NYSE:AIG

American International Group (NYSE:AIG) Increases Dividend and Completes Share Buyback Program

Reviewed by Simply Wall St

American International Group (NYSE:AIG) has recently increased its quarterly cash dividend to $0.45 per share and updated its buyback program by repurchasing 29 million shares for $2.2 billion. These capital management strategies reflect AIG's efforts to enhance shareholder value amid a constructive market landscape, evidenced by the S&P 500's ongoing winning streak. Despite a decline in net income, the company's stable revenue aligned with broader positive market trends could have supported its stock price, which rose 9.75% over the last quarter. These factors combined with the market's overall rise may have contributed to AIG's performance.

Find companies with promising cash flow potential yet trading below their fair value.

American International Group's recent initiatives, including the increased dividend and share buybacks, could bolster investor confidence by highlighting the company's focus on enhancing shareholder value. This move aligns with broader capital management strategies designed to support revenue and operational efficiencies through partnerships with firms like Blackstone and Palantir. Over the longer term, AIG’s shares have delivered a total return of 259.69% over five years, a substantial performance that provides context to these current measures.

When compared to market or industry performance, AIG has underperformed over the past year, with its returns trailing the US Insurance industry's 17.7% increase. However, the company's proactive steps in capital management might influence revenue positively and provide a buffer against earnings pressures from increased catastrophe risks and regulatory constraints.

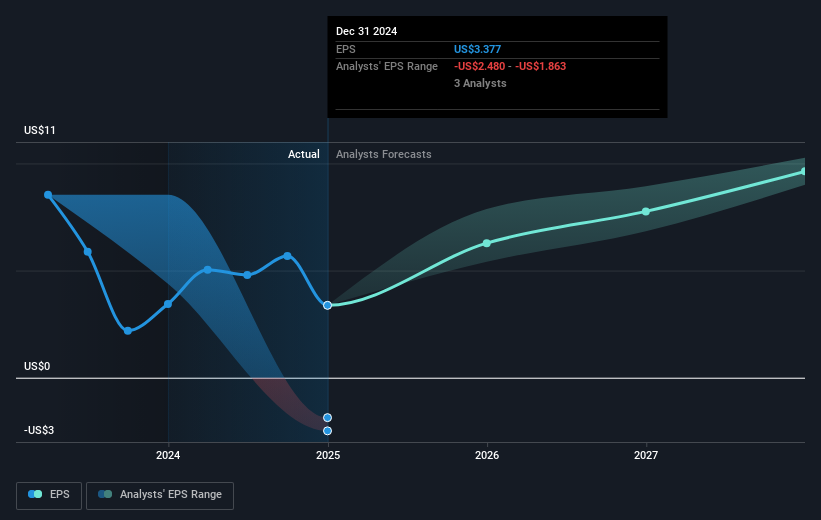

The share price, which rose by 9.75% in the last quarter, remains close to the consensus analyst price target of US$87.72, currently standing at US$82. This proximity suggests that analysts generally see AIG as fairly valued based on its earnings forecasts, expected growth, and strategic collaborations. The new partnerships and streamlined business model following Corebridge's deconsolidation could positively impact revenue streams and earnings forecasts, potentially justifying the confidence some analysts have expressed in future growth projections.

Gain insights into American International Group's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American International Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives