- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Cincinnati Financial (CINF): Assessing Valuation After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

See our latest analysis for Cincinnati Financial.

After a solid stretch earlier this year, Cincinnati Financial’s share price has recently seen some short-term swings, dipping over the past week but still holding onto a strong year-to-date gain. Beneath the weekly volatility, momentum remains positive, with a 1-year total shareholder return of nearly 19% reflecting both growth potential and renewed interest from investors.

If Cincinnati's recent moves have you watching insurers closer, now is a smart moment to broaden your investment radar and discover fast growing stocks with high insider ownership

Given the stock’s strong gains and steady momentum, the key question now is whether Cincinnati Financial’s current price leaves room for additional upside or if the market has already accounted for future growth. Could this be the right moment to buy, or is everything already priced in?

Most Popular Narrative: 3.7% Undervalued

Cincinnati Financial’s widely followed fair value estimate of $164.83 recently edged above the last close of $158.75, reflecting cautious optimism in the current price. Investors are keen to unpack the strategy and projections that underpin this subtle gap.

Ongoing premium growth, particularly double-digit net written premium growth in multiple years (with four out of the last five years), supported by expanding relationships with independent agents and entry into new specialty products and markets, is poised to drive long-term revenue expansion.

Curious what powers this fair value call? There is a delicate balance of rapid premium expansion, evolving market segmentation, and targeted growth forecasts. Want to know which assumptions tip the scale for Cincinnati’s future? Get the full inside story and see how these factors could shape the next move.

Result: Fair Value of $164.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underwriting discipline or robust investment gains could counter downside risks and support stronger margins than many analysts anticipate.

Find out about the key risks to this Cincinnati Financial narrative.

Another View: Multiples Suggest a Higher Bar

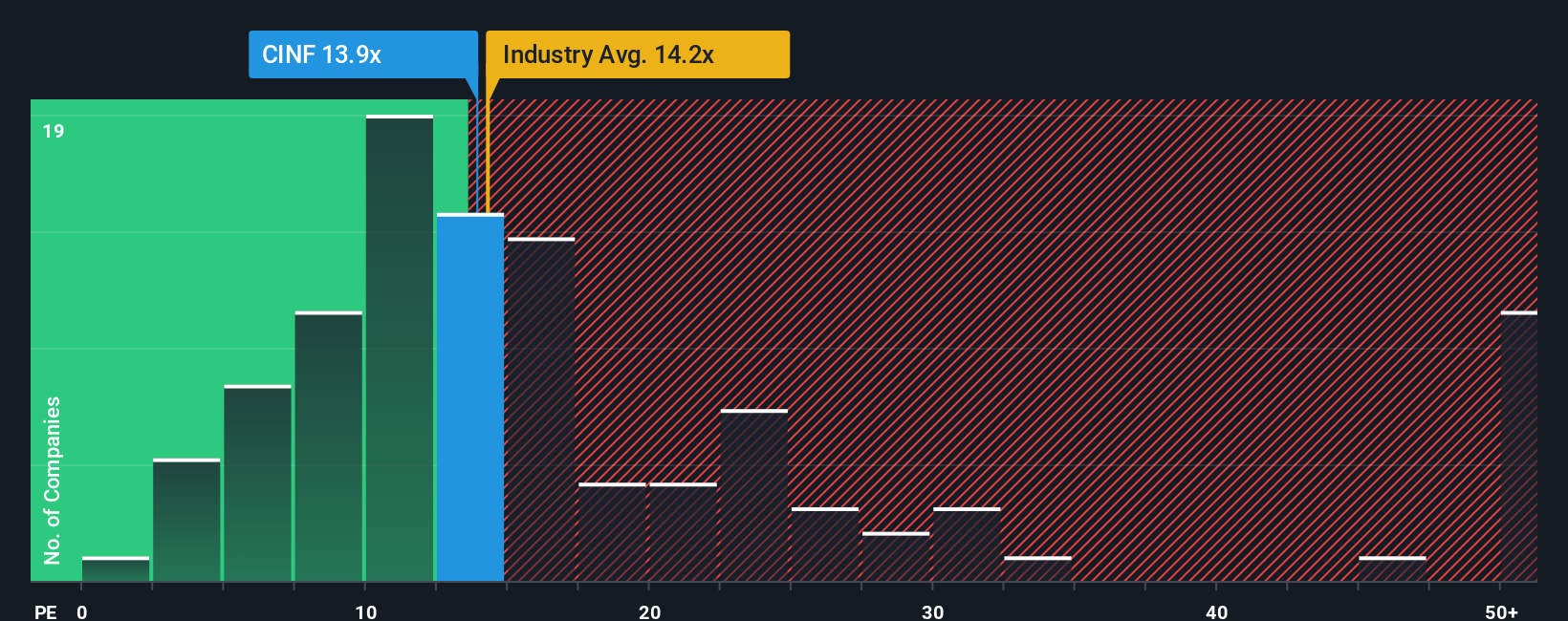

While the fair value estimate points to Cincinnati Financial being slightly undervalued, a closer look at the price-to-earnings ratio raises some doubts. The stock trades at 13.6x earnings, just above peer and industry averages, and well above its fair ratio of 8.8x. This suggests there is less margin for error, and any future stumble could quickly flip the valuation story. Could the market be pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cincinnati Financial Narrative

If the numbers above spark a different perspective or you like getting hands-on with the data, you can piece together your own full narrative in under three minutes. So why not Do it your way?

A great starting point for your Cincinnati Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your investment search and get ahead of the market by acting now. These unique stock picks could be the advantage your portfolio needs this year.

- Tap into income potential and review steady yield opportunities with these 18 dividend stocks with yields > 3% offering payouts above 3%.

- Unlock growth in the future of medicine through these 33 healthcare AI stocks powering innovation at the intersection of healthcare and artificial intelligence.

- Spot companies trading at bargain prices. Find your next hidden gem by checking these 881 undervalued stocks based on cash flows based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives