- United States

- /

- Personal Products

- /

- NYSE:KVUE

3 US Stocks Estimated Up To 31.4% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market continues to reach record highs, fueled by a post-election rally and optimism surrounding potential policy changes, investors are keenly focused on identifying opportunities that may still be undervalued amidst this bullish environment. In such a thriving market, finding stocks trading below their intrinsic value can offer significant potential for growth as these companies may not yet reflect their full worth in the current pricing landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Business First Bancshares (NasdaqGS:BFST) | $29.13 | $55.82 | 47.8% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.56 | $63.96 | 49.1% |

| Datadog (NasdaqGS:DDOG) | $124.45 | $246.86 | 49.6% |

| West Bancorporation (NasdaqGS:WTBA) | $23.93 | $46.88 | 49% |

| Proficient Auto Logistics (NasdaqGS:PAL) | $10.00 | $19.92 | 49.8% |

| Alaska Air Group (NYSE:ALK) | $51.00 | $98.15 | 48% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $277.43 | $546.47 | 49.2% |

| Coeur Mining (NYSE:CDE) | $6.59 | $12.56 | 47.5% |

| Carter Bankshares (NasdaqGS:CARE) | $19.53 | $38.28 | 49% |

| Mobileye Global (NasdaqGS:MBLY) | $16.45 | $31.69 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

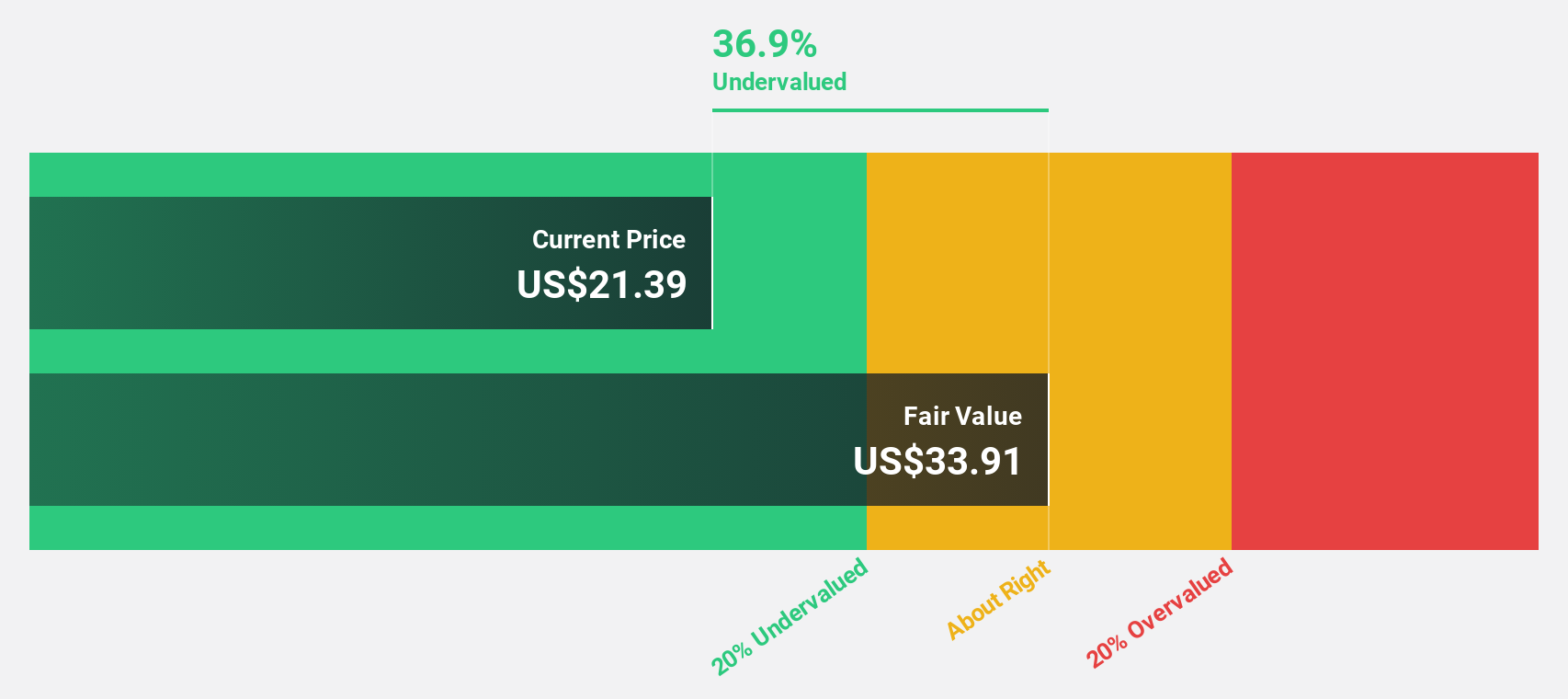

Corpay (NYSE:CPAY)

Overview: Corpay, Inc. is a payments company that assists businesses and consumers with managing vehicle-related expenses, lodging expenses, and corporate payments across the United States, Brazil, the United Kingdom, and internationally; it has a market cap of $25.41 billion.

Operations: The company's revenue segments include Vehicle Payments at $2.01 billion, Corporate Payments at $1.13 billion, and Lodging Payments at $487.62 million.

Estimated Discount To Fair Value: 26.3%

Corpay is trading at 26.3% below its estimated fair value, highlighting potential undervaluation based on cash flows. The company reported third-quarter sales of US$1.03 billion, with net income rising to US$276.4 million, and it has increased its share repurchase program by US$1 billion. Despite high debt levels and recent insider selling, Corpay's earnings are forecast to grow faster than the overall U.S. market at 15.5% annually, supported by strategic M&A pursuits and cross-border partnerships.

- Our earnings growth report unveils the potential for significant increases in Corpay's future results.

- Take a closer look at Corpay's balance sheet health here in our report.

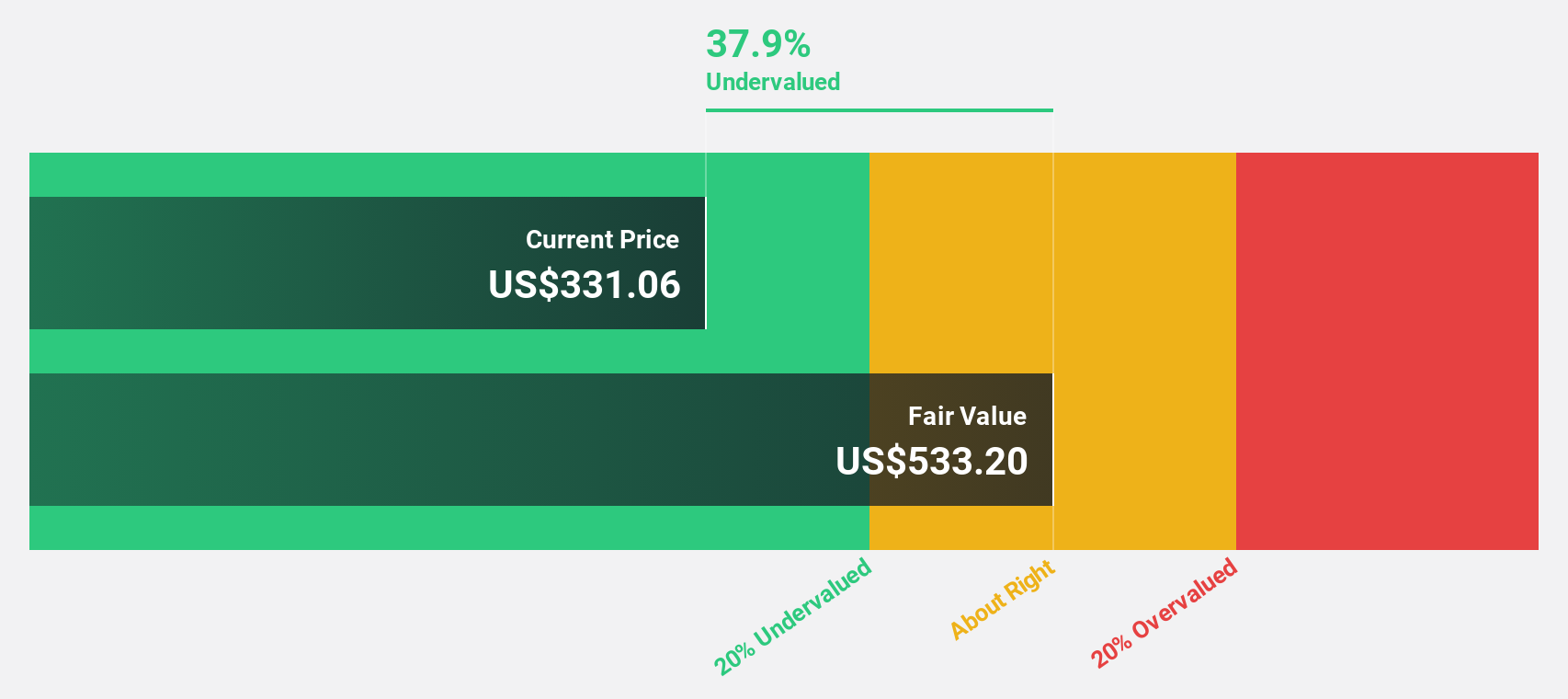

Kenvue (NYSE:KVUE)

Overview: Kenvue Inc. is a global consumer health company with a market capitalization of approximately $45.40 billion.

Operations: The company's revenue is derived from three segments: Self Care at $6.50 billion, Essential Health at $4.73 billion, and Skin Health and Beauty at $4.23 billion.

Estimated Discount To Fair Value: 31.4%

Kenvue is trading 31.4% below its estimated fair value, indicating significant undervaluation based on cash flows. Despite high debt levels and declining profit margins, the company forecasts annual earnings growth of over 20%, outpacing the broader U.S. market. Recent third-quarter results showed sales of US$3.9 billion with net income at US$383 million, while activist investor Starboard Value has pushed for changes to enhance shareholder value amid underperformance concerns.

- Upon reviewing our latest growth report, Kenvue's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Kenvue's balance sheet health report.

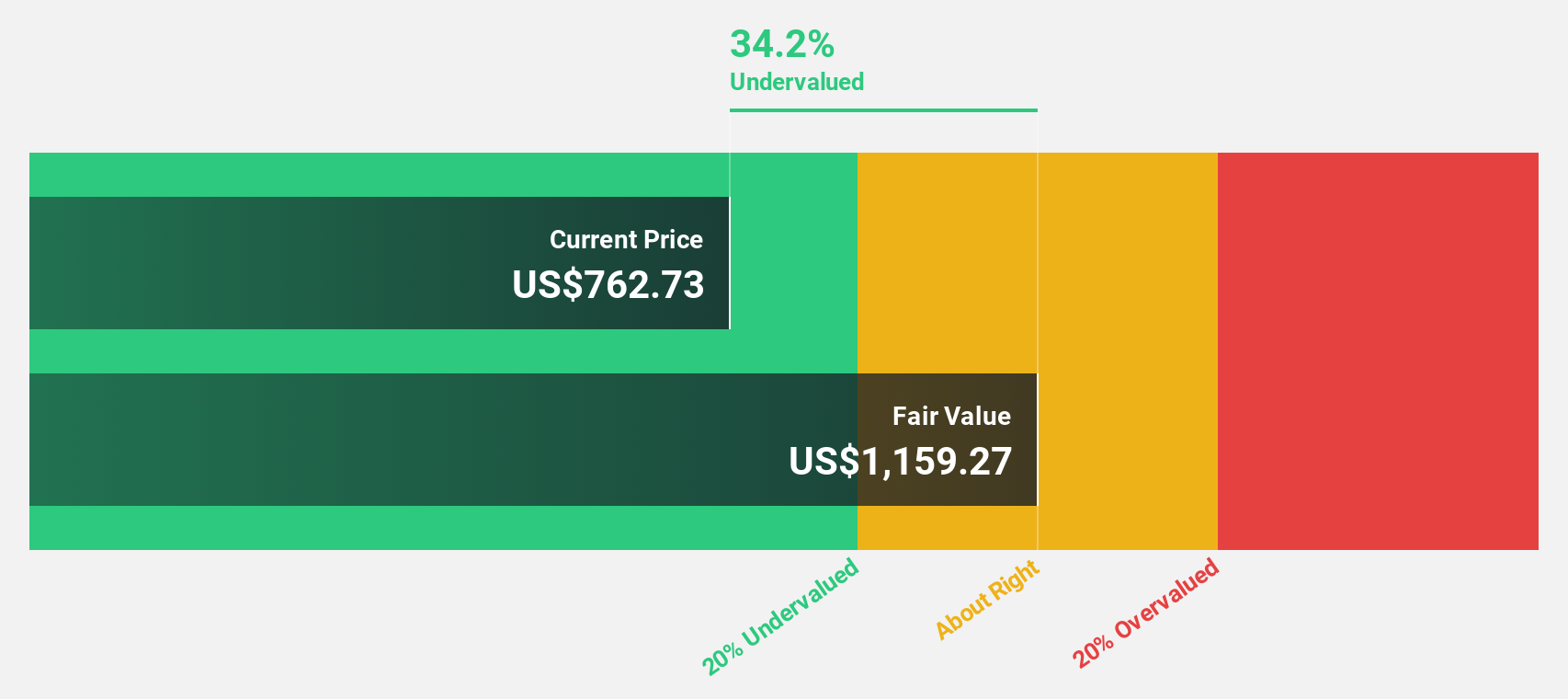

Eli Lilly (NYSE:LLY)

Overview: Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide, with a market cap of approximately $748.75 billion.

Operations: The company's revenue primarily comes from its pharmaceutical products, generating $40.86 billion.

Estimated Discount To Fair Value: 30.3%

Eli Lilly is trading 30.3% below its estimated fair value, highlighting potential undervaluation based on cash flows. The company forecasts earnings growth of 29.4% annually, surpassing the U.S. market average, despite revenue growth projections being slower than 20%. Recent earnings reports showed a net income of US$970 million for Q3 2024 and ongoing product developments in Alzheimer's and cancer treatments could impact future performance positively or negatively depending on trial outcomes and regulatory approvals.

- In light of our recent growth report, it seems possible that Eli Lilly's financial performance will exceed current levels.

- Get an in-depth perspective on Eli Lilly's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 189 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)