- United States

- /

- Auto

- /

- NasdaqGS:LI

Top US Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

As of September 30, 2024, the U.S. stock market has capped off a strong month and quarter, with the S&P 500 and Dow Jones Industrial Average reaching record highs. Investors are increasingly confident in a soft economic landing and potential interest rate cuts by the Federal Reserve. In this favorable market environment, growth companies with high insider ownership can offer compelling investment opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Underneath we present a selection of stocks filtered out by our screen.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

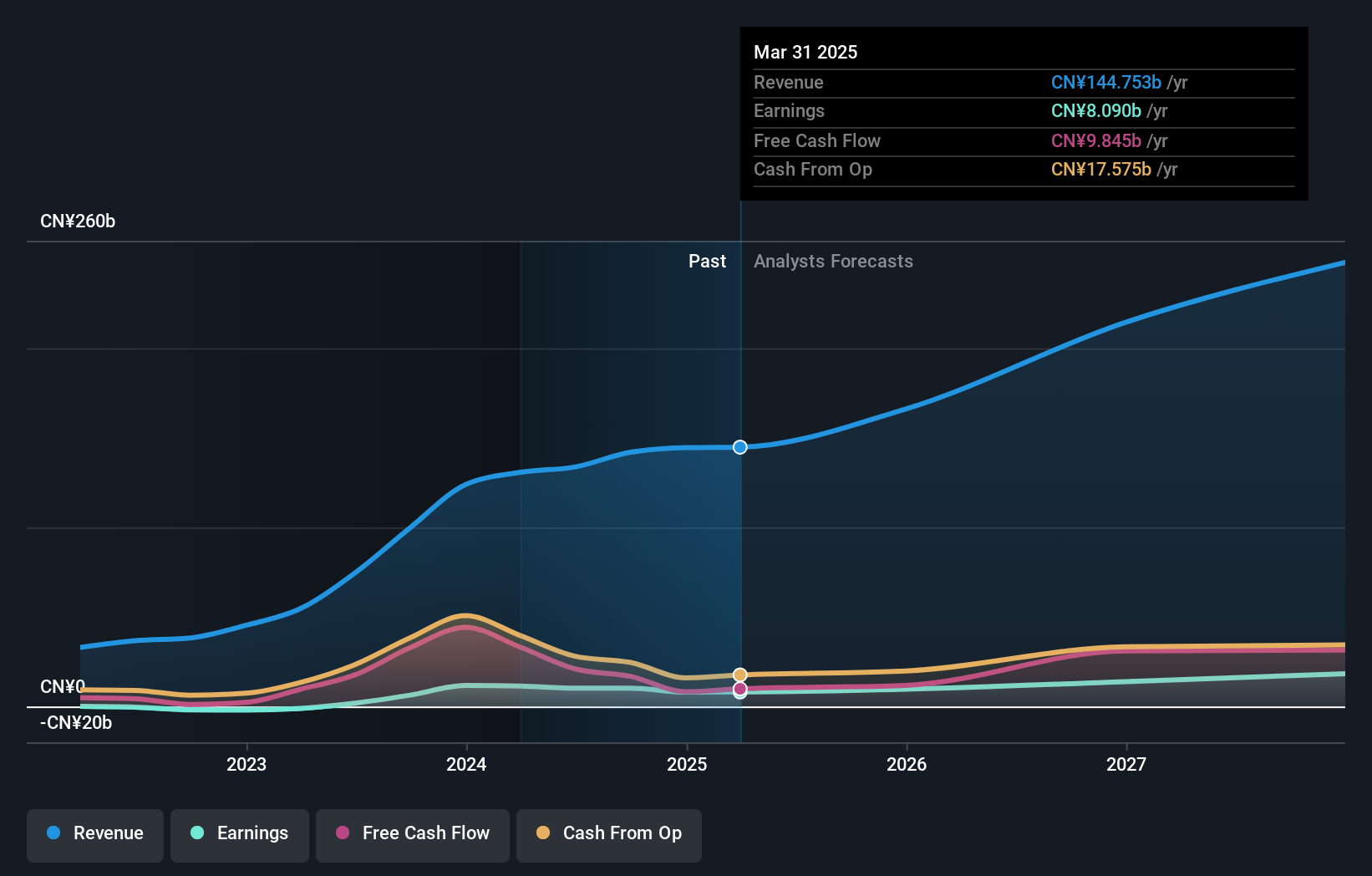

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China and has a market cap of $25.72 billion.

Operations: Li Auto's revenue from the Auto Manufacturers segment is CN¥133.72 billion.

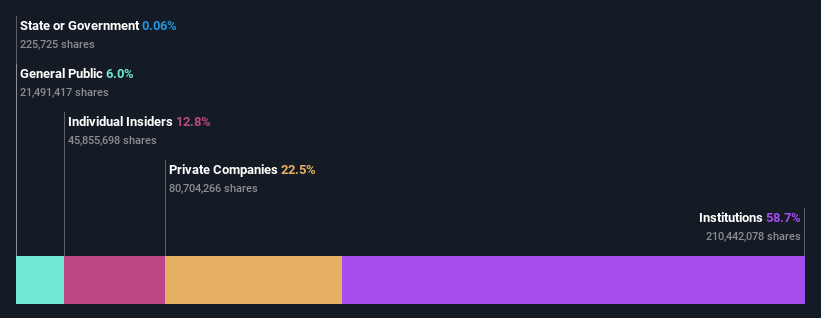

Insider Ownership: 31.1%

Earnings Growth Forecast: 23.1% p.a.

Li Auto has demonstrated significant growth with vehicle deliveries increasing by 48.9% year over year in September 2024, totaling 341,812 vehicles for the year to date. Its earnings are forecasted to grow at 23.1% annually, outpacing the US market average of 15.2%. Despite trading at a valuation below its estimated fair value and having substantial insider ownership, Li Auto's revenue growth is expected to be slightly below 20% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Li Auto.

- The valuation report we've compiled suggests that Li Auto's current price could be quite moderate.

Estée Lauder Companies (NYSE:EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide with a market cap of approximately $35.83 billion.

Operations: The company's revenue segments include Skin Care ($7.91 billion), Makeup ($4.47 billion), Fragrance ($2.49 billion), and Hair Care ($629 million).

Insider Ownership: 12.8%

Earnings Growth Forecast: 28.1% p.a.

Estée Lauder Companies, with substantial insider ownership, is navigating leadership transitions while focusing on strategic growth. Despite a challenging fiscal year with sales of US$15.61 billion and net income dropping to US$390 million, earnings are forecasted to grow at 28.06% annually over the next three years. The company's revenue growth is expected to lag behind the market at 4% per year, but its return on equity is projected to reach 30.3%, indicating strong future profitability potential despite current financial hurdles and high debt levels.

- Unlock comprehensive insights into our analysis of Estée Lauder Companies stock in this growth report.

- Our expertly prepared valuation report Estée Lauder Companies implies its share price may be too high.

TETRA Technologies (NYSE:TTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc., with a market cap of $381.20 million, operates as an energy services and solutions company through its subsidiaries.

Operations: The company's revenue segments include Water & Flowback Services, generating $304.43 million, and Completion Fluids & Products, contributing $323.07 million.

Insider Ownership: 10.3%

Earnings Growth Forecast: 48.2% p.a.

TETRA Technologies, with significant insider ownership, is experiencing leadership changes as Richard D. O’Brien resigns and Elijio V. Serrano takes on additional responsibilities. Despite a decline in net income to US$7.64 million for Q2 2024 from US$18.22 million a year ago, the company's earnings are forecasted to grow at 48.21% annually over the next three years, outpacing the market's growth rate of 15.2%. However, profit margins have decreased and interest payments remain poorly covered by earnings.

- Take a closer look at TETRA Technologies' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of TETRA Technologies shares in the market.

Summing It All Up

- Reveal the 185 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives