- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Undiscovered Gems Republic Bancorp And 2 Other Small Caps With Potential

Reviewed by Simply Wall St

The United States market has shown robust growth, climbing by 2.8% over the past week and rising 25% over the past year, with earnings forecasted to grow annually by 15%. In this environment, identifying small-cap stocks like Republic Bancorp that possess strong fundamentals and potential for expansion can be a strategic approach to uncovering valuable opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Republic Bancorp (NasdaqGS:RBCA.A)

Simply Wall St Value Rating: ★★★★★★

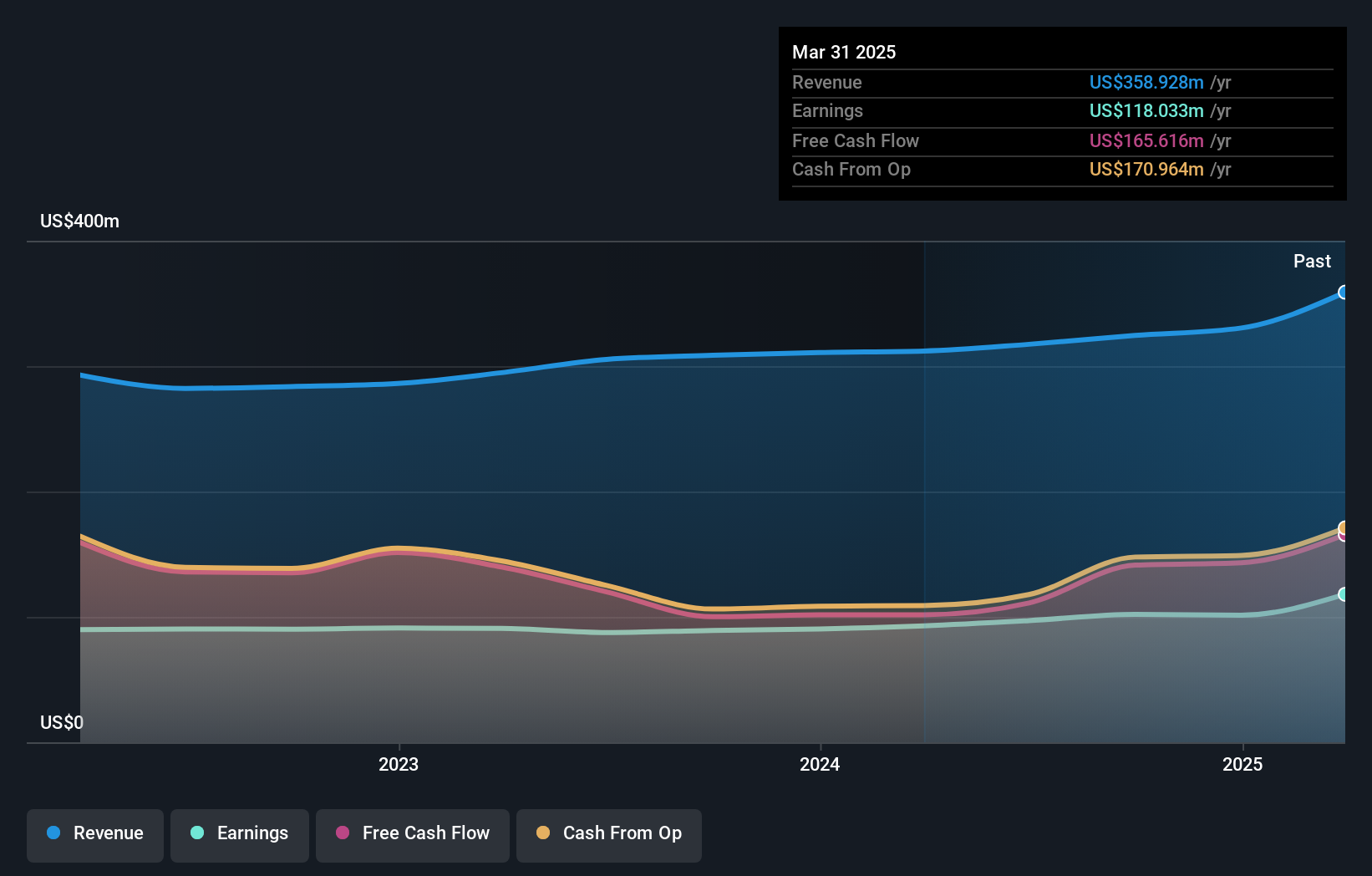

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services across the United States, with a market cap of approximately $1.39 billion.

Operations: The company's revenue streams include Core Banking, with Traditional Banking generating $227.89 million and Warehouse Lending contributing $10.71 million, alongside Republic Processing Group's segments like Tax Refund Solutions at $23.36 million and Republic Credit Solutions at $41.85 million.

Republic Bancorp, a nimble player in the financial sector, boasts total assets of US$6.7 billion and equity of US$979.7 million, with deposits at US$5.1 billion against loans totaling US$5.2 billion. The bank's allowance for bad loans is robust at 420%, covering 0.4% of total loans, reflecting prudent risk management. Its earnings surged by 14% over the past year, outpacing an industry decline of nearly 12%. Trading below estimated fair value by over 30%, Republic offers potential upside with its low-risk funding structure comprising primarily customer deposits and a net interest margin sitting comfortably at 4.9%.

Third Coast Bancshares (NasdaqGS:TCBX)

Simply Wall St Value Rating: ★★★★★★

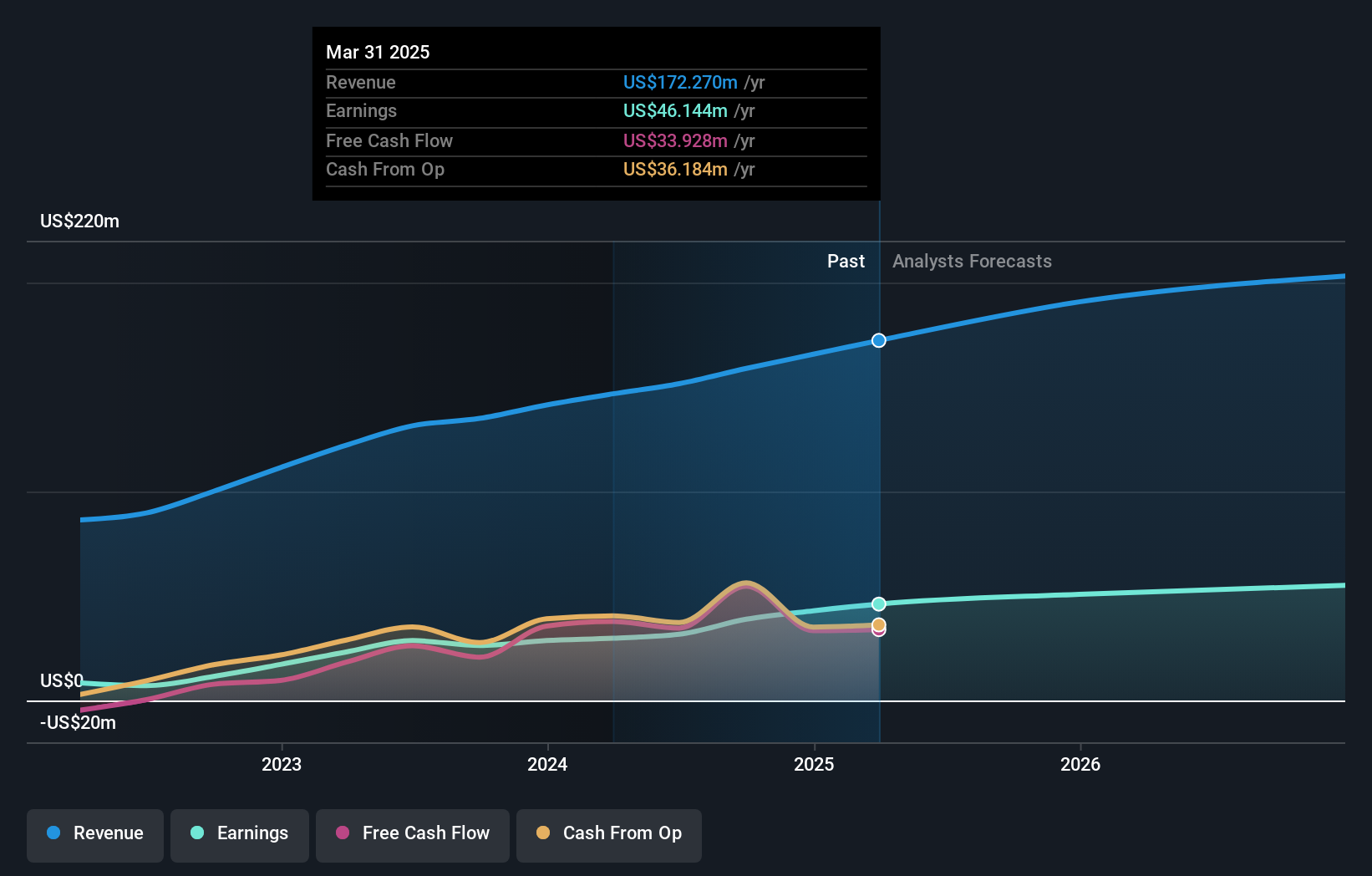

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, SSB, offering commercial banking solutions to small and medium-sized businesses and professionals, with a market cap of $470.01 million.

Operations: Third Coast Bancshares generates revenue primarily through its Community Banking segment, which accounts for $158.91 million. The company's net profit margin reflects its profitability dynamics in the commercial banking sector.

Third Coast Bancshares has shown impressive financial health, with total assets of US$4.6 billion and equity at US$450.5 million. The bank's strong loan portfolio of US$3.9 billion is supported by a sufficient allowance for bad loans at 0.6%, ensuring credit quality remains robust. Impressively, earnings have grown by 47% over the past year, outpacing the industry average significantly, and are forecasted to increase further by 11% annually. With liabilities primarily funded through low-risk customer deposits making up 96% of its funding sources, Third Coast is well-positioned to capitalize on Texas's thriving market while managing potential risks effectively.

Electromed (NYSEAM:ELMD)

Simply Wall St Value Rating: ★★★★★★

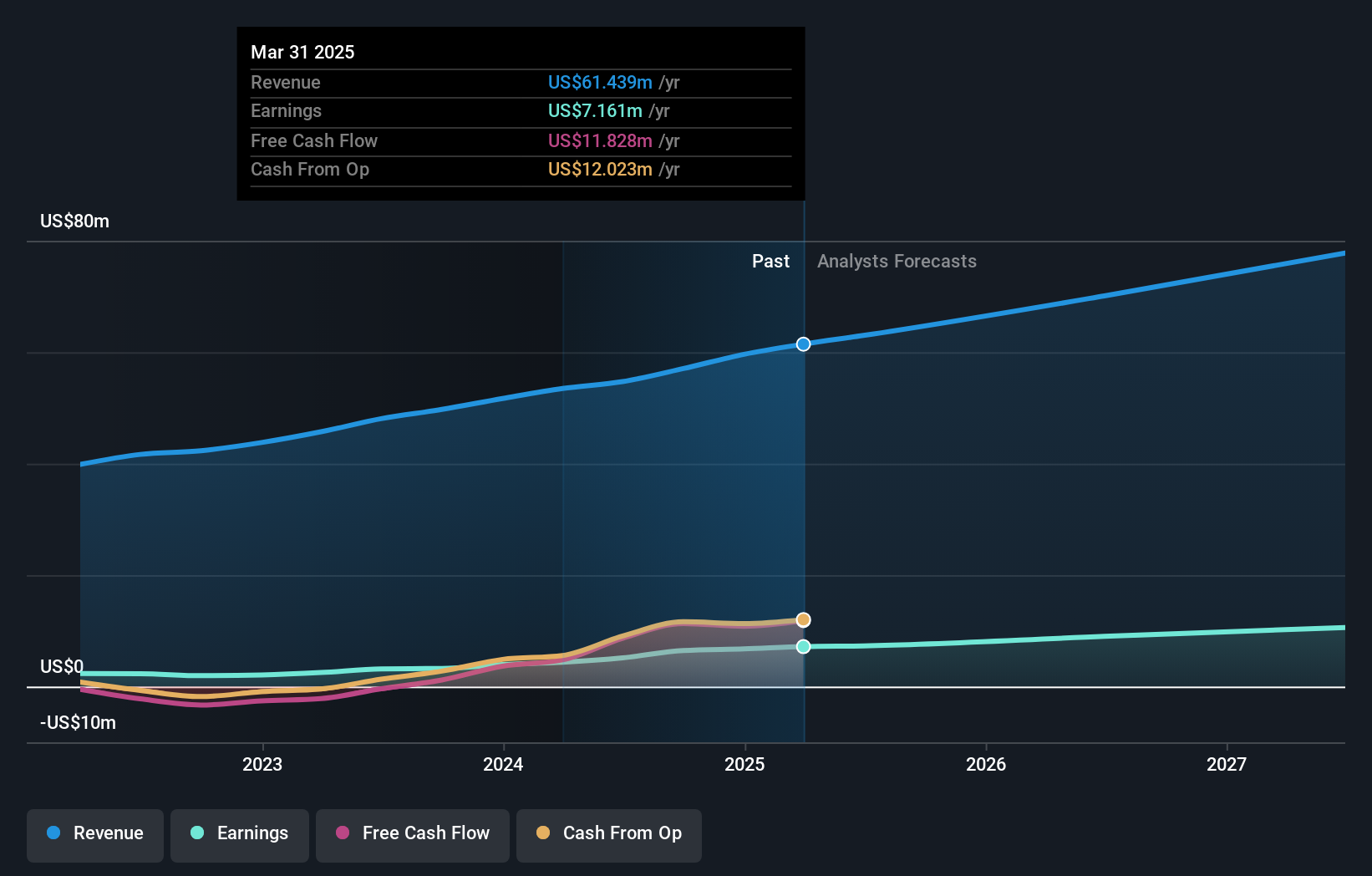

Overview: Electromed, Inc. is a company that specializes in the development, manufacturing, marketing, and sale of airway clearance therapy products using high frequency chest wall oscillation (HFCWO) for pulmonary care across diverse age groups both domestically and internationally, with a market cap of $250.19 million.

Operations: Electromed generates revenue primarily from the development, manufacturing, and marketing of medical equipment, amounting to $57.06 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Electromed, a nimble player in the medical equipment sector, has seen its earnings skyrocket by 99.7% over the past year, outpacing the industry average of 15%. The company recently reported first-quarter sales of US$14.67 million and net income of US$1.47 million, significantly up from last year's figures. With no debt on its books and trading at 90% below estimated fair value, Electromed appears undervalued. Despite recent insider selling, it boasts high-quality earnings and positive free cash flow. Notably, it repurchased 262,756 shares for US$4.54 million as part of a buyback initiative announced in September 2024.

- Navigate through the intricacies of Electromed with our comprehensive health report here.

Assess Electromed's past performance with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 243 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives