- United States

- /

- Banks

- /

- NYSE:CFG

3 Stocks Estimated To Be Up To 49.4% Below Intrinsic Value

Reviewed by Simply Wall St

In the current U.S. market, investors are navigating a mixed landscape with the S&P 500 and Dow Jones aiming to extend their winning streaks amid fluctuating indices and ongoing tariff discussions. As these broader economic factors play out, identifying undervalued stocks becomes crucial for those looking to capitalize on potential discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $24.56 | $48.87 | 49.7% |

| FB Financial (NYSE:FBK) | $44.69 | $89.12 | 49.9% |

| Quaker Chemical (NYSE:KWR) | $103.46 | $206.46 | 49.9% |

| KeyCorp (NYSE:KEY) | $15.49 | $30.81 | 49.7% |

| Amerant Bancorp (NYSE:AMTB) | $17.55 | $34.97 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | $90.58 | $179.14 | 49.4% |

| Granite Ridge Resources (NYSE:GRNT) | $5.10 | $10.09 | 49.5% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.15 | $10.22 | 49.6% |

| Expand Energy (NasdaqGS:EXE) | $105.88 | $211.08 | 49.8% |

| Nutanix (NasdaqGS:NTNX) | $72.54 | $143.63 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

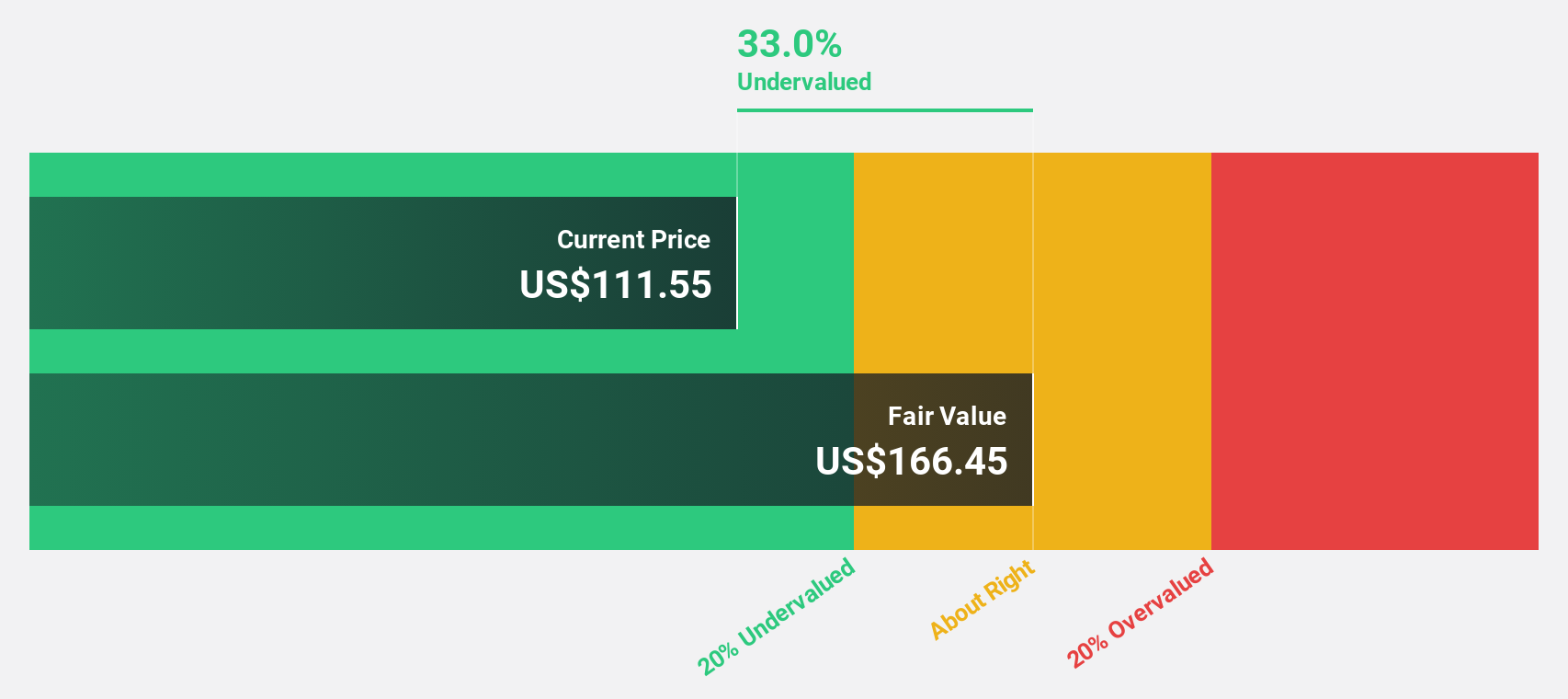

Lantheus Holdings (NasdaqGM:LNTH)

Overview: Lantheus Holdings, Inc. develops, manufactures, and commercializes diagnostic and therapeutic products for heart, cancer, and other diseases globally with a market cap of approximately $7.46 billion.

Operations: The company's revenue is primarily derived from its diagnostic kits and equipment segment, which generated approximately $1.53 billion.

Estimated Discount To Fair Value: 46.4%

Lantheus Holdings is trading at US$108.74, significantly below its estimated fair value of US$202.91, suggesting it may be undervalued based on cash flows. Recent developments include successful clinical trials for MK-6240, bolstering future growth prospects. Despite a slight decrease in net income to US$312.44 million from the previous year, revenue increased to US$1.53 billion with earnings forecasted to grow by 16.5% annually, outpacing the broader U.S. market's growth expectations.

- Our comprehensive growth report raises the possibility that Lantheus Holdings is poised for substantial financial growth.

- Get an in-depth perspective on Lantheus Holdings' balance sheet by reading our health report here.

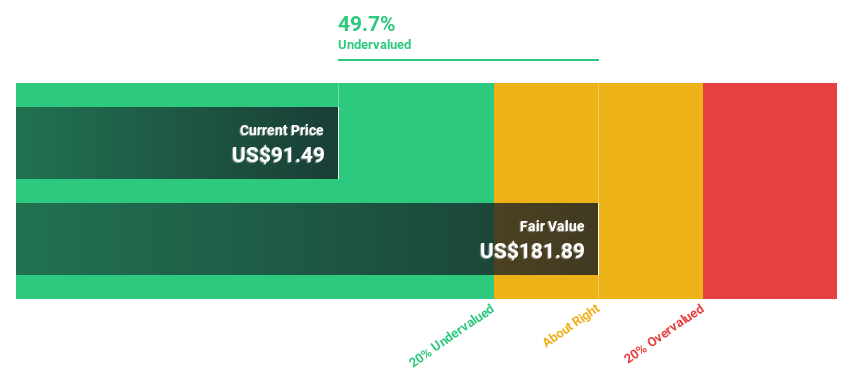

HealthEquity (NasdaqGS:HQY)

Overview: HealthEquity, Inc. offers technology-enabled service platforms for consumers and employers in the United States, with a market cap of approximately $7.83 billion.

Operations: HealthEquity generates revenue through its Pharmacy Services segment, which amounted to $1.20 billion.

Estimated Discount To Fair Value: 49.4%

HealthEquity is trading at US$90.58, considerably below its estimated fair value of US$179.14, indicating potential undervaluation based on cash flows. The company has reported significant earnings growth of 73.6% over the past year and forecasts a further increase of 34.62% annually, outpacing the broader U.S. market's expectations. Recent strategic moves include share buybacks totaling US$122.27 million and launching HealthEquity Assist to enhance healthcare savings and spending for members.

- According our earnings growth report, there's an indication that HealthEquity might be ready to expand.

- Unlock comprehensive insights into our analysis of HealthEquity stock in this financial health report.

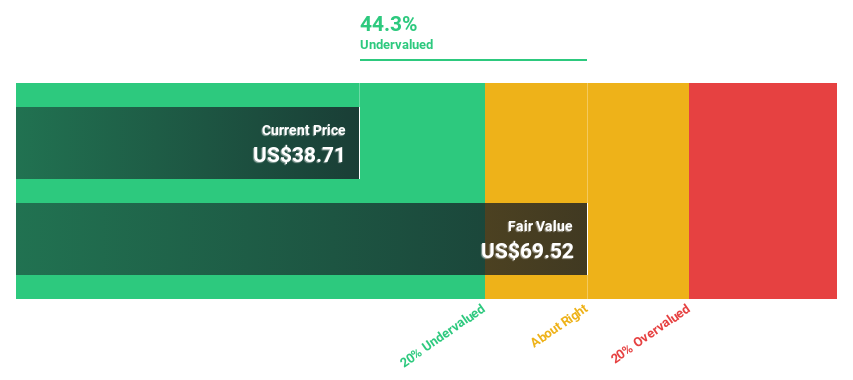

Citizens Financial Group (NYSE:CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking services to a diverse range of clients in the United States, with a market cap of approximately $16.76 billion.

Operations: The company's revenue is primarily generated from its Consumer Banking segment, which accounts for $5.50 billion, and its Commercial Banking segment, contributing $2.42 billion.

Estimated Discount To Fair Value: 44.6%

Citizens Financial Group, trading at US$38.65, is valued below its estimated fair value of US$69.73, reflecting potential undervaluation based on cash flows. The company forecasts significant annual earnings growth of 20%, surpassing the U.S. market average. Recent developments include executive changes and a quarterly common stock dividend of $0.42 per share, alongside preferred dividends across various series, highlighting its commitment to shareholders amidst strategic leadership transitions and ongoing buyback initiatives totaling US$2.60 billion since 2021.

- The analysis detailed in our Citizens Financial Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Citizens Financial Group with our detailed financial health report.

Where To Now?

- Discover the full array of 185 Undervalued US Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives