- United States

- /

- Software

- /

- NasdaqGS:INTA

High Growth Tech Stocks in United States to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.2%, and in the past year, it has climbed 21%, with earnings forecasted to grow by 15% annually. In this environment of robust growth, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability to rapidly changing technological landscapes.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.32% | 24.20% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.74% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

GoodRx Holdings (NasdaqGS:GDRX)

Simply Wall St Growth Rating: ★★★★☆☆

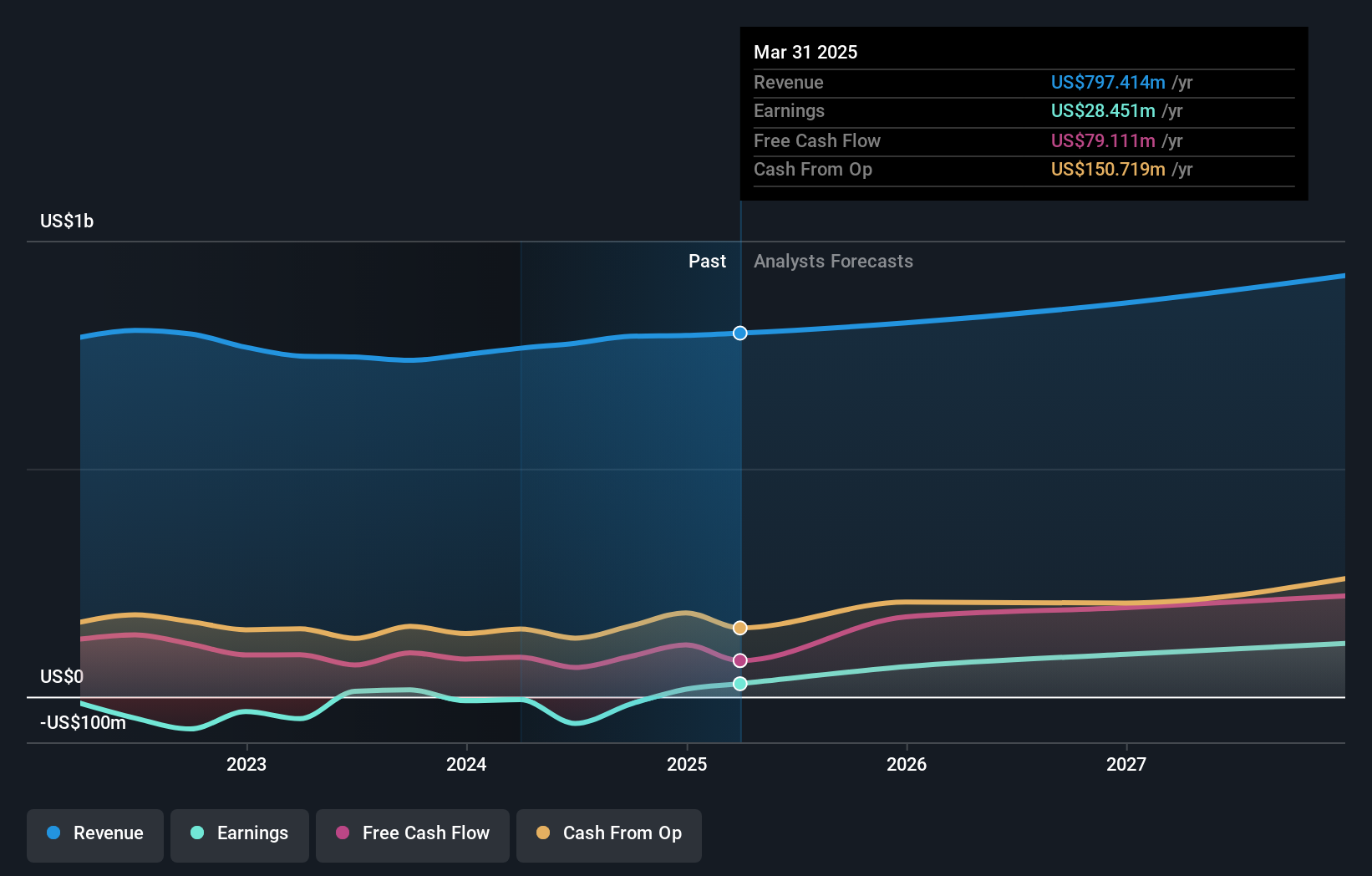

Overview: GoodRx Holdings, Inc., along with its subsidiaries, provides tools and information to help consumers in the United States compare prices and save on prescription drug purchases, with a market cap of approximately $1.86 billion.

Operations: The company generates revenue primarily through its healthcare software segment, which amounted to $790.39 million. Its business model focuses on providing consumers with tools and information to compare prescription drug prices in the U.S., facilitating cost savings for users.

GoodRx Holdings, while not the fastest growing in high-tech sectors, is poised for significant transformations. The company's recent executive reshuffles, including the appointment of Christopher A. McGinnis as CFO and Wendy Barnes as CEO, underscore a strategic pivot towards robust leadership to steer forthcoming profitability; GoodRx forecasts a profit growth of 39.4% annually. Additionally, its innovative GoodRx for Pets platform exemplifies how GoodRx is diversifying offerings and tapping into niche markets—a move that enhances user engagement and broadens revenue streams beyond its traditional scope. These developments could be crucial as it navigates the competitive landscape of healthcare technology with an expected annual revenue growth rate of 5.9%, despite lagging behind the broader U.S market's 8.8%.

Intapp (NasdaqGS:INTA)

Simply Wall St Growth Rating: ★★★★☆☆

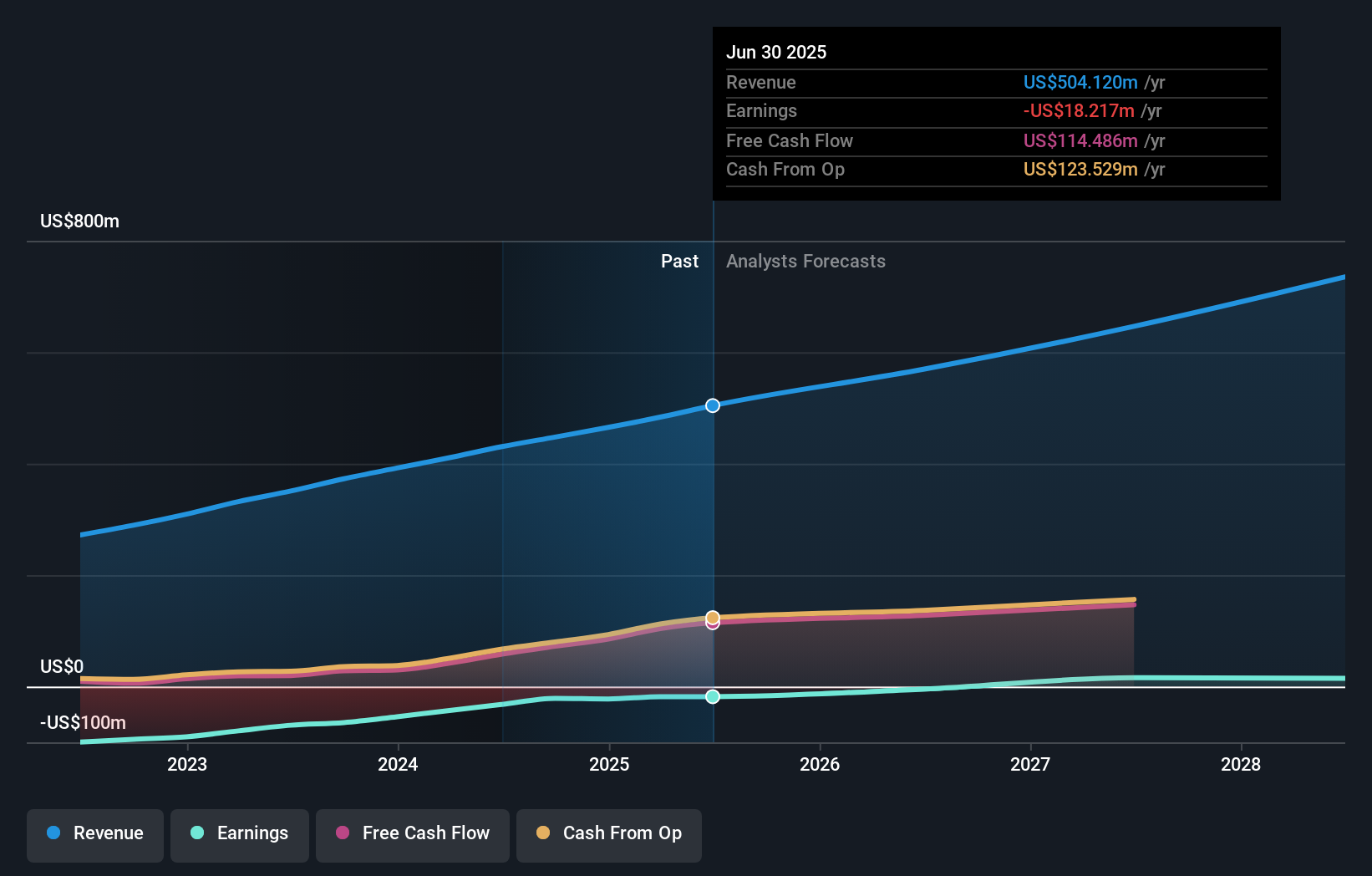

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., offers AI-powered solutions in the United States, the United Kingdom, and internationally with a market cap of approximately $5.69 billion.

Operations: Intapp generates revenue primarily from its Software & Programming segment, which accounts for $465.03 million. The company focuses on providing AI-powered solutions across various regions, including the United States and the United Kingdom.

Intapp, despite its current unprofitability, is signaling robust potential with a projected annual revenue growth of 13.9% and an explosive expected earnings increase of 110.4% per year. Notably, the firm's commitment to innovation is underscored by significant R&D investments, amounting to $240 million in the last fiscal year alone—constituting approximately 20% of its total revenue. This strategic emphasis on development is pivotal as Intapp enhances its software solutions for professional services firms, ensuring they remain at the forefront of efficiency and compliance technology. Recent client acquisitions like U.K.'s Milsted Langdon adopting Intapp's advanced collaboration solutions further validate this approach, potentially setting a precedent for future growth in similar markets.

- Delve into the full analysis health report here for a deeper understanding of Intapp.

Explore historical data to track Intapp's performance over time in our Past section.

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★★☆

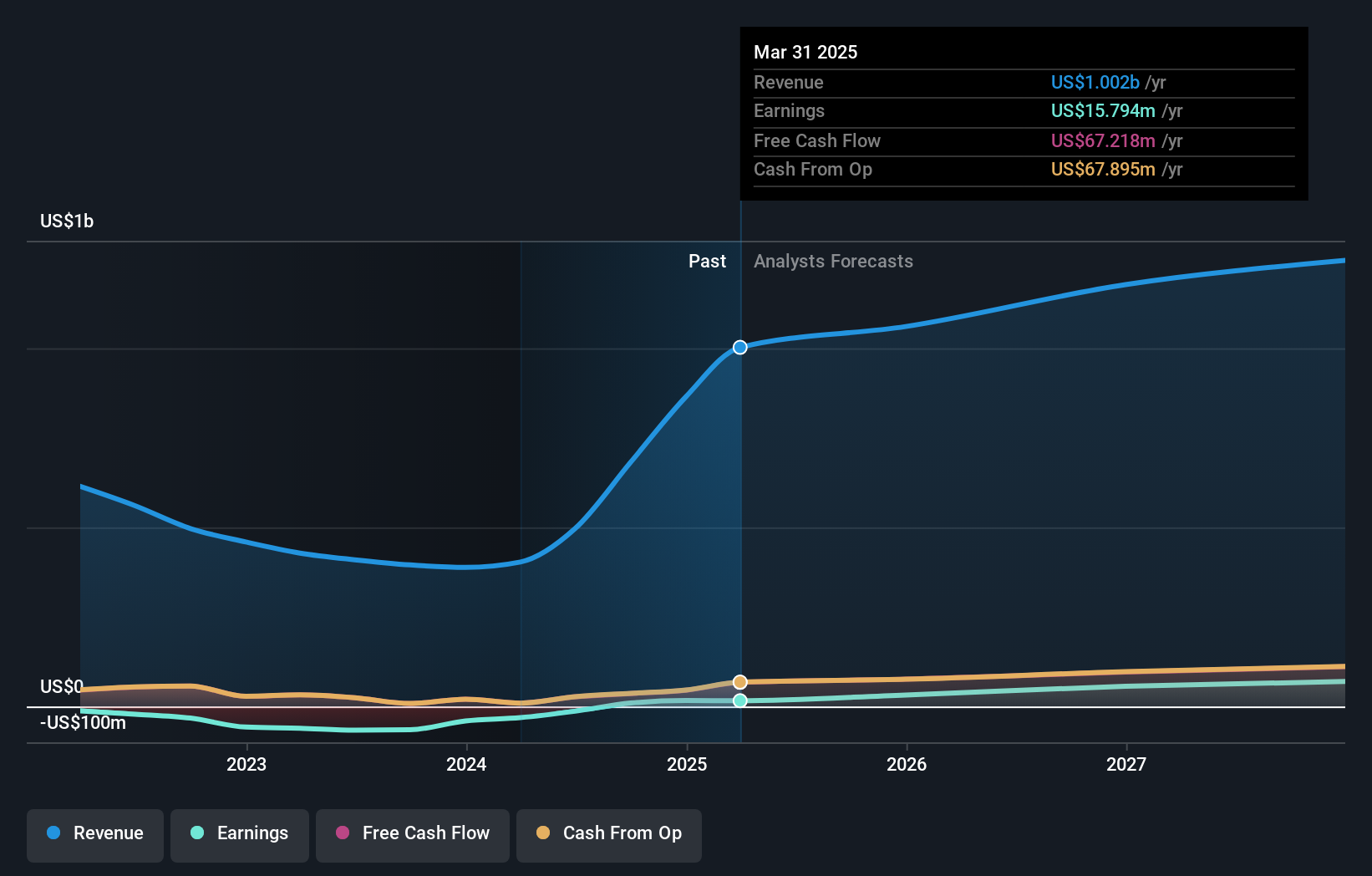

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of approximately $832.64 million.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $681.23 million. Its business model focuses on facilitating insurance customer acquisition through a digital platform in the U.S., leveraging technology to connect consumers with insurance providers efficiently.

MediaAlpha stands out in the competitive landscape of high-growth tech with its impressive annual revenue growth rate of 18.6% and an even more striking earnings growth forecast at 35.3% per year, signaling strong operational efficiency and market demand. The company's strategic investment in R&D is noteworthy, allocating significant resources to foster innovation—evidenced by spending $120 million last year, representing about 15% of its total revenue. This commitment not only enhances MediaAlpha’s product offerings but also solidifies its position in a rapidly evolving digital marketplace, where staying ahead technologically is crucial for sustaining growth. With these robust financial health indicators and a clear focus on technological advancement, MediaAlpha is well-poised to capitalize on future opportunities within the tech sector.

- Click to explore a detailed breakdown of our findings in MediaAlpha's health report.

Examine MediaAlpha's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 231 companies within our US High Growth Tech and AI Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives