- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

3 US Stocks Estimated To Be Trading At Discounts Of Up To 39.3%

Reviewed by Simply Wall St

As stock futures rise and major indices like the Dow Jones, S&P 500, and Nasdaq show positive movement following strong earnings reports from companies such as Nvidia, investors are keenly observing market trends. In this environment of mixed performances and record highs in cryptocurrencies like Bitcoin, identifying undervalued stocks can present opportunities for those looking to capitalize on potential discounts in the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $22.94 | $45.25 | 49.3% |

| Business First Bancshares (NasdaqGS:BFST) | $27.67 | $55.07 | 49.8% |

| West Bancorporation (NasdaqGS:WTBA) | $23.72 | $46.83 | 49.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.23 | $63.89 | 49.6% |

| Better Choice (NYSEAM:BTTR) | $1.78 | $3.45 | 48.5% |

| Afya (NasdaqGS:AFYA) | $16.36 | $31.64 | 48.3% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $110.77 | $219.27 | 49.5% |

| Air Industries Group (NYSEAM:AIRI) | $4.33 | $8.44 | 48.7% |

| Marcus & Millichap (NYSE:MMI) | $40.13 | $78.66 | 49% |

| AirSculpt Technologies (NasdaqGM:AIRS) | $6.35 | $12.46 | 49.1% |

Let's review some notable picks from our screened stocks.

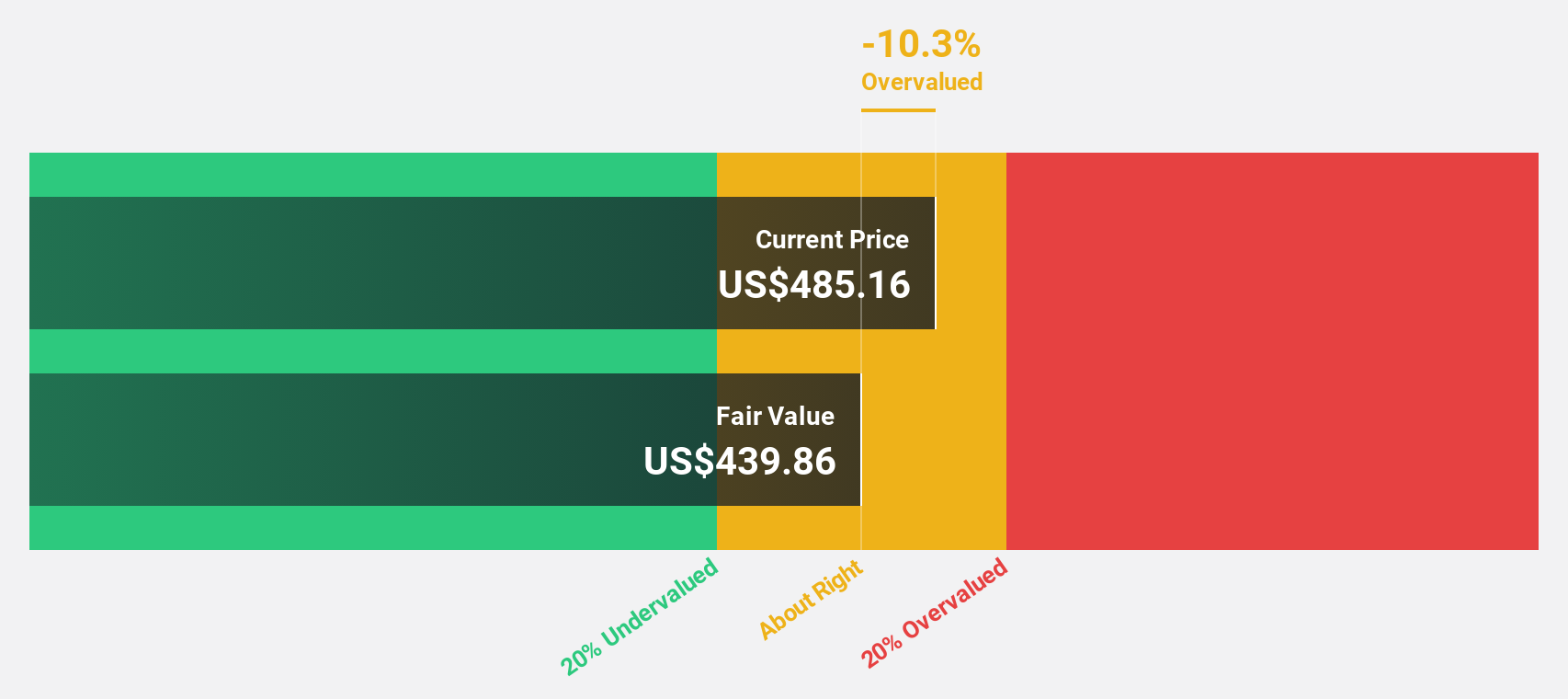

CrowdStrike Holdings (NasdaqGS:CRWD)

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market cap of approximately $86.60 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated $3.52 billion.

Estimated Discount To Fair Value: 14.3%

CrowdStrike Holdings, trading at US$350.15, is slightly undervalued with a fair value estimate of US$408.4 based on discounted cash flow analysis. Despite recent shareholder dilution and significant insider selling, the company became profitable this year and forecasts suggest strong earnings growth of 34.5% annually over the next three years, outpacing the broader U.S. market's 15.4%. Recent strategic partnerships enhance its cybersecurity offerings, potentially bolstering future revenue streams amidst evolving threats.

- Our earnings growth report unveils the potential for significant increases in CrowdStrike Holdings' future results.

- Dive into the specifics of CrowdStrike Holdings here with our thorough financial health report.

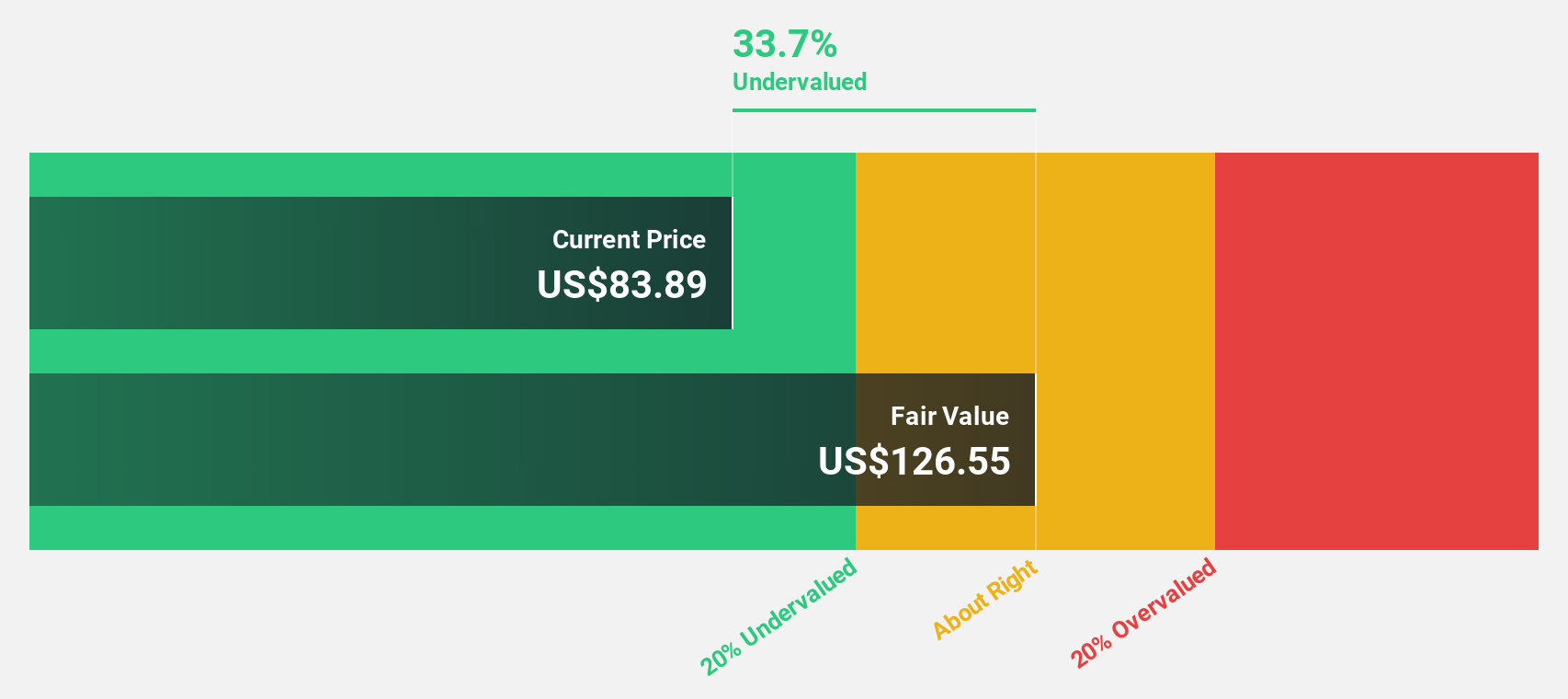

DexCom (NasdaqGS:DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems globally, with a market cap of approximately $29.25 billion.

Operations: Revenue for DexCom primarily comes from its patient monitoring equipment segment, totaling $3.95 billion.

Estimated Discount To Fair Value: 39.3%

DexCom, trading at US$75.24, appears undervalued with an estimated fair value of US$123.95 based on discounted cash flow analysis. Earnings are projected to grow 16.8% annually, surpassing the U.S. market's 15.4%. Recent strategic moves include a partnership with OURA and a US$75 million investment in their Series D funding, enhancing DexCom's metabolic health offerings and potentially expanding its user base beyond the current 2.5 million globally amidst ongoing legal challenges.

- According our earnings growth report, there's an indication that DexCom might be ready to expand.

- Get an in-depth perspective on DexCom's balance sheet by reading our health report here.

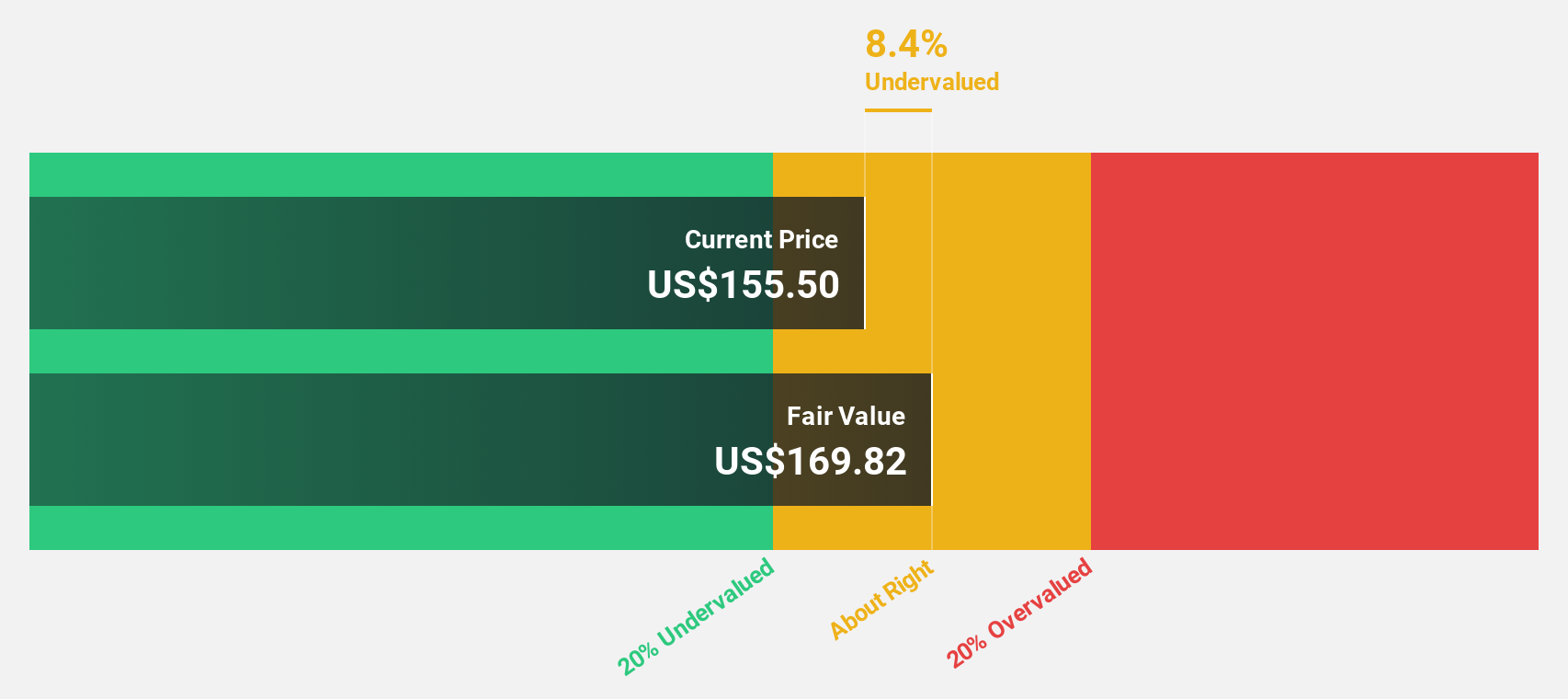

Wix.com (NasdaqGS:WIX)

Overview: Wix.com Ltd. operates as a cloud-based web development platform for registered users and creators worldwide, with a market cap of approximately $11.77 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, which amounts to $1.65 billion.

Estimated Discount To Fair Value: 11.8%

Wix.com, trading at US$210.27, is undervalued relative to its estimated fair value of US$238.33 based on discounted cash flow analysis. The company reported strong Q3 2024 earnings with net income rising substantially to US$26.78 million from the previous year's US$6.98 million and raised its full-year revenue guidance slightly upwards, indicating stable growth prospects despite high debt levels and moderate revenue growth forecasts compared to broader market trends.

- Insights from our recent growth report point to a promising forecast for Wix.com's business outlook.

- Take a closer look at Wix.com's balance sheet health here in our report.

Summing It All Up

- Access the full spectrum of 196 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with solid track record.