- United States

- /

- Food

- /

- NasdaqGM:FRPT

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 44.1%

Reviewed by Simply Wall St

The United States market has shown positive momentum with a 1.7% increase over the past week and an 18% climb in the last year, alongside forecasts of a 15% annual earnings growth. In this environment, identifying stocks trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roku (ROKU) | $90.25 | $174.66 | 48.3% |

| Robert Half (RHI) | $42.40 | $82.86 | 48.8% |

| Hims & Hers Health (HIMS) | $58.02 | $114.17 | 49.2% |

| Gogo (GOGO) | $16.54 | $32.45 | 49% |

| FB Financial (FBK) | $48.54 | $93.90 | 48.3% |

| Carter Bankshares (CARE) | $17.81 | $35.50 | 49.8% |

| Camden National (CAC) | $41.87 | $83.69 | 50% |

| Atlantic Union Bankshares (AUB) | $33.68 | $65.45 | 48.5% |

| ACNB (ACNB) | $43.01 | $84.97 | 49.4% |

| Acadia Realty Trust (AKR) | $19.04 | $36.72 | 48.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Freshpet (FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe with a market cap of approximately $3.57 billion.

Operations: The company generates revenue from its pet food and pet treats segment for dogs and cats, amounting to $1.01 billion.

Estimated Discount To Fair Value: 44.1%

Freshpet is trading significantly below its estimated fair value of US$133.26, presenting potential undervaluation based on discounted cash flows at a current price of US$74.51. Despite reporting a net loss of US$12.7 million for Q1 2025, earnings are forecast to grow substantially at 38.36% annually over the next three years, outpacing the broader market's growth expectations and suggesting strong future cash flow potential despite recent setbacks in profitability.

- Our earnings growth report unveils the potential for significant increases in Freshpet's future results.

- Unlock comprehensive insights into our analysis of Freshpet stock in this financial health report.

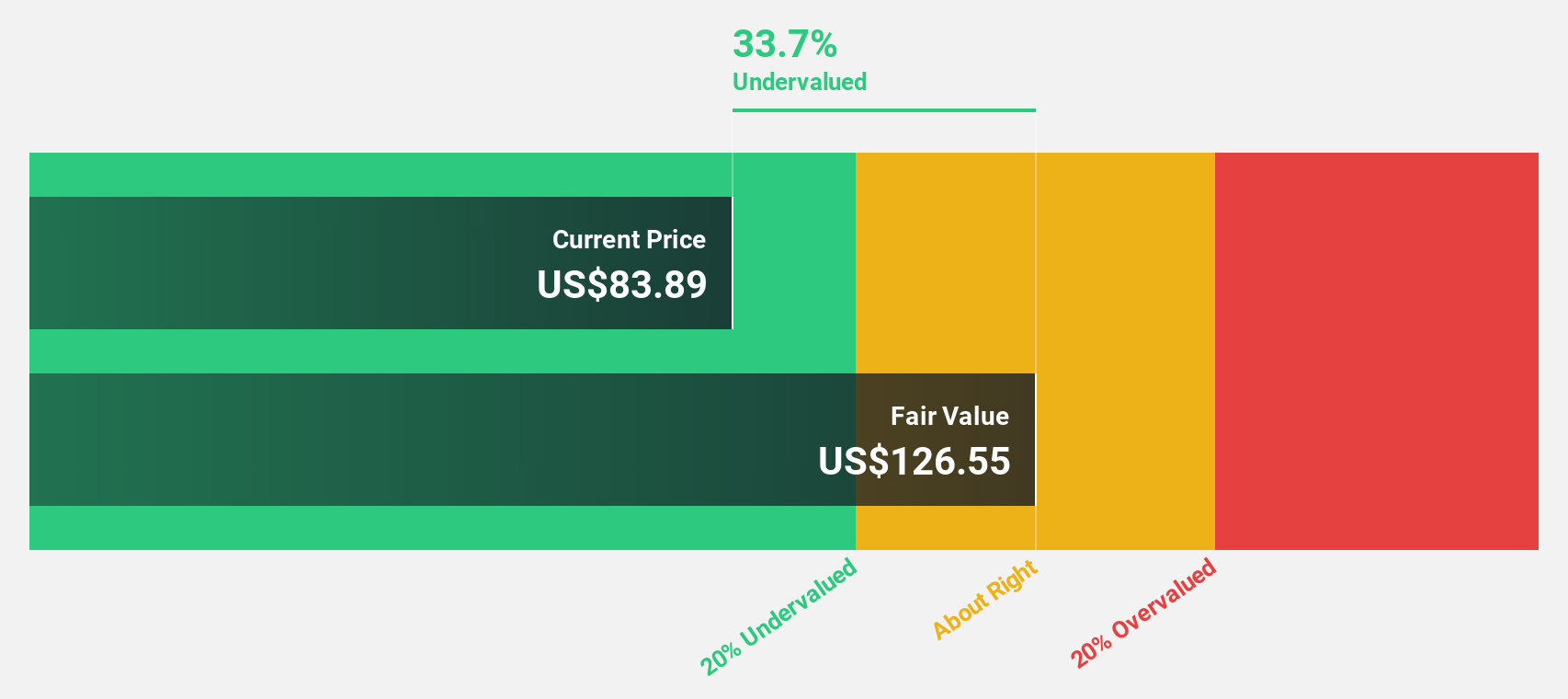

DexCom (DXCM)

Overview: DexCom, Inc. is a medical device company specializing in the design, development, and commercialization of continuous glucose monitoring systems with a market cap of approximately $33.38 billion.

Operations: DexCom generates its revenue primarily from the Patient Monitoring Equipment segment, which accounted for $4.15 billion.

Estimated Discount To Fair Value: 31.8%

DexCom is trading at US$86.43, significantly below its estimated fair value of US$126.81, highlighting potential undervaluation based on discounted cash flows. Despite slower revenue growth at 13.1% annually compared to the industry benchmark, earnings are expected to grow significantly at 23.2% per year, surpassing the broader market's projections. Recent integration with Tenovi enhances DexCom's data utility in healthcare settings; however, ongoing legal challenges concerning trademark issues could impact brand perception and operations.

- Our expertly prepared growth report on DexCom implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of DexCom.

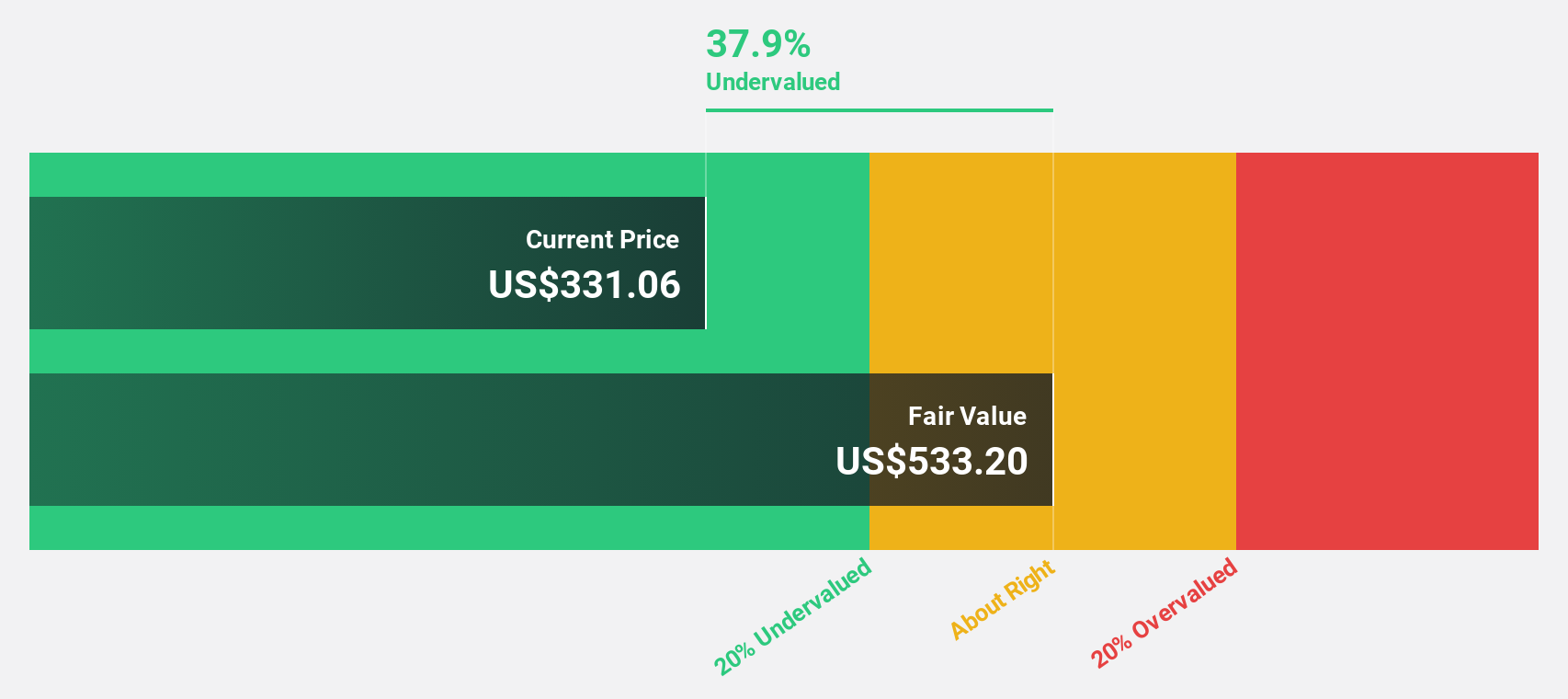

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers across the United States, Brazil, the United Kingdom, and internationally; it has a market cap of $23.57 billion.

Operations: Corpay's revenue is primarily derived from its Vehicle Payments segment at $2.00 billion, followed by Corporate Payments at $1.31 billion and Lodging Payments at $487.52 million.

Estimated Discount To Fair Value: 35.3%

Corpay is trading at US$344.14, significantly below its estimated fair value of US$532.1, suggesting potential undervaluation based on discounted cash flows. While revenue growth is projected at 10.3% annually, slightly above the market average, earnings are expected to grow at 17.8% per year, outpacing the broader market's expectations. Recent strategic partnerships and acquisitions enhance Corpay’s cross-border payment capabilities; however, debt coverage by operating cash flow remains a concern for financial stability.

- According our earnings growth report, there's an indication that Corpay might be ready to expand.

- Click to explore a detailed breakdown of our findings in Corpay's balance sheet health report.

Key Takeaways

- Delve into our full catalog of 176 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)