- United States

- /

- Real Estate

- /

- NasdaqCM:RMR

The RMR Group Inc.'s (NASDAQ:RMR) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- RMR Group will host its Annual General Meeting on 29th of March

- Salary of US$375.0k is part of CEO Adam Portnoy's total remuneration

- Total compensation is similar to the industry average

- RMR Group's EPS declined by 0.6% over the past three years while total shareholder return over the past three years was 24%

Despite The RMR Group Inc.'s (NASDAQ:RMR) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 29th of March. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for RMR Group

Comparing The RMR Group Inc.'s CEO Compensation With The Industry

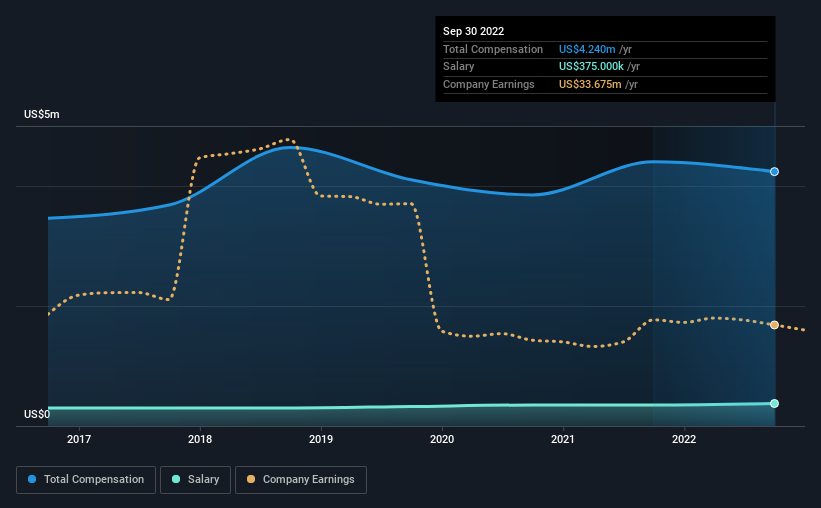

Our data indicates that The RMR Group Inc. has a market capitalization of US$799m, and total annual CEO compensation was reported as US$4.2m for the year to September 2022. That's a slight decrease of 3.7% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$375k.

For comparison, other companies in the American Real Estate industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$4.9m. So it looks like RMR Group compensates Adam Portnoy in line with the median for the industry. Furthermore, Adam Portnoy directly owns US$2.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$375k | US$350k | 9% |

| Other | US$3.9m | US$4.1m | 91% |

| Total Compensation | US$4.2m | US$4.4m | 100% |

On an industry level, roughly 23% of total compensation represents salary and 77% is other remuneration. RMR Group pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

The RMR Group Inc.'s Growth

Earnings per share at The RMR Group Inc. are much the same as they were three years ago, albeit slightly lower. Its revenue is up 13% over the last year.

The lack of EPS growth is certainly uninspiring. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has The RMR Group Inc. Been A Good Investment?

The RMR Group Inc. has served shareholders reasonably well, with a total return of 24% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for RMR Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RMR

RMR Group

Through its subsidiary, The RMR Group LLC, provides real estate asset management services in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)