- United States

- /

- Food

- /

- NasdaqGS:CVGW

Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In the wake of recent market turmoil, with significant declines in major indices like the S&P 500 and Nasdaq due to escalating trade tensions and tariff announcements, small-cap stocks have experienced heightened volatility. Despite these challenges, some investors are turning their attention to small-cap companies that may be trading at attractive valuations, especially those where insider buying suggests confidence in their long-term potential.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.9x | 3.4x | 47.66% | ★★★★★★ |

| Flowco Holdings | 6.0x | 0.9x | 35.99% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 34.69% | ★★★★★☆ |

| Shore Bancshares | 9.2x | 2.0x | 18.97% | ★★★★☆☆ |

| MVB Financial | 10.6x | 1.4x | 38.14% | ★★★★☆☆ |

| PDF Solutions | 162.5x | 3.7x | 27.42% | ★★★★☆☆ |

| Franklin Financial Services | 13.5x | 2.2x | 41.66% | ★★★☆☆☆ |

| Union Bankshares | 14.5x | 2.7x | 49.14% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -172.20% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -288.92% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

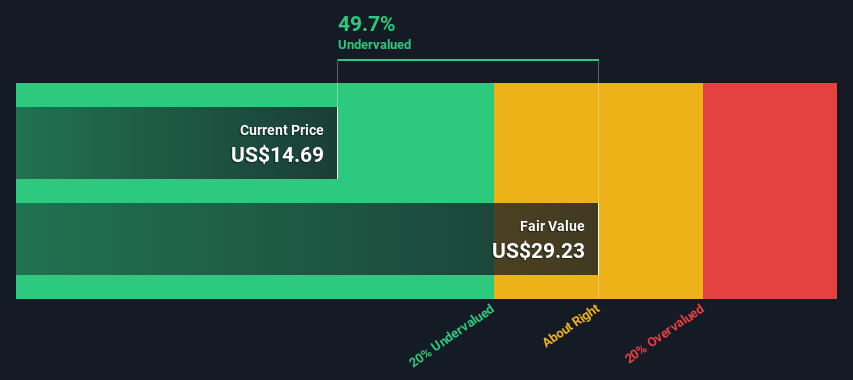

BigCommerce Holdings (NasdaqGM:BIGC)

Simply Wall St Value Rating: ★★★★★☆

Overview: BigCommerce Holdings is a company that provides e-commerce software solutions to help businesses create and manage online stores, with a market capitalization of approximately $0.63 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, totaling $332.93 million. Over the periods observed, gross profit margin has shown a trend of gradual improvement, reaching 76.69% by the end of 2024. Operating expenses are consistently higher than gross profit, with significant allocations to sales and marketing as well as research and development expenses.

PE: -15.8x

BigCommerce Holdings, a small-cap company in the US, shows potential as an undervalued stock. The company reported annual sales of US$332.93 million, up from US$309.39 million the previous year, with net losses narrowing to US$27.03 million from US$64.67 million. Recent insider confidence is evident through share purchases over the past six months. A new partnership with NAED aims to enhance digital transformation in electrical distribution, while strategic leadership changes and product innovations like Catalyst signal growth opportunities amidst industry challenges.

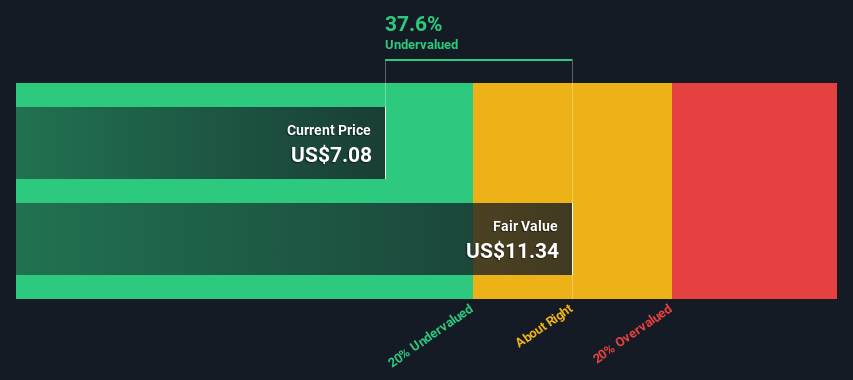

Calavo Growers (NasdaqGS:CVGW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Calavo Growers is a company engaged in the production and distribution of fresh avocados and other fresh produce, as well as prepared food products, with a market capitalization of approximately $0.55 billion.

Operations: The company generates revenue primarily from its Fresh segment, amounting to $624.39 million, with additional income from the Prepared segment at $63.93 million. Over recent periods, the gross profit margin has shown variability but reached 10.57% as of January 31, 2025. Operating expenses have been a significant cost factor, consistently exceeding $47 million in recent quarters.

PE: 30.5x

Calavo Growers, a U.S. small-cap company, is drawing attention with its recent financial turnaround and strategic initiatives. Reporting Q1 2025 sales of US$154 million and net income of US$4.42 million, the company has rebounded from last year's losses. A share repurchase program worth up to US$25 million indicates insider confidence in its future prospects. Despite relying on external borrowing for funding, Calavo's projected earnings growth of 47% annually highlights potential for investors seeking undervalued opportunities in the agriculture sector.

- Take a closer look at Calavo Growers' potential here in our valuation report.

Review our historical performance report to gain insights into Calavo Growers''s past performance.

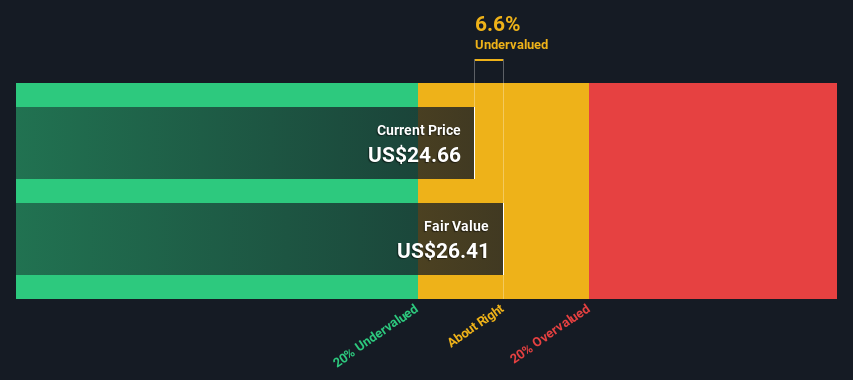

Colony Bankcorp (NYSE:CBAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Colony Bankcorp operates primarily through its Banking Division, Mortgage Banking Division, and Small Business Specialty Lending Division, with a focus on providing financial services and has a market capitalization of approximately $0.13 billion.

Operations: The company generates revenue from its Banking Division, Mortgage Banking Division, and Small Business Specialty Lending Division. Operating expenses are primarily driven by general and administrative costs, which reached $66.21 million in the latest period. The net income margin has shown a notable trend, reaching 20.23% as of the most recent quarter ending September 2024.

PE: 10.8x

Colony Bankcorp, a smaller financial institution in the U.S., has shown potential for growth with recent strategic leadership changes and board expansion. Insider confidence is evident as company repurchased 35,000 shares from October to December 2024. Financially, they reported a net income increase to US$7.43 million for Q4 2024 from US$5.6 million the previous year. The company's earnings are projected to grow by 15% annually, suggesting promising future prospects in the banking sector.

- Click here and access our complete valuation analysis report to understand the dynamics of Colony Bankcorp.

Examine Colony Bankcorp's past performance report to understand how it has performed in the past.

Next Steps

- Access the full spectrum of 80 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Calavo Growers, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVGW

Calavo Growers

Calavo Growers, Inc. markets and distributes avocados, prepared avocados, and other perishable foods to retail grocery, foodservice, club stores, mass merchandisers, food distributors, and wholesale customers worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives