- United States

- /

- Oil and Gas

- /

- NYSE:TPL

Texas Pacific Land (NYSE:TPL) Declares US$1.60 Per Share Dividend

Reviewed by Simply Wall St

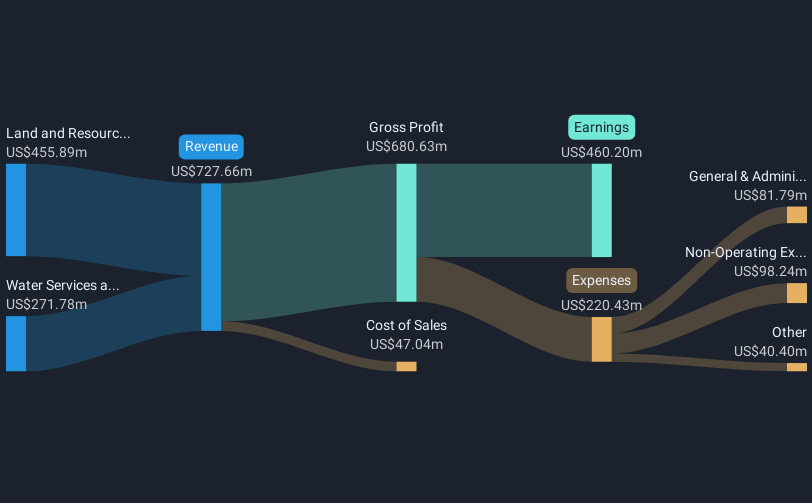

Texas Pacific Land (NYSE:TPL) recently declared a cash dividend of $1.60 per share and reported solid first quarter earnings, showing revenue and net income gains from the previous year. The company's shares moved 12% higher over the past month. These financial disclosures, alongside an announcement regarding dividends, reinforce shareholder value. This period coincided with a broader market trend, as the S&P 500 also experienced gains, suggesting that Texas Pacific Land’s performance was in alignment with overall market movements, further supported by positive economic indicators and easing trade tensions between the U.S. and China.

We've spotted 2 risks for Texas Pacific Land you should be aware of, and 1 of them can't be ignored.

Over the past five years, Texas Pacific Land has experienced a substantial total shareholder return of 689.15%, reflecting a very large growth in both share price and dividends. Compared to the past year, Texas Pacific Land outperformed the US Oil and Gas industry, which saw a loss of 5.2%, as well as the broader US market which gained 11.2%, underscoring the company's resilience in a challenging sector.

The company's recent financial performance, including a solid rise in first-quarter revenue and income, supports its longer-term growth trajectory. The announcement of continued dividends and strategic acquisitions can positively influence future revenue and earnings forecasts, indicating sustained financial health. With shares moving 12% higher in the past month, it's important to note that Texas Pacific Land is currently trading well above the consensus fair value estimate, suggesting that market expectations may significantly exceed analysts' projections at this time. These elements provide a broader context to the recent share price movements and underscore the company's ability to maintain shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives