- United States

- /

- Personal Products

- /

- NasdaqCM:LFVN

Uncovering LifeVantage And Two Promising Small Caps In The US

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has seen a 23% increase over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying promising small-cap stocks like LifeVantage can offer unique opportunities for investors seeking growth potential beyond well-trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

LifeVantage (NasdaqCM:LFVN)

Simply Wall St Value Rating: ★★★★★★

Overview: LifeVantage Corporation focuses on the identification, research, development, formulation, and sale of advanced nutrigenomic activators and various health-related products with a market cap of approximately $250.13 million.

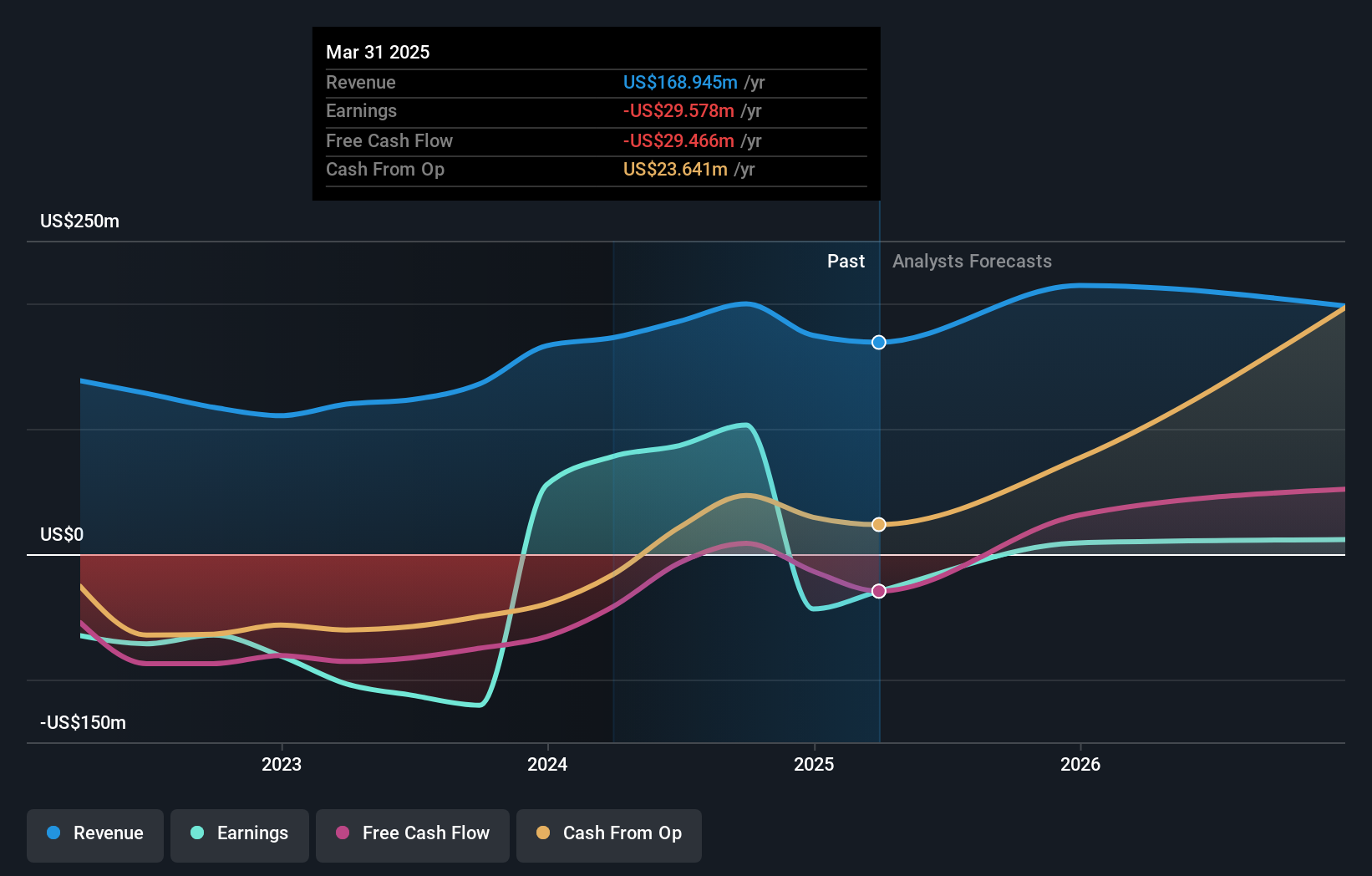

Operations: The company generates revenue primarily from the sale of vitamins and nutrition products, amounting to $196.01 million.

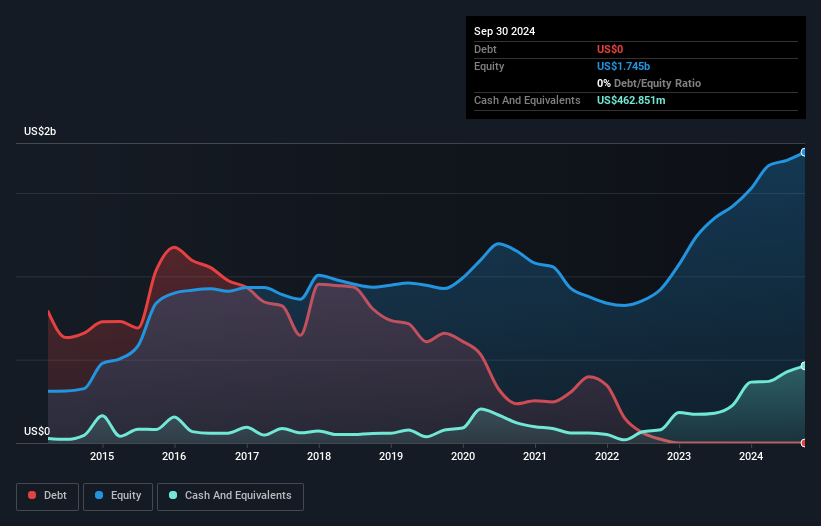

LifeVantage, a company in the personal products industry, has shown notable financial dynamics. It is trading at 35.1% below its estimated fair value and boasts high-quality past earnings with no debt concerns, as its debt to equity ratio was 3.3% five years ago but now stands at zero. Recent developments include a significant earnings growth of 61.5% over the past year, outpacing the industry's -5.2%. The firm also raised its revenue guidance for fiscal 2025 to between US$235 million and US$245 million from an earlier projection of US$200 million to US$210 million, reflecting strong market confidence despite volatility in share prices over recent months.

- Unlock comprehensive insights into our analysis of LifeVantage stock in this health report.

Gain insights into LifeVantage's historical performance by reviewing our past performance report.

McEwen Mining (NYSE:MUX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: McEwen Mining Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market capitalization of approximately $441.41 million.

Operations: Revenue primarily comes from the USA and Canada, contributing $126.10 million and $70.99 million respectively, with a smaller portion of $2.55 million from Mexico.

McEwen Mining, a dynamic player in the mining sector, recently reported significant assay results from the Grey Fox deposit in Ontario, indicating high-grade gold potential. The company has become profitable this year and is trading at 44% below its estimated fair value. Despite a net loss of US$2.08 million for Q3 2024, this marks an improvement from US$18.45 million last year. The debt-to-equity ratio has improved to 8% over five years, reflecting prudent financial management. With revenue forecasted to grow by 18% annually and a robust exploration budget of US$9.7 million for Grey Fox in 2025, McEwen seems poised for growth despite challenges ahead.

- Delve into the full analysis health report here for a deeper understanding of McEwen Mining.

Gain insights into McEwen Mining's past trends and performance with our Past report.

Teekay Tankers (NYSE:TNK)

Simply Wall St Value Rating: ★★★★★★

Overview: Teekay Tankers Ltd. offers crude oil and marine transportation services to the oil industry globally, with a market capitalization of approximately $1.45 billion.

Operations: Teekay Tankers generates revenue primarily from its tanker segment, which reported $1.19 billion. The company's financial performance is influenced by its ability to manage operating costs and optimize fleet utilization.

Teekay Tankers, a company with no debt and high-quality past earnings, appears to be trading at 82.9% below its estimated fair value. Despite a challenging year with negative earnings growth of 23%, it remains profitable and boasts positive free cash flow. The recent board changes aim to streamline operations within the Teekay Group, potentially enhancing efficiency as the company navigates market volatility and geopolitical risks. While revenue has decreased from $285.86 million to $243.28 million in Q3 2024 compared to last year, net income was $58.82 million against $81.37 million previously, reflecting current industry challenges.

Seize The Opportunity

- Reveal the 248 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LFVN

LifeVantage

Engages in the identification, research, development, formulation, and sale of advanced nutrigenomic activators, dietary supplements, nootropics, pre- and pro-biotics, weight management, and skin and hair care products.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives